Characteristics of the currency pair EURUSD

One third of all transactions in the market are in the EUR/USD options. This is not surprising because the economies of the US and the Eurozone are huge. In EUR/USD, the euro is the base currency, and the US dollar is called the quoted one. The exchange rate is the amount of dollars that is needed to purchase euros.

What you need to know about currency pairs?

A currency pair is always a pair or two currencies with a price ratio.

The order in a pair will always be like this:

| First currency | Second currency | |

| Basic | Quoted |

Initially, it is difficult to quickly learn to read a currency pair, but after a short time it will become easier.

There are three types of trading pairs:

| Basic | Cross-pairs | Exotic couples | ||

| These are the ratio of currencies of countries with powerful economies - the USA, Great Britain, Switzerland, etc. The main pairs are in demand, they "reign" on the stock market. In such a pair, the US dollar is always present. The most popular pair is euro / dollar. | There is no US dollar in such pairs. All currencies are pegged to the US dollar, and in order to exchange the euro for the pound, you must first convert the euro to the US dollar and then to the pound. In a cross pair, this intermediate transfer is done automatically by the trading platform. | Pairs with the currencies of economically weak countries (Africa, Asia, South America), or small European republics in which there is no euro (Denmark, Norway, etc.). |

Exchange rates

The exchange rate is the ratio between two currencies, or it is the price of one currency expressed through another currency. The nominal exchange rate is the actual price of one currency in terms of another currency.

Types of exchange rates:

| Fixed | Floating | Cross-rate | ||

| This is the legal relationship between the two currencies. | Installed at trading on the currency exchange. | This is the ratio between two currencies, which follows from their rate in relation to a third currency. |

Currency ISO codes are used to indicate currencies when concluding transactions. The individual currency code consists of three letters: the first two letters represent the country, the third - the currency. Each currency code is individual and irreplaceable, this is done so that there is no confusion on different exchanges.

The currency that is bought or sold, that is, traded, is called the traded currency, and the currency that is used to evaluate the traded currency is called the quote currency. So, when displaying a currency pair, the first of the indicated currencies is the traded currency, and the second is the quote currency. Usually, when the exchange rate is indicated, the foreign currency acts as the traded currency, and the local currency acts as the quote currency.

Trading sessions

The market becomes available to traders at midnight from Sunday to Monday. The market operates around the clock due to the time difference of those countries whose exchanges form the market system. The market closes at midnight from Friday to Saturday. Thus, we can talk about the round-the-clock work of the foreign exchange market with breaks on weekends.

Each exchange has its own schedule. Due to the time difference, there is a certain shift in the operating period of one exchange relative to the other. Thus, overlapping with each other by a certain number of hours of work, exchanges of different countries seem to replace each other in the market.

Trading session schedule:

| Pacific | Asian | European | American | |||

| 00:00 - 09:00 | 03:00 - 12:00 | 09:00 - 18:00 | 16:00 - 01:00 | |||

| Least volatile, opens at midnight. The trading day begins in New Zealand and Australia. The Pacific financial center is located in Wellington, but its turnover is very low. | Starts in Tokyo, then Singapore and Hong Kong join it. Trading activity here is quite moderate. Due to low trading activity, market participants often merge the Asian and Pacific sessions. | Reaches its peak activity during the first two to three hours. After that, the market slows down a bit until the opening of the American session. | At this time, the most important fundamental news and statistics are released. Therefore, the market is not very calm during this period of time. |

Knowing at what time the asset price behaves calmly, and when it fluctuates constantly, you can open deals with minimal risks. This helps to preserve your personal and earned money.

Trading time intervals

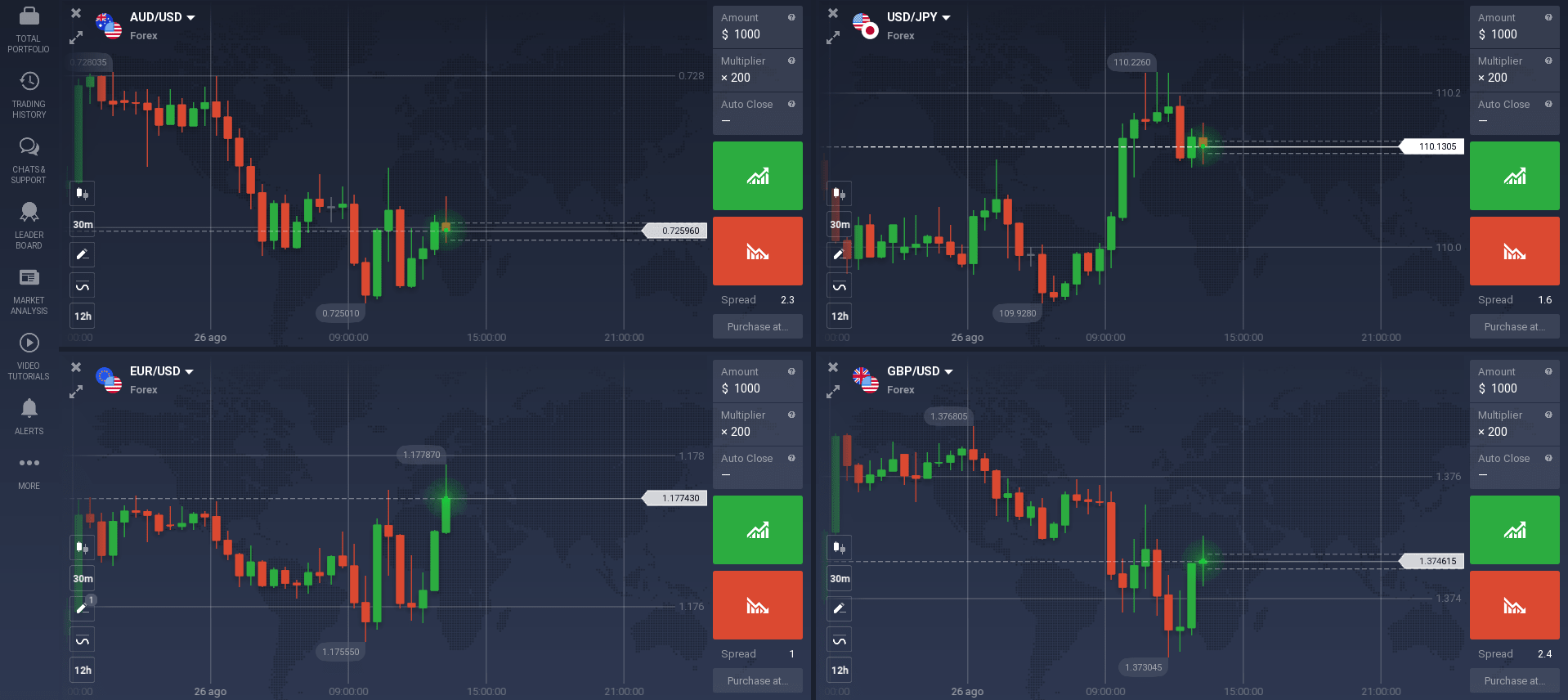

Time interval (timeframe) is a method of grouping quotes for more convenient display on the chart.

There are many types of timeframes, but the most common among them are the following:

| Minutes | Sentinels | Day | Weekly | |||

| M1 (minute); | Н1 (hourly); | D1 (daytime). | W1 (weekly). | |||

| M5 (five minutes); | Н4 (four hours). | |||||

| M15 (fifteen minutes); | ||||||

| M30 (thirty minutes). |

Timeframe markings indicate the amount of time in one candlestick. The larger the timeframe the trader chooses, the longer the time frame includes one candle on the chart.

The choice of timeframe depends on a number of features, for example, the nature of a particular trading strategy or the approach to trading in general. Some traders trade within the day and make many transactions per day, others - 1-2 transactions per day, and some even make 1 transaction per week. That is why the time intervals are selected individually.

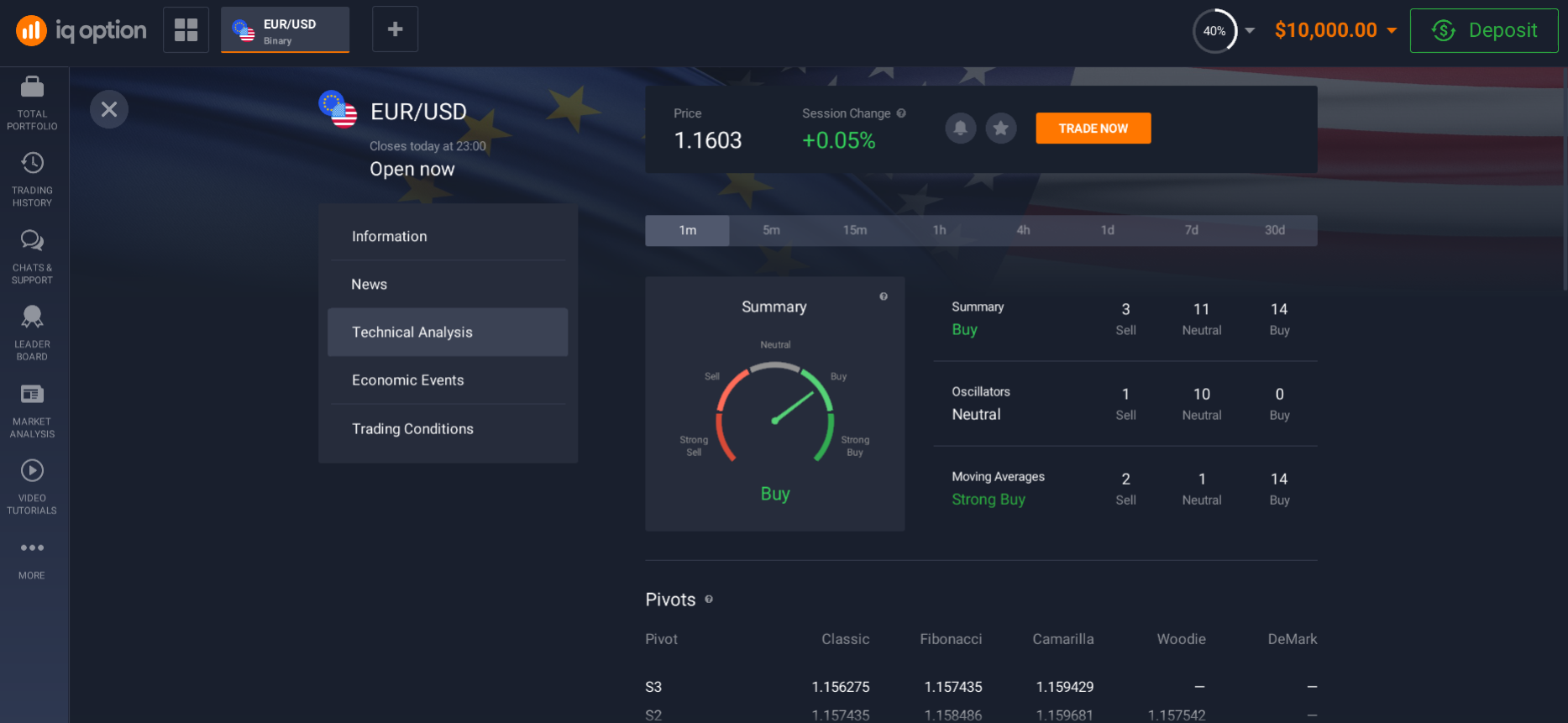

Trading strategy

One of the conditions in order to trade profitably in the market is to have a well-developed, profitable trading strategy. Therefore, special attention is paid to this issue when starting work on the market.

The foreign exchange market has its own specific laws. Currency speculations are conducted on the basis of such laws. The market does not move in a chaotic manner, it operates according to its own rules. Any experienced trader understands this and therefore uses a method in his work. All transactions of a currency speculator are performed using a trading strategy. Not a single professional will trade just like that, at random or by intuition, entrusting his deposit to luck. There is a clearly defined order in every trader's trade.

Every newbie who comes to the market must decide on the trading method with which he will work. There is a wide variety of trading strategies. Therefore, the choice of a suitable method must be approached with great responsibility. Depending on the chosen strategy, the profit or loss of the future trader will be formed. Trading strategies are selected individually. The selection of the method depends on many factors, for example, such as:

| Time range | Overclocking the deposit | The nature of the trader himself | ||

| A specific trading method is selected, for example, scalping trading or long-term transactions. | The system of work with which the trader will work is taken into account. This refers to the aggressive or classical method. | The psychological factor also influences the choice of strategy. If a trader is inexperienced and timid, then he will trade carefully using the classics. Conversely, an ambitious, assertive, ready for different experiments, such a beginner, will use an aggressive trading method. |

The strategies are also divided into types:

| Non-indicator | Indicator | |

| Based on candlesticks or bars. These trading methods use candlestick analysis based on various candlestick configurations and patterns. | They use various technical indicators, which can be used to determine the direction of price movement. |

Whatever trading method a novice trader chooses, the most important thing is that he himself understands how the strategy works, the simpler its conditions, the better. The choice always remains with the trader, and if he takes into account all the advice that was given by experienced traders, then the chances of choosing a profitable trading strategy for himself increase.

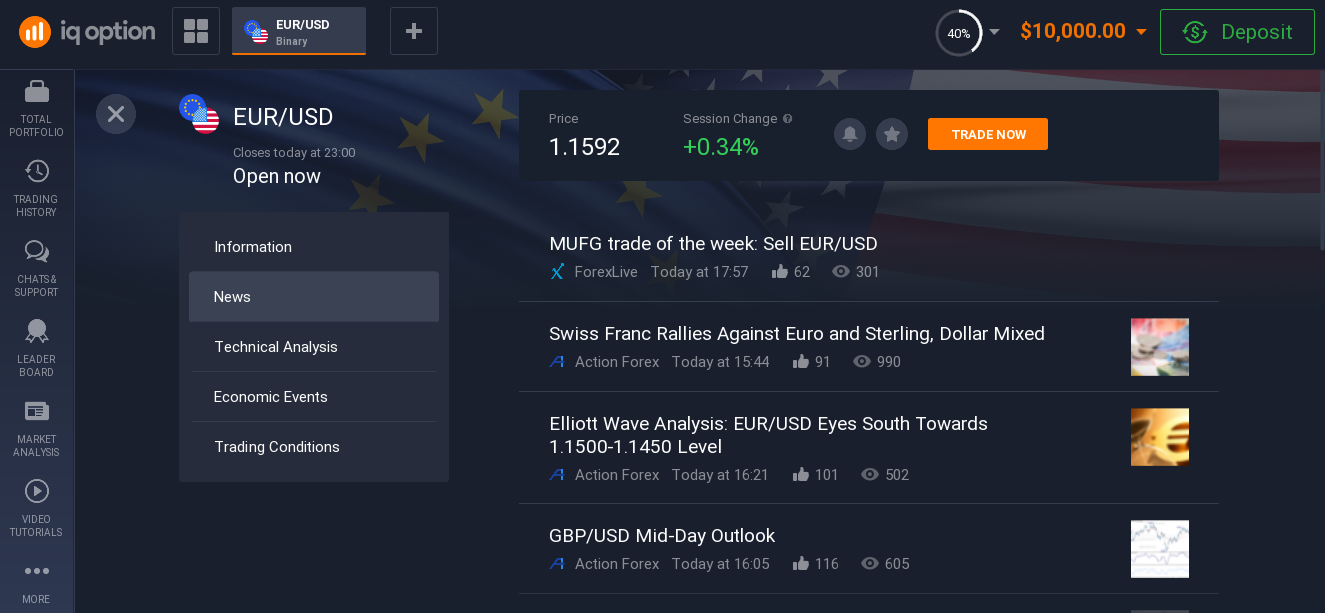

Features of the EURUSD currency pair

Among the main advantages of this pair of currencies are:

- High and stable liquidity ratio.

- There is a lot of information available to a wide audience for making a decision.

- Stable economies of the Eurozone and the United States.

- The good position of these countries in the commodity markets and commodity markets.

- Regular financial reporting of large companies.

- Development policy of these countries.

According to recent estimates, the EURUSD pair accounts for about a third of all transactions in the global foreign exchange market, so it is constantly in motion and provides a chance to make money not only for large banks and funds, but also for private traders.

It is no secret that on currency pairs you can make money both on the decline and on the growth of the exchange rate. In particular, if there are positive statistics from the Eurozone (or negative statistics from the US), then I bet on the growth of the pair, in the opposite case - on the decline. This is a great opportunity to stay profitable even if the asset's market price falls.

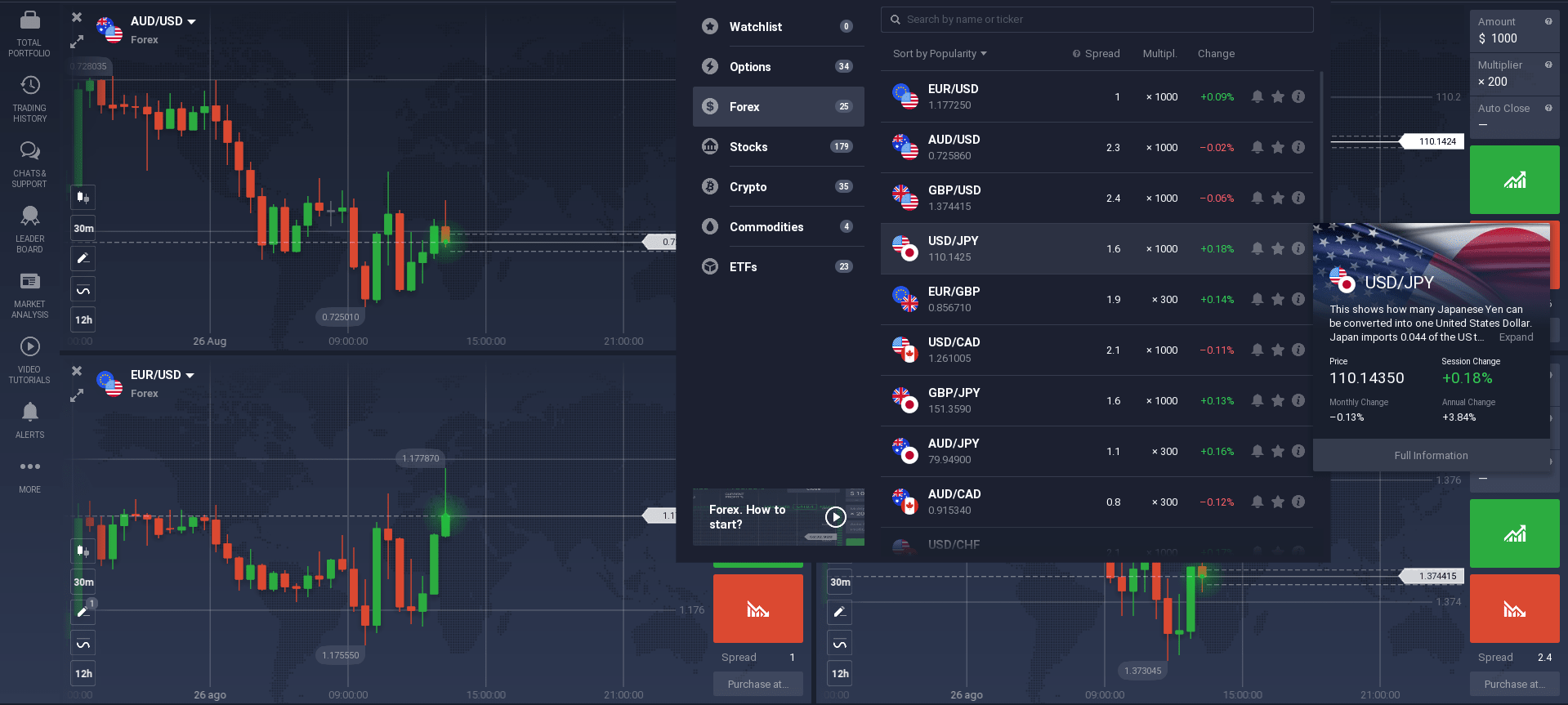

How to start trading EURUSD in Hong Kong

The easiest way to trade currency pairs is using the platforms provided by an online broker. With the development of the Internet at the moment, this is the most popular way to trade. Its advantages are as follows:

- Quick access to the market. You can use the platform while traveling or at home using a mobile application.

- Security. The sites are equipped with security protocols.

- Availability of educational material. You can learn to trade directly on the platform using a practice account.

How to start trading EURUSD in Hong Kong

The easiest way to trade currency pairs is using the platforms provided by an online broker. With the development of the Internet at the moment, this is the most popular way to trade. Its advantages are as follows:

- Quick access to the market. You can use the platform while traveling or at home using a mobile application.

- Security. The sites are equipped with security protocols.

- Availability of educational material. You can learn to trade directly on the platform using a practice account.

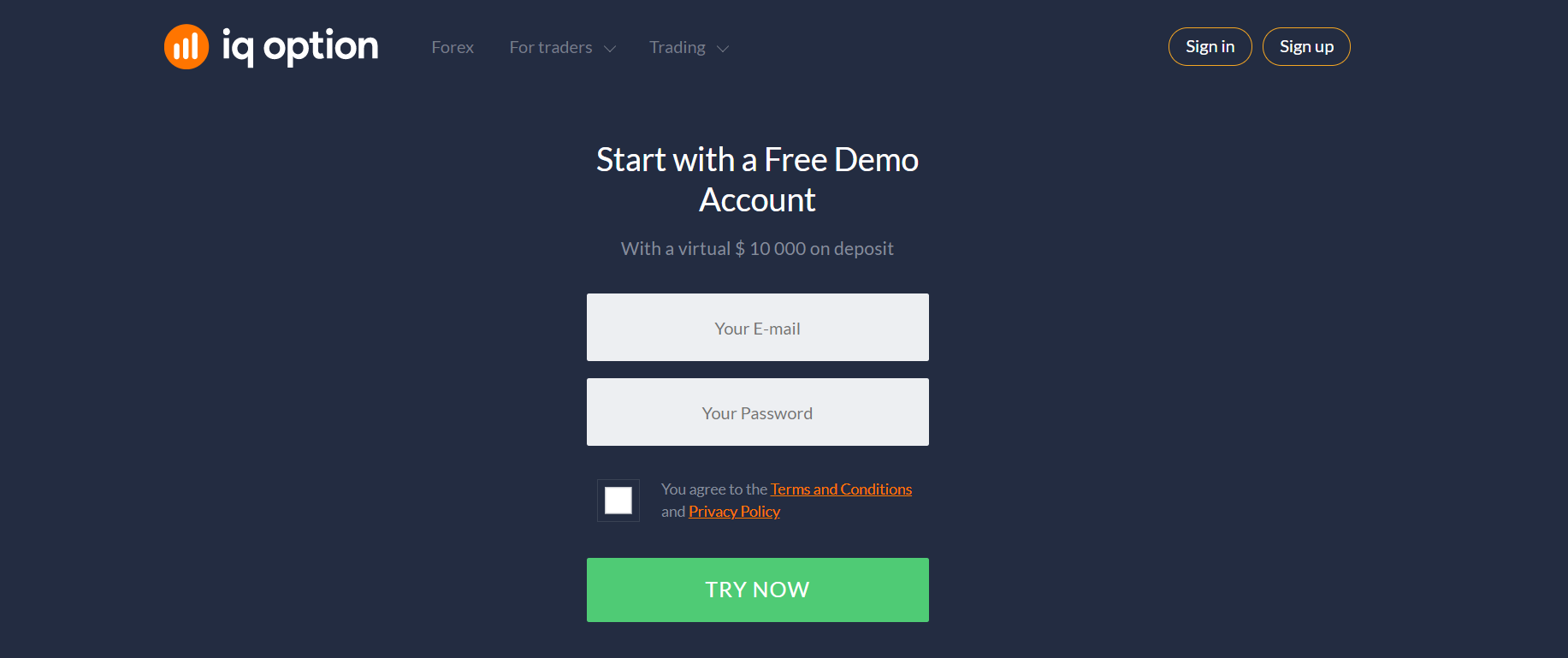

To start trading, you first need to go through a quick registration process (it takes less than 10 minutes). Your portfolio is linked to an active email after confirmation.

After registration, the system offers to switch to a real account or a training one. For a newbie trader, it is important to pay attention to the training account, as he can work out his strategies and get used to trading, while not increasing his pace.

When an investor or trader decides that it is time to switch to a real account, the system automatically prompts for a down payment. It is important to remember that it is important to start with the funds that the trader can afford to lose, since more mistakes are made at first. And later, when trading is more confident, you can increase the deposit and open more deals.

Success depends on being careful and collected. If you enter the market balanced, then trading will go smoothly and income will not be long in coming.

Related pages

How to download IQ Option X APK