CFD trading platform in Hong Kong

Trading CFDs allows traders to use a wide range of financial assets, from metals to stocks of the world's largest companies. In this case, the process of work, in comparison with the use of basic assets, is greatly facilitated by the free trading terminal, lower commissions and leverage. It means that trader's possibilities for making profit are expanding and new prospects for earning are being created.

A CFD is a derivative product for an underlying security that allows the investor to profit from both rising and falling prices of the underlying security. With a CFD trading platform, you can speculate on price movements. This means that in a volatile market, fluctuations work to the trader's advantage, especially if there are sharp rises or falls.

The trader does not buy the asset itself and is not obliged to trade or sell them. Instead, the investor undertakes to exchange the difference in the value of the asset from the time the contract is opened until a specified date in the future. Depending on whether their prediction is correct or not, they will either win or lose.

By choosing CFD trading platform in Hong Kong for speculative trading, you can earn money by trading without incurring unnecessary costs and organizational complications. You can use the time you save to improve your trading strategy.

What are the trading platform capabilities for trading CFDs in Hong Kong?

On a CFD trading platform, an investor does not own any shares, nor can he receive any dividends from the shares when buying them (nor does he have any obligations regarding the shares). You can work with CFDs with a small deposit but the specifics are that you can use higher leverage. The number of contracts is chosen by the trader. Contract prices may be different at various platforms; there is also a minimum contract size, starting from which one can start trading on the CFD trading platform.

Working on a CFD trading platform implies tracking corporate news but also the news from the national financial markets is very important. This type of market is very sensitive to news background. CFD practitioners argue that the main disadvantage of the market is that the difference between the buy and sell price may be too high. You should therefore look for brokers with better spreads.

The disadvantage that comes from the advantage is the opportunity to invest on margin. If done correctly, the profit will be large, but if there is a mistake, the loss could exceed the size of the deposit.

CFD trading platform features

Working with CFD on the news. Fundamental analysis is quite effective when working with contracts. Forecasted events (quarterly reports, annual reports, statements of large deals) allow us to predict the volatility and to place an order with high probability of profit. Major high profile events from the "main events" section of media resources have a greater impact on the dynamics of stock prices.

The peculiarity of the CFD market is that news also have an effect on orders which have already been opened. It means that it is undesirable to open the orders before release of expected news. The best option before opening orders, especially if the positions are large, is to wait for the event to happen and its direction will be clear. You should also be prepared for sudden news events and be able to quickly predict their effect on the market.

Hedging. This is a way to safeguard assets against unpredictable price movements or too much volatility. Hedging is done in different ways, such as by opening opposite positions. Traders can also buy and sell contracts in different markets and so on. The hedging strategy is more effective when prices are above the notional average or when investing in assets with a wide range.

Another well-known method of working with contracts is swinging, which aims to profit from small price reversals. For example, during a pronounced uptrend, prices drop but then recover. During a downward price movement, a buy order may be placed. During a downtrend, prices may rebound briefly, at which point you may sell. The main difficulty in this strategy is determining the dynamics of the trend.

The strategy of breaking through the local extrema. It is recommended to hold positions during the day on the London or New York session. The work is done on the candlestick chart, volume indicators and moving averages are used. The goal of the strategy is to wait for a false breakout of the high or low level, to which most market participants will react.

The extremum is chosen based on one's own understanding of the situation. An investor enters the trade when a false breakout is confirmed, which is accompanied by volume growth and the direction of the moving average. If a false breakout is not confirmed, the trade can be closed. It is advisable to place stop-losses below the false-break and take-profit orders no higher than the extremum in the direction of the trend.

Strategy with RSI. It is an oscillator, which shows overbought/oversold values of the market, ranging from 0 to 100. Interpreting the oscillator indicators suggests that RSI above the 70 level means that the market is overbought and a trend reversal to lower prices is possible. If RSI is below 30, the asset is oversold and the trend may reverse to rising prices. When working with CFDs, a buy order is placed if the RSI is above the 30-point mark. If the RSI line falls below 70 pips, then a sell order is placed.

The strategy with the MACD indicator. This is a moving average convergence/divergence oscillator, which is designed to calculate the difference between the fast and slow moving averages. When the MACD reading is above zero it means that buyers are dominating the market, and when it is below zero it means that sellers are dominating the market. The MACD is actively used in CFD trading, if the oscillators are above zero, this is a sell signal, if they are below zero, this is a buy signal.

Fibonacci levels strategy. A popular tool of CFD trading based on the Fibonacci Numerical Series. There are several Fibo indicators, and levels are the most popular of them. Asset prices are believed to trend towards levels in the order of the Fibonacci numbers, and as the price approaches them it can change direction, and when it breaks it shows a continuation of the trend. According to the indicator values, positions are opened when trading with CFD. Also, levels are suitable for determining take profit and stop loss.

The strategy with ParSAR. A trend indicator, which is like a series of points placed below or above the price on a chart. If indicators are placed under the price - the trend is upward, if under the price - the trend is downward. The indicator is used for working on a strong trend.

On a CFD trading platform similar strategies can be applied as on other types of markets. In CFDs, awareness of global and corporate events is important. Market participants should therefore choose good quality news and follow it regularly. So go for it, have fun trading!

There are a number of advantages to trading CFDs in Hong Kong which make this type of investment attractive and rewarding. But it also has some disadvantages - high spreads, insufficient market settlement. CFDs are a high-risk asset, because the market player can work with a minimum deposit for really large amounts. This is an advantage that turns into a disadvantage if it is used incorrectly. So you have to be disciplined when it comes to contracts and you have to spend enough time on the demo account.

How to make money trading CFDs in Hong Kong?

Almost all trading strategies are applied in the best CFD trading platform in Hong Kong. Thanks to the high leverage offered by brokerage companies, traders have the possibility to try out several strategies. It does not take much time and one can increase the trading profit rather quickly. Leverage is the ratio of your own funds to the value of what you wish to buy or sell. The amount of leverage shows how much a broker is willing to lend.

With leverage on a CFD trading platform, an investor can make more money on every market movement: when the price rises and when it falls. But one must understand that leverage is worth using if one has the necessary knowledge, experience and understanding of the situation.

Sometimes an investor does not have enough of his own money to make a deal, he borrows from a broker. In this case, the investor's own money serves as collateral, which in exchange trading is commonly referred to as "margin". Therefore, trading with borrowed money or securities is called margin trading.

To obtain a loan from a broker, you must have your own money in your account to serve as collateral for the loan. You can start margin trading with any amount. For the credit granted a broker charges a certain percentage. If you close the transaction and return the money within one calendar day, the broker will not charge a fee for providing the loan.

Traders and investors are increasingly interested in a CFD trading platform in Hong Kong that enables them to optimize their risk and use a regular strategy. First of all, a market participant must decide which asset is more interesting for him/her: short-term, medium-term or long-term trading.

Short-term trading (also called intraday trading). It brings profit to a trader from price changes occurring from a minute to a minute or from an hour to an hour. It means the price has to change within a short period of time. Briefly. Its costs are usually lower than those of long-term trading.

In short-term trading a trade remains open for a few hours but less than a day. This kind of trading is also called "day trading" and the trader will have to trade for a few hours. There is also a shorter term type of day trading called scalping. Positions are held open for no more than an hour, even a few minutes or seconds. Thus, a trader can perform a dozen of deals during a day.

Mid-term trading. The position stays open for several days, but no more than a week. On average, 30-60 minutes are spent for trading, to monitor the situation on the market.

Long-term strategy. Many people prefer it for the reason that it is easier to make accurate predictions. Typically, a long term trade lasts anywhere from a week to several months. Transactions are less strenuous, just monitor the market once every three to four days.

Which trading option to choose on a CFD trading platform?

It primarily depends on the mental stability of the trader, because short-term trading is very stressful and can exhaust the nervous system. Long-term trading needs experience in trading in order to analyze the market situation and make predictions in the long-term outlook.

How to start CFD trading in Hong Kong?

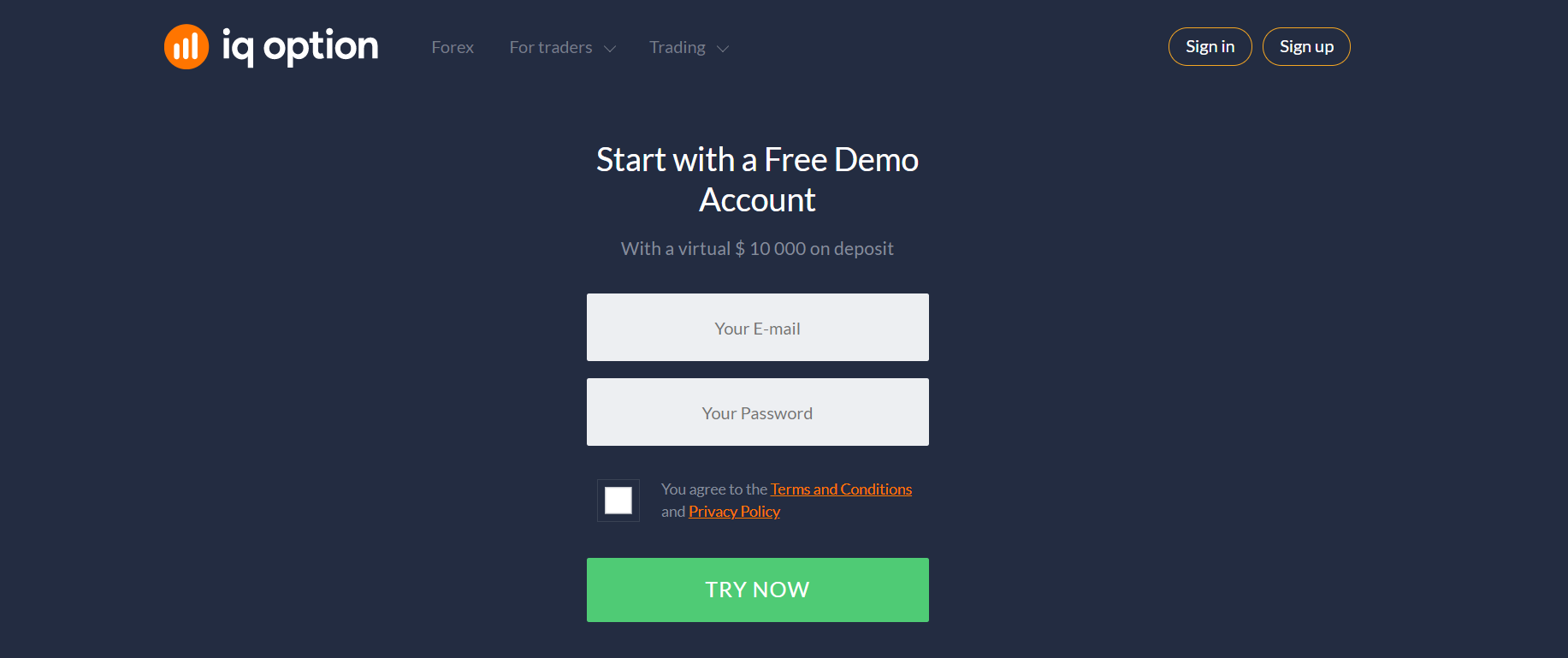

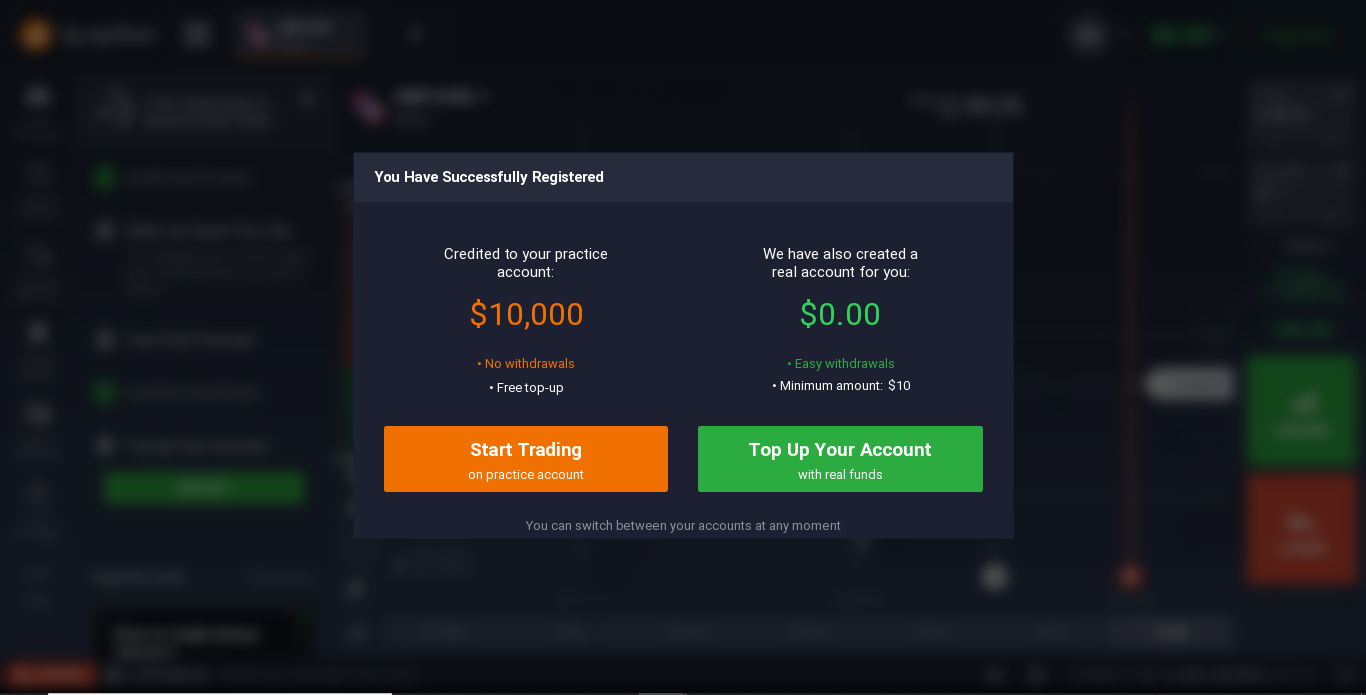

In today's world, CFDs are developing very rapidly, so it is not difficult to find a trading platform to work with. Most brokers, who provide access to the best CFD trading platform in Hong Kong, have a very simple procedure for opening an account, depositing and withdrawing funds.

You can open an account with a broker by registering with the platform, providing your personal details (name, email address) and confirming the registration process. It is important to do so in order to have access to the CFD trading platform and the trading accounts opened on it at all times. Once you have set up your trading account you can start trading and select the CFD stocks that suit your trading strategy.

The CFD trading platform guarantees accurate stock quotes and the safety of your funds.

Once you have registered and verified your details, you can proceed to make a deposit using one of the payment methods shown. You can do this by transferring money using a bank card, bank transfer, or via e-wallet. The whole procedure takes a few days at most.

On the CFD trading platform you will have access to a demo account. The demo account does not differ from a regular one in terms of the basic parameters and features. You can trade on the demo account using virtual funds. A demo account gives you a chance to get priceless experience in trading on the best trading platform in Hong Kong, and learn how to deal with different situations, explore the features of the trading platform, etc. Just get started, the most important thing is the first step!

Related pages

Best Crude Oil Trading Platform in Hong Kong