Buy Intel shares in Hong Kong

Intel Corporation is a world-class technology company headquartered in Santa Clara, California, and an American microchip firm. According to market research, it is the largest semiconductor processor manufacturer with the highest value and the third largest manufacturer in the world. The company's history dates back to 1965, when it began developing microprocessor systems for use in personal computers. Today it is a publicly traded company listed on the New York Stock Exchange.

Main Intel products:

- motherboards

- chipsets

- servers

- personal computers, pocket computers

- digital printing and multimedia

- personal technologies

- equipment

- automotive industry

- consumer goods

- communication.

The reasons for Intel's financial performance are mixed. Chip manufacturing is a fast growing industry. But the global economic crisis has affected almost every other company in the sector. Thus, the overall financial performance is somewhat uncertain given the strong reliance on high-tech products in the corporate sector. However, chipmaker Intel is one of the few companies that benefits from continuous technological advancement, resulting in long-term customer loyalty and future gross product sales.

Intel's revenues are expected to grow in the coming years. The current scenario is encouraging that Intel will develop products that maximize profits in a very short period of time. The market for computer components is growing rapidly and the demand is growing every year. This is due to the popularity of PCs and the growing demand for faster, lower power processors.

The demand for high performance and energy efficient processors is growing. The demand for these microcircuits is growing due to the rise in electricity prices. The use of semiconductors in personal computers and other electronic devices, including mobile phones, tablets, digital cameras, watches, medical equipment, and other household items, requires large amounts of electricity, resulting in higher electricity bills. In such conditions, many companies, both domestic and foreign, are looking for ways to make their electricity consumption cost-effective. Intel's profits can be contributed to this process.

The financial market is very volatile. The stock prices of many companies fall every now and then. The state of the business depends on the state of the economy. While reporting a company's stock and dividend is helpful to the management of a particular company, it is not the only basis for its growth and financial performance. Intel's financial information helps its business leaders decide how to invest the company's profits.

Intel's semiconductor revenues are skyrocketing. The company's revenue depends on the sales of its motherboards. Motherboards are the components that power your PC or laptop. Without these components, the computer cannot function. The motherboards use a third-party Intel development technology called Haswell, which allows Intel chips to be placed in these motherboards.

The chips embedded in motherboards are known as Intel Edison and have a lot of potential to generate profits for Intel. These chips can run various software from other companies. These motherboards are also useful for those looking to develop their own applications and games using Intel technology. This means programmers using Intel chips have more options for work and business.

The company also conducts a number of research and development activities. The most popular of these is the Mobile Phone Business project, which is currently being implemented by the organization. Another very lucrative project is the Internet of Things project, which aims to integrate the principle of wireless communication with computing devices such as mobile phones.

Intel's future revenues will grow as Intel continues to expand its business in the IT industry.

How to invest in Intel shares in Hong Kong

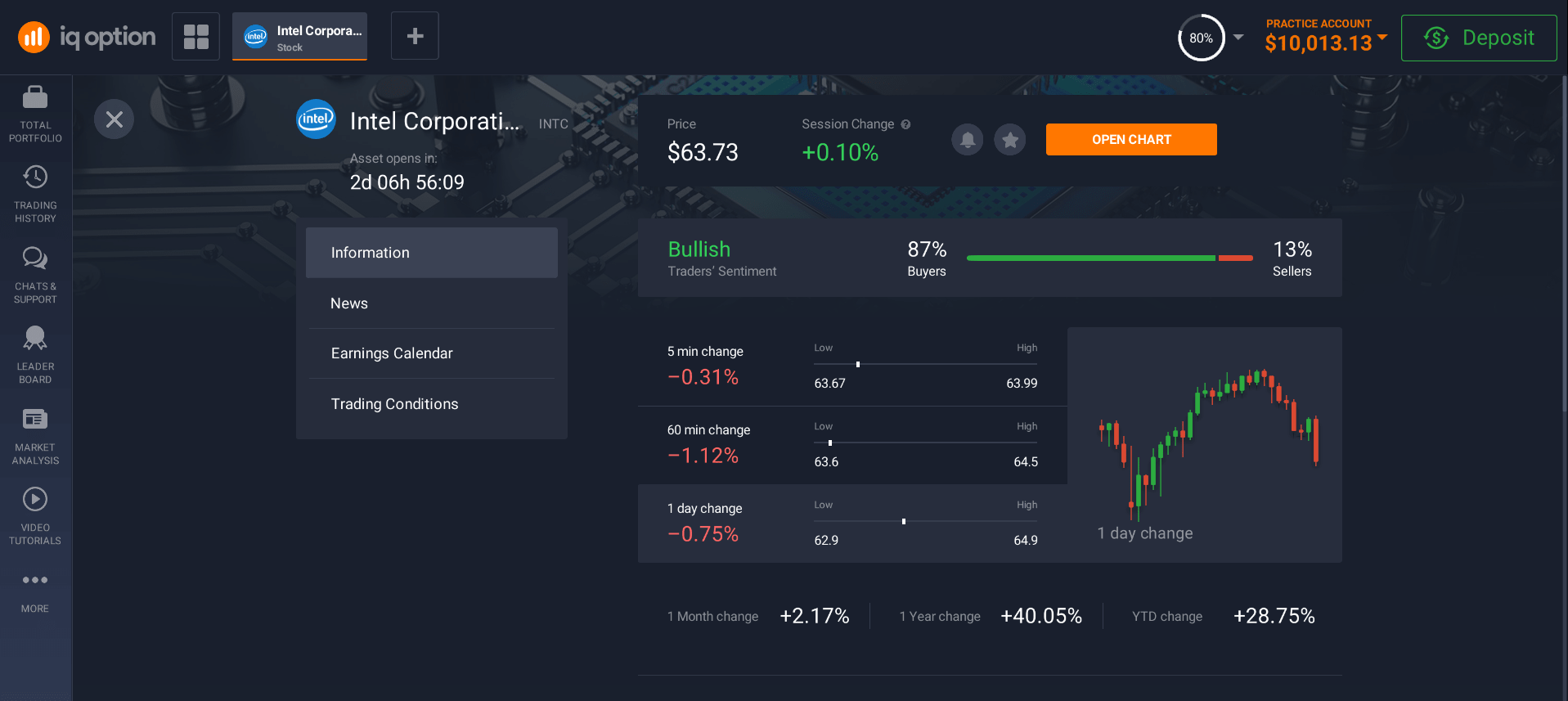

If you want to know how to invest in Intel shares in Hong Kong, you first need to define your long-term investment goals. You can use technical analysis to analyze various factors that can influence the success or failure of your chosen business venture. This can help you invest more if you choose a business with an impressive history, strong market position, and a reputation as a reliable company, such as Intel.

Long-term investing in Intel stock is a smart move for people who are interested in long-term investment as they don't have to worry about regularly changing their investment packages. Investing in stocks means that you will be making a profit over the long term and that your investment portfolio will remain unchanged over the same period. However, it is important to choose the right sector for investment so that your portfolio does not lose its attractiveness over time.

If you are interested in long-term investment in Intel shares in Hong Kong, you need to do a technical analysis of the stock market and the company. Technical analysis is one way to learn more about a company and analyze its results. The technical analysis of the stock market is divided into two categories: fundamental analysis and technical analysis. Fundamental analysis is about making money buying and selling stocks in the stock market, while technical analysis is about using basic mathematical calculations to predict the movement of stock prices.

If you want to know how to invest in Intel shares in Hong Kong, you should also be aware of the different directions the company takes to maintain its brand. Some of these rules include maintaining a strong brand image by attending conferences and exhibitions and offering discounts on your products. It is important to understand the policies that companies adopt to improve customer service and product quality, and to protect their intellectual property rights. Thus, if you are looking for a safe yet profitable long-term investment, you should invest in Intel in Hong Kong.

Before investing in Intel shares in Hong Kong, you also need to learn about the company's financial management. A good investment strategy requires a careful study of Intel's financial condition and business history. You need to find out how the firm conducts its business on a regular basis. One of the best ways to invest in Intel Hong Kong stock is to make sure you are aware of the AGM and other business matters. Thus, you can decide whether a change in corporate policy or governance structure is necessary.

Before investing in stocks, you should always consider your financial situation. The current market value of the shares is obviously lower than the price you paid for them. This means that you can lose even more than your initial investment. If you are planning to invest in Intel stock, you must remember that there are certain risks involved. Therefore, you should not only check how much you can get from the sale, but also check the financial statements of the organization to assess its strengths and weaknesses. Therefore, it is very important to thoroughly understand how to invest in Intel shares in Hong Kong before making a final decision.

At first, it may seem like investing in Intel stock in Hong Kong is not easy, especially if you are not entirely familiar with the business. However, once you gain some experience, you will realize that there are many benefits to investing in this corporation. Thus, a deliberate choice of stocks is always preferable to an ignorant one.

The main reason many people prefer the stock of this corporation is the high return on investment. In general, shares of leading corporations annually receive about 90% of the total value. In addition, long-term investments in these stocks are not as dangerous as short-term ones. Therefore, if you want to benefit from such a successful investment, it is recommended to invest in Intel shares in Hong Kong.

Investing in Intel Corporation in Hong Kong is a good choice for a long-term investment.

How to buy Intel shares in Hong Kong

The question of how to buy Intel shares in Hong Kong is asked by many who are interested in long-term investments. But this requires that the person knows the stock market well and actively participates in stock trading. Without them, you won't even be able to open a brokerage account.

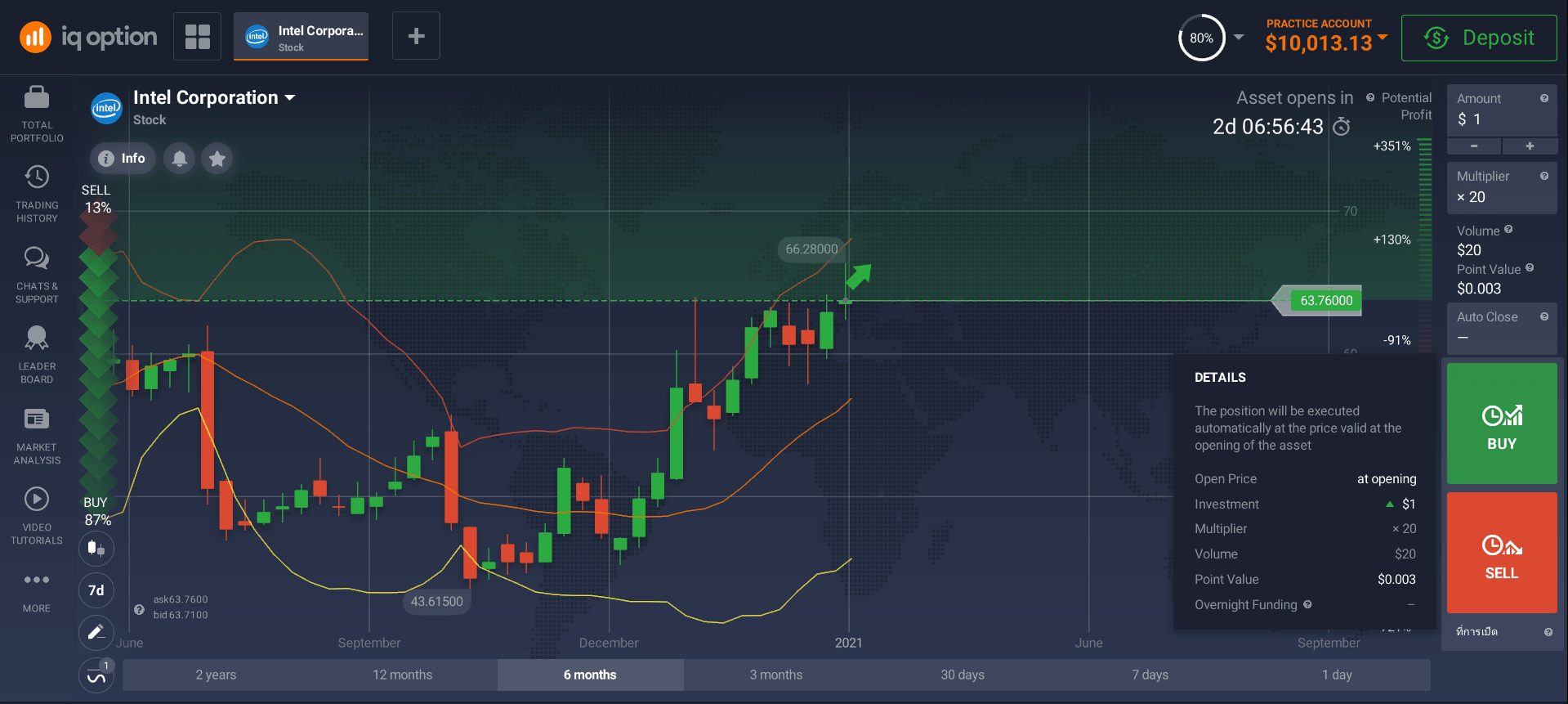

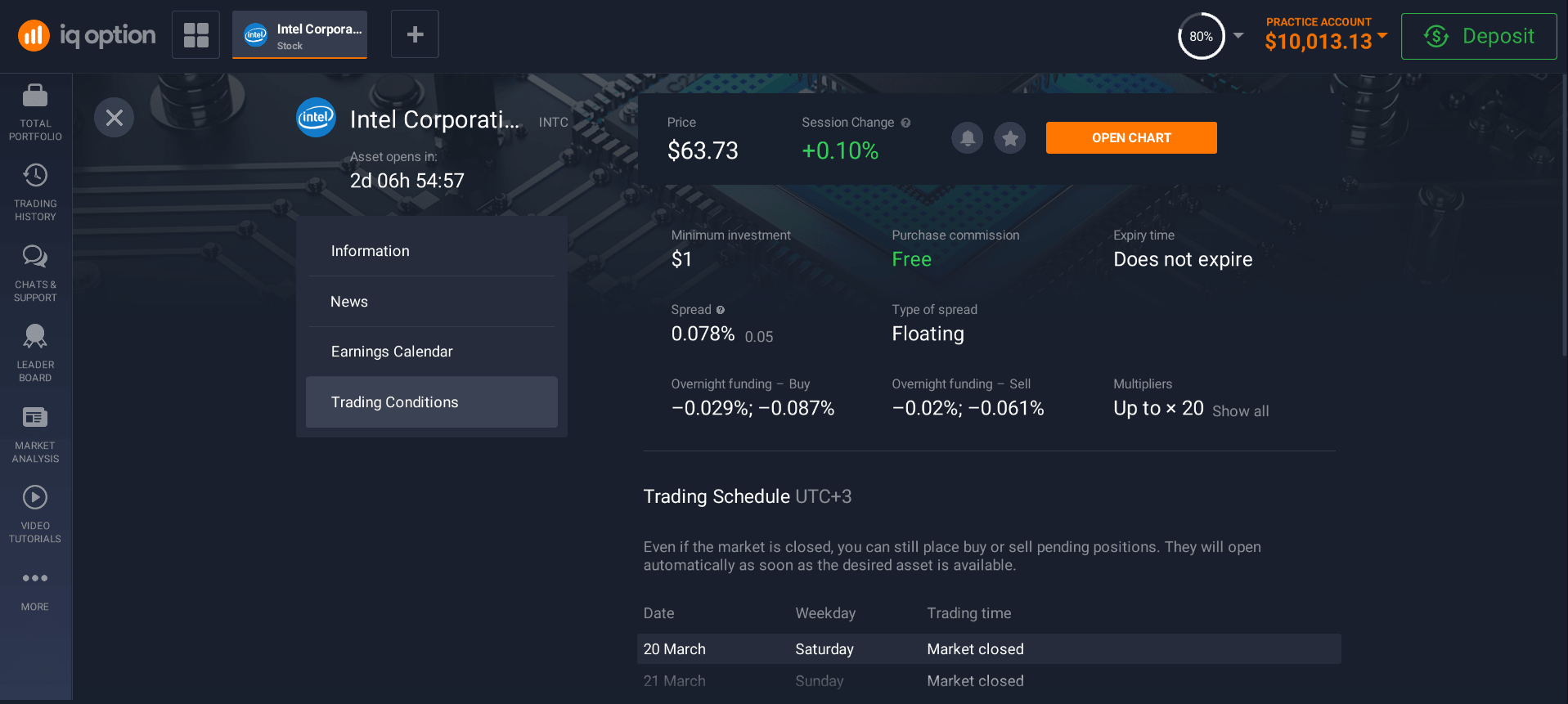

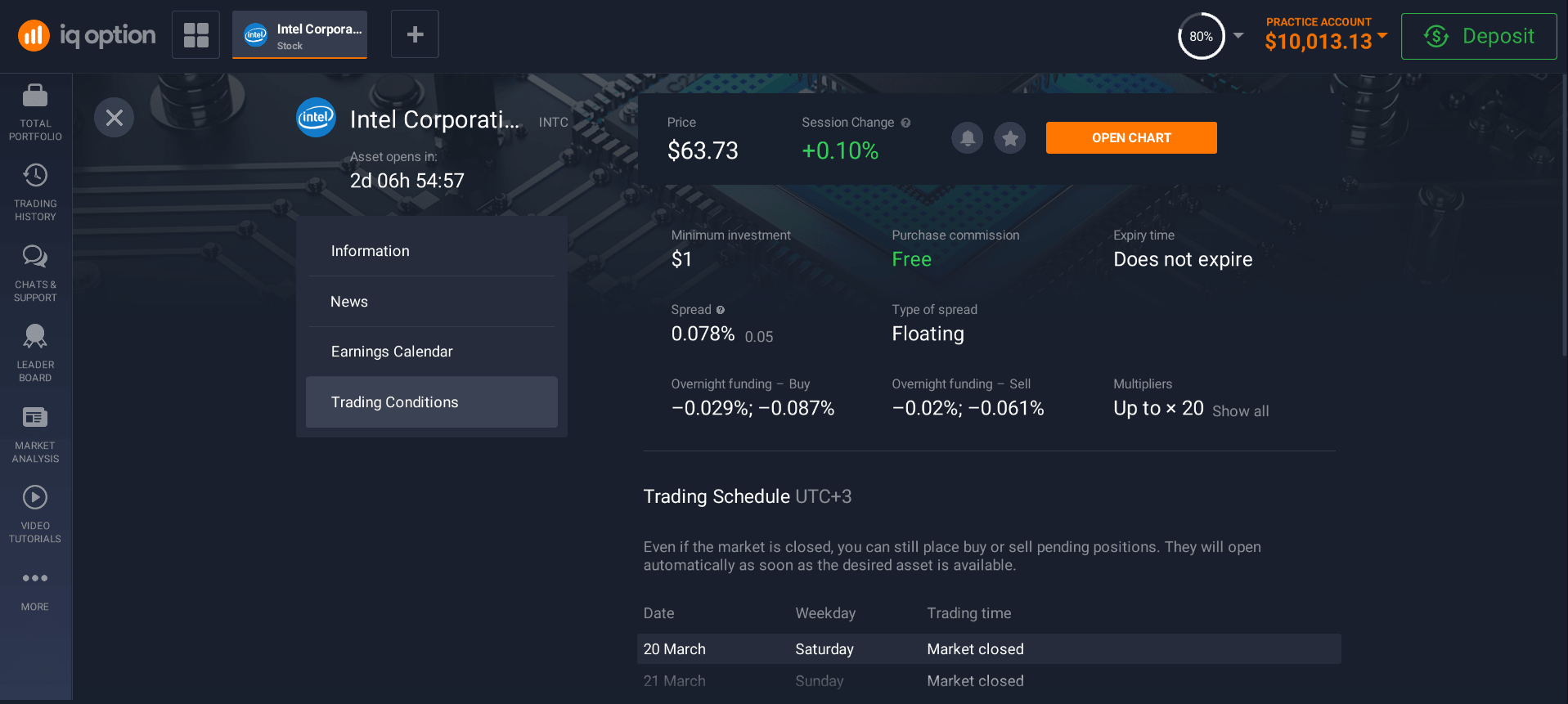

However, it is easy to figure out how to buy Intel shares in Hong Kong at the lowest price. Pay attention to brokers and trading platforms. Online trading platforms allow you to buy and sell Intel stock with just a few clicks. In addition, most of these platforms offer traders free training and trading advice to help them learn how to do business. With a good trading platform, you can make a lot of money in just a couple of days.

A good trading platform should meet your needs and provide you with the most complete information and assistance while trading. Check out the trading platform - it must be reliable and compatible. Reliable trading platform software and various other services such as research and analysis, real-time stock quotes, integrated charts and market movement news will help you make the right investment choice.

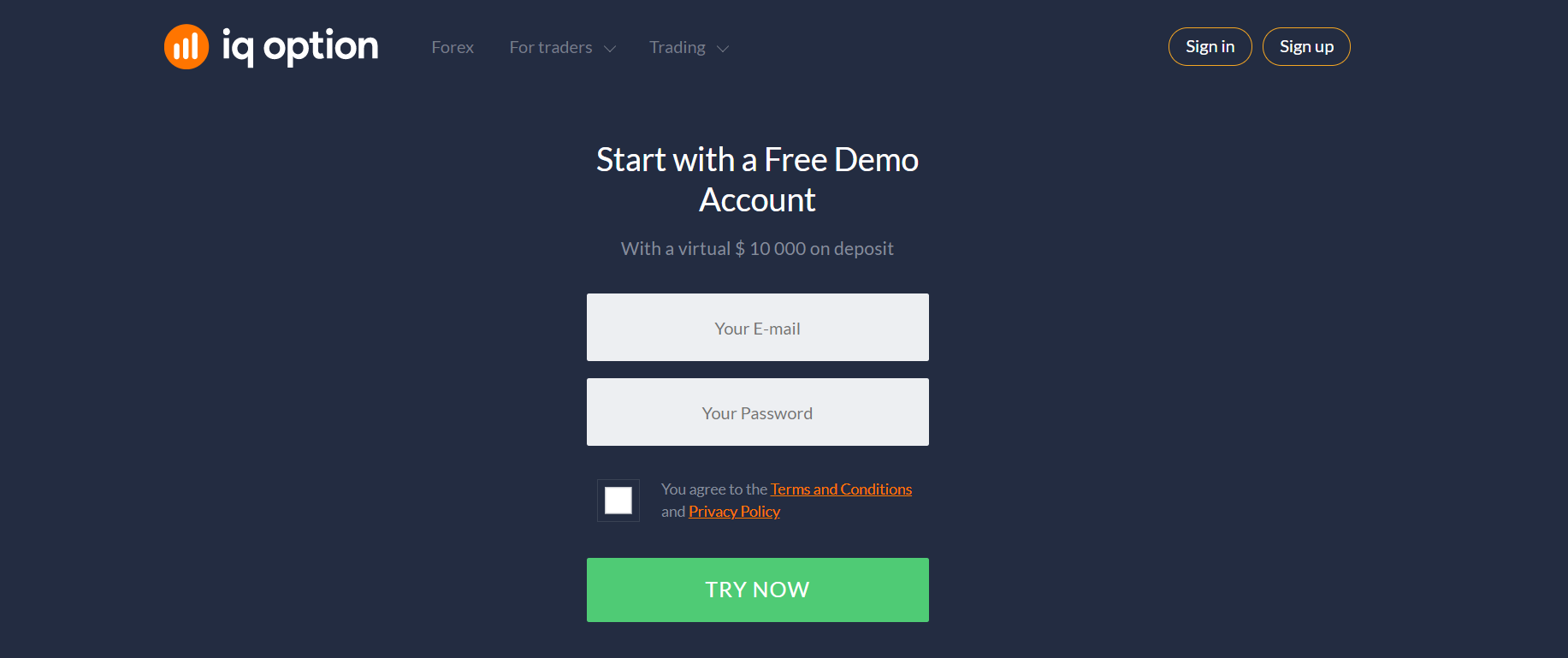

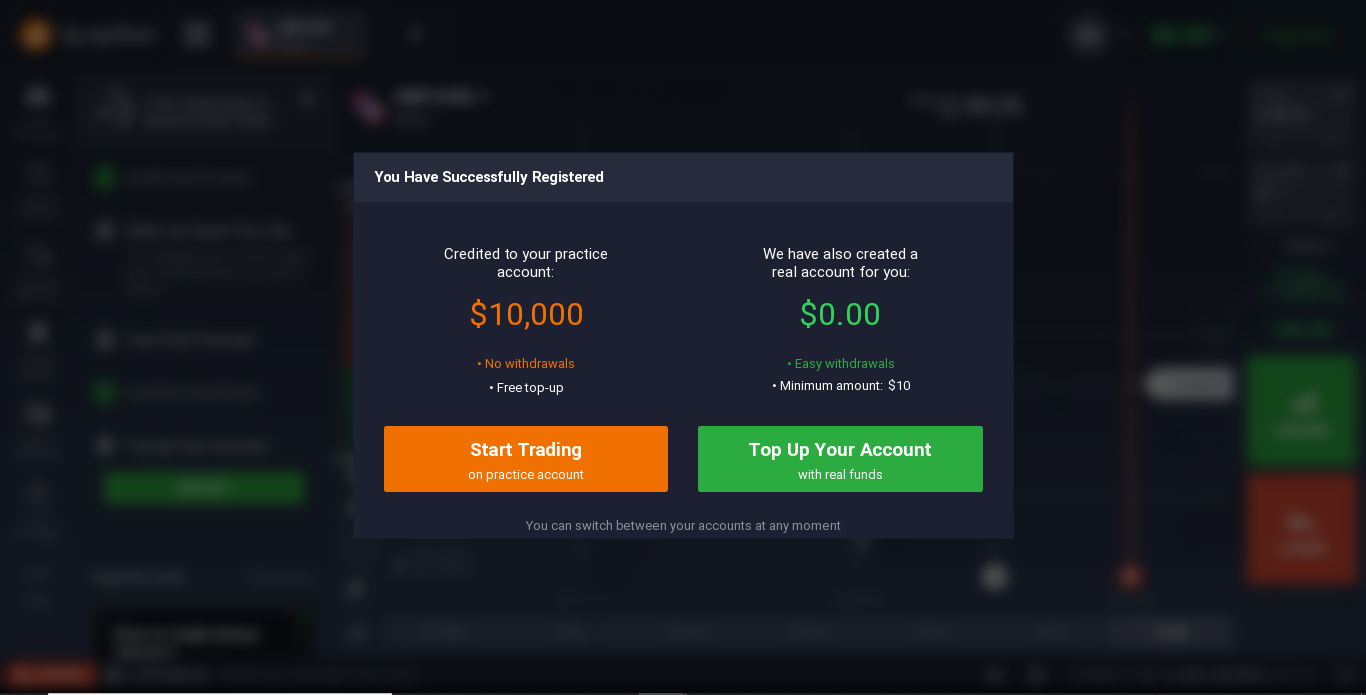

To get started, open a demo account on the trading platform. It does not take a lot of time. You need to register on the platform. To do this, you need to provide your data - name, email address. You will be opened a demo account with virtual US dollars in the amount of 10,000.00 US dollars. You can now practice trading Intel stocks in Hong Kong without losing any money! A demo account will allow you to find out all the features of the trading platform. You will not make money trading with a demo account, but you can learn a lot for further investments. Trading in the stock market involves much more than just buying and selling shares in a company. You should also understand the different trading strategies and the different types of orders that you can place in the stock market.

Stock markets are extremely volatile and unpredictable, especially during periods of company boom or when they experience financial ups and downs. However, you must understand that the market will not always move in your favor. Stock prices can drop to a low before starting to rally again, especially if the company you are investing in is a good company. Thus, you need to know when is the right time to buy or sell your stock.

Once you are confident in your abilities, you can buy Intel shares in Hong Kong. The minimum deposit to open a trading account on the online platform is only $ 10. This is the first step towards a long-term investment in Intel shares in Hong Kong. You can now take full advantage of the trading platform to buy and sell Intel stock.

You can fund your trading account. To do this, you can use a bank transfer, credit card, or e-wallet. The money will appear in your account almost instantly.

Withdrawing profits from a trading account is also easy. The minimum amount for withdrawing money from a trading account is $ 2. Withdraw requests are processed fairly quickly. Money transfer usually takes from one day to a week.

You can be confident in your investment. Experienced and reliable consultants will always come to your aid on the trading floor. They are in touch around the clock. You can ask your questions in the platform chat, write by email, or simply call the support team. The consultants will help you and answer your questions.

Related pages