Buy Twitter shares in Hong Kong

Every year, the issue of investment becomes a priority for people all over the world, including Hong Kong. The global pandemic has shaken the global economy, causing many medium-sized companies to go bankrupt. People are looking to take care of their savings and protect their funds.

When it comes to choosing an asset for investing their savings, people first look for stocks of successful companies. One of such companies can easily be called an American company Twitter Inc.

Twitter is a microblogging service where users post messages known as "tweets". Initially, tweets were limited to 140 characters, but on 7 November 2017 this limit was doubled to 280 for all languages except Chinese, Japanese and Korean. The service is owned by the company of the same name.

Twitter is owned by Twitter Inc. and is headquartered in San Francisco, California. Twitter Inc. also has servers and offices in San Antonio, Texas, and Boston, Massachusetts. Launched by Jack Dorsey in 2006, Twitter soon gained popularity around the world. Today the service boasts 1.3 billion accounts. Twitter has 330 million monthly active users, with 500 million tweets sent every day.

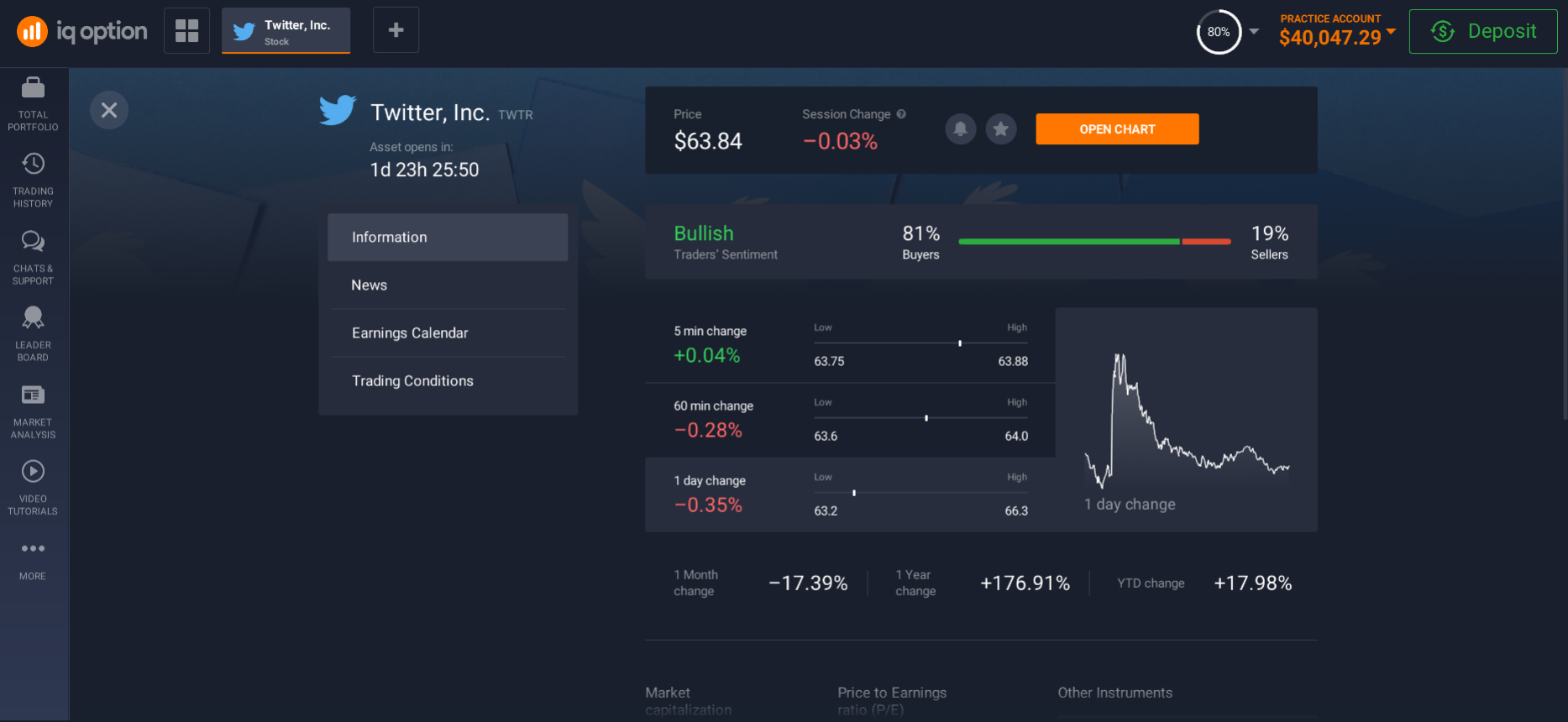

On November 7, 2013, Twitter Inc. held an IPO on the New York Stock Exchange and raised $1.8 billion. As of the date of publication of this article, Twitter's share price is $63.84, an increase of 176.91 percent from the same time last year.

As of January 2021, the company had an estimated market value of $47.7 billion.

Below we take a look at Twitter stock investments in Hong Kong.

How to invest in Twitter shares in Hong Kong?

Twitter shares are included in the calculation base of many indices, in particular: DJ Internet, NYSE Composite, DJ Internet Commerce, DJ US, DJ Technology, DJ Growth, DJ Internet Composite, DJ Software & Computer Services, DJ Mid-Cap Growth, DJ Mid-Cap, ARCA Computer Technology and others.

Twitter Inc. had its initial public offering in November 2013 on the New York Stock Exchange.

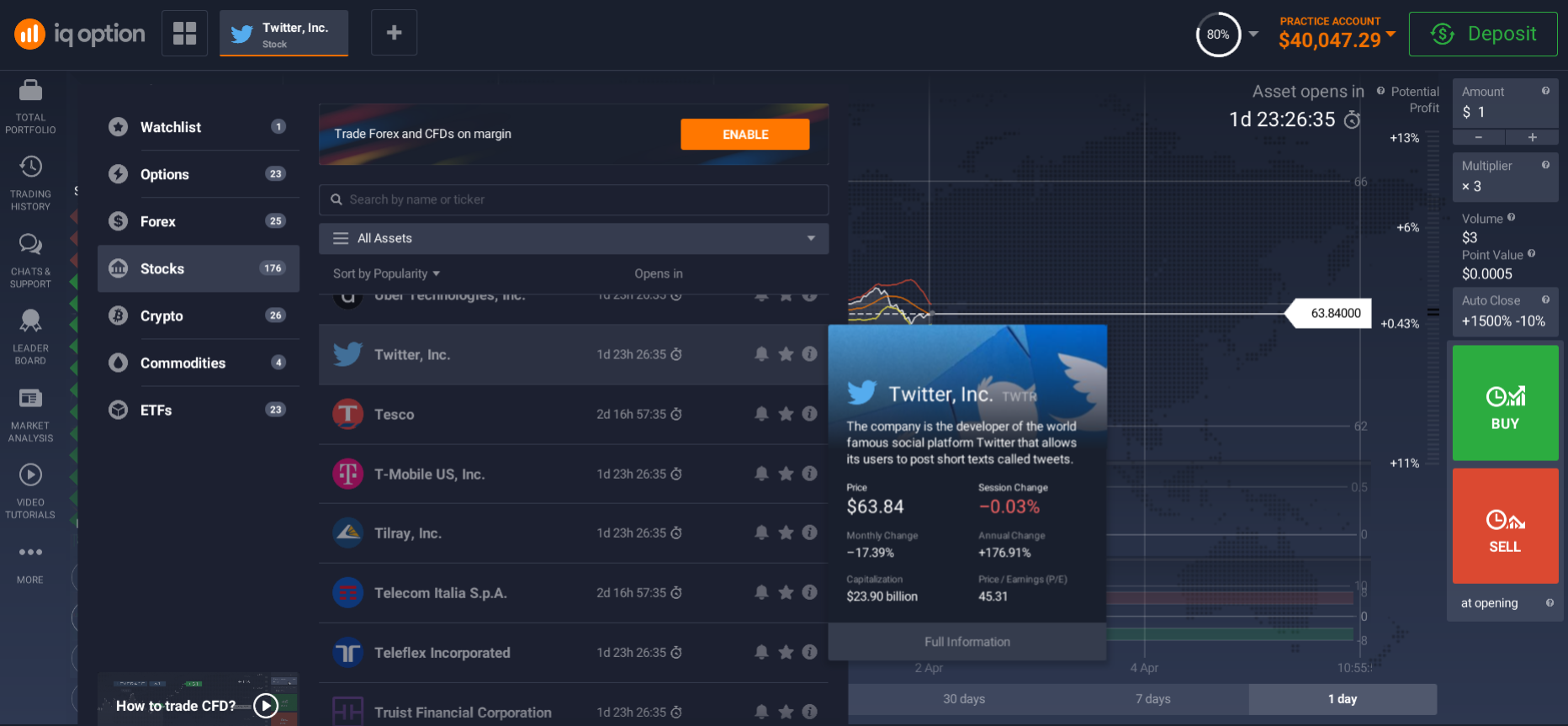

The company is currently listed on the NYSE under the ticker TWTR.

Shares of the issuer are also traded on other exchanges, for example: Frankfurt, Hamburg, Düsseldorf, Stuttgart, Berlin, Munich, London and Hanover.

For the average Hong Kongn, an affordable and easy way to buy Twitter shares is to buy them on the stock exchange via an online broker. If you're not a billionaire, and you're not going to be working for Twitter anytime soon, buying shares through a broker is the only way to go. For anyone interested in investing in stocks, especially overseas stocks, it is essential to find a reliable stock market financial intermediary, without which no stock market transaction can take place.

To choose a good broker, pay attention to the following aspects:

- Whether the broker has the necessary regulatory licences entitling it to engage in brokering activities;

- Availability and quality of the online trading platform;

- The availability of 24 hour information for consultation;

- The trading conditions available with a wide range of trading instruments;

- Availability of technical indicators to analyse stock price fluctuations;

- Access to free training material;

- Speed of response to enquiries;

- Low service fees;

- Availability of various withdrawal methods.

The most popular way to invest in Twitter shares is through binary options.

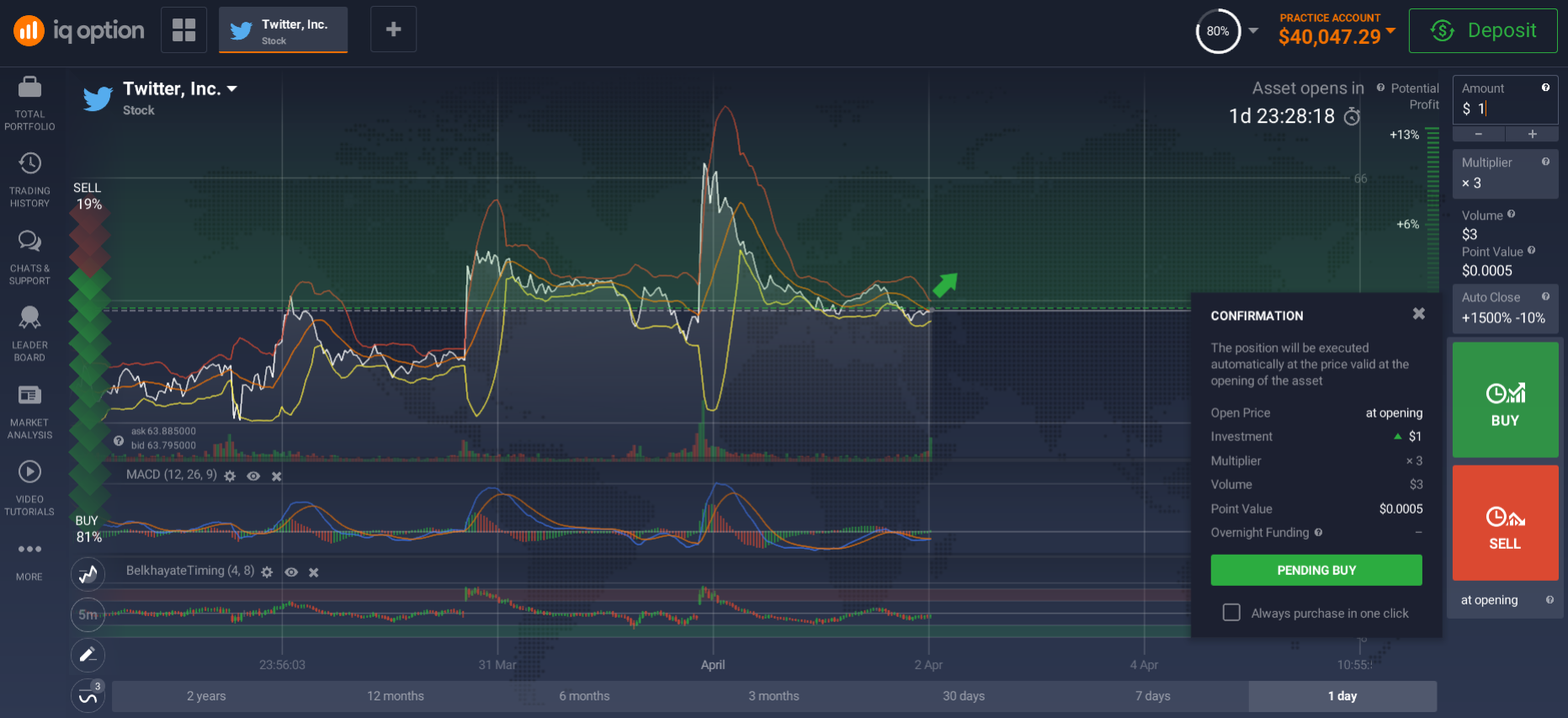

To do so, you need to be able to predict the share price. With a giant like Twitter, it's best to focus on growth. At the expiration of the option (30 minutes, an hour, a day, a week or a month) you can make a profit on the investment, even if the price has risen only 0.001 points since you bought it. It really is a profitable investment - you just have to determine whether it's going up or down. Because when you buy options, you specify that condition and time immediately, and you know immediately how much profit you will make and when.

The US company has not paid any dividends to its shareholders since it listed its shares in the autumn of 2013. The reason for this is that all profits were used to develop the business. If the issuer were to begin paying dividends in the future, it would improve the outlook for the paper and cause its share price to rise over time.

A popular alternative to dividend investing is the trading of derivatives called CFDs.

CFD means 'contract for difference', and is a contract between two parties - the buyer and the seller. The essence of the contract is that the positive difference between the opening and closing price of a particular financial instrument is paid by the seller to the buyer, and the negative difference is paid by the buyer to the seller. The contract also stipulates the time at which the difference is determined.

CFD were invented by English brokers, who decided to interest their clients in trading stocks without paying special tax. Formally, making a deal with CFD was not a deal with shares, and was not liable to tax. Then the CFD became an ideal instrument for those, who did not have the opportunity to enter the market, for example due to lack of money.

The main advantage of CFDs is the lower capital requirement.

This reduction is achieved, as there is no need to pay taxes and commissions for delivery of goods, to be included in the register of shareholders, as well as other fees, which are paid for trading with stocks. In addition, CFD trading allows the use of leverage. Trading with financial leverage can substantially increase your initial capital, however, it involves a lot of risk. So before using the leverage option, make sure you have a good understanding of how leverage works and that you are experienced enough to handle such trades.

Practice with a demo account - we will explain more about what a demo account is.

How to buy Twitter shares in Hong Kong?

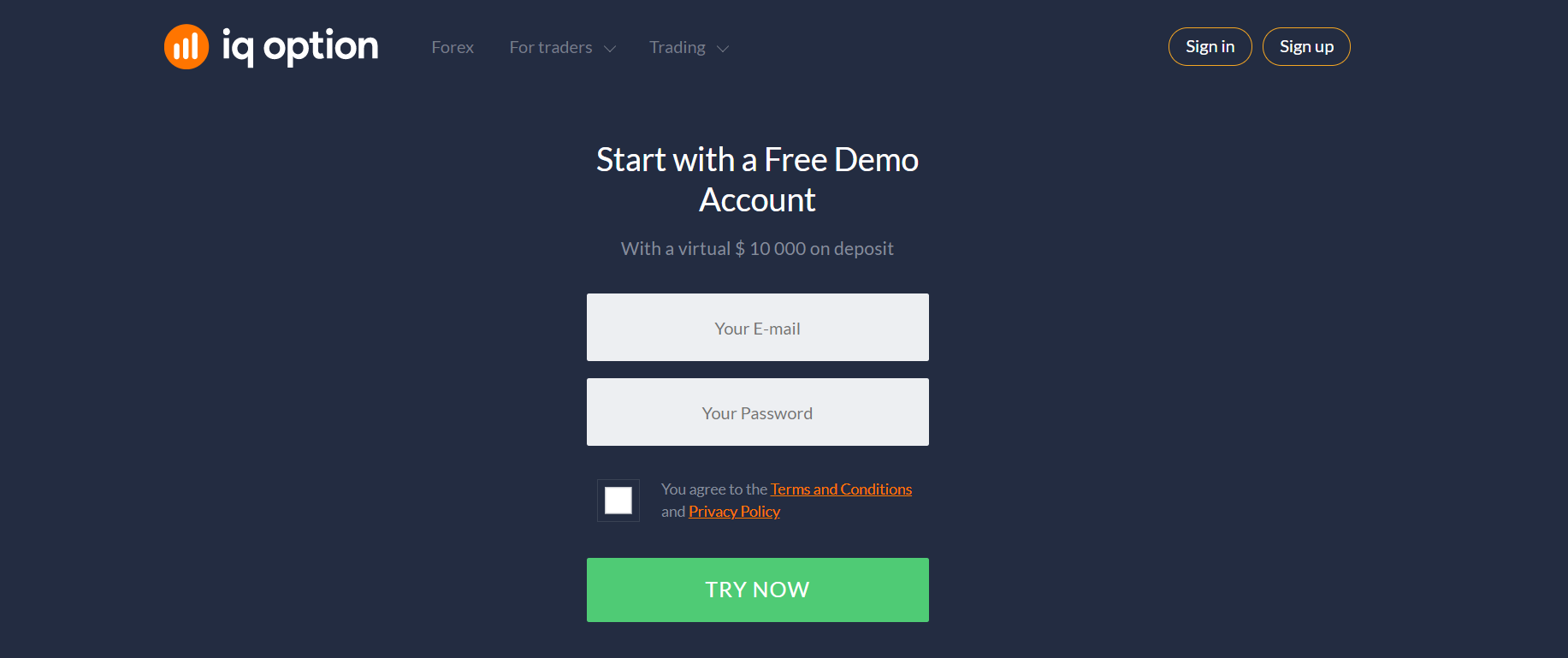

After selecting the right broker, take the next step, i.e. register on their online investment platform, which is offered as a working platform for trading.

Registering on the website is standard and is not technically different from registering on any website, be it a social networking site or an online shop.

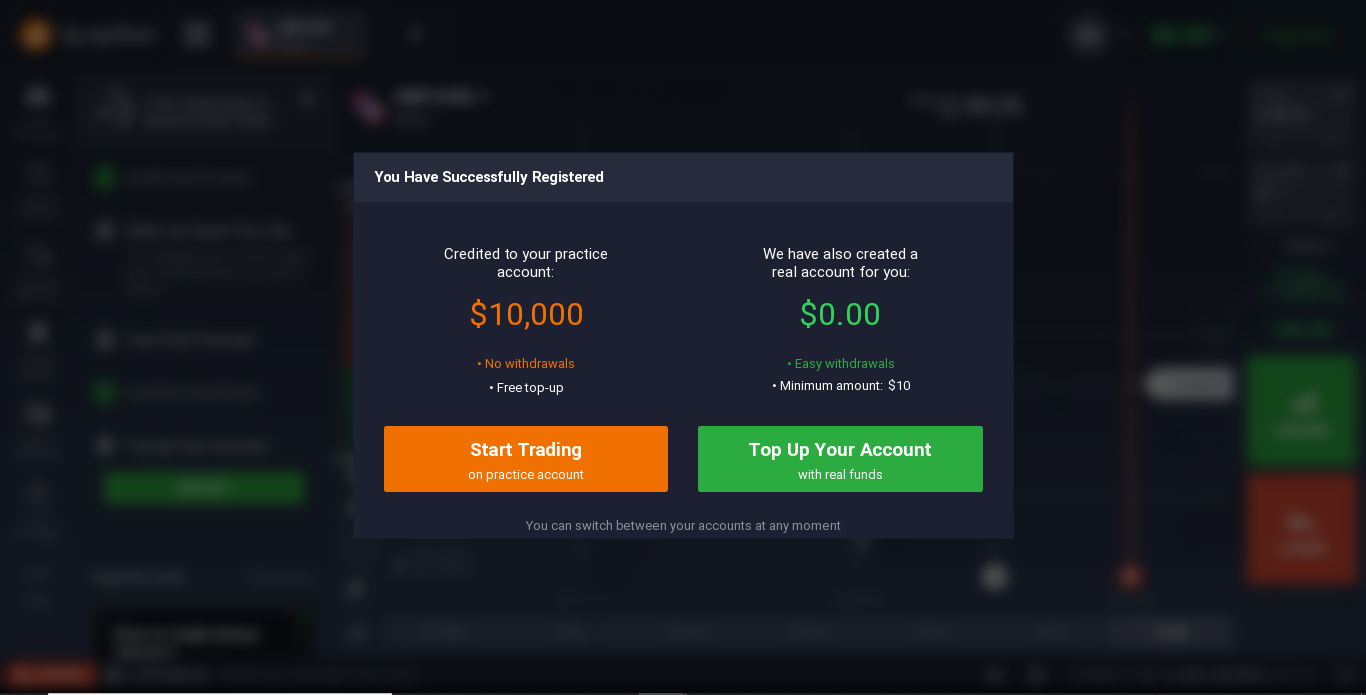

You will then have the option to open a demo account. We sincerely recommend that you take this opportunity to learn how to work with the platform. On your demo account, you will see an available amount of (in most cases) USD 10,000. You can use this amount at your discretion, as if it were real money: buy shares, use multipliers, etc. But remember that the amount in the demo account is fictitious and is only for training and testing purposes. You can renew this amount as many times as necessary, if necessary. Needless to say, you will not be able to withdraw this amount to your real account.

To fund your real account and start buying real shares, use one of the payment systems offered on the platform. Normally, the minimum initial deposit amount is no more than $10. Funds are almost always credited instantly, in exceptional cases, up to five banking days.

If you trade successfully, you can withdraw money from your account using the same payment systems.

How to start investing in Twitter shares?

Investing is a science that requires from a potential investor an understanding of basic knowledge about functioning of stock market, certain regularities and processes, as well as constant learning and deepening of knowledge. If you persistently study these processes, follow market trends, and monitor the behaviour of certain companies, you will eventually learn how to analyse and predict the possible rise or fall in the value of a company's assets. This will enable you to make successful investments in the stock market and grow professionally as an investor.

The online investment platform is a powerful, innovative system which also includes a 'learning' section. Don't let the ease of access to the investment world mislead you into thinking that investing is easy. In fact, it is a risky activity, with the wrong approach and 'blind' trading you run the risk of significant financial losses. Therefore, we strongly recommend you to study all educational theoretical materials available on the platform, as well as to deepen your knowledge with the help of other educational sources. Luckily, these days the Internet is overflowing with information, training programs, courses, etc. about investments.

Practice keeping up to date with the news of the company you are investing in. This could be information about possible roll-outs or, conversely, the closure of operations, expansion of products or services, news about the resale or partial change of co-owners of the company, etc. Listen to the experts.

Remember that even if a company is successful, external factors also affect the value of its shares; these include political situation in the country and in the world at large, economic news as well as news that might seem unrelated to the investment, such as man-made disasters or natural catastrophes.

Remember that the risk you take when investing in stocks online depends largely on your in-depth knowledge, your understanding of the stock market, your ability to analyse thoroughly, as well as your experience and even your intuition.

As for Twitter shares, analysts predict that their value will continue to rise, so buying them in the medium to long term will not only solve the problem of protecting your savings from inflation, but will also generate substantial profits. Now might be a good time to buy shares.

Related pages

Buy Volkswagen shares in Hong Kong