Buy actions

The way we buy shares has changed radically around the world. And these changes have also reached Hong Kong, where modern tools and digital media are available, making this task much more accessible and lucrative.

Investing in shares can help combat the effects of inflation on the personal economy. It also helps to increase the value of the money saved, making it yield excellent dividends.

Today it is even possible to start with really small amounts. It all depends on getting information and training, something that is now freely available online. The stock market awaits, for all those ready to start a new experience.

What are company shares?

Shares are equal parts of the share capital of a company. It has been divided and made available to investors who wish to acquire them, who are known as shareholders. These are capitalist partners who are also owners, in proportion to the percentage of shares they have acquired in that company.

The purchase of shares is possible when a private company or even a growing public company decides to divide its capital into a certain number of parts and put them up for sale on the stock market. This is generally done to finance its expansion and to be able to carry out productive projects with which it will obtain greater profit margins.

This capital increase is also known as capitalization. And in order to be able to put these parts of your company on the market, they must pass the corresponding approval of your stock list, in which their solvency and trading volume is checked, among other requirements.

In the majority of cases, only less than 51% is put up for sale, in order to retain control of the company. The rest can be acquired by the shareholders, who may:

- Obtain economic benefits.

- Participate in the company's decision making.

In both cases this happens in proportion to the capital shares that have been subscribed.

Firstly, a shareholder can obtain a share in the company's profits, known as a dividend, if any. He can also make money by selling a company's shares, when they are on the rise. That is, they keep the difference between the purchase price and the sale price.

On the other hand, above certain percentages, investors can attend meetings of some companies, where important decisions are made.

What is the price of a share?

Initially the value of the company's shares depends on the value of the capital and the amount of shares made available to potential buyers.

Suppose a company that is valued at usd 20,000,000 puts 100,000 shares up for sale. The nominal value of each one results from the division made between the capital and the amount of those shares. In this case, each share costs usd 20 each.

But this price does not remain unchanged. It can actually increase or decrease according to the laws of supply and demand. This means that when there is confidence in the company's financial situation, the amount of shares purchased increases, which increases their value.

On the other hand, if there is no confidence in the possibilities of making a profit, this can lead to the sale of these shares, which brings about a decrease in their price.

All these factors depend on the situation in the market, the laws and legislation of each country, established to regulate the economy and trade in general.

Types of companies and shares

Businesses are responsible for the most basic functioning of the economy. They can start as micro-enterprises, with a tiny number of employees and few resources. But with the right management they can achieve much more.

They can go through the stage of small businesses, become medium sized and eventually become large commercial companies.

When these huge corporations have developed substantial capital and put it up for sale on the financial market, shares emerge that offer the opportunity for various benefits.

There are several classes of shares, which are classified according to factors such as dividend yield, level of risk or according to the obligations or political rights over the company. The following are some of the most widely traded.

Common or ordinary shares

These are the actions themselves, as we have described so far. They are those that are issued from the company's share capital, which results in various people becoming shareholders or capitalist partners of the company.

In this case they may receive part of the dividend obtained. But the most important thing is that, from certain percentages and the internal policy of each company, they can participate in the annual shareholders' meeting.

At these meetings they vote on whether to distribute the profits of the period or reinvest them in the company's capital.

Preferred shares

In this case the holder of the preference shares has a preference over the holders of the ordinary shares. They must first collect the profits made by the company.

Curiously, they do not have the right to vote at meetings. But they do have access first to the money resulting from the liquidation of the company's assets, in the event that the company is in bankruptcy.

Nominative shares

This is the case for most shares, which are specifically issued in the name of a buyer or shareholder.

Bearer shares

These are shares that are not in the name of any one holder. Their benefits can be obtained by any person who owns these shares.

Other actions

- Convertible

- Gold

- Securities

- Variable income

- Depreciable

- Cumulative

- Non-cumulative

- Private

- Recoverable

- Syndicated

- Institutional

- Minority

How to buy shares on the stock exchange?

To buy shares it is necessary to use the service of a Broker. This is a duly authorised and supervised agent or company that carries out buying and selling operations of these investments, with the aim of obtaining the highest possible profit margin.

In the traditional market Brokers work with financial options, securities, national bonds, negotiable obligations, guarantees or Cedear.

A lot of money is required to acquire this type of stock. And the possibility of obtaining profit margins depends on the experience that each trader has in the stock market.

However, there is an excellent opportunity in currency markets such as Forex, binary options or crypto-currencies. These are operations in which you can also participate with minimum capital.

The advantage is that these can be easily accessed via the Internet. These are the sites of large brokers, which also offer the advantages that technology now provides.

Online platform for buying shares

The benefits offered by the platforms for buying shares, include really minimal fees, modern tools for financial education and updating and the opportunity to practice first with a demo account.

This is especially convenient for those who are just starting out in this activity. You can start with minimal amounts, while learning according to your personal needs.

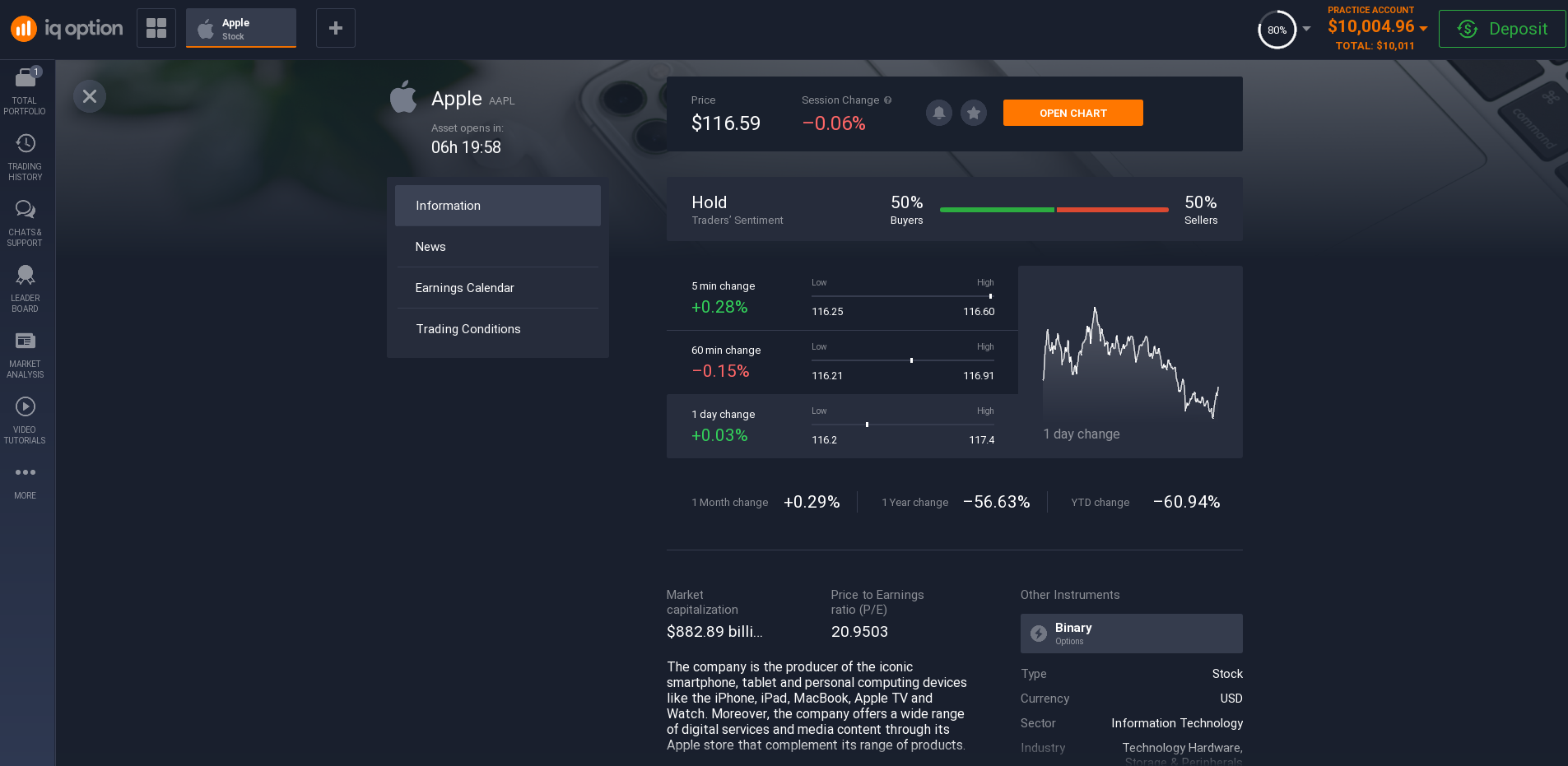

The tools available on each platform are of great help in buying shares and keeping track of stock quotes in real time.

Each company provides the corresponding website, a software to be accessed from a personal computer or an application that is accessible from mobile devices such as smartphones or tablets.

From these tools, each investor can select the way to buy shares that suits his or her objectives.

It is important to take advantage of the opportunity offered by a demo account, before making a real purchase. In addition to using virtual money and testing trading performance, it is ideal for learning how the platform works and all the benefits it can offer.

It is equally important to set your goals, which are realistic and in line with your trading style.

At the beginning you may choose to trade with lower profits that have low risk on the money invested.

As you gain experience you can opt for a medium or aggressive risk acquisition where you can achieve higher profit margins.

It is important for each trader to spend time researching the best stock market moves for the trade he or she chooses to participate in.

How to start buying shares?

It is vital to investigate an online investment platform before starting the registration process. To do this you should read their Terms and Conditions of Service, and find out what they offer to new traders.

It is also vital to go through the tutorial section, which explains every detail of the registration process, is clear in its functions and indicates the means of payment accessible to the country from which you wish to operate.

It should give a clear idea of what options you have for investment and what kind of benefits they offer. It should also have a user support section that answers your questions immediately and effectively.

How to register?

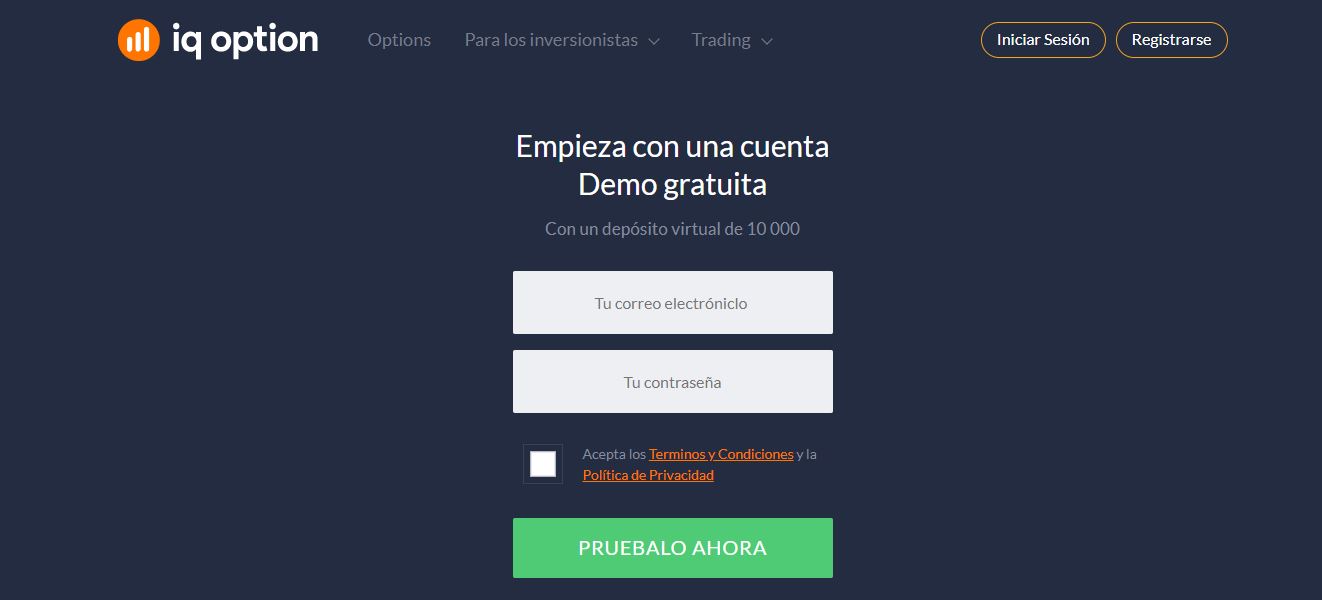

The registration process starts by entering your personal email and a password. It is also necessary to check the box accepting the terms and conditions and the privacy policy, after reading them.

It may then be necessary to enter the email to respond to the notification confirming the use of the account. You must then proceed to complete the personal data requested by the website.

How to open a demo account?

To start with the demo account of a trading platform you can start by clicking on the part indicated for this action. However, even if you go directly to the registration section, in most cases you start by offering the demo account in advance.

It is convenient to act without haste and select this option and install the application first, which will allow you to perform the corresponding practice.

How to open a real account?

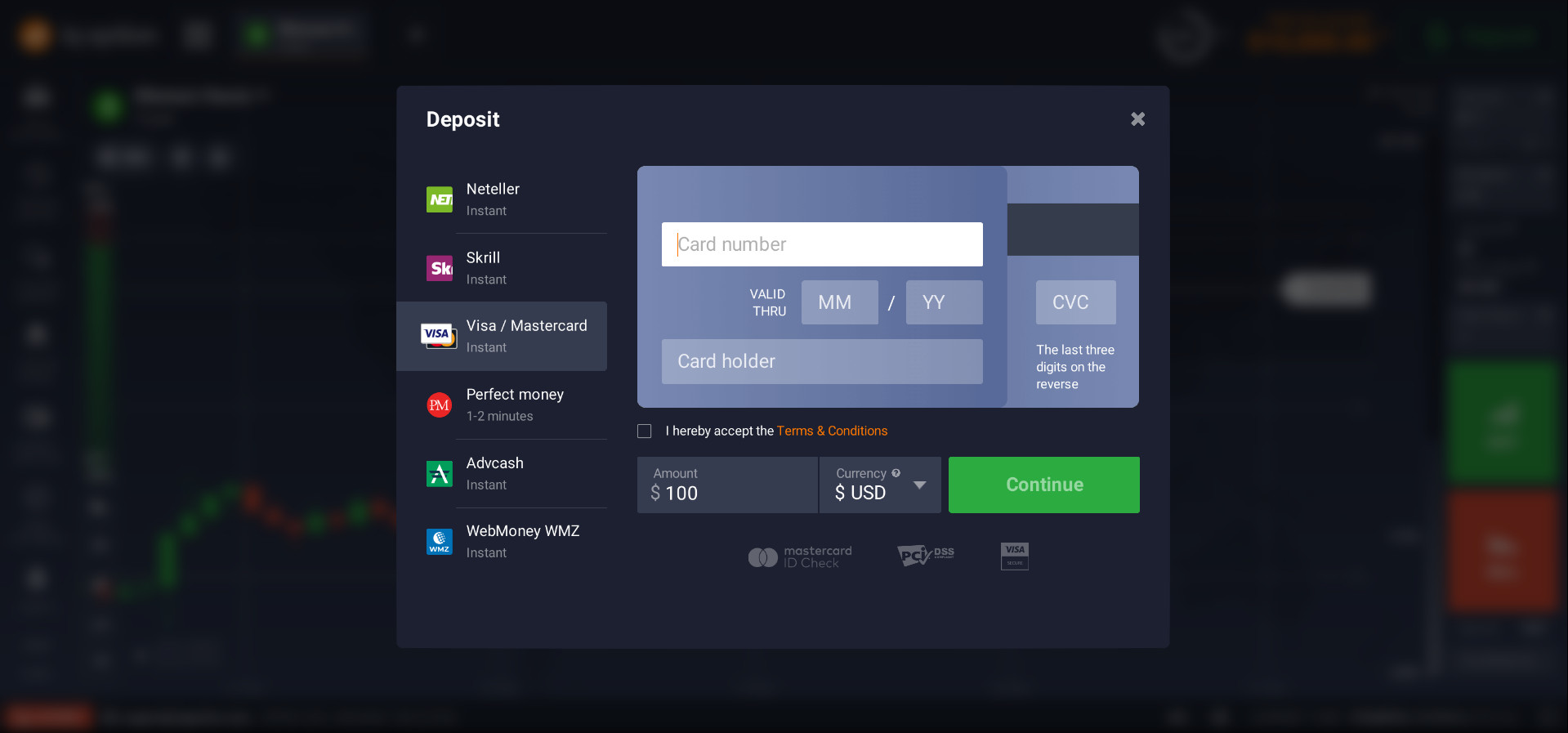

To open a real account you can choose the option that turns the demo account into a real account. The only requirement is usually to upload funds from an accepted medium. It is usually possible to do so by a credit card, debit card, accepted bank transfer or other means of transferring money online (Skrill, Paypal, Payoneer, or Easy Pay).

How do I replenish a deposit?

A user can replenish a deposit in his account with authorized means, as in the previous step. He has to choose a credit card or chosen means and fill in the box with the amount of money in the corresponding currency.

Minimum deposit amount

Many platforms usually ask for amounts around USD 1000 or Euros. However, it is now possible to make transactions with smaller amounts of around 10 or 20 USD. Each user chooses the amount of money they are willing to invest.

How to withdraw money?

To withdraw the money you must make the corresponding request and choose the means by which you wish to receive the funds. It must be among the means accepted by the company, which may include transfer to other payment accounts, or even transfer to a bank account.

Is it safe to buy shares on the stock exchange?

The best platforms consider options to best help traders participate without ending up with a negative balance. They generally do not allow for leverage. Those that generate the most confidence have a very firm legal constitution and respond to international bodies.

This is important, as it is in this way that they generate a high level of trust, which is vital for them to continue to function.

On the other hand, each user must be informed about market movements, in order to make the best possible decisions, before making a stock purchase. This will increase their chances of winning with the money invested.

Is it safe to buy shares on the stock exchange online?

Like millions of websites where commercial transactions take place 24 hours a day, security is crucial. The platforms that have been working the longest have the best encryption to protect their users' personal data.

However, it never hurts to contact the site's customer service department and ask about the level of security they use to protect their customers' data.

Is my share purchase protected?

This is another advantage offered by online platforms for buying shares. They have options to protect their customers against accelerated money loss. They offer coverage to avoid ending the operations with a negative balance. This is another fundamental service, such as the protection of privacy that is specified in the service.

Is it safe to buy stocks on the stock market in Hong Kong?

To achieve the best results it remains vital not to rush operations. It is important to control the emotion and temptation to make money and not to act on an alleged "instinct" that does not exist. The best traders know the transactions with the best chances of growing and only then make their investment.

FAQ

What is the stock market and why buy shares?

The stock exchange is a place where authorised brokers buy and sell company shares on the orders of traders who use their services. Other securities such as the value of gold, oil, bonds, securities and other securities are also listed. The trading platforms are listed with forex, binary options and crypto-currencies among others.

How can I make money from shares?

You can earn money by hiring the services of an authorized broker, who trades on a stock exchange or through a virtual investment platform. It is necessary to know how to invest in shares. To do this you need to be informed about what is happening in the markets in order to know the best opportunities.

How do I buy shares in a company?

The purchase of shares is done through an order. It is a request received by a broker, who will take care of acquiring the shares of the chosen company, for a determined amount. The payment for his services is a percentage of the operation. Currently these transactions can be carried out through tools such as desktop or mobile device applications.

What do you need to buy shares?

The services of an authorised broker are required to purchase shares. This is responsible for buying and selling the shares according to the orders of the trader who has contracted it.

When is the best time to buy shares?

The best time to buy shares is usually when they have reached a maximum value. This means that a company's performance is the best and that this is why demand for its shares has increased. In any case it has to be an informed stock and you should consult with the broker who will know how to interpret the market's movements.

How do you know if a value is expensive or cheap?

The value of a share is expensive when it has risen above the market price. This may be due to the company's optimal timing. On the other hand, if it falls below the market value, it means that it is cheap.

What is a "Blue Chip" action?

Blue Chip comes from the English term "blue chip", referring to the highest value chips in this game. This is the way high quality stocks are called, which are profitable and very well established in the market.

What do you get when you buy shares?

What you get is the opportunity to obtain the dividends of a company, the right to participate in its board of directors (if you have high percentages of shares) or the possibility of earning difference that is obtained with its sale in the stock market.

How to buy shares in Hong Kong?

In Hong Kong the purchase of shares is done through brokers who are authorized by the National Securities Commission. Trading platforms are also available that are accessible and present an opportunity to expand personal savings.

Related pages