Characteristics of the currency pair GBP/USD

What are currency pairs?

A currency pair is the ratio of the prices of the two currencies in a currency market that comprise that pair. It is widely used in the Forex market to simplify trading, as when a trader buys one currency, he is always selling the other, and vice versa. Likewise, when a trader sells one currency, he is buying the other. The first currency in a pair is the base currency, and the second is the quoted one.

For example, the euro-dollar pair EUR/USD. The price of this currency pair shows how many US Dollars (USD) it is possible to buy for 1 Euro (EUR). By opening a "buy" order, the trader acquires EUR, paying with USD. When profit is fixed, an inverse operation is executed - buying USD for EUR. In this pair, EUR is the base currency. EUR is also the base currency of all world currencies.

It is up to the International Organization for Standardization (ISO) to decide the base currency and the quoted currency. ISO also determines the currency codes and their order in each currency pair.

Currency prices

The forex exchange rate is a dynamic indicator reflecting the value of one currency concerning another. Therefore, currency exchange rates fluctuate, which is the basic principle of profit-making in the forex market.

Currency rates in the forex market are one of the critical concepts of the currency market. It is on the fluctuations of currency rates that traders make their money. By buying a currency, a trader expects its rate to go up against another currency. If the trend is correctly predicted, the trader earns a profit. If the rate goes in the opposite direction, the trader suffers a loss. Let us look at how the currency rate in the Forex market is formed, what it depends on and how understanding its trends and making correct forecasts can help.

Currency rates can change several times a day. Therefore, when it is said that exchange rates are an expression of the value of one currency through another currency, this is not entirely accurate. Consequently, you must always add to this definition - "at a particular point in time". This parameter is crucial for a trader. After all, at what point he bought and sold this or does that currency determine his profits.

Exchange rate of a currency pair

In the Forex market, currency pairs are traded. For example, the currency pair's exchange rate GBP/USD is equal to the specified value. Suppose that the GBPUSD rate is equal to 1.3757. It means that 1 pound is equal to 1.3757 USD. You will see two prices on your terminal screen. The bottom price is a Bid price at which you may sell euros and buy a corresponding amount of US dollars. The second Ask price (ask) is the price to buy euros and sell the related dollars.

The exchange rate at currency exchanges involves the calculation of supply and demand for a particular currency.

Factors affecting the exchange rate

Understanding how and why they are formed is an undeniable advantage. A person who can analyse the exchange rate fluctuations can do more than sell or buy profitably in Forex. Exchange rates can be a tool to explore a country's economy as a whole, not to mention a good reference point for taking a loan or buying securities.

Many factors influence the fluctuations of currency rates in the Forex market. However, it is customary to single out several major ones, which exert the most vital pressure on the national currency:

- Issue of currency. If the government starts to print money intensively or increases the money supply, for example, by giving loans to banks, it leads to the growth of the national currency supply. And when the supply of currency exceeds the demand, the exchange rate falls.

- Foreign trade balance. The principle is simple: the more exports a country has, the higher the need for internal currency, and therefore the higher its exchange rate. Imports, on the contrary, create a supply of currency. Correspondingly, more imports result in a lower currency exchange rate.

- Confidence in the currency. For example, suppose citizens seeking to protect their savings from risks associated with changes in the national currency prefer to keep their money in euros. In that case, it leads to an increased demand for euros and its exchange rate. Large companies are similarly influenced by choice of one currency or another when entering into contracts.

- However, other factors may also contribute to price movements. Everything from natural disasters to statements of influential politicians can have a significant impact on rates. It is impossible to predict every movement, but they are short-lived unless an actual economic event is underpinning the activities.

Trading sessions

A trading session is a time when an exchange trades on a particular exchange or exchanges in the same region. There are set opening hours for every exchange in the world - this is the period of the leading trading session during which official trading takes place. Stock exchanges are open daily from Monday to Friday; public holidays and Saturdays and Sundays are days off.

There are three main trading sessions: Asian, London (European) and New York.

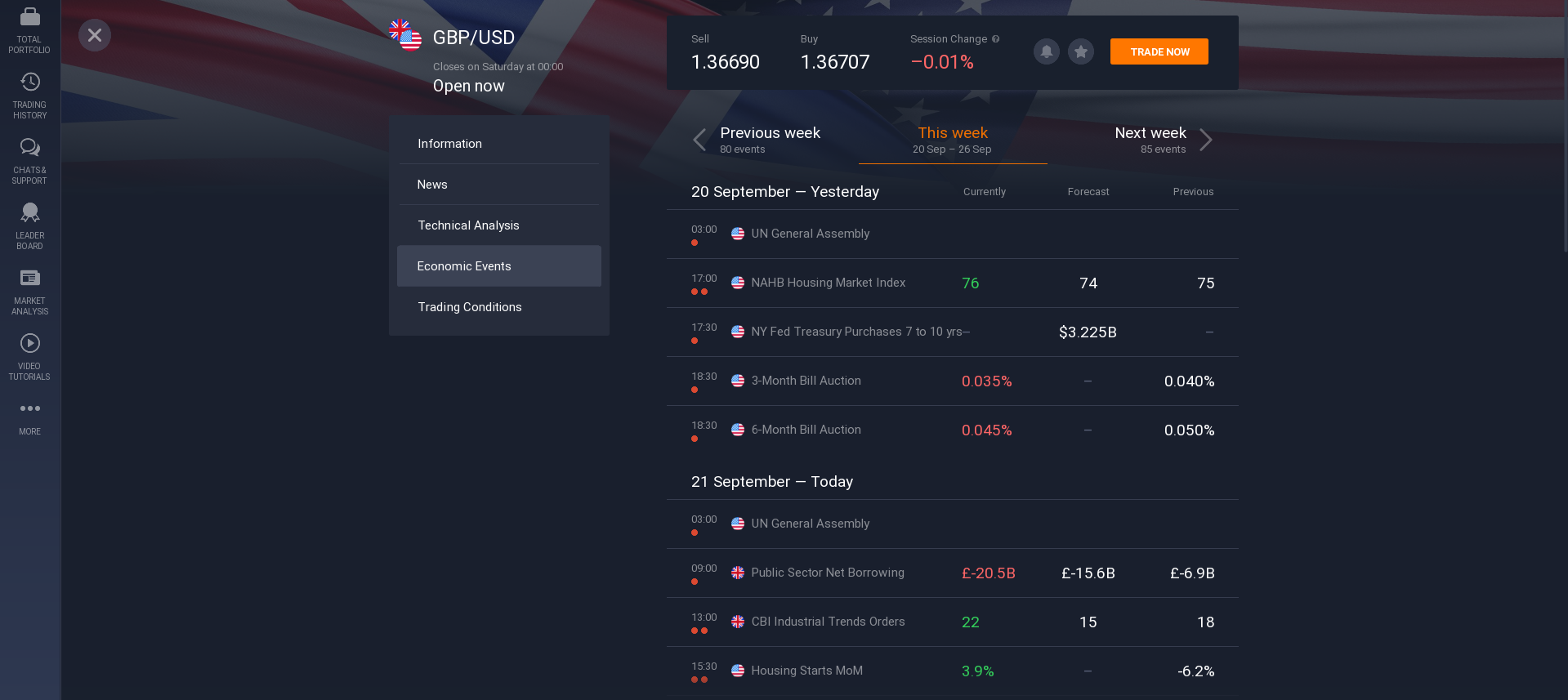

No matter which session you prefer, you should keep in mind one thing: before you enter the market, check your economic calendar.

As you know, the release of a particular news item can have a significant impact. Even during the Pacific or Asian sessions, which are not notable for large price swings, the news can affect the situation drastically. Therefore, it is recommended that traders actively use the calendar, which will allow them to avoid a large number of losing orders.

The most profitable time for trading is when trading sessions are matched.

Consider, for example, the European and American sessions, which are considered the most suitable for trading. For example, the European session closes at 8 p.m. And the New York Stock Exchange starts at 16.00. These 4 hours are considered the best, according to many traders.

There is an activity in both European currencies and the US dollar. Orders opened during this period can bring significant profit. Of course, one should not forget about news, as it can dramatically change the situation in seconds.

Trading time frames

Time frame is a trading period during which quotations are grouped, and elements of a price chart are built (candlesticks, bars, lines, etc.).

There are different time frames in trading:

- M - a minute (for example, M10 is ten minutes).

- H - an hour (for example, H4 - four hours).

- D or Daily - a day (for example, D1 is a daily period).

- W or Weekly is a week (e.g. W1 is one week).

- MN or Monthly is a month (e.g. MN1 is one month).

- Finally, Y is a year (e.g. Y1 is one year).

Is there an optimal time frame for Forex trading?

Regrettably, no. The best time frame for forex trading depends on the trading strategy, trading style, and trader personality. All these factors influence the final choice of the best time frame.

There are two popular ways to choose a time frame on your own: trial and error and identity verification.

1. Trial and error method.

Imagine you trade on anyone's time frame, and you notice how comfortable it is. Next time you trade on it, ask yourself the following questions:

- Do you think the market is moving too fast or too slow? For example, suppose you want to trade EURUSD. Does the market price seem to whiz past the spot on the chart where you planned to enter the trade before you have completed your analysis? Or have you been waiting for ages for the price to hit a profit level? If so, it could be a sign that the chosen time frame is either too fast or too slow.

- Do you always have enough time to monitor your trades until they close? If you think you have more than enough time, then consider moving to a lower time frame. And if you notice that your trades are closing before you can track them, consider trading on a higher time frame.

With this trial and error method, you'll have a relatively high chance of finding a time frame that's right for you. However, this may take some time.

2. Identity verification.

Before choosing a time frame, think about what kind of person you are and ask yourself the following questions:

- How patient are you? If you are patient enough to keep a trade open for days or even weeks, then higher time frames (daily, weekly or monthly) will be your friends.

- Do you want to enter and exit trades during the day? If so, then the lower time frames will suit you. With these, you will be able to analyse, enter and close trades by the end of the day. In that case, you should choose the 15-minute, hourly or 4-hour time frames.

- Short of time to trade? If you spend very little time on the Forex market, it means you want to open and close trades within minutes. In that case, trade on very low time frames, from one minute to 15-minute.

That being said, knowing what day of the week is the best day to trade Forex can save you more time. This way, you won't simply waste time on days when you can only make a small profit.

Trading strategy

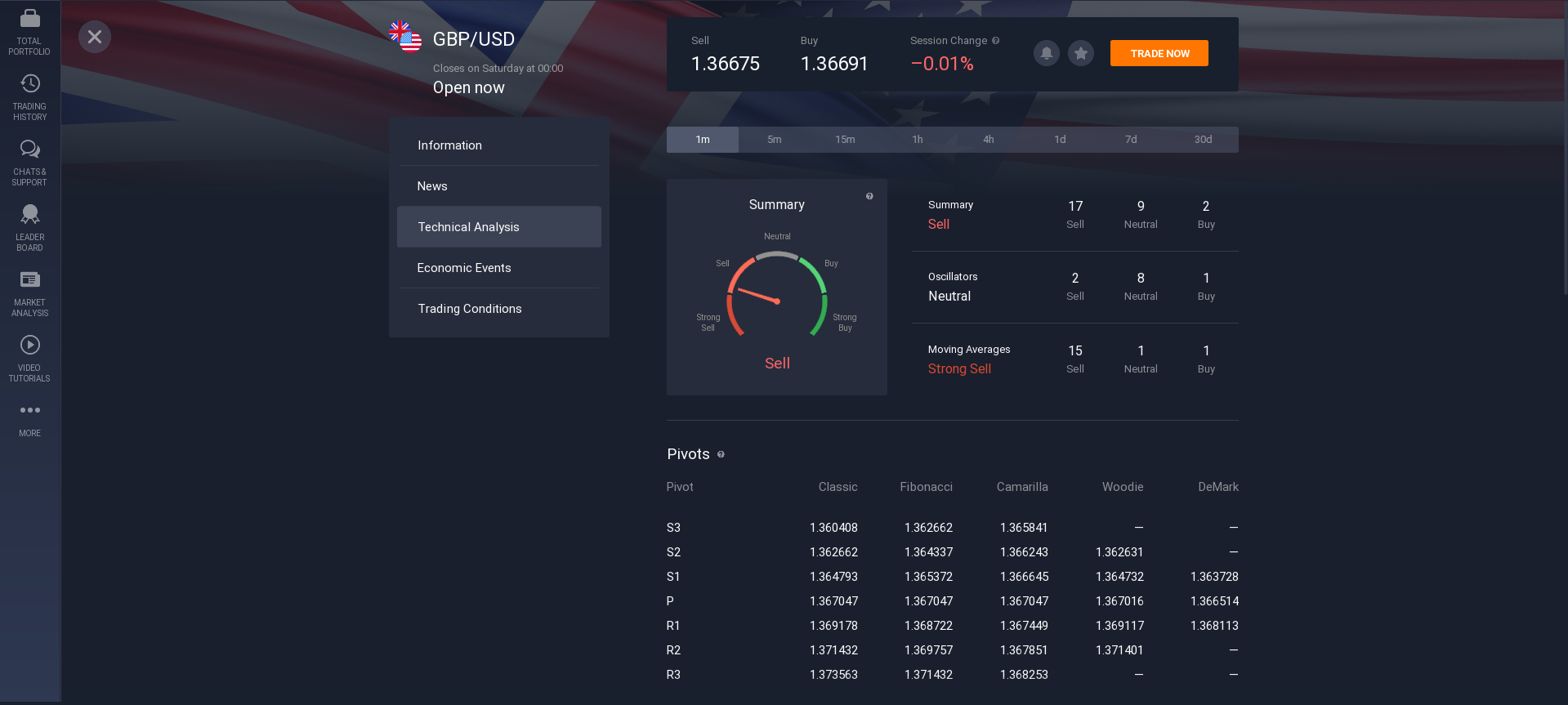

A forex trading strategy is a method used by a forex trader to determine whether to buy or sell a currency pair at any given time.

Forex trading strategies can be based on technical analysis or real news. A trader's currency trading strategy usually consists of trading signals that trigger buying or selling decisions. Forex trading strategies are available online, or traders can develop trading strategies.

Key Findings

Forex trading strategies use specific trading techniques to profit from buying and selling currency pairs in the Forex market.

Manual or automatic tools are used to generate trading signals in forex trading strategies.

Traders working on their trading systems should test their strategies and trade on paper to ensure they work well before investing capital.

Features of the currency pair GBP/USD

The currency pair GBPUSD (Great Britain Pound) is one of the most traded and popular currency pairs on the Forex market. GBP stands for Great Britain Pound. The pound is the official currency of Great Britain and is the oldest currency that is still freely used in cash transactions and large financial transactions.

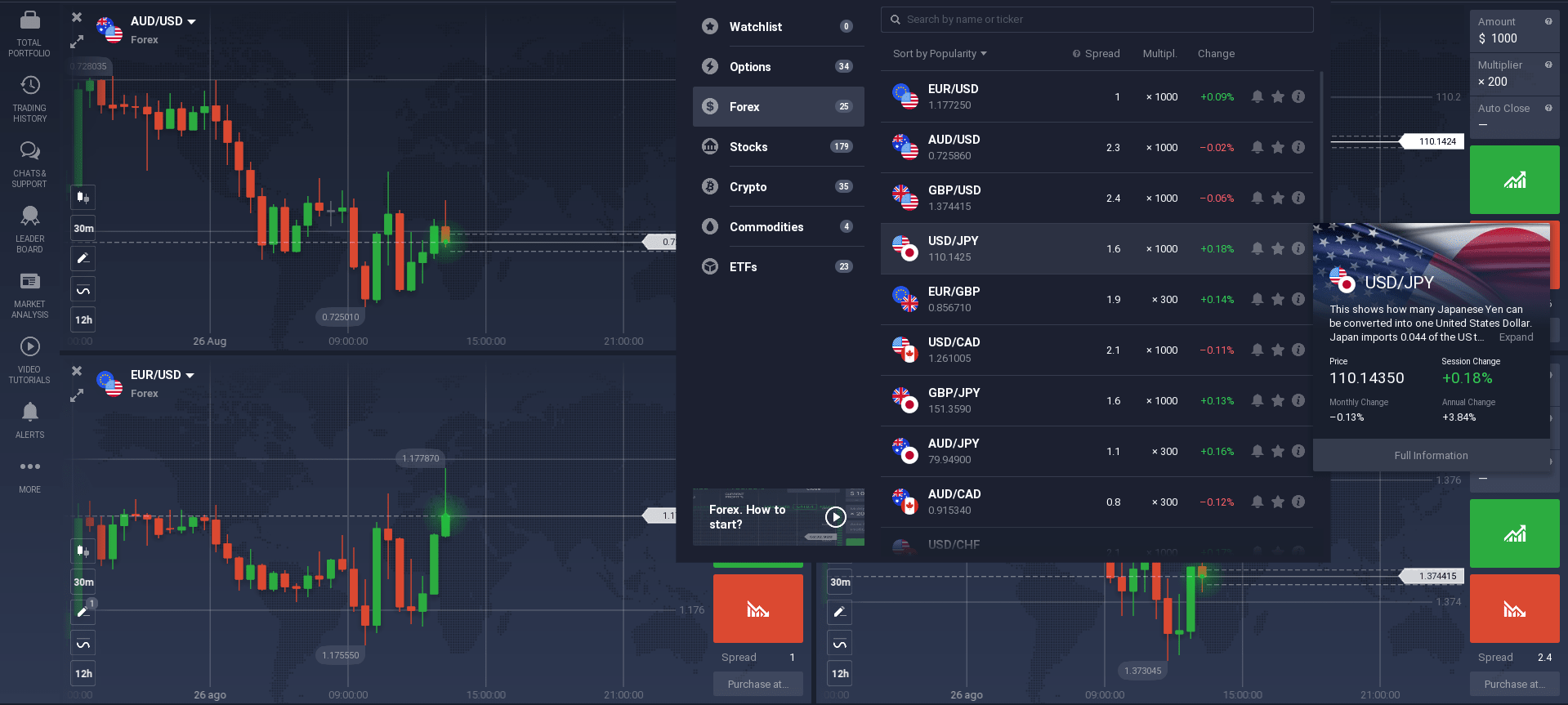

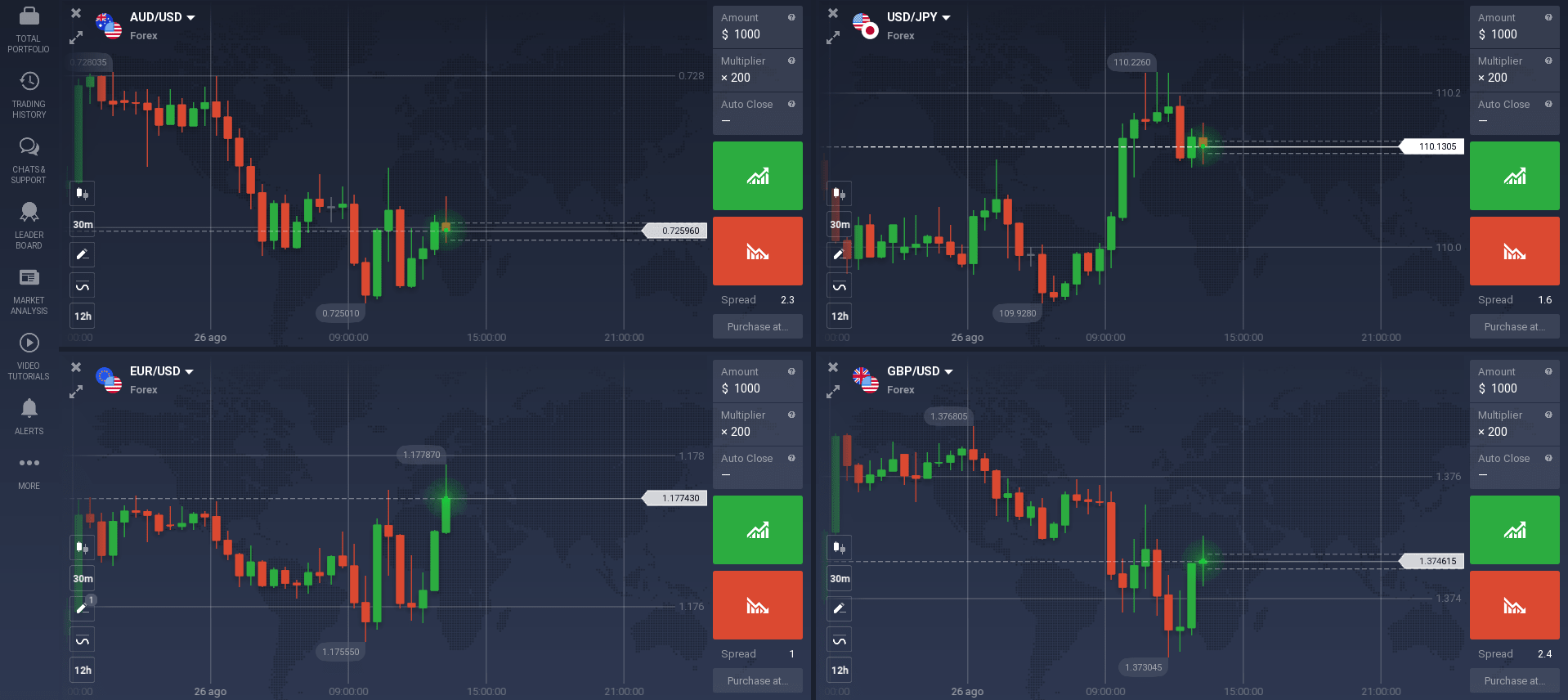

GBP/USD attracts traders because of its high volatility (sharp and strong movements). Hence, it is not surprising why pipsing is so popular while trading this pair. However, most traders agree that this pair repeats the movements of EUR/USD. There is some truth in this (see the chart below), but it often happens that the pair's movements are fundamentally different. Therefore, be very careful with this pair.

It should be noted that this is a pair with an inverse quote.

You can see on the charts how the GBP/USD pair sometimes repeats the movements of the EUR/USD pair.

Factors affecting GBP/USD

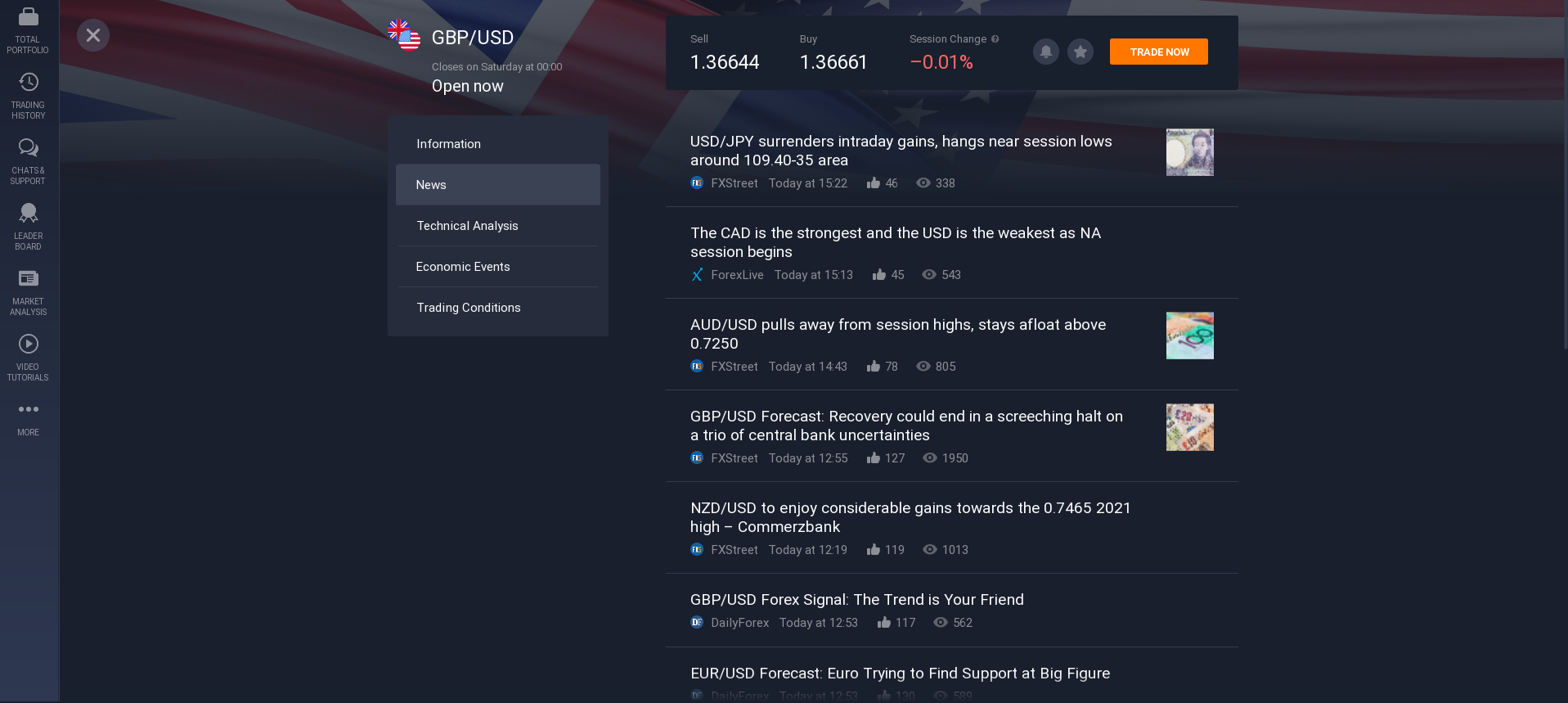

Like any other currency pair, GBP/USD is affected by a multitude of factors. The tables below show the main and most influential factors.

Factors:

- Interest Rate announcement (1st or 2nd Thursday of each month);

- Retail Sales (MoM) (monthly);

- GDP (QoQ) (end of each month);

- Bank of England inflation report (quarterly);

- Change in the number of unemployed (monthly);

- EUR/USD impact;

- RICS House Price Survey (monthly);

- Speech by the Governor of the Bank of England (regular);

- Political Situation;

- Emergencies (military action, etc.).

Interesting fact

Sometimes you may hear the name for this currency pair - "Cable". This is because a cable running under the Atlantic Ocean connecting North America to Great Britain was used to transmit the pair's trades in the 1930s. This nickname has stuck with the pair ever since.

How to start trade GBP/USD in Hong Kong?

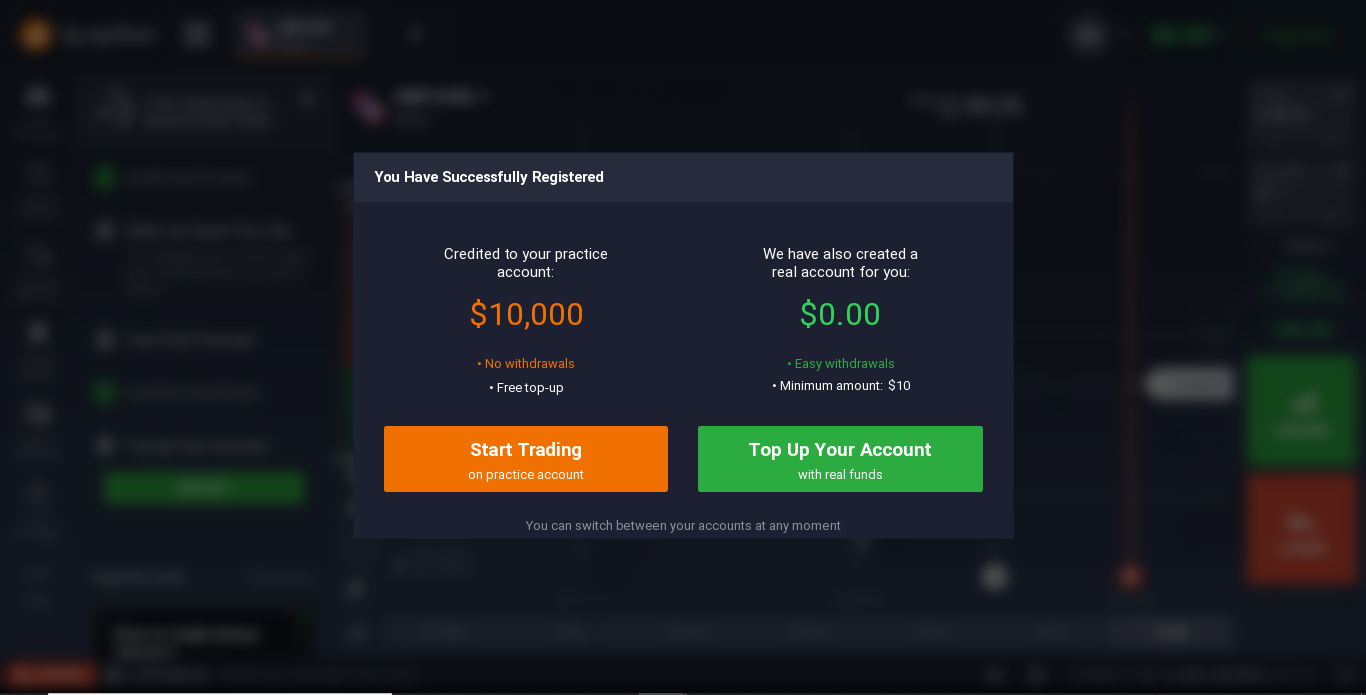

To start trading GBP/USD, you must be registered on the website. Registration is a quick and easy process. All you have to do is enter some personal details.

Demo account

Of course, it is not easy to get started in trading without the risk of losing money. But to make the learning process as painless and rewarding as possible, you can experiment on a demo account. That way, you can learn almost anything you are interested in trading and currency pairs trading.

Real account

Once you have completed your training, you can open a real account. If you feel confident enough to move on to real action, you must make a minimum deposit.

Perseverance, training and a desire to earn is all you need to be successful as a trader.

Related pages