Buying Tesla shares

When talking about investments in the financial market, it is impossible not to include the shares of Tesla, a company belonging to the multimillionaire Elon Musk, which generates many controversies and doubts, despite the large number of electric vehicles it sells, and which it seems will increase its production even more in the future.

Tesla Motors generates millions of dollars every year, and in view of that great statement, you are probably thinking of buying Tesla shares. The truth is that before you begin to do this, you should inform yourself about many aspects that are involved in shares quotes.

When we talk about investing in Tesla, we need to analyse various shares indices, the shares market, financial news, choosing a good online broker and other factors which we will detail in this technical analysis we have done on how to buy Testa shares in Hong Kong.

How to buy Tesla shares?

Earning money by buying Tesla shares is possible, and much easier than you probably imagine. Once you start in the shares market, learning about the technical terms of trading and other aspects, the activity will become more than simple.

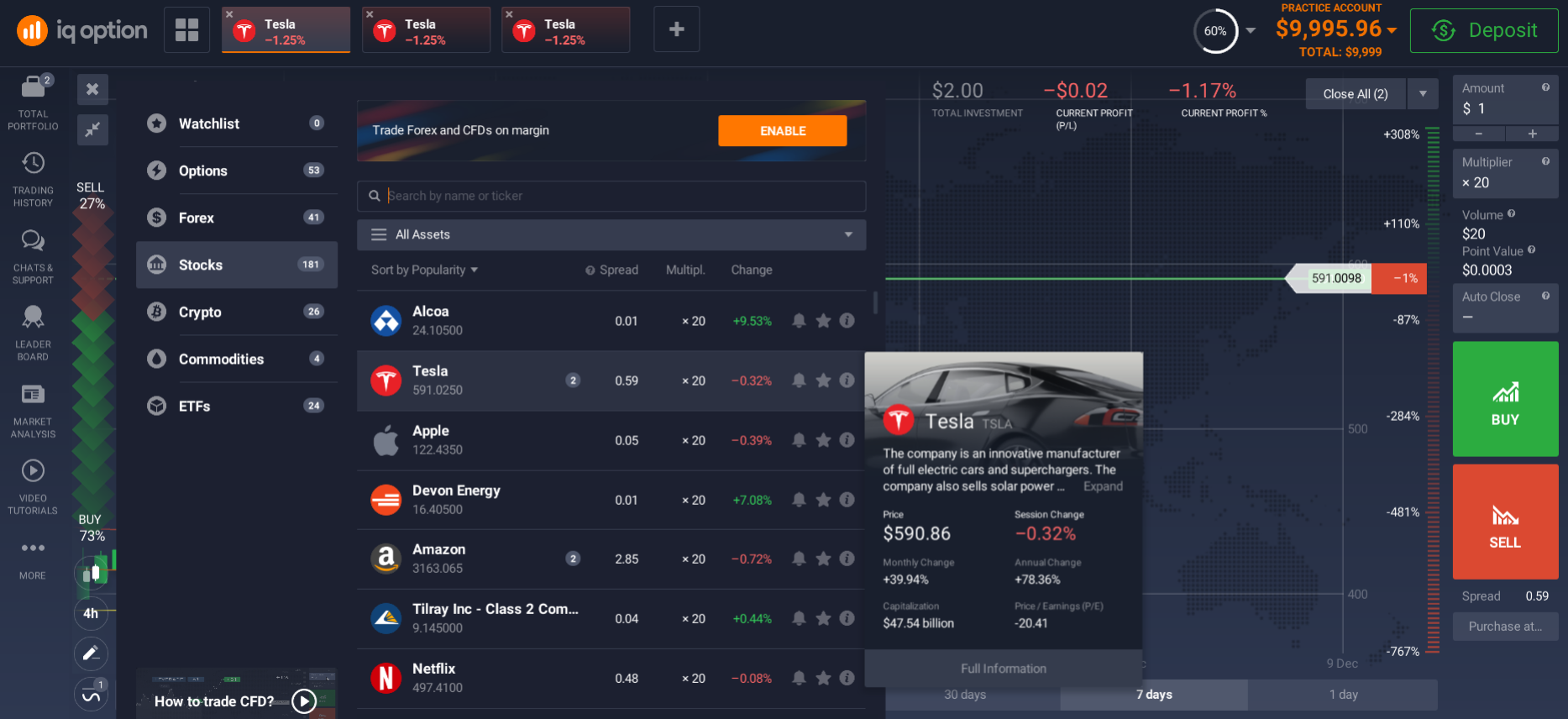

These investment platforms, also known as brokers, offer you contracts for difference (CFDs) on equities, with which you can easily buy Tesla shares without having to go to large banking companies, a public company, or investment groups.

When making an investment through Tesla shares, you will receive securities that implicitly offer you an order to transfer them after executing a sale of shares that translates into profits when the market valuation favors you.

In the case of TSLA shares, known as that according to the Nasdaq index, there are important and basic factors that you must take into account to get the most out of your money:

- Evaluate the broker's commissions.

- Take into account the security of the website.

- Analyze the financial situation of the company.

- Do not lose sight of the news about the financial markets.

Clearly to understand how to invest in Tesla shares and get the most out of it, there are many aspects that you should analyze, but without a doubt, to start, the main thing is that you focus on the online platform, since depending on it they will be defined, by For example, the minimum deposit limits, the means of payment, the dividend yield, and others that we will talk about later.

Investing in TSLA is based on a process that outperforms electric cars and Elon Musk.

How to invest in Tesla shares?

If you have thought about how to buy Tesla shares in Hong Kong, you probably imagine a process that is too complicated, but the truth is that technology is allowing us to expand our finances much further, just as it is making Tesla Motors vehicles the machines of the automotive world.

Thanks to online brokers, it is now much easier to understand how to invest in Tesla, as they easily offer you resources that will make your trading experience much more enjoyable, for example:

- Secure and intuitive interfaces.

- Video tutorials on different aspects.

- Explanation of shares indices.

Always take into account that shares market investments are processes that can pay off in the long term, but still represent a risk.

Tesla shares Investing Platform

Choosing a certified broker to invest is undoubtedly one of the most important processes for buying Tesla shares. An online broker can greatly impact the results of your investment, either because they do not offer you the tools necessary to forecast falls and rises in the price of a share, among other factors.

The offer of investment platforms in the online market is very varied, which is why before choosing one, you should analyse the benefits or advantages they offer you very well. Without a doubt, something you should take into account is:

- Analyze investors' opinions about brokers.

- Enter the platform and see if it has an understandable interface.

- Check if they have trading licenses.

- Study their minimum deposit amounts.

Before joining an online broker to buy Tesla shares, take the time to open a demo account (we'll talk about this later), so you can become more familiar with the trading terminology.

How to start investing in Tesla shares?

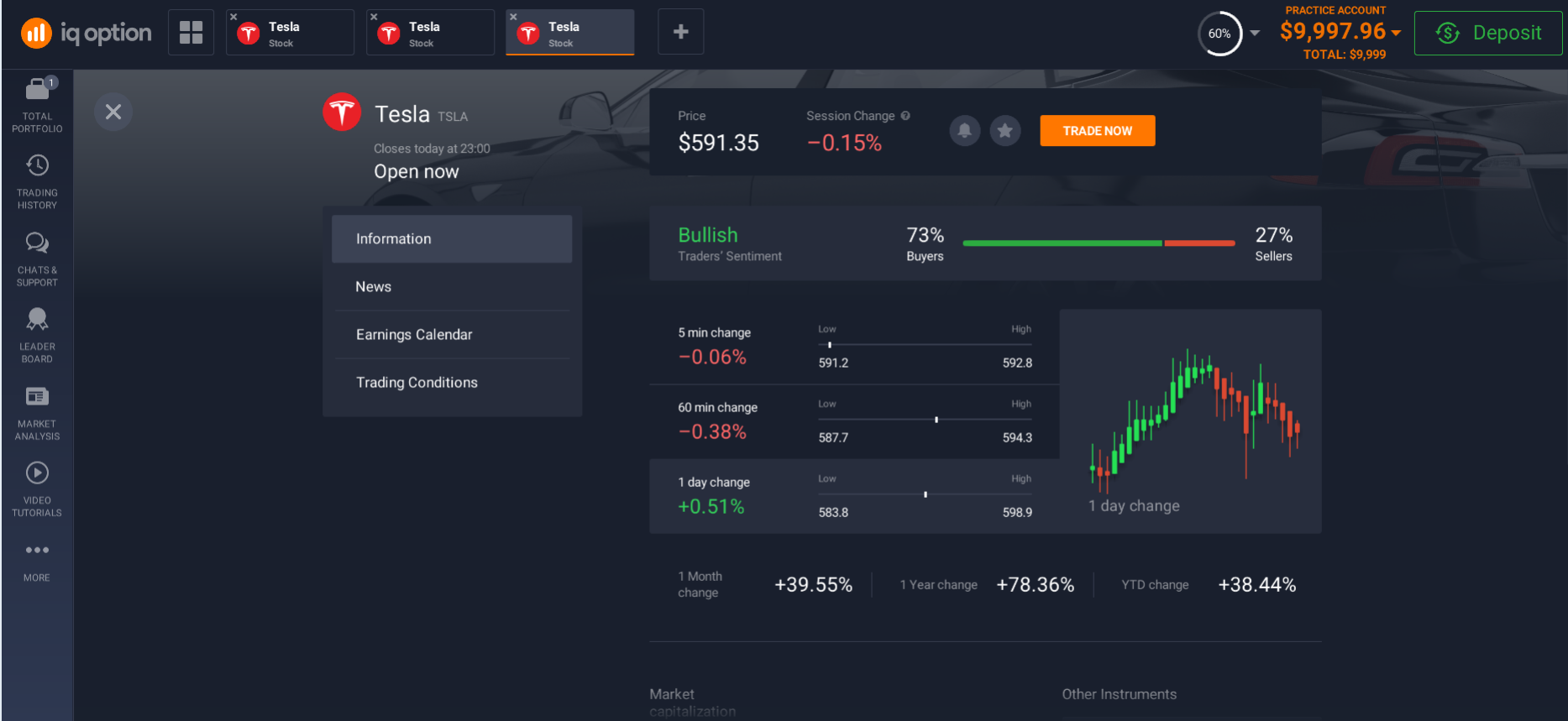

To invest in Tesla, the first thing you need to consider is precisely the price of the shares. From this point, you can define another factor that is also of great importance to investors, and that is their monetary capacity, i.e. the amount of money they are willing to use.

Tesla's market capitalization will allow you to calculate what your earnings would be if you bought and sold shares, and give you a clear indication of what the company's future projections might be.

(Equity) Tesla is a company that for many years has raised doubts among investors, but since 2019 its economic and popular leap has been more than evident.

How to register?

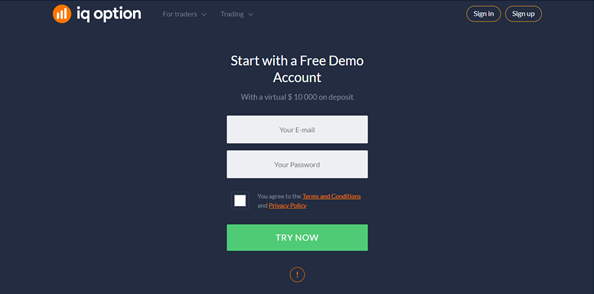

In general, the process of opening an account on an online platform is very simple. An email and password are enough to start familiarizing yourself with the online interface and trading process. Depending on each broker, the registration requirements for buying Tesla shares may vary, but generally the process is divided as follows:

1. Login to the platform, search and press the "register" button.

2. enter your email address and password

3. If you are prompted at startup, enter your first and last name.

Most platforms take the verification process seriously, so they will send you a link to your email to confirm it.

After checking your inbox and clicking on the confirmation link, you will need to finish filling out your form to verify your account and be able to make electronic deposits.

To purchase Tesla shares and make deposits and withdrawals, you will need to verify your account with a phone number to verify that you are in Hong Kong, and then provide personal information, which varies depending on the platform.

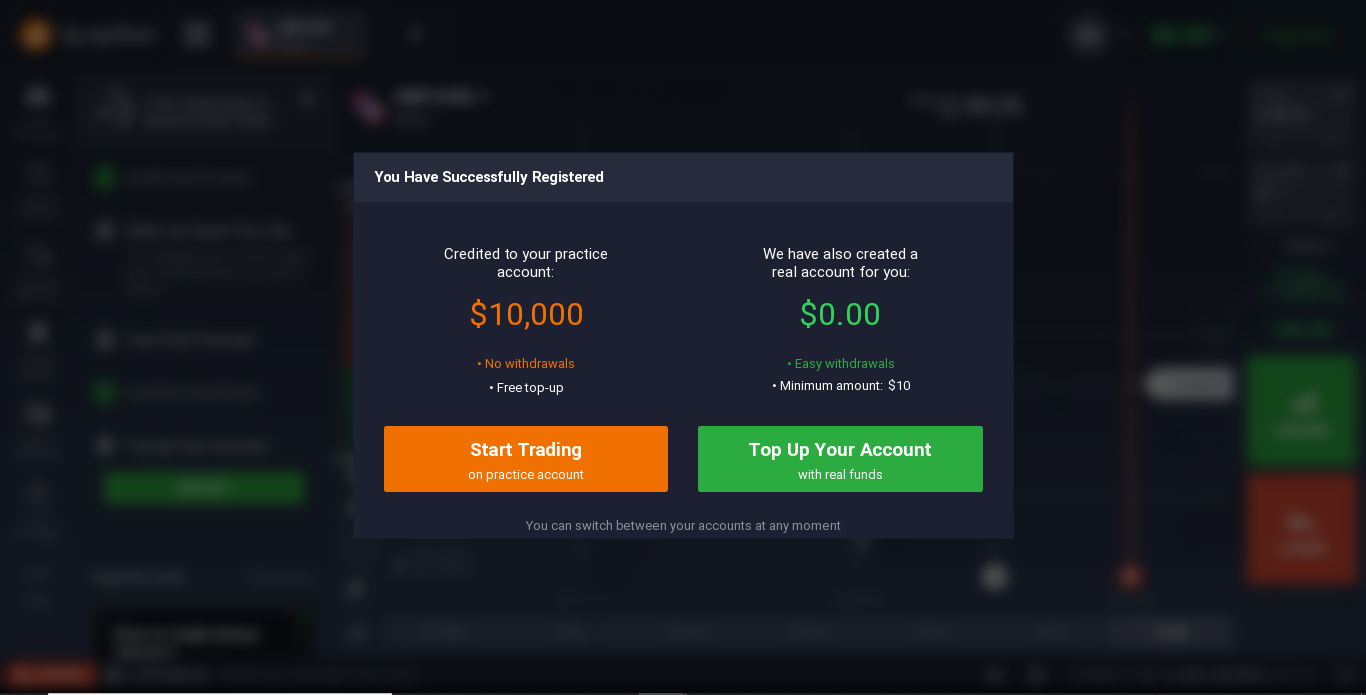

How to open a demo account?

Most platforms offer a demo account mode, where you can try out most of the interface's features, so you can also learn how to invest in Tesla sharess. This will make it easier for you to make a deposit and start buying shares.

One of the greatest benefits of a broker's demo account is that it enables a fictitious financial amount to be placed in your account to make the process even more real. We assure you that this will give you a fairly complete experience on how to invest.

It's important to know that these funds are for trial purposes only, so you won't be able to withdraw any earnings. This is a free learning service.

How to open a real account?

To open a real account with a broker, we strongly recommend that you do so after testing with a demo account. When you are ready to buy Tesla shares, all you have to do is make your first deposit, the minimum and maximum amount of which will depend on several factors that we discuss below.

In addition to being able to buy and sell shares, you will be able to access a list of benefits that, also depend on each broker, but are mostly based on

- Communities of investors.

- Trading tournaments.

- News and updates on the financial markets.

- Data on the sale of TSLA shares.

- Tutorials.

How do I replenish a deposit?

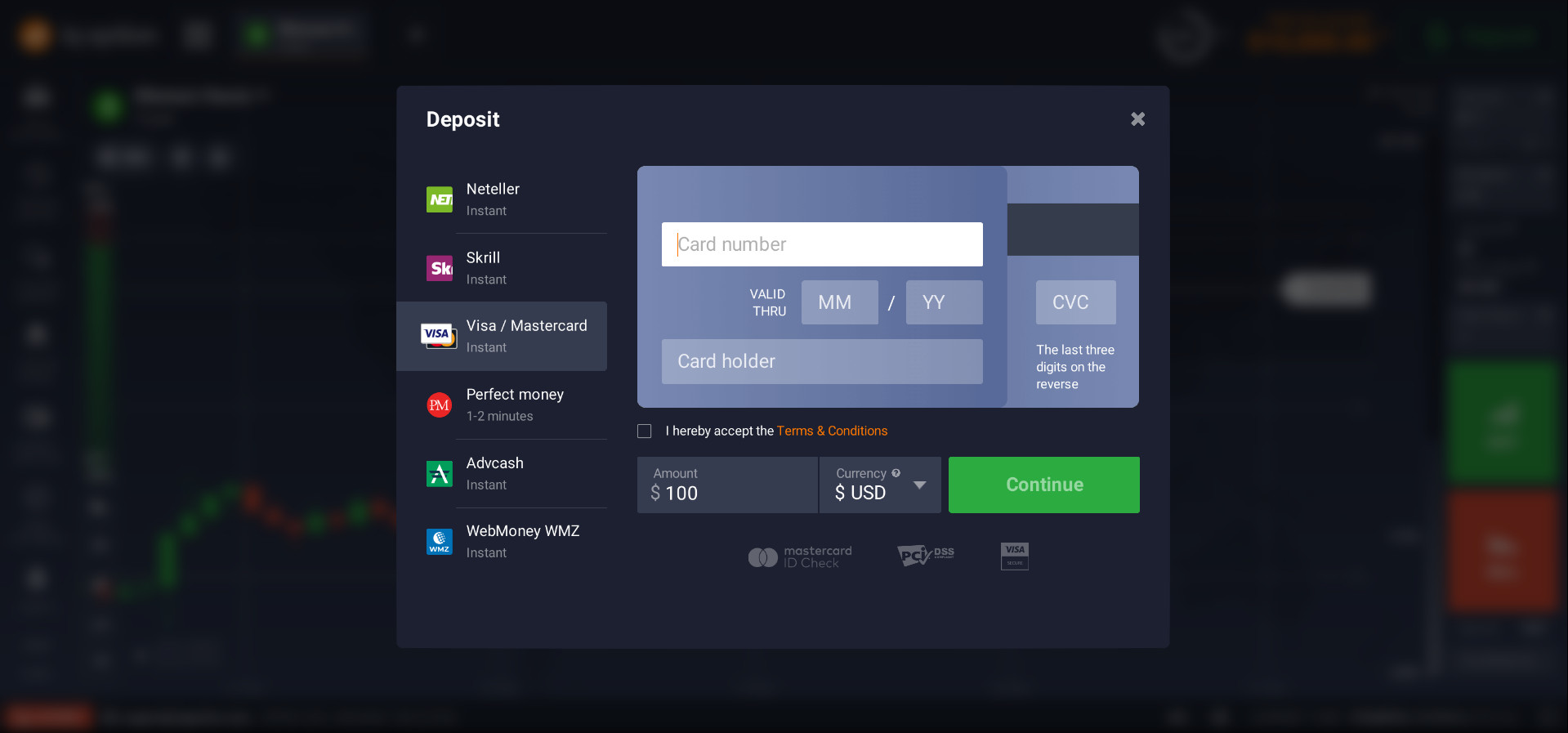

Depending on the platform you choose, you will have at your disposal a set of channels to make your deposits to buy Tesla shares. These are normally made through electronic channels such as payments with credit or debit cards, bank transfers, and other electronic smart payment services.

Each broker will set its services, and will do the same with the commissions that you must pay to execute a deposit, which can vary depending on the platform.

In general, to make a deposit the first thing you have to do is select your payment method, the currency in which you want to deposit, and enter the amount.

Minimum deposit amount

Each platform will be responsible for setting the minimum deposit amount accepted, and this undoubtedly plays a key role when choosing a broker. Take into account your needs and financial power, as many platforms are made for expert investors and set very high minimum amounts, while others offer you a deposit base starting from $10.

How to withdraw money?

As with deposits, platforms also establish the means available for withdrawing money, which are usually the same as those set for depositing. These withdrawal methods are mostly electronic, and it will depend on each online broker what process you need to follow.

Security of Tesla shares investments

Tesla Motor comes from the United States, so you have the confidence first hand that it is a company from which the shares come from a safe place, as long as you do it through a certified broker.

This security refers to the process of protecting your data and deposits, but not a guarantee of profits.

How safe is it to invest in Tesla shares?

When we talk about a shares, we are talking about a process of leverage with which the price of a shares varies in a positive and negative way. Your deposits will be safe, but the dividend yield will depend entirely on you.

Is it safe to invest in Tesla shares online?

Making investments online is now very secure thanks to the data protection processes and security encryptions of online platforms. Get a trusted broker and make sure you are part of a protected system.

How can I safely invest in Tesla shares online?

When it comes to safe investing, you have to bear in mind that these are equity products, so their price is changeable, and Tesla's shares are no exception. There is always a risk, but on the return, not on the protection of your movements and data.

Are my investments in Tesla shares protected?

When you make deposits that will be used in Tesla shares, online platforms protect your investment through their technology tools. With a certified broker, you have the guarantee that your deposits and earnings are insured.

FAQ:

Where can I buy Tesla shares?

You can buy Tesla shares through certified investment platforms that offer protection for your deposits and earnings. There is a wide variety in the market.

How much does a Tesla shares cost?

The price of a share is probably the first thing you think about when investing in Tesla, but we tell you beforehand that it is not a fixed value. They are amounts that rise and fall depending on the financial situation of the company and the shares market.

How do I buy Tesla shares in Hong Kong?

To buy Tesla shares in Hong Kong, you only need to access one of the various brokers available in the country, which allow you to make payments and withdrawals using Hong Kong financial methods.

What happened to Tesla shares?

Tesla's shares recently plunged to a historic low of 21.06%, which undoubtedly raised concerns among investors, especially about the increase in share prices seen at the beginning of this year.

Why did Tesla's shares fall?

Tesla's shares fell after an equity committee failed to include Tesla in the S&P500 rebalancing. As mentioned above, investing in sharess has a risk.

Why did Tesla's shares rise?

It is normal for movements in the financial market, and in society, to cause company shares to rise, as was the case with Tesla's shares, which came in at a high of 300%, and are projected to be very good in 2021.

Related pages