How to make money online on staking?

Nowadays, people's views on saving go in different directions. Some people look toward different banking products, believing this is the best way to save, while others are desperate to trade by holding onto the stock market. There seems to be a financial product for everyone. However, only a few are aware of modern investment solutions. What are these high-tech alternatives? Why is leaving your money to the bank not a viable and safe way to invest? Read on to find out the answer.

1. Why do banks fail?

- Safety and security.

- There is no profit, but there is a loss.

- If not banks, then what?

2. Why would you stake?

- How does staking work?

- Currency staking.

- Why is staking profitable?

3. Staking and savings.

- Savings account.

- Risks associated with staking on cryptocurrencies.

Why do banks fail?

In this turbulent year, many have faced the question of how to save and multiply their money. Tough times have forced some to turn to risky ways to increase their capital, such as trading futures, options, leverage and more. On the other hand, conservative investors have been locked into savings deposits in bank accounts and other low-yielding products from traditional institutions. In fact, these products are often not only profitable, but also loss-making. Here are some reasons why.

Safety and security

Keeping your money in a bank account is not as safe as many people think. Are you sure that your deposit is in the safest place in the world? In reality, your money is in circulation, circulating between lenders, the bank uses it in many different ways, and no one knows if one day the bank won't collapse or be robbed. Let's recall just a few cases.

Let's look at the continuing economic crises in Latin America that began in the 1980s, some of which are still ongoing. The most famous case, unofficially called Corralito, happened in 2001-2002. During this time, many banks collapsed in Argentina, and people saw their bank deposits frozen. That's a pretty safe investment of money, right? With the country having the highest external debt in the world economy, there is nothing the banks can do, so de facto no guarantees are given.

What about the complex financial crisis in Cyprus in 2013? International creditors imposed a fixed interest rate on insured and uninsured deposits. In other words, they confiscated the funds of bank depositors. The process of confiscating savings to protect the Cypriot banking system was called bail-in. It has been proven that the banks in no way and more do not inspire confidence and provide basic security. Imagine one day losing 1 in $15 of your deposits. What if it was 1 in $10 or even 1 in $5?

What happened in Cyprus became a high-profile case of banks with big problems across Europe. Investors lost billions on this incident.

These are just judgments, but no one is ruling out assaults and robberies, let's be honest.

- We recall the robbery of the Central Bank in Fortaleza, in which some 160 million reais were stolen.

- The Securitas robbery was the largest robbery in the UK in 2006.

- In 1976, Beirut witnessed the world's biggest robbery when a group of people decided to rob the local branch of the British Bank.

And it is not a definitive list.

There is no profit, but there is a loss

Have you ever heard of negative interest rates? If so, do you like the idea of paying a bank to hold your money? It would be strange if you did. Imagine paying a bank in Germany between 0.4 and 0.5% interest per year if your deposit is over €100,000. Currently, more than 200 banks in Germany apply negative interest rates for individual customers. These charges range from 0.4% to 0.6% for deposits between €25,000 and €100,000. For people who want to increase their capital, this instrument can only mean one thing: you do not earn money, but you have an additional expense.

Basically, banks lower interest rates below zero to stimulate economic growth and it is one of the tools of monetary and fiscal policy to influence economic demand. If central banks lower interest rates, interest payments such as mortgages or loans become cheaper and borrowers have more money to spend on other things. In turn, it discourages depositors from saving and keeping their money in the bank. Thus, it increases financial spending.

If not banks, then what?

Many people stick to investing money in real estate in US dollars. Investing in real estate can be profitable, but you need to be prepared for risk.

- However, the nature of the real estate market is unpredictable and you never know when it will drop.

- Buying property takes time and money, especially if you are going to rent or sell. Let's assume you are dealing with renting to tenants and maintaining the property.

- Funds are not liquid, i.e., they cannot be picked up immediately.

- Sometimes, in order to buy a property, you have to get a mortgage, which means you have to go to the bank.

- Other risks include poor location, negative cash flow, high vacancy rates and structural problems that cannot be predicted or identified in advance.

In conclusion, the biggest drawback of real estate investing is that you don't have the ability to withdraw your capital whenever you want. And there are always plenty of pitfalls lurking around the corner. Sure, you can use this strategy to start building your wealth, but from your perspective, it's better to have more than to keep your money in real estate and try to keep up with the pace of inflation.

Why would you stake?

Investors often vacillate between the high annual returns offered by staking and the security imposed by traditional savings and other financial products. There is a false impression of volatility and high risk in the world of cryptocurrencies. In reality, it is a new space that most people avoid because they don't know much about it. We often rely on something familiar and don't want to explore new options offered by new-age finance. When you lift the veil to look, you will see a plethora of investment opportunities with cryptocurrencies. In addition to buying and holding cryptocurrencies, there is a more lucrative and exciting way to make money: staking on cryptocurrencies. What does cryptocurrency staking entail? Read more.

How does staking work?

It's not rocket science and you'll catch what it's about right away. The main point is that the stake is available on Proof-of-Stake (PoS) blockchains. These blockchains use a Proof-of-Stake algorithm that determines how transactions are verified. When a transaction is sent to the network, the network nodes make sure that the person has enough tokens or that it will not cause damage to the network, and then confirm it. Once a transaction is added to the blockchain, it cannot be changed. Well-known blockchain PoS include Cardano, Ethereum 2.0, Polkadot, Binance Chain and Algorand.

Staking means that you stake your coins to participate in the operation of the network and receive rewards for doing so, and the proportion of rewards is related to the amount of coins you stake. Some blockchains only allow users to participate with a certain amount of coins .

Crypto coins and exchange platforms

We explain the following. Some cryptocurrencies are stake-able and others are not available for stake, why? The answer is that the blockchains referenced by these cryptocurrencies are based on different mechanisms: PoS and PoW. One of the PoW (Proof-of-Work) currencies is Bitcoin and cannot be put into play. PoS (Proof-of-Stake) coins can be introduced into the game.

Compared to regular cryptocurrencies, there are currencies that are not based on fiat money: stablecoins. Stablecoins are pegged to a real world asset (such as the US dollar), and their value does not change much. As we know, cryptocurrencies are highly volatile, so stablecoins were created to reduce volatility. Basically, staking on stablecoins also offers lucrative investment prospects.

When talking about where to put your cryptocurrency, there are many blockchain networks. Some of them work exclusively with Proof-of-Stake mechanisms, others use PoS versions such as DPoS, and others. Among all this rich variety, there are a few that are highly mentioned and recommended.

Let's take a look at the most profitable places where your capital will not only be safe, but also multiplied. Here are the best platforms that are reliable, profitable and have potential!

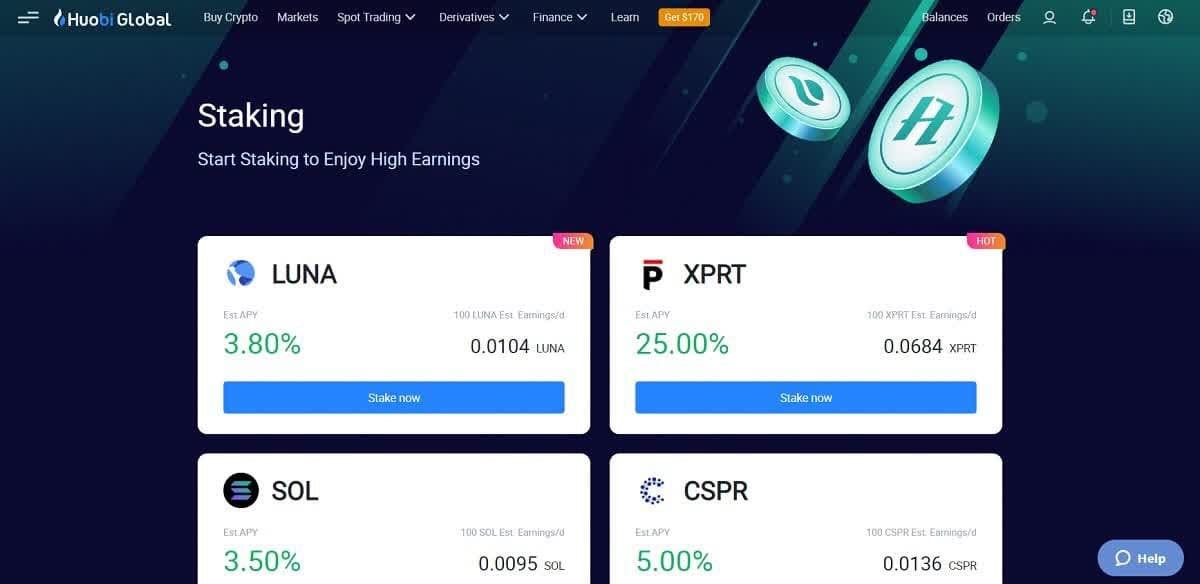

Win on Huobi

Don't want to tie up your assets without being able to sell or withdraw? Go for Huobi: there is no lock-in period and you can earn up to 50% APY! Be as flexible as you want with your funds! For easy staking and consistent, profitable returns, choose Huobi! Huobi has been a global leader in cryptocurrencies since 2013, so you can enjoy maximum security and reliability. Staking on Huobi is just that - a way to increase your income quickly!

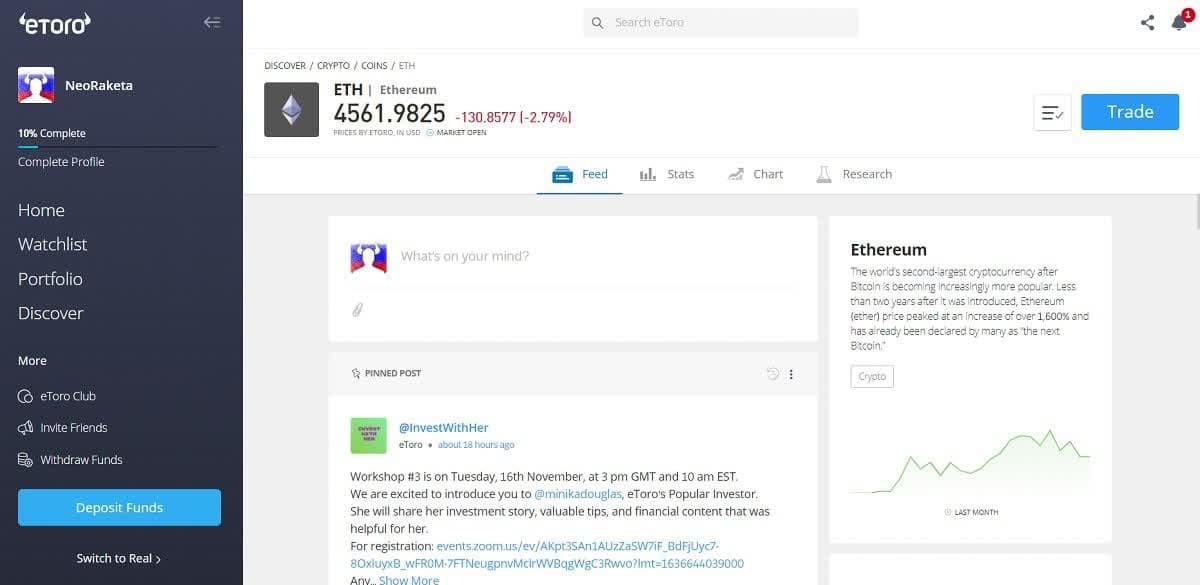

eToro

Enjoy fast and hassle-free growth on eToro without having to do anything. eToro takes care of the entire staking process while you earn consistent monthly profits. Simply deposit your money, lock it in and you're done! True passive income is at your fingertips! Earnings are compounded and range from 75% to 90%. This is the perfect booster to increase your capital! eToro has over 20 million users worldwide and is regulated by leading authorities (UK FCA, etc.), so you can feel confident! Don't miss a moment: take your finances to the next level with eToro!

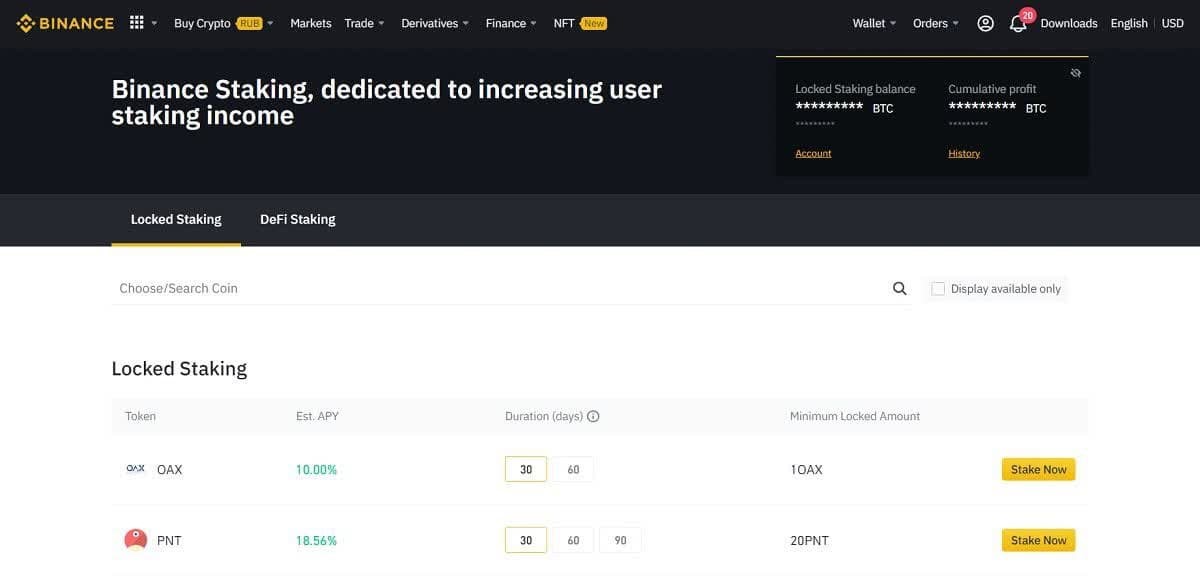

Binance

If you are looking for security, reliability and want to sleep soundly at night, go to Binance, the world's largest cryptocurrency exchange. Binance is the best place to make money with cryptocurrencies, for both beginners and experienced traders and investors. Although Binance is not regulated by higher authorities, your funds are protected by SAFU. Congratulations, you can forget about your nerves. Create a passive income easily and safely! Also try staking your newly minted coins to get a higher APY.

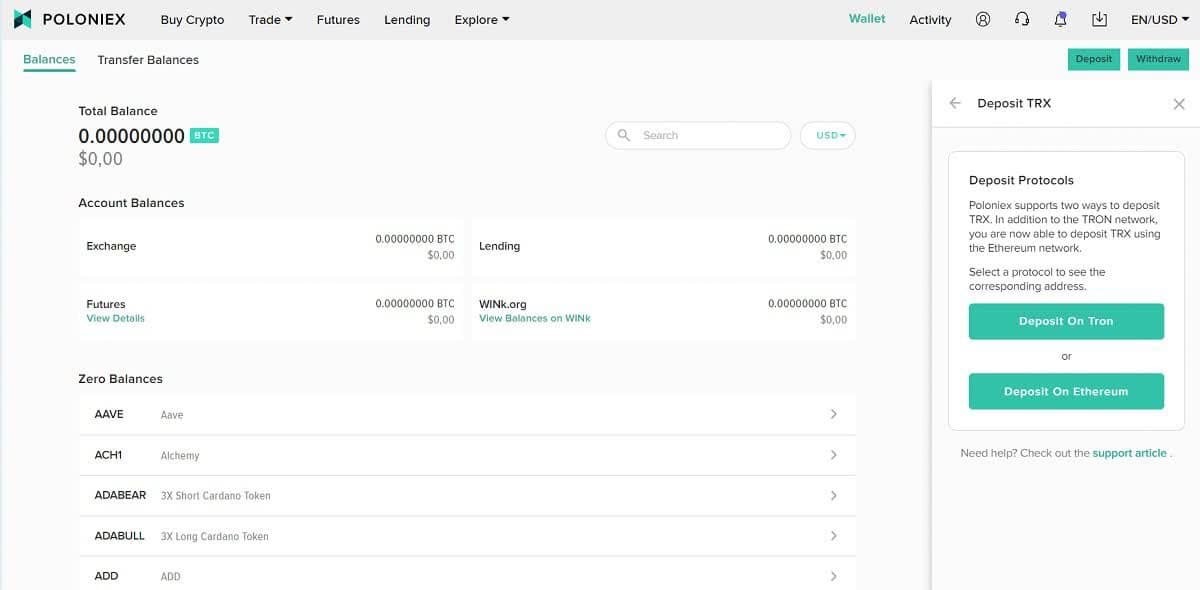

Poloniex

Follow a few simple steps to start earning passive income on Poloniex: deposit money, keep it in your account and earn rewards. Worried that you won't be able to trade or withdraw your money while earning rewards? Don't worry, you can! While Poloniex generates very competitive profits for you, you can sell, trade and withdraw your funds: no lock-in period and no fees!

Coinbase

If you only have $1, you can increase that amount right now by staking on Coinbase. For as little as $1 you can start earning passive income! Is staking technically difficult? Don't worry, Coinbase will do all the work for you. It is one of the leading cryptocurrency exchanges in the United States. It helps you manage and sync nodes with the blockchain, so you can just sit back and earn rewards. Isn't this a great start to increasing your income?

Why is staking profitable?

Now that you know what the stakes are, let's talk about why they've increased so much.

When you buy coins and start participating in the network, you get rewards. In this way, you make your money work and generate passive income. In fact, it can be compared to keeping coins in your wallet for a period of time and giving you permission to use them.

Although the return depends on blockchain, the average is still above 10%, which is much more profitable in terms of APY than traditional banks. Overall, staking is an easy way to generate passive income.

As time goes by, it gets easier and easier when it comes to the technical aspects of staking. The fact is that participating in staking, for now, involves only a few steps: set up your wallet, fill it with coins, and start staking! It's not rocket science.

Staking and savings

Savings account

A savings account is the most popular financial product offered by most banks. You receive a regular payout based on the amount of your savings. However, interest rates and available options vary depending on what country you are in. Typically, investors receive no more than 2% APR. We don't take into account countries with higher inflation rates, where the APR can be as high as 30%, even if the actual benefits are lost.

Banks make money from these low opportunities by using their money to make loans, for example. The profits from these business practices are shared with depositors in ways that are not profitable for them.

Essentially, you do not control your capital in the bank; you do not own it. In the event of a crisis, there are no illusions: the bank can honour its guarantees with the help of the state, but there is always a second scenario in which liability is avoided and savers lose their money.

Crypto Staking

Staking is different. First, you get paid to participate in the operation of the network. Secondly, the least profitable remuneration is still higher than in banks: about 5%. However, this is higher than any savings account offered by a bank.

Speaking of risk, it exists in cryptocurrency staking. It is common knowledge that cryptocurrencies are quite volatile and during the lock-up period, they can fall depending on the state of the market (worst case scenario). In such a case, you may lose money. However, they can also rise and you will receive a generous amount of money in addition to the reward for your stake. To avoid this volatility and high volatility, people choose to stake stablecoins, such as USDT. They are not likely to suddenly plunge or surge, which makes investors relaxed about future profits.

While traditional savings are less risky in this regard, one should not forget the macroeconomic situation where banks are literally run by the government and very often follow its orders.

In terms of the time it takes to get started, staking are the best. In fact, it is by far the fastest option. It may take days (sometimes weeks) to open a savings account, but it may only take a few minutes to start staking.

In general, staking is easier in many ways and more profitable than banking products; however, it does carry some risk. However, you can combine these two methods and have a diversified portfolio.

Conclusions:

There are many ways to save and multiply your income these days, but people often opt for old-fashioned and trite options such as bank savings accounts or real estate. These supposedly safe and secure options are accompanied by many pitfalls, plus some really unsuccessful schemes. It's best to keep your eyes open and always be on guard, even with these seemingly "foolproof" investment solutions from banks.

It is best to move with the times and take advantage of the opportunities in the digital world. The cryptocurrency industry is rich and abundant with numerous investment options. Many find it difficult because they are unfamiliar with the sector, but it's not too late to get started! Don't be afraid to increase your income with cryptocurrencies, master modern ways that are much better and more effective in terms of creating passive income!

Related pages

What is a CoinPayments Wallet?