Learning About Binary Options in Indonesia

The country of Indonesia has rapidly turned into one of the world's leading trading destinations for both binary options and Forex trading. This huge country situated in Southeast Asia is a perfect place to be a part of the trillion dollars daily turnover when it comes to trading Forex. Indonesia is home to the biggest port in the world and has a rich collection of Forex trading companies and institutions that have helped make it one of the largest trading centers. The large population of the Indonesian people as well as their love for shopping and other leisure activities have made the country one of the best binary options brokers in the world today.

With so many different types of trading available, Indonesia has attracted many new traders and investors. Many have begun to take full advantage of the new financial trading opportunities that Indonesia offers its residents. To attract more investors and traders, the country of Indonesia has made a number of important changes to the way its options trading system works. These changes have made it easier for traders to enjoy a better experience when trading in Indonesia. Whether you are new to binary trading or an experienced trader looking to increase your trading volume, Indonesia is one of the best countries to start with.

One of the most important changes to binary option dalam trading option setup in Indonesia has been the introduction of the minimum deposit. Previously, most people who wanted to take advantage of a particular financial trading option or investment had to put in a large amount of money. In the past, people who wanted to trade binary options in Indonesia needed to personally visit their brokers and sign papers in order to trade. With the introduction of minimum deposit requirements to trading option data, more traders are now able to trade in the country without personally visiting their brokers. With this easy setup, more investors have become interested in trading options and binary trading in Indonesia.

Binary options trading Indonesia

This article provides an overview of binary options trading. Learn more about binary options and discover how this financial instrument works.

Binary options have become one of the most popular trading instruments in Indonesia. Compared to complex financial instruments, binary options are quite easy to understand and, what’s more important for a nonexpert, to trade. Another reason why they are so attractive is their high profitability. This instrument can give investors 70%, 80% and even 90% of investment returns in a few minutes. But you should keep in mind that high profitability is always accompanied by increased risks, so never put your entire capital at risk.

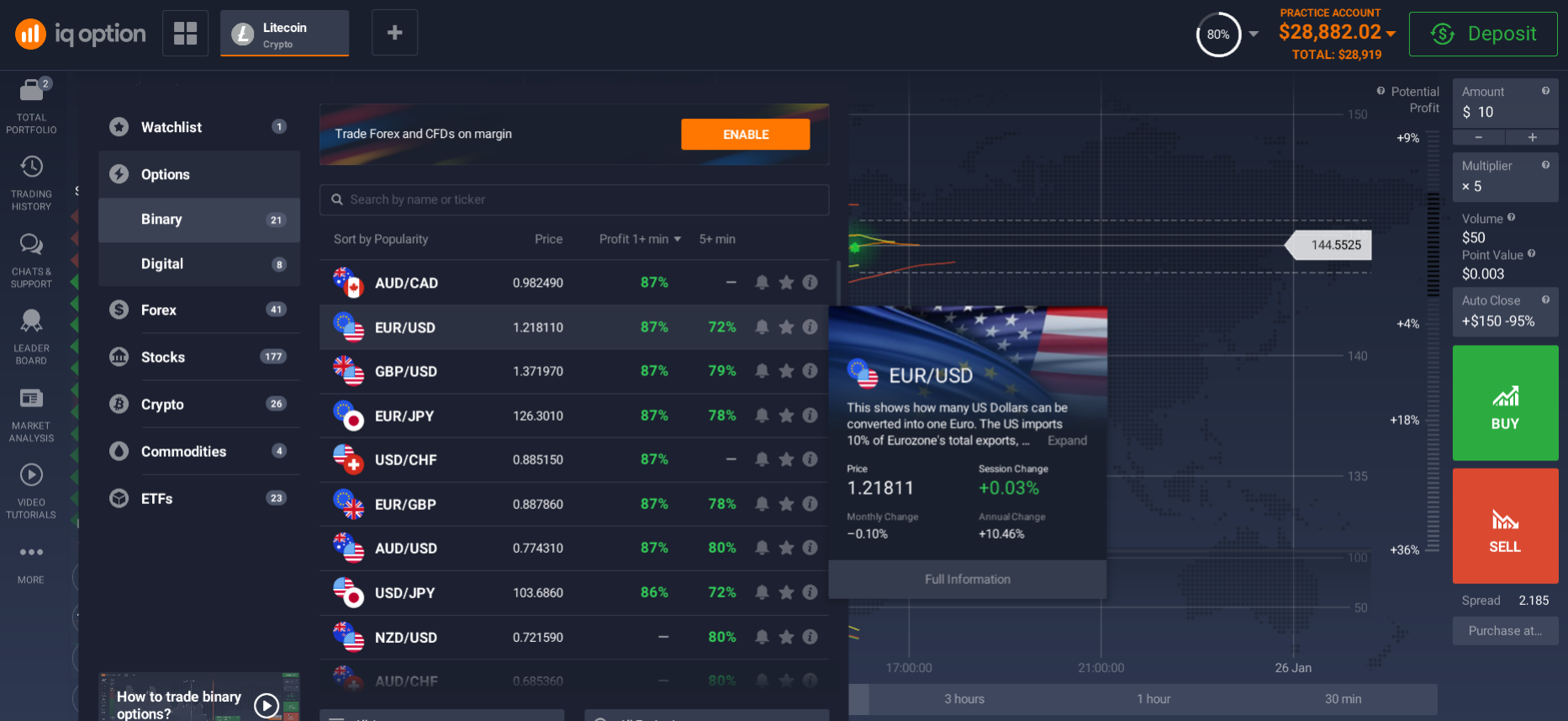

The Indonesian binary options market is developing very fast, and binary options trading is gaining more and more popularity every day. At present, Indonesian binary options traders can choose from a large variety of brokers, both domestic and foreign. With the experience accumulated over the years, we provide our clients with a safe and transparent trading environment, high level of customer service and one of the best financial products in the industry.

Over the years made binary options an easily accessible product to traders from different parts of the world, including Indonesia. Apart from fast deposits and withdrawals, we offer our Indonesian clients the most popular payment methods in their country and provide them with professional customer support in their native language.

What are binary options?

Before speaking about binary options, let’s explore what an option is in terms of finance and trading.

An option is a contract that gives you the right to buy or sell an asset at a pre-set price at a specified moment of time in the future. A predetermined point in the future after which an option ceases to exist is called the expiration time. There exist call options and put options. A call gives you the right to buy an asset. A put gives you the right to sell an asset.

Options have many variations. There are binary options, digital options, FX options, etc.

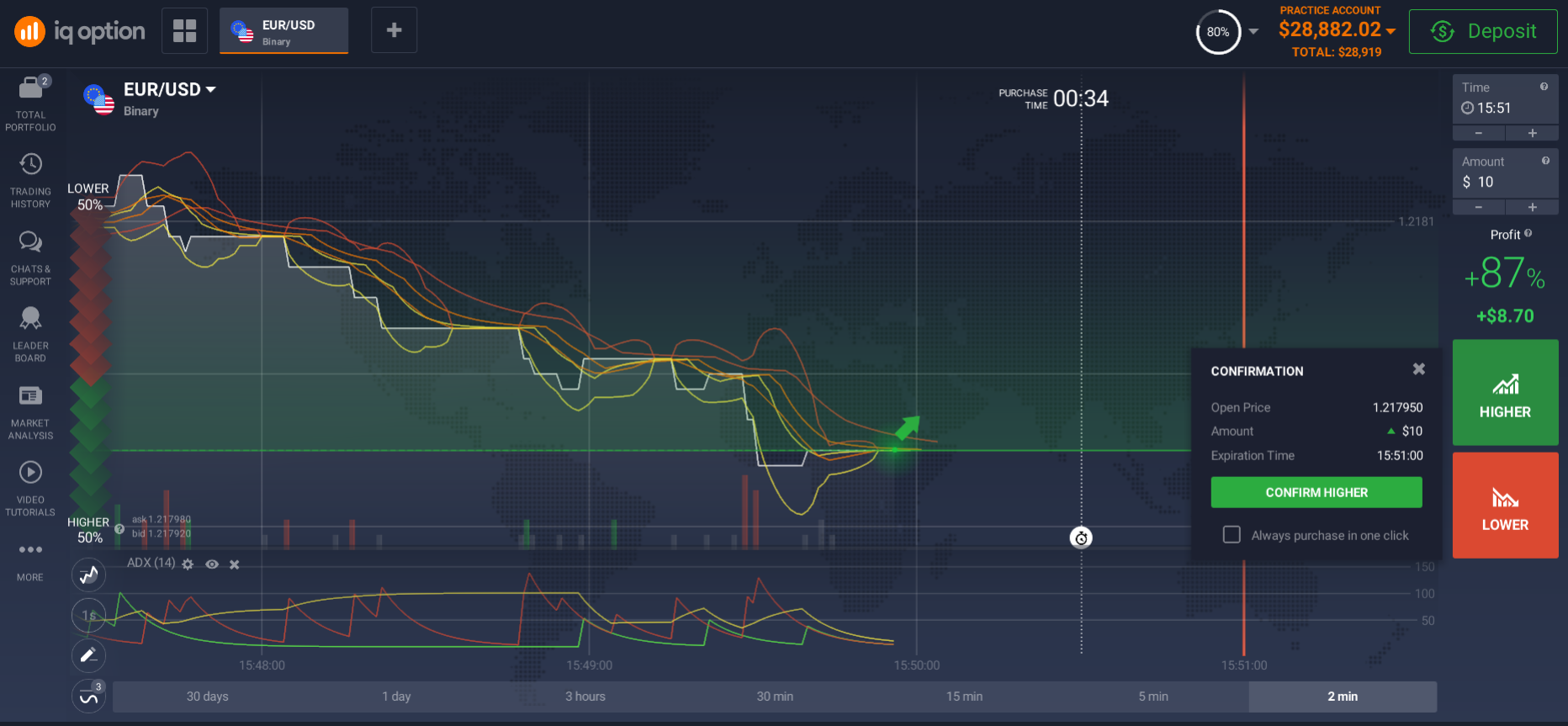

So, what are binary options? Binary options are a financial instrument that allows traders to speculate on price movements. Basically, a trader should predict whether the price of an asset, let’s say gold, will go up or down.

The payout in binary options trading depends on the accuracy of the forecast: if the prediction is correct, a trader receives a fixed amount of return on the initial investment; in case the forecast is wrong, a trader loses the initial investment. So, as you can see, only two results are possible in binary options trading – either a win or loss (the “yes” or “no” result). It is reflected in the name of the financial instrument: “binary” means relating to or involving two things.

How do binary options work?

Now let’s take a look at how binary options work.

When we speak about binary options, first of all, we mean predicting the price direction of an asset. The binary nature of this financial instrument means that there can be only two results at the end of the trade: price appreciation or price depreciation in relation to the opening price. If the forecast is correct, a trader makes a profit upon completion of the trade. If the prediction is wrong, a trader incurs a loss, which is equal to the amount of the initial investment.

Unlike contracts for difference (CFDs), currency pairs (Forex) or commodities, binary options have a limited time span, known as the expiration time. To put it another way, it is the moment in the future when an option ceases to exist.

The expiration time in binary options trading can be very short – up to 1 minute. That is why binary options are so popular – traders can get a result in the shortest periods of time. On the platform, the shortest time span is 1 minute, while the largest time span is extended until the end of the current month.

Can I trade binary options in Indonesia?

Many Indonesian traders wonder whether binary options are allowed in their country. Binary options are not considered illegal in Indonesia and trading this financial instrument is not prohibited in the country.

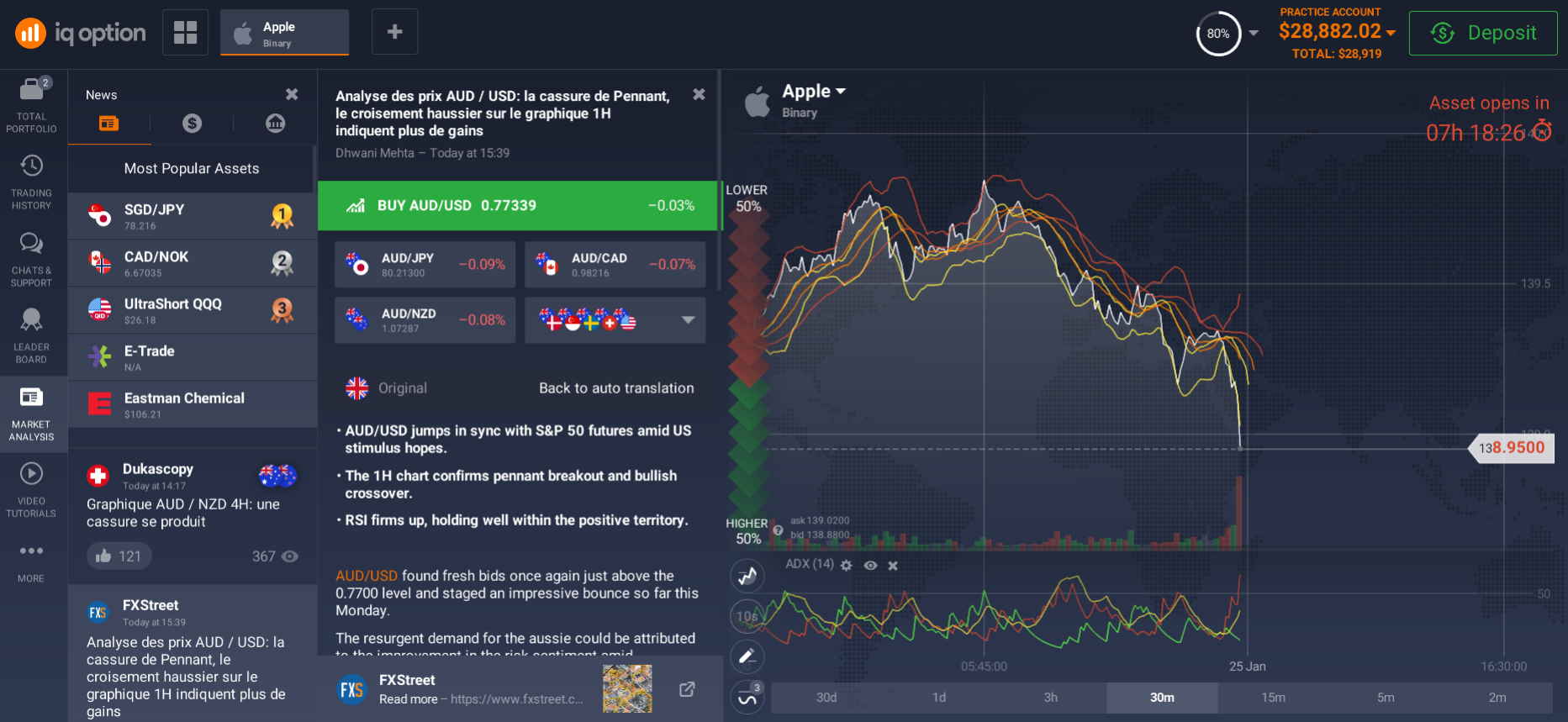

Even though binary options are considered to be a simple financial instrument, you will need a strategy or, better, several strategies to trade binary options efficiently.

Basically, a trading strategy is a trading plan that will allow you to achieve profits and avoid losses when trading. Usually, trading strategies are based on fundamental or technical analysis factors. Fundamental trading strategies rely on fundamental factors, such as inflation, unemployment, GDP, retail sales, companies’ earnings, etc. Trading signals generated from technical indicators form the basis of technical trading strategies. On the platform, you have access to over 100 technical indicators, in addition to fundamental analysis tools (economic calendars in the Market Analysis section). We recommend that you get acquainted with our video tutorials on fundamental and technical analysis.

There are multiple binary options strategies. One of the most popular strategies is called trend following. According to this strategy, a trader buys an asset when the price increases (in an uptrend) and sells an asset when the price decreases (in a downtrend). Other popular strategies include swing trading, news trading, scalping, candlestick pattern trading, momentum strategy etc.

Features of binary options

Managed risk - the main feature of binary options is that the trader knows how much he can lose or earn on any of the options before entering into a transaction.

Availability - traders buy the contract, not the asset itself, which allows more traders to profit from the predicted price movement, who otherwise would not be able to overcome the high price barrier. For example, instead of buying 20 shares for $ 1000, you can alternatively spend $ 20 to buy 2 binary Call options (see examples below).

Profitability - this indicator can many times exceed the profitability of placing similar amounts in the direct purchase of assets, since the profitability does not depend on the final price difference, but is associated with a change in the direction of movement of the asset price or the price reaching a certain level.

Simplicity - since the size of payments for binary options depends mainly on the direction of the asset price change, and is not so much related to the price difference, less detailed information about the asset is required to make a profit. This makes binary options trading available to less experienced traders.

Examples of trading binary options:

1. Buying an option to exceed the price level. At the cost of one Apple share of $ 50, you will need at least $ 1000 to purchase a lot of 20 shares. If the share price rises to $ 55, the return is $ 100 (20 shares x $ 5) at 10% yield. Income can have other meanings, depending on price fluctuations. If the price is unfavorable, then the trader will have a choice - to close at a loss or wait for the price to rise. Alternatively, you can buy 2 binary Call options at $ 10 with the condition that Apple shares reach $ 55 by the end of the week. The price of the exercised option will be $ 100. If the price does reach $ 55 or higher, then the trader will receive $ 200 (100 x 2) at a cost of $ 20, the return is $ 180, the return is 900%. If the price does not reach the specified level, then he loses the $ 20 paid for the option.

2. Buying an option to increase the price from the current level. Believing that by the end of the day Microsoft shares will be more expensive than at the moment, the trader buys a binary Call option at the closing price higher than the current one for $ 10 with a possible premium of $ 17.10 (71% return on investment). If Microsoft shares do rise in price by the end of the day, the trader will receive $ 17.10 ($ 7.10 profit). If the share price falls, then the trader will lose the invested funds.

3. Selling an option to exceed the level. At noon, the euro against the US dollar (EUR / USD) is 20 pips behind the previous day's closing price at 20:00 London time. An option to exceed the EUR / USD level of the previous day can be sold at $ 38 or bought at $ 41.50. The trader decides that the price will not recover and sells 2 options at $ 38 for $ 76 in revenue. The worst outcome for a trader would be the closing price of the EUR / USD day higher than the previous one, which would lead to an estimated option price of 100, which the trader would have to pay. His risk is limited to (100 - 38) x 2 contracts = $ 124. If the underlying instrument does not end with an increase on that day, the option will lose its value and the trader will not have to pay anything to anyone, while he previously received $ 76, which becomes his profit.

FAQ:

How to register?

Opening a profile on a platform is as simple as when opening a profile on any other website. You just have to proceed as follows:

· Choose the option "Register".

· Enter an email and a personal password.

· If requested by the system, check the email messages in the notifications section to confirm the creation of the account.

· Finish filling out the data form, if requested.

First start using the demo version with play money before making real investments.

How to open a demo account?

There are two options to create a demo account in these cases. The first is by choosing the option "Free Trial" or "Demo Account". The second is to choose this option once the main profile has started to be created. It can be converted to a real account at any time, with the deposit of funds.

How to open a real account?

When entering the profile of any demo account, you must choose the option "Deposit" or "Invest money". Then the means of payment accepted by the trading service will appear.

Some of these may include international credit cards like Mastercard, Visa, or American Express. Virtual wallets such as Skrill, Rapipago, Neteller, Adv Cash, Webmoney WNZ, Perfecto Money or through Virtual Loading are also in common use.

Finally, you must enter the amount chosen to invest, which can be 100, 50, 20 or even 10 dollars. Then you have to authorize the payment. From there it will be possible to start making real investments.

Related pages