Online trading in Hong Kong

Online Trading in Hong Kong

Are you interested in online trading in Hong Kong? There are many ways you do this and online trading can be financially rewarding if done in the right way. Generally, the stock market functions on the system of supply and demand.

This article intends to help both beginners and professionals with online trading in Hong Kong and become an efficient investor.

What is online trading?

With online trading, you can place trade orders or cancel them right from the comfort of your home. You can either buy shares or mutual funds or invest in IPO as well and start by simply opening an account and trading account with any registered broker.

It involves the trading of securities through an online trading portal and may include various financial instruments such as mutual funds, equities, and commodities. An online trading platform allows traders and investors to buy/sell these financial instruments.

How to trade online?

Hong Kong has come a long way and talking about the Hong Kong Stock Exchange, it is reportedly the 5th largest in the world. If you are willing to gain exposure to Hong Kong online trading, we have shared some key takeaways that might help you to get started and how to trade online:

The following are a few ways you can trade directly or indirectly in the Hong Kong Stock Exchange:

- Exchange-Traded Funds: One of the easiest ways is through Exchange-Traded Funds or ETFs as it involves no currency risk. Some popular Exchange-Traded Funds that you may be interested in include iShares MSCI Hong Kong ETF and First Trust Hong Kong AlphaDEX Fund.

- American Depositary Receipts: If you belong to the United States, you may choose to invest in the Hong Kong Stocks listed as American Depositary Receipts (ADRs) on your home stock exchanges or over-the-counter (OTC) exchanges.

- Invest Directly Through a Broker: Regardless of the country you live in, ETFs are an indirect way to hold stocks on the Hong Kong Stock Exchange.

- Invest Directly Through a Hong Kong Broker: You can do online trading through local stockbrokers in Honk Kong.

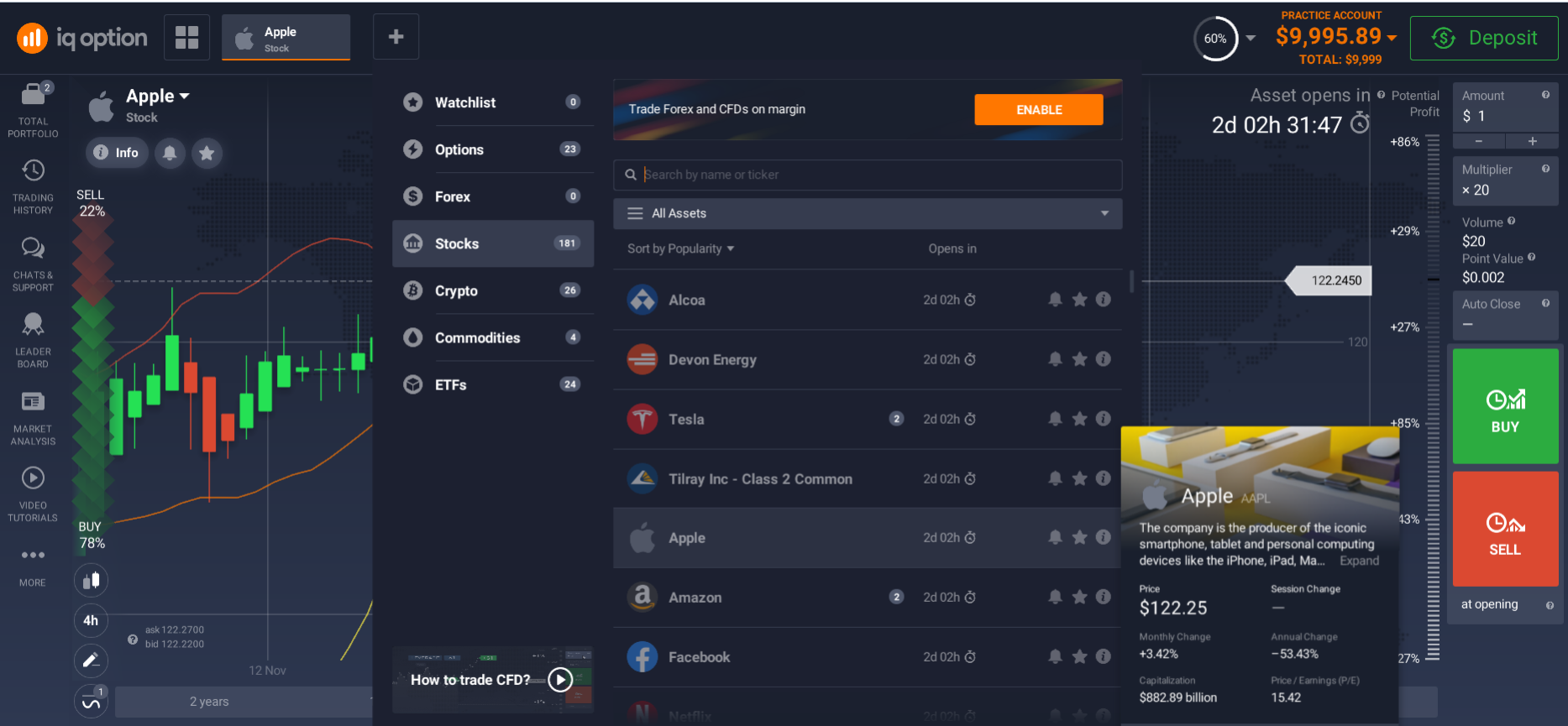

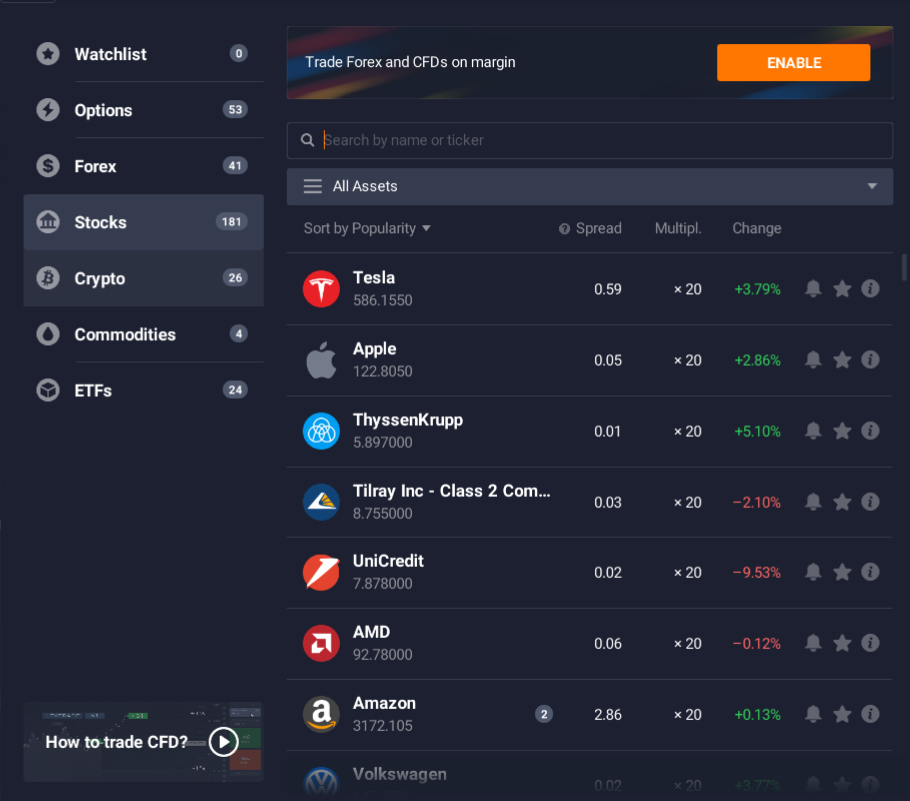

If the above-mentioned terms seems to be pretty complex to you, don’t worry as IQ Option can make trading online an extremely simple process. Once registered, you can find an array of options for trading online and make good money from the marketplace.

Online Trading Platform

When it comes to online trading, online trading platforms allow users to invest across a range of options. A good trading platform offers low costs, innovative strategy tools, premium research, and a comprehensive trading platform. The best online brokers also offer a variety of categories so that you can choose one based on your personal preferences.

As far as a reliable trading platform is concerned, they provides a secure and fuss-free trading and access to a wide range of assets. Also, you can take advice from the experts in the field and get to know about the trading platforms even better.

What is an online trading platform?

A trading platform is a program that allows traders and investors to position trades and track accounts. Such platforms come bundled with services as news feeds, quotes in real-time, charting software, stock price analysis, etc.

The trading platforms work by providing all the necessary assistance and access to trading, price analysis of stocks, market news, etc. In simple words, the technology uses for trading is known as a trading platform and the platform is used to connect buyers and sellers.

We can divide the platform into two categories: Commercial Websites and Prop Platforms. The Commercial Websites are targeted towards day traders and retail investors while the Prop Platforms are customized to match the specific demand for trading.

How to start trading online?

First, you need to pick a trading platform to start trading online while considering the factors like the fees involves, the functionality available, the services provided, access to specialized markets, and more.

If you’re willing to start trading online, here’s what you need to do:

- Trading Account: To begin trading online you need to open an online trading account and for this, you need to find a reliable online broking firm.

- Learn the Basics: Getting started with something new should always start with learning all the stock quotes and basics so that you know the world you are going to step into.

- Draft a Plan: It is important to plan investment strategies and decide in advance how much you are willing to invest. You can also set limits on the amount of loss you are willing to bear.

- Buy/Sell Securities: With the right amount of information in your hand and working with a reliable trading company, you can start buying and selling securities.

Still confused? IQ Option can be a good place to start with as this platform gives you an easy way to start trading online. You will be guided by the experts at every step and within seconds, you can access an array of financial instruments along with tools and tutorials to start trading online fast.

How to register?

Want to register for online trading? The Stock markets have become electronic and all you need to do is find a suitable trading platform and register yourself with them. You need a trading account to invest in the stock market that you can open with a stockbroker.

Here’s how you can registe:

- Select a stockbroker or a trading firm to get started and ensure that you pick a reliable platform.

- Go through the different offerings from the stockbroker and compare brokerage rates.

- Fill in the details in a form provided by the broker and your application may be verified either through a phone call or in-person check.

- Once everything is cleared and processed, you will be given your trading hours and account details.

Note: You may need to submit some documents to register and open a trading account such as proof of identity, proof of address, etc.

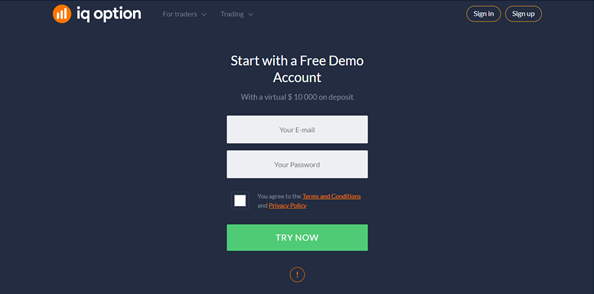

How to open a demo account?

Before opening a fully functional trading account, you have an option to open a demo account to understand the trading world better. A reliable trading platform will provide you with both a Demo and a Real Account to trade and you can start with a demo account automatically.

A demo account opening is as simple as registering with an online shopping site as all you need is to provide a few details and get started. Register yourself for the demo account, get your account number and password, log in for further details, and start trading online.

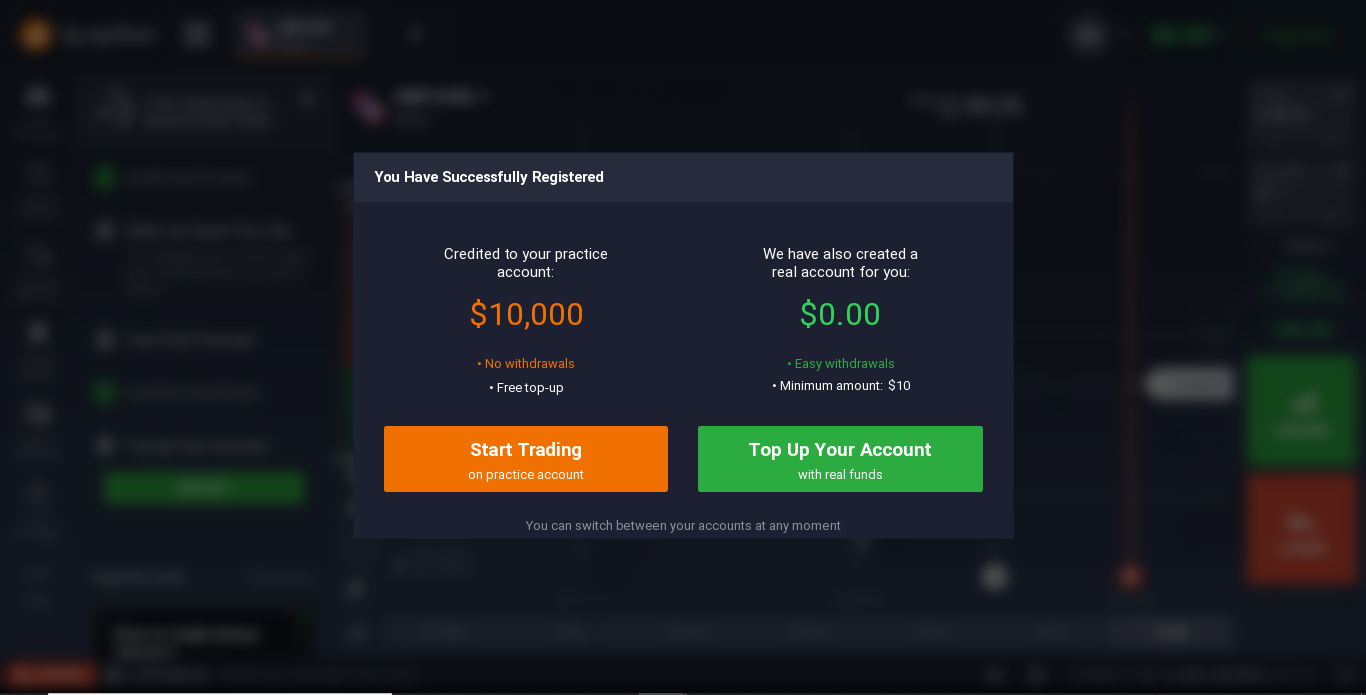

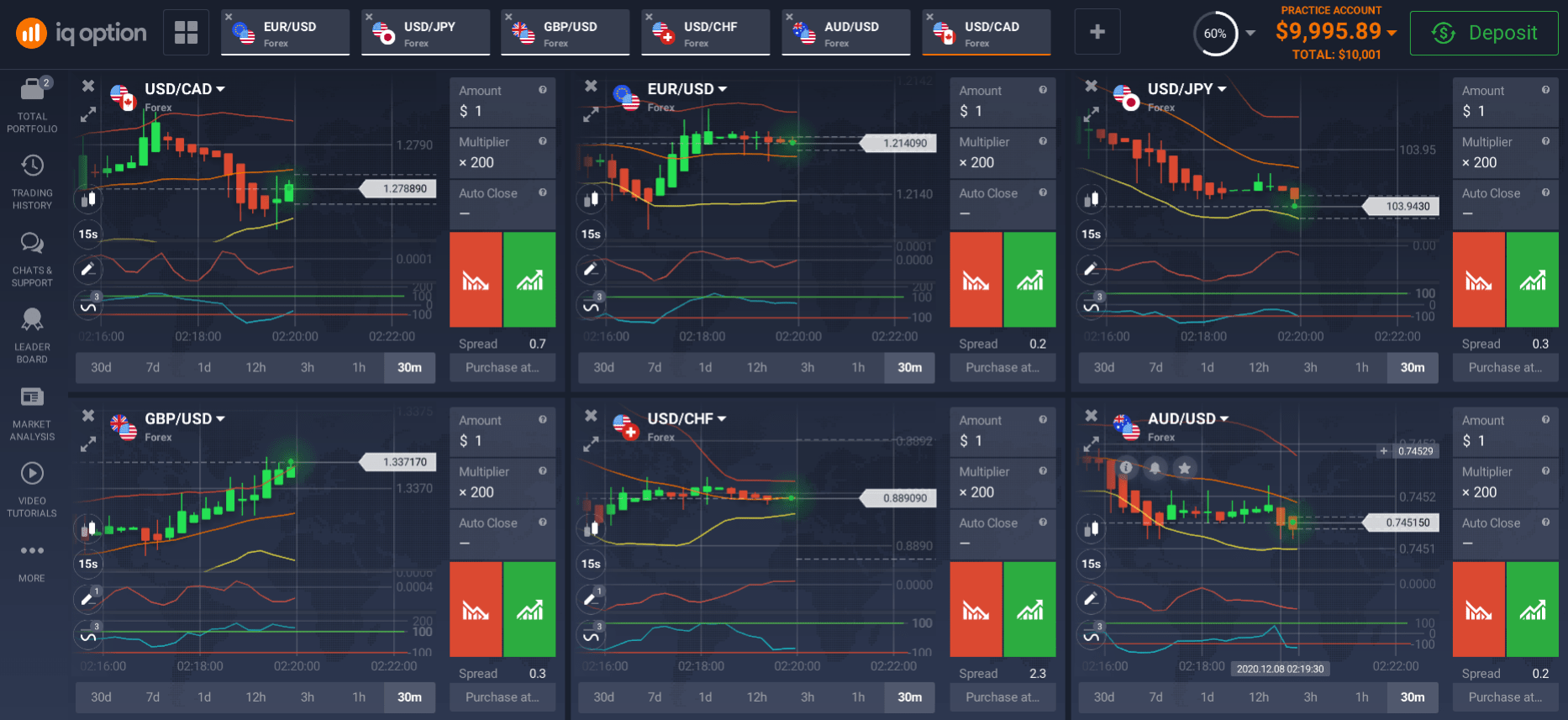

IQ Option has an in-built demo account that you can access for free and also get a replenishable $10,000 virtual amount for practicing online trade.

How to open a real account?

The real trading account is your trading account with a broker and it provides you access to the financial markets trading. So, if you’re ready to open a real account, you need to follow these steps:

- Choose a reliable broker

- Choose the trading account with acceptable conditions

- Register and open the trading account

- Verify your identity for safety requirements

- Get started with trading online

If you’re looking for an easy-to-understand platform for opening a real account, IQ option offers you professional assistance along with a safe account opening.

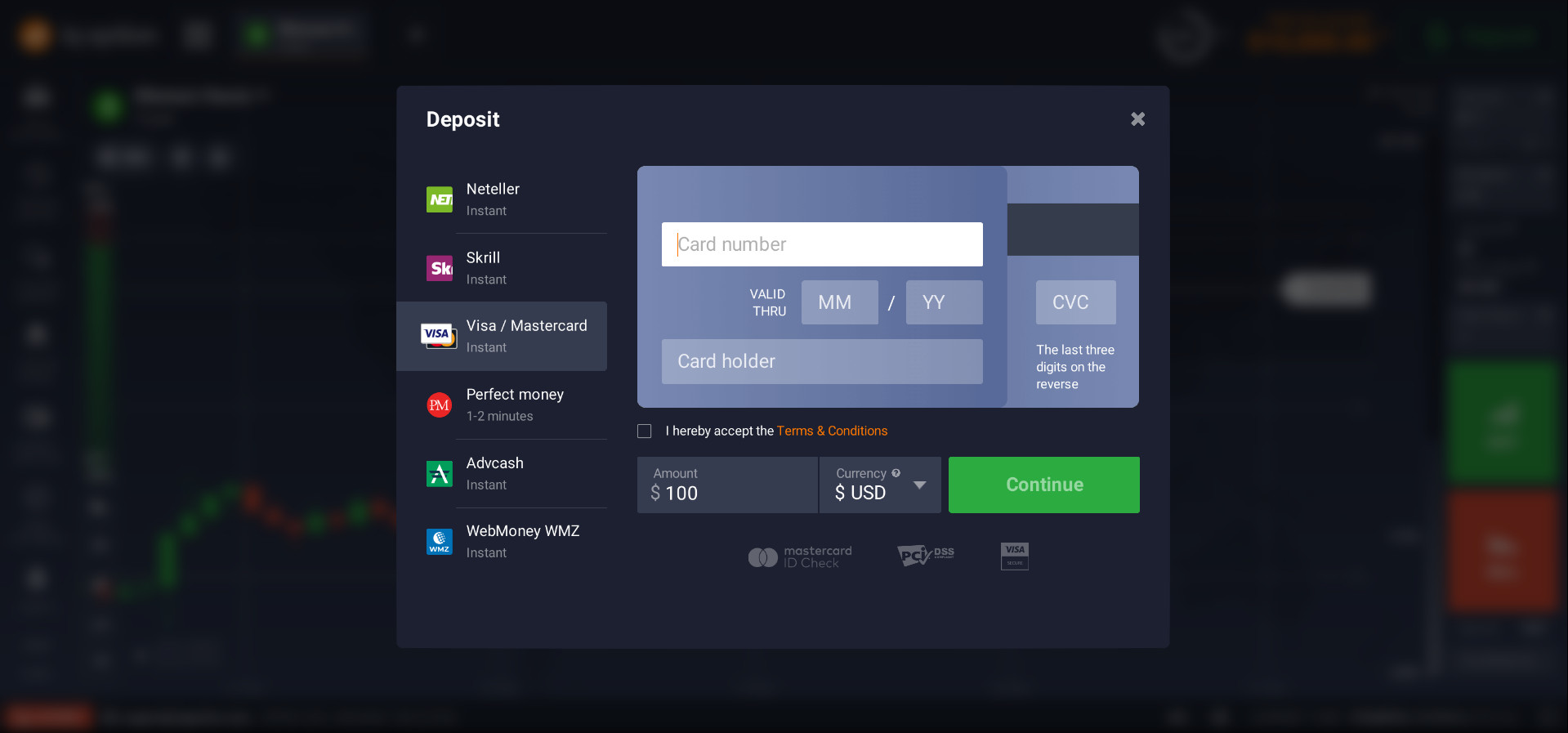

How to fund a deposit?

To get started with trading online, you need to research a bit as each system has its own set of services for making deposits and withdrawals. These systems will allow you to fund investments in the market and IQ Option is one such platform where you can enjoy a wide selection of payment services around the world. It means you can choose your preferred online system to fund a deposit.

Minimum Deposit Amount

The minimum deposit amount for online trading depends on the type of securities or financial instruments you want to buy. If you’re buying or selling stocks, they typically trade in round lots, or orders of at least 100 shares. However, you can start trading with as low as $10 as a minimum deposit.

You may also need to consider the trading expenses like commissions, brokerage requirements, etc. Though you can buy less than the usual round lot for security, you may probably end up paying a high commission which means the returns on each trade will be small.

How to withdraw money?

Withdrawing money from your trading account is as simple as it is with a bank account when you have a sufficient amount to maintain in your regular brokerage account. However, withdrawals are subject to ordinary income taxes and there maybe 8-week stocks hold rule.

If you want to withdraw money from your trading account, you can place a withdrawal request, click on the funds’ tab and enter the amount you want to withdraw in the ‘Withdrawal Amount’ tab. Click on the ‘proceed’ tab and you will be able to withdraw money.

Trading Markets

You will find that there are different trading markets and the main types include Options, Currencies, Futures, and Stock Markets. There are groups of markets within these types that are based on Stock Indexes, Currency Exchange Rates, and Commodities.

Forex or Foreign Exchange Market (FX) is considered the best, the largest, and the most liquid market in the world. A lot of investors trade Forex online via various trading platforms and trading styles such as Scalping, Day Trading, Swing Trading, and Position Trading.

How to trade on the Stock Market?

Stocks, or shares of a company, represent ownership equity in the firm and the shareholders get voting rights and a residual claim on corporate earnings in the form of Dividends or Capital Gains. There are two main types of stock, Common and Preferred.

If you’re interested in stock trading, here’s what you need to do:

- Hire a trading firm or stockbroker who can place trades on your behalf and give you professional advice.

- Do proper research and monitor market movement as online trading is subject to market risk.

- Get paid subscriptions based on market research and analysis.

- Choose the stocks you want to trade and start with a small investment.

- Set a limit to your loss via Set Loss to be in a better financial position.

How to trade indices?

Stock Indices are a popular trading vehicle but you can’t trade them directly as an Index moves according to the stocks held within it. The most popular way to trade indices is via Contracts for Difference or CFDs.

There are 3 major indices including the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. The S&P 500 is the most traded indices and investors consider it to be the best indicator of the US Stock Market performance.

How to trade stocks?

Planning to invest in Hong Kong stocks? The following steps might help:

- Select the Stocks You Want to Trade: Choose the stocks you’re interested in and you should do proper research to know the best options available for growth.

- Pick the Right Broker: To get started with trading stocks, find a good broker, and open an account to trade stocks.

- Use a Demo Account: Don’t rush into a real account opening if you’re a beginner but start with a demo account to evaluate their service and trading platform.

- Begin Trading Stocks: Fund an account with your chosen broker and Strat trading stocks on the Hong Kong Stock exchanges.

Forex Trading

Forex, also known as Foreign Exchange or FX, is a decentralized global market where all the traders from around the world trade currencies. Simply put, the Forex market is a global marketplace for exchanging national currencies against one another.

You can trade currency based on its value just like stocks but a major difference is that you can trade up or down just as easily. In simple words, if your research says a currency will increase in value, you can buy it and vice versa.

How to trade currencies?

The currency market or Forex market allows for 24/7 trading in currency pairs where currencies are traded against one another as pairs and each pair is quoted in pips (percentage in points) out to four decimal places.

As trading currencies can be a bit complex for a beginner, working with a professional like IQ Option can lend you a helping hand. The professionals can help you with trading currencies and get to know more about market conditions and making profits.

Major Pairs

The four most heavily traded currency pairs in the Forex Market are termed as Major Pairs and these include EUR/USD, USD/JPY, GBP/USD, and USD/CHF. These pairs are deliverable currencies and also a part of the g10 currency group.

As far as the most heavily traded currency pair in the world is concerned, the EUR/USD is by far popular due to its large daily volume.

Cross Currency

Cross currency refers to a currency that does not involve the U.S. dollar as a contract settlement currency. Cross rates are the relation of two currencies against each other and in most countries cross-currency trading is allowed in currency pairs.

Cryptocurrencies Trading

Cryptocurrency trading or a Digital Currency Exchange (DCE) is a business that allows investors to trade digital currencies for other assets. It involves speculating on price movements via a CFD trading account or buying/selling the underlying coins through an exchange.

When you buy cryptocurrencies via an exchange, you purchase the coins themselves and Crete an exchange account. In the process, you put up the full value of the asset to open a position and store the cryptocurrency token in your wallet to hold until you’re ready to sell.

How to trade bitcoin?

To trade bitcoins, you need to follow these steps:

- Open an account on a Bitcoin Exchange and get a Bitcoin wallet.

- Fill in the necessary details and verify your identity.

- Connect your wallet to a bank account.

- Set your stops and limits.

- Open and monitor your trade.

- Close your position on the exchange.

How to trade Ethereum?

First, choose a reliable cryptocurrency trading platform and create an account by providing your details. Once the verification is done, you will need to deposit currency into your account through your bank account or debit card.

With a verified account, begin purchasing Ethereum via the exchange and once the transaction is complete, withdraw ETH into your wallet.

How to trade ripple?

Ripple is a real time gross settlement system, currency exchange, and open payment system in beta. To trade Ripple CFDs, you will need to open a cryptocurrency account, fund your account, enter your preferred investment amount, and start trading.

Commodity trading

Commodity trading is gaining immense popularity and a commodity is a basic good use in commerce that is interchangeable with other similar goods. Some popular examples include gold, oil, silver, natural gas, and more.

How to trade metals?

There are many ways you can trade precious metals such as Gold, Silver, Platinum, etc. Metal trading is based on the overall global economy and major currencies. You can take ownership of metals or invest in coins or go for indirect investment.

Some popular options to trade metals include Commodity Exchange Traded Funds (ETFs), Common Stocks and Mutual Stocks, Future and Options, Bullion, and Certificates.

How to trade gold?

You can find an online platform dealing with gold trading and the traders can buy or sell fractional amounts of gold bars or coins. A professional trader will provide details on the gold price chart to consider whether the markets are in ‘risk-on’ or ‘risk-off’ mode.

How to trade silver?

You can either choose to buy silver directly in the form of bullion and coins or trade bases on its later value with futures and options or CFDs. It is just like trading stocks as you need to determine the market trend.

How to trade crude oil?

The best way to trade crude oil is via getting shares of oil companies or through energy-based exchange-traded funds (ETFs). However, some countries allow you to buy actual oil by the barrel or as light sweet crude oil futures contracts.

How to trade assets?

A collection of securities held by a firm to resell for a profit are trading assets and they may include U.S. Treasury Securities, Foreign Exchange Rate Contracts, Mortgage-backed Securities, and Interest Rate Contracts. These are acquired and held for reselling at a profit.

How to trade CFDs?

CFDs trading involves the buying and selling of Contracts of Differences or CFDs where the investors enjoy the profit from price movement without owning the underlying asset. You can trade CFDs via a contract with a broker without utilizing any stock, Forex, commodity, or Futures, etc.

How to trade ETFs?

An Exchange Traded Fund (ETF) involves a collection of securities such as stocks and in many ways similar to mutual funds. ETF shares trade throughout the day and you will need to open a trading account with a broker for holding the ETF units.

How to trade binary options?

Binary options are financial options that come with two options: a fixed amount or nothing at all and trading is based on whether there is a simple yes or no proposition. Traders set the bid and ask price depending on the possibility and you will need to work with a broker.

Safety of Internet Trading

Though Internet trading is safe these days, cyber-fraud is also expanding at a dramatic speed. Therefore, work with a secure Internet connection and the computers/laptops must be loaded with anti-virus and anti-spyware program. Using a dial-up or a secured wi-fi is good for a trading account.

How safe is it to trade online?

Most reliable online trading companies use secure networks and keep their client’s information encrypted and protected. Also, there is not much paperwork involved and everything can be managed via a mobile app means your confidential details are safe.

My online trading are protected

If you’re involved in online trading, it is better to be prepared to protect your personal and financial data. Make your trading password as complicated to guess as possible as simple ones can be hacked easily. Never share your trading account with anyone and change the password often.

Most reliable brokers will offer you a two-way authentication (2FA) which means you will need an OTP to login. Also, installing an anti-spyware or a personal firewall can help you stay protected from hackers or viruses.

FAQ:

Is online trading safe?

Yes, online trading is safe as far as you follow all the safety guidelines and stay alert regarding your account details, password, etc.

Is online trading profitable?

Though proper research and practice is the key to successful online trading, finding a reliable trading broker or firm plays an imperative role.

How do I start online trading?

If you’re new to online trading, it is best to go through the basics first and then select a reliable online broker. Also, start researching various options available to make a plan.

How much do I need to day trade?

If you’re interested in day trading, the day traders working in the U.S. Stock Market are required to maintain a minimum account balance of at least $25,000. However, the best idea is to find a good broker and they may provide you a suitable solution.

Register and start trading online with IQ Option to become a successful trader! You can simply log in to find out how to start trading and make money online right now!

Related pages