Buy PayPal shares

Paypal is an American company that offers a payment system supported by money transfers between one user and another. This platform is used as an alternative payment system to traditional payment systems and currently represents one of the largest online payment companies in the world.

How to buy PayPal shares?

Paypal Holdings, Inc. is a recognized company thanks to its affiliation with Ebay that has allowed it to connect millions of merchants with their customers from one end of the planet to the other. In addition, it is now used as a payment gateway like any other because it has the support of the US government and a variety of globally recognized banks.

This platform has more than 300 million users who have been active since 2012 and continue to use its services. Paypal went public in July 2014 with a price of 37 dollars per share. By the beginning of 2021, the price of a PYPL share exceeds 237 dollars.

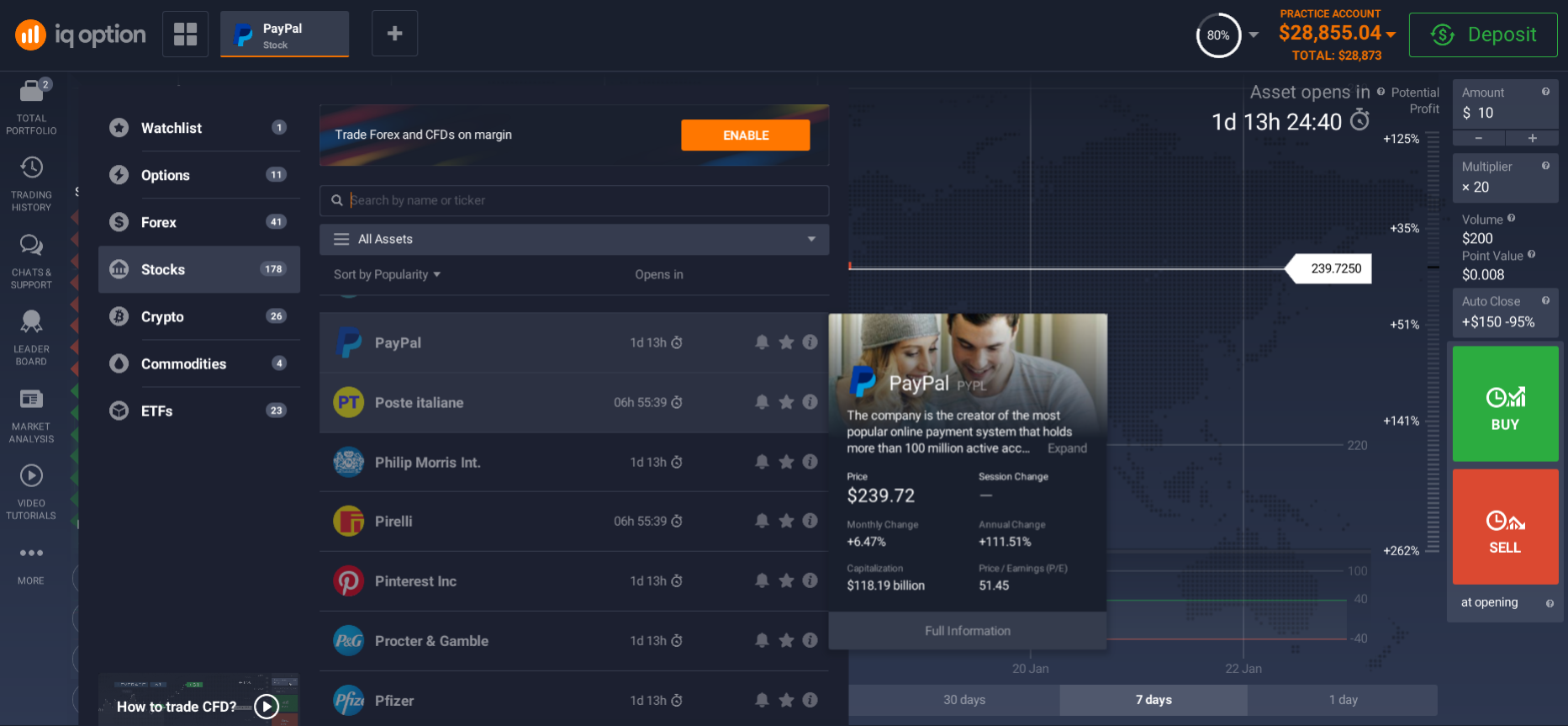

The first step to invest in Paypal shares is to choose a brokerage platform that is adjusted to your needs and that allows you to trade this asset under the "PYPL" ticket. These companies allow the purchase and sale of shares of large companies by investors from all over the world and with different amounts of capital. In this way, it is possible to be part of the financial markets with little experience, without high amounts of capital and participating in real time in price fluctuations.

Once you have seen the number of platforms or brokers available online, you need to register with one to start investing in the listed assets, buy and sell shares of Paypal and other large companies, access their leverage options, etc.

In order to obtain good results and learn how to invest in Paypal shares or trade any other instrument successfully, we recommend making a broad fundamental analysis, studying the financial situation of the company, being attentive to the decisions of the board of directors, attending the charts and making a deep technical analysis of them. Thus, every time you open an order you can ensure a good capitalization while avoiding putting your money at stake.

On the internet you will find that some brokers offer different types of information that will teach you how to invest from the most basic. In addition, these platforms allow their users to use test accounts so that they can practice buying Paypal shares and different assets before using their real money.

Studying the movements of the market, knowing the different types of investment present in each server and understanding the internal and external factors that affect the price of different assets, will be fundamental aspects in guaranteeing your success on the trading path.

How to invest in PayPal shares?

Learning how to invest in Paypal involves learning about the company's financial information, debt statements and public image. This includes the outcome of half-yearly, quarterly or annual meetings and external factors that affect the share price and may represent a risk to your capital.

To invest in Paypal you can buy shares in Latin American stock exchanges such as those in Mexico and Argentina. However, from any other part of the world you can access an online platform and trade contracts for the difference of this asset.

In case you buy a share, take into account that you must know the current, historical and forecasted situation of the company and have more capital, since the share must be paid in cash.

In addition, with this type of investment your earnings depend on the market valuation of the public company. In other words, if the company improves its stock prices, you generate profits. If not, you will be disadvantaged.

On the other hand, in the purchase and sale of CFDs or contracts for difference, a purchase is made for securities that represent a fraction of the share price.

In this sense, you can benefit from both the rise and fall of the stock price, simply by entering in a timely manner and waiting for the fluctuation of the stock value. The variation of the price between the opening and closing time of your order will be the equivalent of the profit generated by your operation.

This type of investment is made through digital platforms that allow you to inflate your capital by means of leverage and therefore, increase your degree of participation and your profits

Investing in Paypal is a great way to diversify your capital and achieve great long-term returns. Since it represents an optimistic and profitable investment that we recommend to take advantage of.

PayPal Stock Trading Platform

You will find a large number of internet platforms that allow you to trade this asset. When choosing a reliable broker, we suggest you consider the following aspects:

- It must be regulated and licensed under the supervision of a government entity. Every brokerage company (digital or physical) must be registered under the laws of some government, and preferably locate its offices in some stable country (avoid brokers located in tax havens).

- Each broker has its own policies and rules of use, including the minimum deposit amount required to begin trading. It is important to review this aspect and make sure that this amount is in line with your needs, capital and investment objectives.

- Likewise, each page uses payment and withdrawal methods that vary in effectiveness times, commission amounts, and depend on the country where the broker or its users are established. Knowing these details in advance will save you time and money.

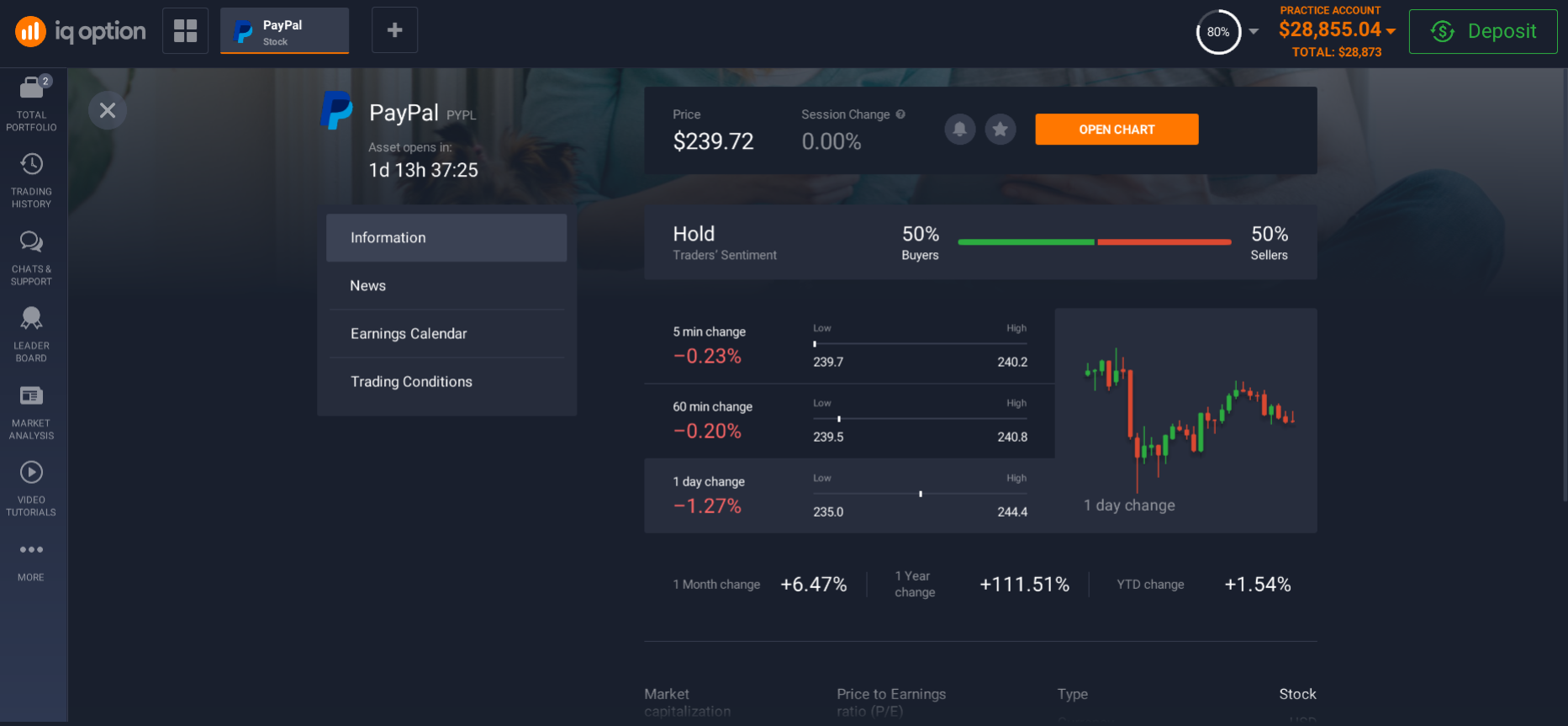

- Investment platforms offer a large number of financial instruments for trading. To buy and sell Paypal shares, you must find the "PYPL" ticket among the options present in the broker's shares section. Once located, you can make use of tools and indicators to make a good technical analysis, observe the product's graphics, and make a constant follow-up of your investment.

How to start investing in PayPal shares?

To start investing in Paypal and generate a good return from the start, you must:

- Familiarize yourself with the financial situation of the company, now and in the past As well as its future prospects.

- Know the company's position within the financial markets and among competitors in your industry. In this case, information and technology.

- To allocate a percentage of its capital to the investment of this asset, diversifying its investments in an intelligent way.

- Register with a trusted broker, adapted to your needs. Make your first deposit and start investing.

- Monitor your investments constantly and actively.

- Frequently update your technical and fundamental analysis regarding the valuation of the company.

How to register?

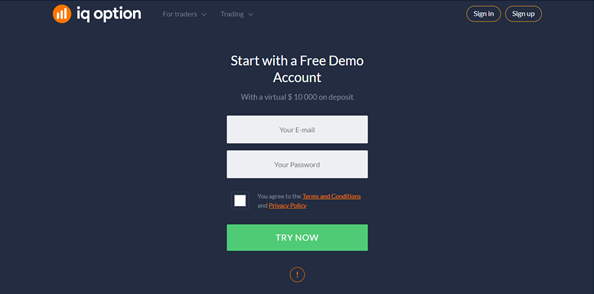

This process is mandatory in duly regulated trading platforms. Despite the fact that some of them require more detailed data for their entry, all of them coincide in the basic data of the user (name, surname and e-mail). A basic registration process usually includes:

- Entering the platform and clicking on the "Register" button, located in the upper right-hand corner of the platform's home page.

- Filling out the pop-up form with the required data and creating a password for your new account.

- Look in the inbox of the email entered in the registration for a confirmation email in the name of the broker. Click on the link that will send it back to the platform in order to log in.

- Once this process is complete, you can take advantage of all the functions of the platform, use its tools, review the assets it offers, access detailed information, analysis, news and charts for each product, and start trading from your demo or real account.

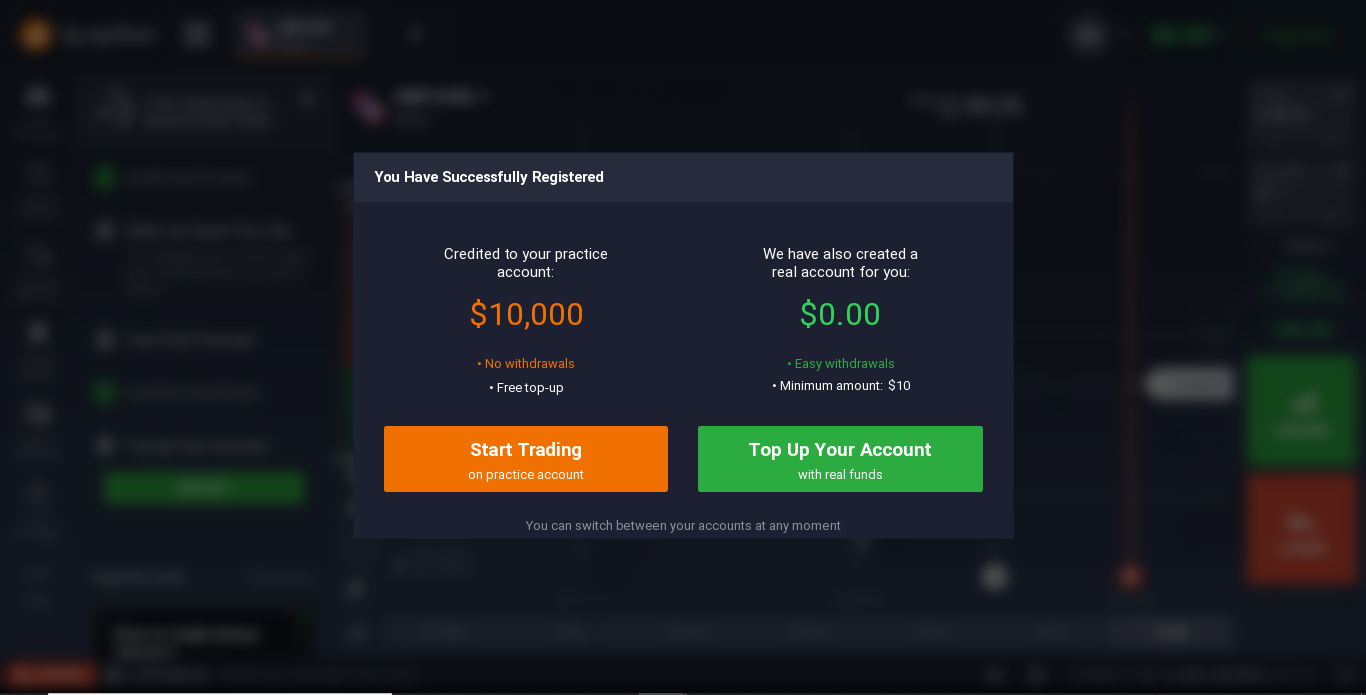

How to open a demo account?

The demo account is automatically created once your registration is completed. You can access it by logging in and start using it to invest with fictitious money. This account is ideal for trying out the right strategies to multiply your capital and become familiar with the platform, while avoiding putting your money at risk.

How to open a real account?

Like the demo account, it is created at the end of the registration process at the broker. The real account, on the other hand, needs a deposit of real money to be able to make use of it and enter the market and thus generate a good return per dividend while multiplying its capital. However, we recommend the prolonged use of the demo account until a solid and functional trading strategy is created.

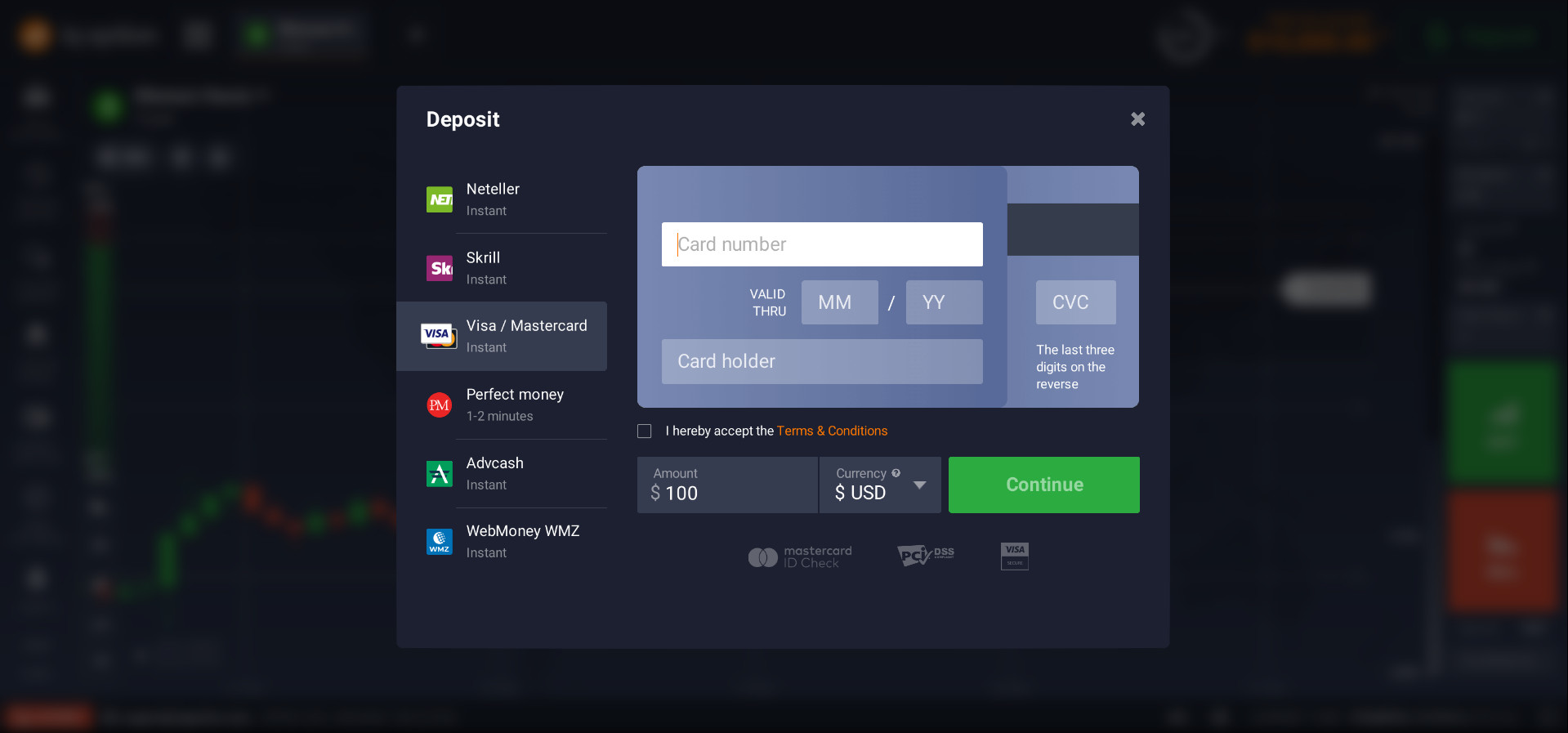

How do I replenish a deposit?

Deposits are required to start using your real account. To make a deposit, choose the most convenient payment method for you. The most common means of payment on trading platforms usually include bank transfers, credit card charges, and occasionally, cryptocurrencies.

The minimum amount of deposits, as well as the means of payment accepted, commissions charged and time of effectiveness vary from one platform to another.

Minimum deposit amount

It represents the lowest payment amount accepted by these platforms in order to start using your real account. This varies according to the policies of each broker, and as well as the accepted means of payment, it is advisable to know them before proceeding with the registration.

To trade stocks, there are platforms that allow income from 10 U.S. dollars, which allows entry to the financial market to traders with little experience and lower capital figures.

How to withdraw money?

Generally, deposit methods are the same as those used for withdrawal. However, some platforms require the money to be withdrawn through the same means that was used to deposit in the first place. That is, if you use a bank account to make the deposit, you must make the withdrawal to the same account.

Security of PayPal stock investments

Every investment carries a certain degree of risk. Despite this, Paypal stock purchase or sale investments present a great opportunity to generate long-term income. In any investment you make, remember that the success of your moves depends on your analysis, optimal reading, and timely entries and exits from the markets.

Paypal is booming thanks to the amount of facilities it offers its users, such as credit card deposits or bank deposits, allowing transactions to flow more smoothly between buyers and sellers.

How safe is it to invest in PayPal shares?

Buying Paypal shares is considered a profitable long-term investment, due to the growth and diversification strategies presented by the company. In addition, the future looks bright for companies offering digital services due to the isolation caused by the pandemic.

Is it safe to invest in PayPal shares online?

By connecting to a reliable platform, carefully studying your opportunities and price movements, you will ensure the security of your investment and a positive return always in your favour.

How can I safely invest in PayPal shares online?

Study your movements well, stick to your trading hours and don't get carried away by moments of uncertainty. This way, every trade you make will be a safe online investment.

Are my PayPal stock investments protected?

The security of your capital depends largely on the legality of the broker you are investing with. Keeping yourself constantly trained and updated will also contribute to the success of your investments and the security and growth of your capital.

FAQ:

Where can I buy PayPal shares?

To buy or sell Paypal shares you need to access a broker and carry out the purchase or sale negotiations online.

How much does a PayPal share cost?

At the beginning of 2021, the price of a Paypal share is around 237 US dollars.

What happened to PayPal shares?

During the first quarter of 2020, uncertainty led to a fall in Paypal shares. This, like all sectors, was affected by the health crisis produced by the pandemic.

Why did PayPal's shares fall?

Like all industries, Paypal suffered a setback caused by the coronavirus which is reflected in a 30% drop in the share price. However, due to the high demand for digital services as a result of the lockdown, it experienced a dramatic increase and resounding success in subsequent months.

Why did PayPal's shares rise?

As online buying and selling was favoured in the face of social isolation and the temporary closure of other businesses, many merchants and buyers turned to PayPal as an alternative means of payment, which triggered their stocks and led to a return to the upward trend it had been in since its inception.

Related pages