Start operating with crypto coins

At some point you will have heard about cryptocurrencies and wondered what they are, how to start operating with crypto coins, how to buy or even how to generate money using these new technologies.

To correctly start trading in crypto-currencies, it is essential to understand that a cryptocurrency is a digital currency that uses cryptographic encryption techniques in order to offer more secure transactions, and at the same time they are decentralised currencies, which makes them independent from any government or central bank, so their value depends on the supply and demand that these digital currencies have. The first crypt coin that is spoken of is Bitcoin, which was created by Satoshi Nakamoto, who introduced the blockchain, the software on which Bitcoin is based.

First of all, it's important to remember that cryptocurrency trading involves a high level of risk, so it's not recommended to invest money you can't afford to lose.

What is cryptocurrency trading? How to start trading?

Mentioning the risk, one way to generate profits using cryptosystems is by trading cryptosystems, and by trading we mean the buying and selling of these currencies to benefit from the difference between the prices at which we buy them and the prices at which we sell them. This can be done in the same way as buying any good, that is to say, we buy the cryptocurrency at a cheap price in the spot market (we buy it and receive it immediately), we keep it for a while, and when the price has risen enough to make a profit, then we sell the cryptocurrency, also in the spot market, and we obtain as a profit the difference between the two prices.

What do you need to trade in cryptocurrency?

Trading transactions are not carried out physically, everything is done digitally, and it is possible to do it in a cryptocurrency exchange, that is, a digital exchange focused on cryptocurrency trading. And if we want to trade crypto currencies in this way, then it is necessary to open an account in an exchange, and register an account in a crypto currency portfolio, which is where we will keep the crypto currencies we buy. It should be stressed that an exchange is a website, or an application, that offers several of the most popular сryptocurrency on the market, and in principle it is the place where each of the сryptocurrency is priced. The price will depend on the quantity of cryptocurrencies available (each cryptomoney has a quantity available and sometimes limited to a certain number), and on the supply and demand that each cryptomoney has. This means that the fewer crypt coins you have available for sale and the higher the demand for them, the higher the price you have to pay to obtain them. But if, on the contrary, the demand is low and you have many, then the price will be cheaper.

Some of the disadvantages of trading by buying and selling, which we have already explained, are that we need to have an open account in at least one exchange, we need a portfolio of crypto currencies and every time a transaction is made a commission of a percentage of this is paid to the exchange and to the blockchain itself, which makes it expensive to carry out these transactions. This in turn has created the need to create alternative methods to trade cryptocurrencies.

One of these alternative methods to start trading cryptocurrencies and be able to generate a profit is by using the so-called CFDs (Contract For Difference), that is, to benefit from the real price movements without having to own the cryptocurrencies, which makes their operation "easier" and their operational costs "cheaper".

To be able to trade cryptocurrency through CFDs you need first of all to have a trading account in a broker, that is why when choosing a broker you must pay attention to different basic points such as:

- That you have customer service in our language, this because at some point you will have some questions, and what better than when you contact customer service they will answer all our doubts clearly and in English.

- It offers a trading platform available for trading from a personal computer and from an application available for the mobile phone, so you can trade from anywhere and at any time. And of course, the application must also be available in our language.

- Offer a demo account, the demo account will help us learn how the platform works, and allow us to gain experience trading with practice money, so we don't risk real money to learn how to trade.

- What are the minimum and maximum deposit and withdrawal amounts? At the beginning this seems not so important, but once you have gained experience, you should be clear about these amounts as if your goal is to generate extra income, you must deposit real money in order to start generating in your trading account. In fact, once you are ready to start with a real account, you can make a minimum deposit to see how ready you are, a minimum deposit is recommended so you don't risk too much capital when you are starting out.

- What methods are available for depositing and withdrawing funds. A very important point, since the platform must offer convenient methods for depositing and withdrawing money in English.

IQ Option is an example of a platform where you can trade crypto currencies through CFDs. It offers a wide range of crypto currencies, has a English language platform and its customer service is available 24/7.

The main crypto-currencies to consider when negotiating.

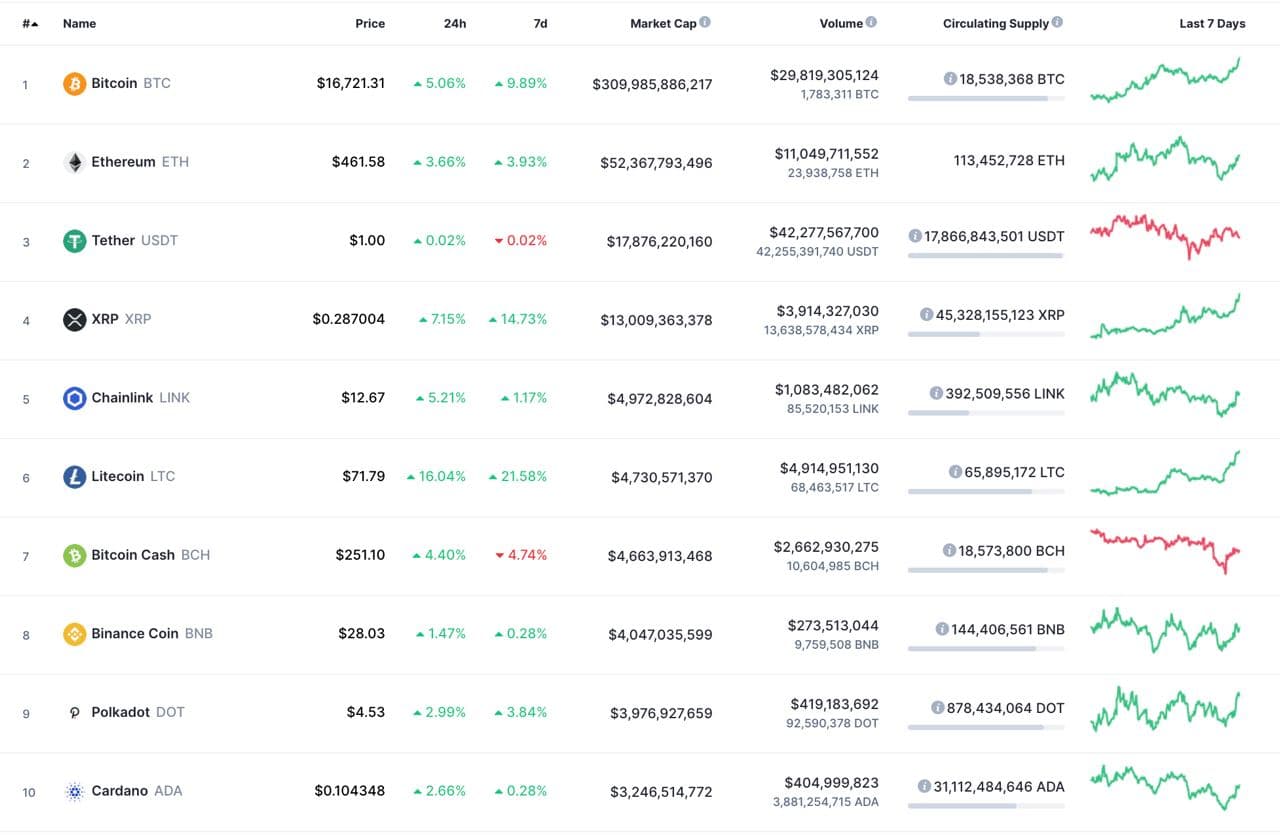

At present the crypto market is a very large market, there are more than 3000 different crypto currencies, although most of them have a very small price, which makes traders focus on the crypto currencies with the highest trading volume or with the highest market capitalisation (capitalisation is the number of currencies circulating in the market multiplied by the unit value of that crypto), as shown in the image below.

Bitcoin is the largest with a capitalization almost 6 times higher than Ethereum, second on the list and Tether in third position. In this same list, there are other renowned cryptocurrencies such as Litecoin, XRP (Ripple), Bitcoin Cash, a fork that emerged from Bitcoin itself, or Cardano, although there are other cryptocurrencies with a lower market cap such as Stellar, IOTA, NEO or Monero that are also quite well operated and enter the top 35 with the highest capitalization. The list shows the market capitalization as of this writing.

How do you analyse crypto coins to find market entry points?

When you have chosen the broker where you are going to trade you should consider a trading strategy, this is because you should avoid trading widely. You should always carry out an analysis of the crypto currency you wish to trade, as this will allow you to avoid what is known as "blind trading", and at the same time by analysing the crypto currencies you will be able to control the emotions which trading brings with it.

When developing a trading strategy there are two important concepts to consider:

1. Fundamental analysis is the analysis of the news, of the events that occur and that can affect the cryptocurrency that interests us. Remember that the sooner we learn about new trends in crypto (if we are early adopters), the more advantage we can take from the price movement we have. In order to make a news analysis as precise as possible, we must constantly read what is happening in the crypt world, this is information that is available on the internet and is free, so we must take advantage of it.

2. Technical analysis: it is the analysis of the price chart to find repetitive patterns that can give us trading signals (possible alerts to enter the market with a buy or sell operation), and so try to predict the price movements that you may have. When we talk about technical analysis, we are talking about trend analysis, the use of some technical indicators (indicators are tools that allow the analysis of the historical data through mathematical formulas), some trend line, support or resistance, etc. Next we will explain the use of some concepts of technical analysis and some indicators and how these can be used in operating сryptocurrency.

Market trend: The trend can be defined as the direction the market is taking over a period of time. A rising trend, or bull market, is when the asset has been gaining value over the last minutes, hours, days, etc.; conversely, a falling trend, or bear market, is when the asset has been depreciating.

Support and resistance lines: these are lines that are drawn on the price chart and that the price has touched a few times (either up or down), but cannot break. Support is when the price tries to go down but cannot get above a minimum price that has been reached before and bounces upwards; resistance is basically the same but in this case the price tries to go up and cannot get above a maximum price where it bounces downwards. Fibonacci retracements are a great tool for establishing zones of support and resistance by dividing the height of a move into levels derived from Fibonacci ratios.

Example of a support line at 0.08946 USD and a resistance line at 0.11246 USD for each Cardinal on a Japanese candlestick chart at a one-day time frame per candle.

Technical analysis also includes the use of indicators, with the moving average (MA) being one of the most commonly used indicators. The moving average represents a continuously calculated value of the arithmetic mean of the price over a specified time period, and serves to identify upward or downward trends. It is an upward trend if the price chart is above the line representing the moving average, and a downward trend if it is below it. The exponential moving average (EMA) is a derivative of the MA, and is often used in conjunction with other indicators, such as Bollinger Bands, to create more complex and therefore "more accurate" trading strategies, although accuracy has nothing to do with the number of indicators used. Other combinations of indicators such as the Stochastic Oscillator or the Relative Strength Index (RSI) with Bollinger Bands can also be used to find moments of volatility and market overbought or oversold. Finally, there are many indicators that will give us trading signals depending on what they calculate, there are available the moving average of convergence-divergence (MACD), or also the average directional index (ADX).

Trading Plan. Getting started properly in cryptocurrency trading

Another thing that should be taken into account when trading crypto currencies is the trading plan, the trading plan will help us to better manage our trading account by serving as a guide and at the same time it will help us to have better financial management and reduce potential financial risk to the maximum. In order to create a trading plan we must first think about whether we want to trade short term to benefit from small market movements, or long term trading to benefit from larger movements. Whichever time frame we are interested in, we should bear in mind that when trading сryptocurrency through CFDs there are some tools that should be provided by the trading platform we choose to better manage our risks. One of these tools is the Stop loss, a tool that will allow us to stop our possible loss (in case the market goes against us) at a level we have selected, or the Take profit, which is the taking of profits at a level we have programmed and will take action once the price reaches that level.

Some platforms also allow us to program operations according to our analysis, and if the price of the asset touches the price at which we want to enter the market, then the operations open automatically; there are 4 types of operations that we can program, known as pending orders, they are 2 of the type sale orders, and 2 of the type buy orders. Remember that when we program a pending order there is no time for negotiation, the operation will be opened only if the price of the asset touches the price at which we want to enter the market, of course, as long as it is available, otherwise there can be a small slide in the price.

The sales orders are:

- Sell limit: when you have a scheduled sale operation above the current market price.

- Sell stop: when you have a programmed operation of sale below the current market price.

Buy orders are:

- Buy limit - when you have a scheduled buy trade below the current market price.

- Buy stop: when you have a programmed operation to buy above the current market price.

General trading strategies

One last issue to be addressed is some general strategies when trading, but these strategies are more focused on how the trades will be made, or how long a trade would be active, rather than on the analysis of the price of the asset. Some of these "ways" to trade are:

- Day trading, as the name suggests, is trading that opens and closes on the same day, the biggest advantage is that no fees are paid for leaving trades open overnight.

- Swing trading is the opposite of day trading, where you have open trades for a longer period of time, lasting up to a few weeks open. The advantage of this is that the trader benefits from long term movements.

- Scalping, this is a way of trading at the very short term, because what is sought is to open many operations, and each time that an operation manages to have a profit, no matter how minimal it is, it is closed, so that when adding up all the small profits of all the operations made, an interesting profit is obtained; the disadvantage of this type of trading strategy is that you must be in front of the computer each time you go to trade.

- Buying and holding, this is the way of trading that we described at the beginning when we talked about the crypto currency exchanges because you buy at a low price to sell at a higher price to take advantage of the price difference.

I hope that this short article has been helpful to you in better understanding cryptocurrency trading and how to get started in this world. So if you have found it useful, start trading cryptosystems on your practice account, and as you gain experience you can invest from time to time in a live account with a minimum deposit.

To conclude I would like to answer some questions that are very common among those interested in starting in this trading world.

FAQ

Is the trade in cryptocurrency safe?

Trading in cryptocurrency is a risky activity, which means that you can make a profit as well as a loss, so it is not recommended to invest money you cannot afford to lose.

Which cryptocurrency is the best for beginners, and which cryptocurrency is the best for trading?

You don't have one crypto money that is better than another, analyse the market and find one that seems stable to you according to your own analysis. What I can comment on is that the cryptomoney currency which could be best traded is the one which shows more stability in the medium and long term.

How much does it cost to start trading in cryptocurrencies?

In principle, operating with cryptocurrencies is free, although we should remember that when transactions are made with cryptocurrencies we always end up paying a small commission to the exchange and to the blockchain which processes our payment. If we trade CFDs, then the charges per trade depend on the leverage we use and the days we have the trade open (the night commission), but starting with a real account to gain experience is free.

Is cryptocurrency trading profitable?

It can be a profitable activity, but it is important to always remember the risk involved.

What are the 3 main cryptocurrencies?

The main cryptocurrencies by market capitalisation are Bitcoin, Ethereum and Tether.

The main cryptocurrencies by reputation: Bitcoin, Ethereum and XRP (ripple).

Related pages