Characteristics of the currency pair USD/JPY

USD stands for U.S. dollar and is widely used around the world for trading. Buying and selling of goods, foreign currencies and funds is mainly done using USD/JPY. The U.S. dollar is highly valued as a result of its powerful global appeal. The reason is that USD/JPY has many significant factors that make it a popular choice for many. One of the major factors is that USD/JPY is traded almost exclusively through major financial institutions, which greatly increases the dollar's purchasing power.

USD/JPY is the main currency pair in Japan, where the main interest rate is set against the dollar and the Japanese yen. In other words, the interest rate is determined by economic conditions in Japan and that is why the interest rate set by the Federal Reserve is usually higher for the Japanese Yen than for the U.S. Dollar. Japan's economic and trade climate is very similar to that of the United States, which is why most Forex trading is done accordingly.

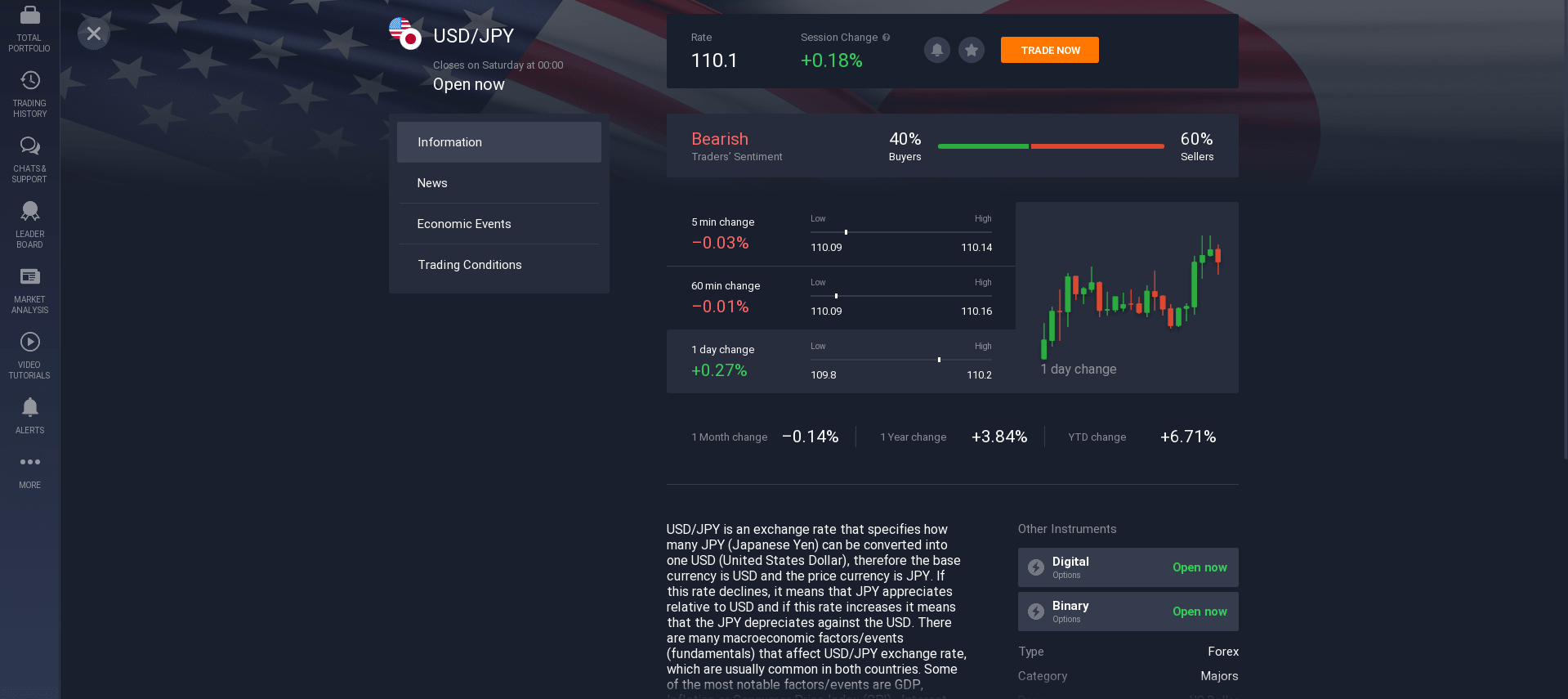

USD/JPY is the currency pair that has the highest daily turnover of any currency. This indicator tells you how many buyers and sellers are in the market, which makes this trade very liquid and profitable. USD/JPY is traded mainly in the US because of its favorable exchange rate and stability over time. The reasons for its popularity can be seen in the relatively high ratio of market liquidity, low spreads and strong economic indicators. The stability of the USD/JPY exchange rate over the past few years is largely responsible for its consistently high performance in the market.

The daily turnover of USD/JPY is about $53.6 billion, which is the highest among all major pairs. USD/JPY trading has little impact on the U.S. economy and helps it to maintain its position as the world's leading currency. USD/JPY traded very subdued throughout the recent global financial crisis, but over the past few weeks has registered significant growth due to the U.S. government's decision to raise the benchmark interest rates.

There are many reasons for the higher exchange rate of USD/JPY. One major reason is that Japan does not allow gold trading and therefore the purchase of gold by Japanese residents is limited. Another reason is that the Japanese economy is heavily dependent on oil and gas exports and that gross domestic product (GDP) per unit of output is much lower than in China. In other words, the Japanese exchange rate is largely based on the export sector and the fact that the country exports most of its goods and services and has a large number of small businesses that rely on the foreign exchange market for their livelihood. The weakness of the Japanese economy has been one of the main reasons for the strengthening of the USD/JPY exchange rate, which is seen as an investment haven.

What are currency pairs?

Currency pairs are two words that are used to refer to the world's money pairs. These are the currencies you hear about when you hear the term "exchange rate quotes. These pairs are usually the world's major currencies, and they must be recognized as such in order for exchange rate quotes to be accurate. The names of the currencies may be the same, but they are not considered interchangeable. The names may differ because of the different symbols used to refer to them in the international marketplace.

The best currency pairs to trade are those that are able to follow a given trend over a long period of time. These are the currencies that you trade back and forth with your broker to make a profit.

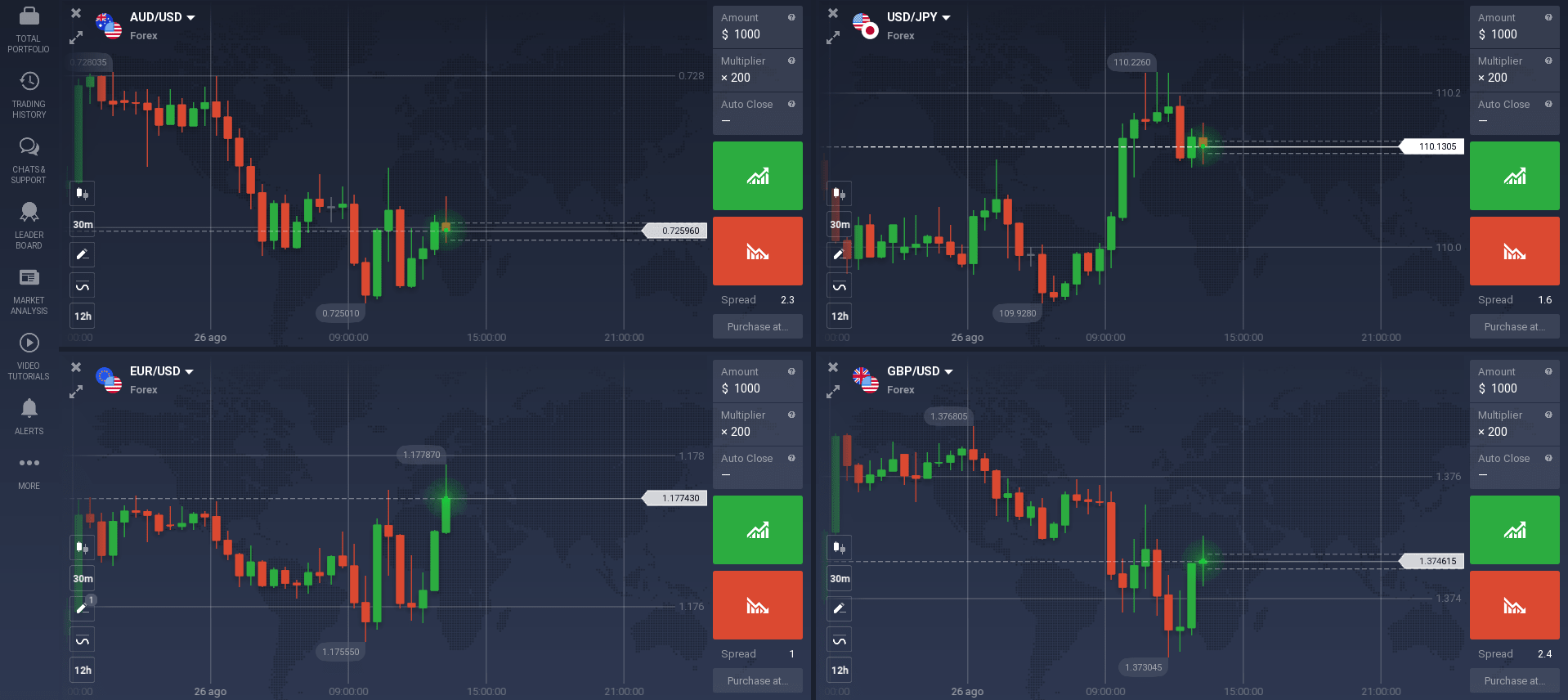

USD/JPY is the most widely traded pair on the world market today. In this case, you need to take advantage of different markets to have an edge. Most traders do not like to trade more than one currency pair at a time. You will need to pay attention to the price charts which will show you the strength and weakness of the currencies. The strength of a currency indicates how strong the national economy is, while weakness indicates that the economy may be in decline.

Traders usually turn to the stock market to make their first trades. It is true that the stock market is a widely traded commodity, and there is some risk in beginning to trade in it, as in any other market. For the most part, however, small investors who don't want to take much risk make up a much larger portion of the stock market than do the futures or currency markets.

Therefore, the market offers a unique opportunity for those who prefer to trade small volumes rather than engage in large speculative transactions in the stock market. For those investors who are interested in trading only one currency pair, the smaller transaction size makes it easier to build a track record, learn about market conditions and develop the best strategies to maximize profits. You can learn a lot about developing winning strategies by studying the history of major traders who have successfully traded the USD/JPY currency pair.

Currency Prices

Let's look at some examples of the relationship between currency prices and key global currencies. The Japanese yen is one of the most important international currencies, especially when compared to the U.S. dollar. When the Japanese yen weakens against the U.S. dollar, it has a significant impact on the Japanese economy as imports and exports suffer.

There are several factors that affect currency prices. One of them is the national currency pair. Each country's currency is priced according to the performance of its national economy. This means that even if the Japanese yen weakens against the U.S. dollar, Japan's economy is still performing strongly. On the other hand, when oil prices skyrocket, oil will become more expensive in the U.S., causing the price of the U.S. dollar to rise.

In market trading, the favorable price is determined by supply and demand in the open market. This means that the supply and demand for a particular currency is sufficient to maintain a stable floating exchange rate between two countries. A country with more domestic consumers than exports is likely to experience a steady increase in the value of its currency. On the other hand, if the competition is too great, the demand for that currency decreases.

The most important factor affecting currency risk is a country's political and economic conditions. While political uncertainty does not directly affect supply and demand factors, it indirectly affects the floating exchange rate. If a country's government is unable to obtain foreign assets or incurs high costs, there is a risk that these resources will become difficult to obtain. There is also a risk that the supply of some currencies will exceed demand.

To determine floating and basic spot exchange rates between two different countries, an international online broker can provide valuable advice. Such advice is based on a fundamental analysis of the financial markets of both countries as well as the general characteristics of the local economy. In order to determine the possible relationship between the two currencies, it is necessary to examine the nature of the domestic currency system as well as the political framework of the country in question. By understanding how the central bank of one country controls the national money supply and foreign trade, one can better understand the potential risks associated with the exchange rate.

Trading Sessions

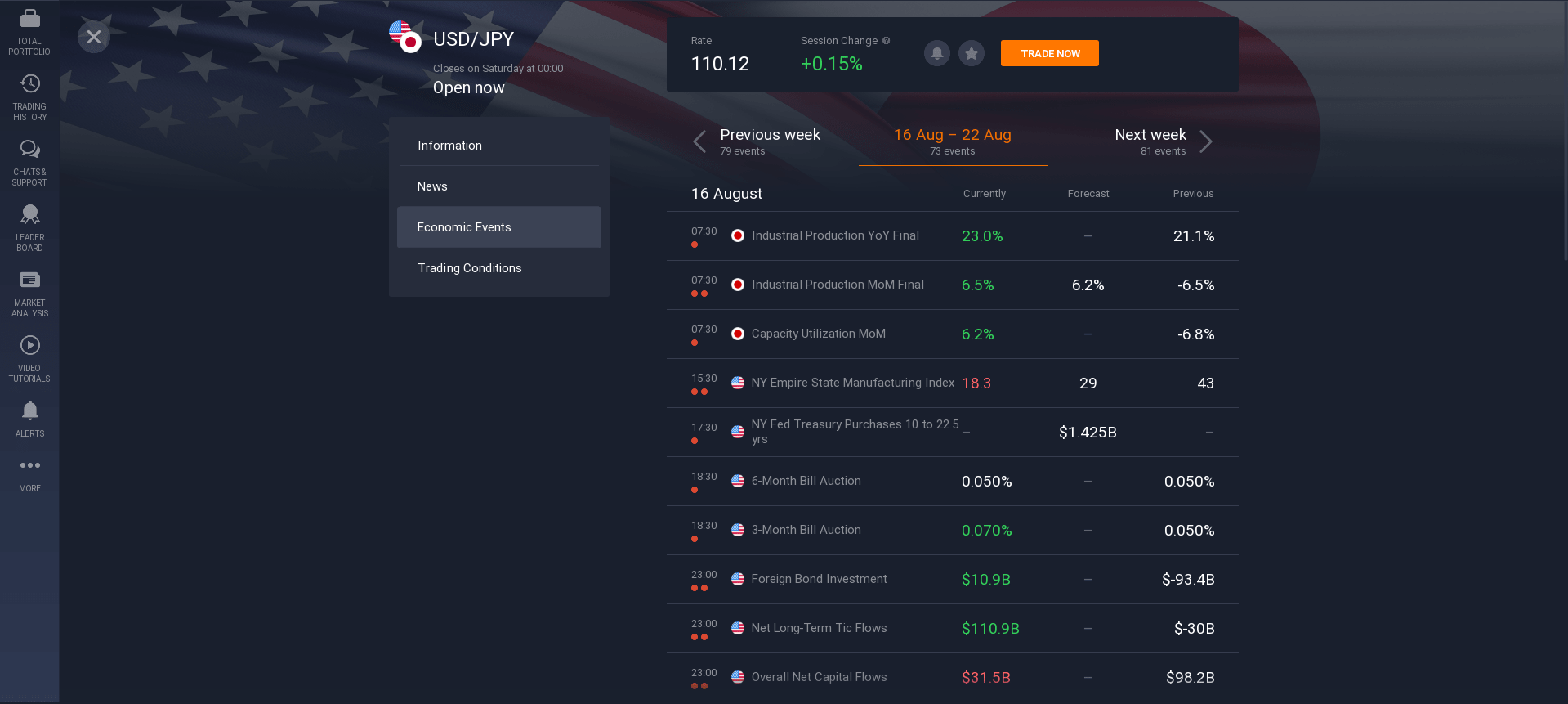

Market trading sessions are commonly used to determine market sentiment and currency direction. This information is used by traders to make trades on financial exchanges. Most professional traders use trading sessions to determine which way the markets will move, and they can stay open for hours or even days to see if the market will go one way or the other.

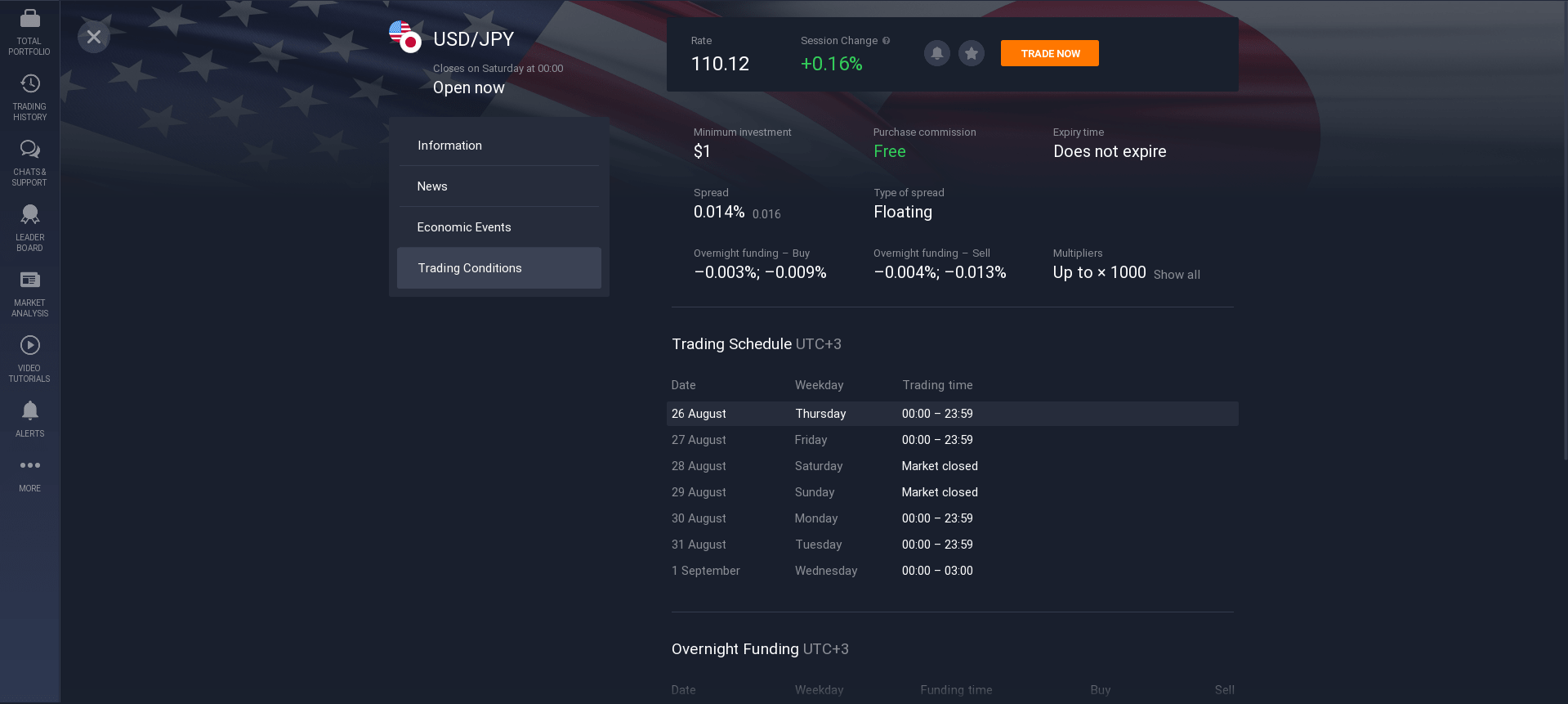

Although most trading sessions last several hours, they can last anywhere from one hour to four hours. Many of the major currency pairs have their own trading hours, as well as several regional hours outside of these major trading hours. Most of the time, prices tend to move quickly, but there are some major currency pairs that can have a much longer range during trading sessions.

The U.S. markets are busiest during these hours. This is due to the number of Americans who travel back and forth from Canada to the U.S. on a daily basis. Businessmen and other people who need U.S. dollars use U.S. currency during their travels. The large number of people using U.S. money results in very volatile exchange rates between U.S. dollars and Canadian dollars. With less activity, the Canadian dollar can easily overtake the U.S. dollar. This gives the trader an opportunity to profit from the volatility of these two currencies.

European markets tend to be calmer than the U.S. and Canadian markets during most trading sessions. This is due to the size and level of trading of the euro against the U.S. dollar. The size of the European economy and the level of exchange rates of the euro and other currencies make them less susceptible to large fluctuations during the time period they represent. A trading session may end before the expiration of a specified period of time, or it may continue until the expiration of a specified period of time.

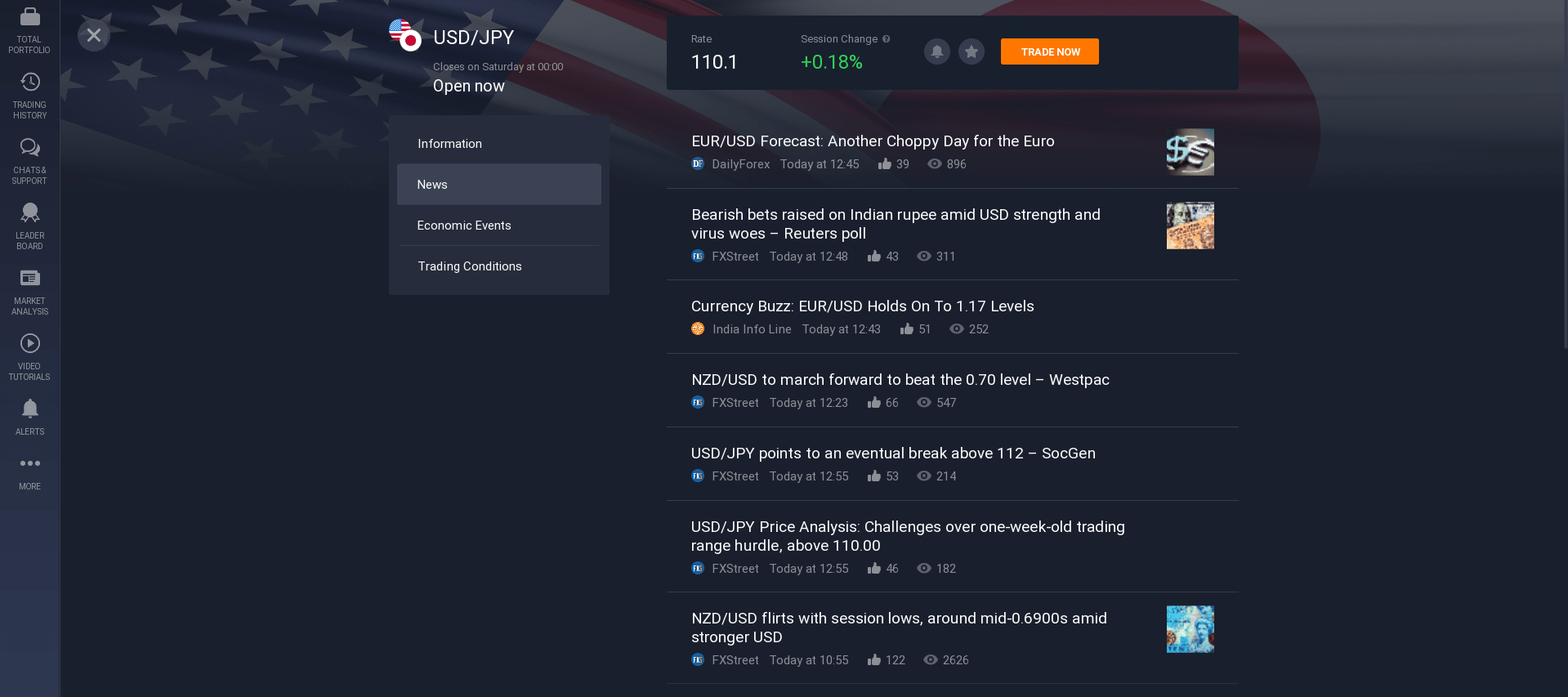

The most common way to trade online, which almost anyone can take advantage of, is to use a software platform that works online. The platform is designed to analyze real-time data, such as news, real-time quotes from financial services companies, and real-time global quotes. Based on this information, the platform determines the best time to open or close a trade. By analyzing this information, which comes in on a daily basis, the platform gives the most suitable and profitable time for a trader to trade.

Trading Timeframes

Market trading timeframes, also known as daily, hourly and minute timeframes, are often used to indicate the type of trading activity taking place in the market. These time frames help traders determine when is the best time to buy, sell or trade and give them a general guide for determining entry and exit points. It can be difficult to determine which type of timeframe to use, but all types have their advantages and disadvantages. It is advisable to determine which timeframe best suits your style before learning the timeframes themselves.

You will be able to see the timeframe designations on your trading platform:

- M1 - 1 minute;

- M5 - 5 minutes;

- M15 - 15 minutes;

- M30 - 30 minutes;

- H1 - 1 hour;

- H4 - 4 hours;

- D1 - 1 day;

- W1 - 1 week;

- MN - 1 month.

Try trading with all timeframes and determine which one suits you best.

Trading Strategy

A market trading strategy basically defines the trading strategy that a trader uses to decide when to buy or sell a particular currency pair. There are various strategies that traders can use, such as fundamental or technical analysis. It is important to learn the basic concepts of trading in the market before trying your hand in this field. This way, you will know how to make a profitable move and what not to do when trading in the currency market. There are different strategies that can be used depending on what kind of trader you are.

One of the most common strategies for a trader is the short-term swing trading strategy. This type of trading involves holding a position for only a few minutes or seconds. With this strategy, you will not need to make large trades from time to time. It is more suitable for people who have a small capital and would like to learn how to trade stocks.

A long term swing trader usually follows a simple pattern that includes an uptrend, a downtrend, and a sideways trend. For example, if a trader sees that an uptrend will continue for more than a month, he will try to make a long-term trade that will have a high chance of making a higher profit. On the other hand, if a trader sees that a downtrend will continue for at least a month, he will be inclined to make a short-term trade that will have a low chance of making a higher profit.

Another trading strategy that is used by most traders is the carry trade strategy. With this strategy, traders who are new to the business try to get hold of a short-term carry trade. As soon as the uptrend begins to weaken, traders decide to get out of the trade before the price drops too much. They do this in order to avoid facing heavy losses. In addition, they hope that the long-term uptrend will continue.

There is another form of trading, called a multi-level position strategy. This strategy does not adhere to a single-level trading strategy, but deals with trades at different levels of the market. Traders do this so that profitable trades can be easily identified. The multi-level position method uses stochastic oscillators or volume indicators to identify trading opportunities.

One of the simplest time-trading strategies is called the trend following strategy. A trend following strategy consists of long-term trading in hopes of finding a trend breakout at a certain level. Once the trend breaks, traders sell their long positions and buy those at the low point. Usually the price at the low point is determined by the continuation of the trend. Traders use technical and fundamental analysis to decide when it is appropriate to enter a long position.

Day trading strategies are becoming popular among investors. Some investors prefer day trading as a part-time strategy, while others use it as their primary source of income. To be successful at day trading, you must combine technical and fundamental analysis to determine price movements. You must also look for opportunities in the market and place orders to be able to profit from prices that fall.

Features of the USD/JPY currency pair

The U.S. dollar and the Japanese yen are a widely traded and hedged currency pair. This makes it suitable for trading in the market. The two currencies are highly correlated, which means that changes in one often correlate with changes in the other. Some of the frequently traded currency pairs with the US dollar are USD/CAD, USD/GBP, USD/CHF and the most popular Japanese yen/US dollar pair.

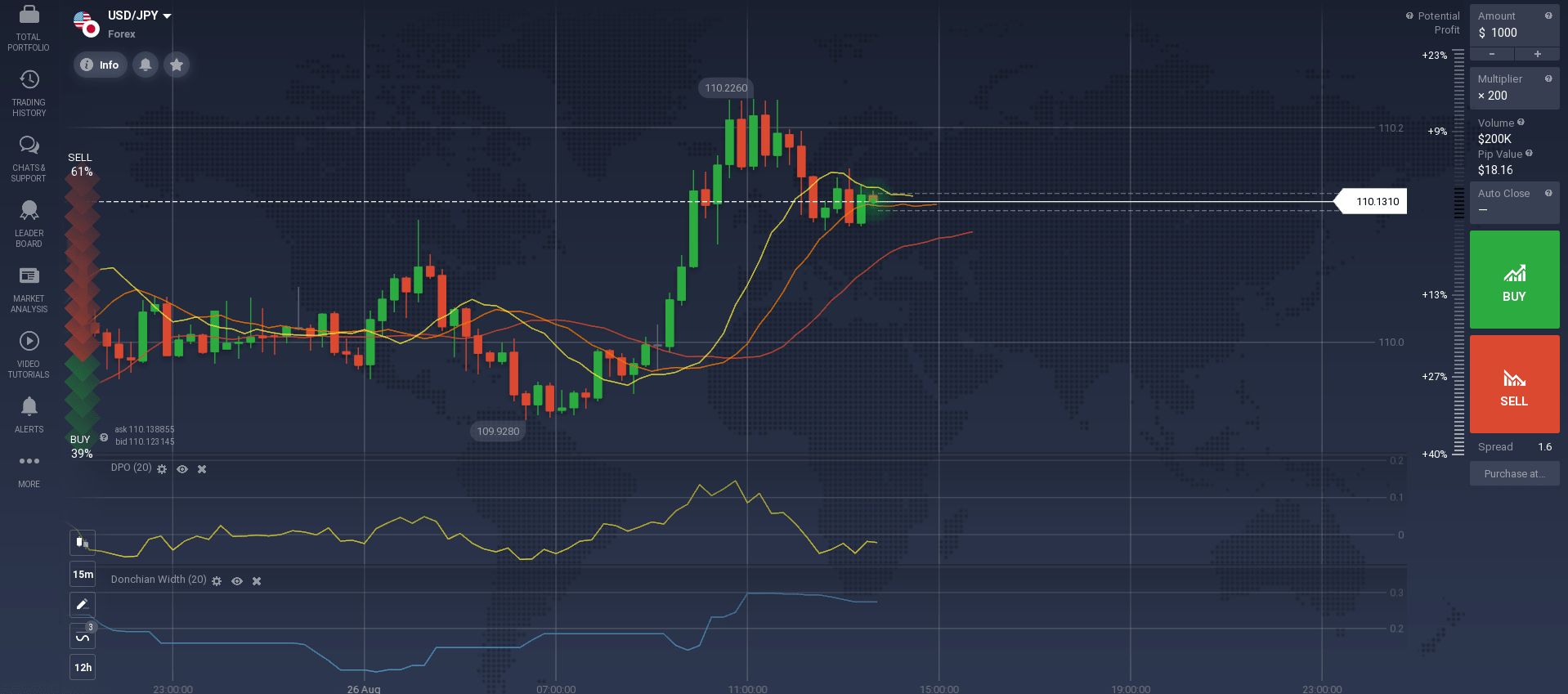

Historical minimum and maximum values on this chart are very important to consider when analyzing this pair. The historical low can be considered as a low point of the trend, and the historical high - as a high point of this trend. In the past, the US dollar has been able to hold longer trend lines than the Japanese yen. These long trend lines are usually narrow in shape with little variation. This form of price movement can be used to find support and resistance levels in the currency pair. Most technical traders will try to target the support level, which is usually indicated by the longer length on the chart.

Current market depth is another characteristic to consider when trading this pair. Trading using price drivers is best done with this form of chart as price tends to follow the uptrend line more clearly.

Finally, you can consider the historical volatility of the pair. Volatility tends to increase as the time interval between the closing price and the opening price increases. This form of price movement tends to rise or fall. Trading using the time component of the price can give us a high level of accuracy when entering the market. Traders may want to consider the time period during which the best market entries have occurred in the past.

There are many other factors that can be considered when technically analyzing the USD/JPY pair. One of the most important factors is the trading format. USD/JPY markets are more like traditional markets, where sellers usually compensate for their losses by increasing their bets. However, there is no such mechanism in market trading, and buyers often take advantage of this feature to take advantage of short-term price movements.

Traders may want to analyze the psychology of the market when determining which currency pair to trade. The Japanese currency tends to be quite predictable, which provides a good platform for day traders. Traders can observe daily price changes and time periods for the best entries. However, there is also the risk of opposition from market makers who may decide to interfere with the exchange.

The U.S. dollar and the Japanese yen have many unique characteristics, but both are widely used as world currencies. In some financial markets, these pairs are used daily for direct trading. Others trade on a weekly or monthly basis. The major trading pairs share several similarities but are unique in their own way.

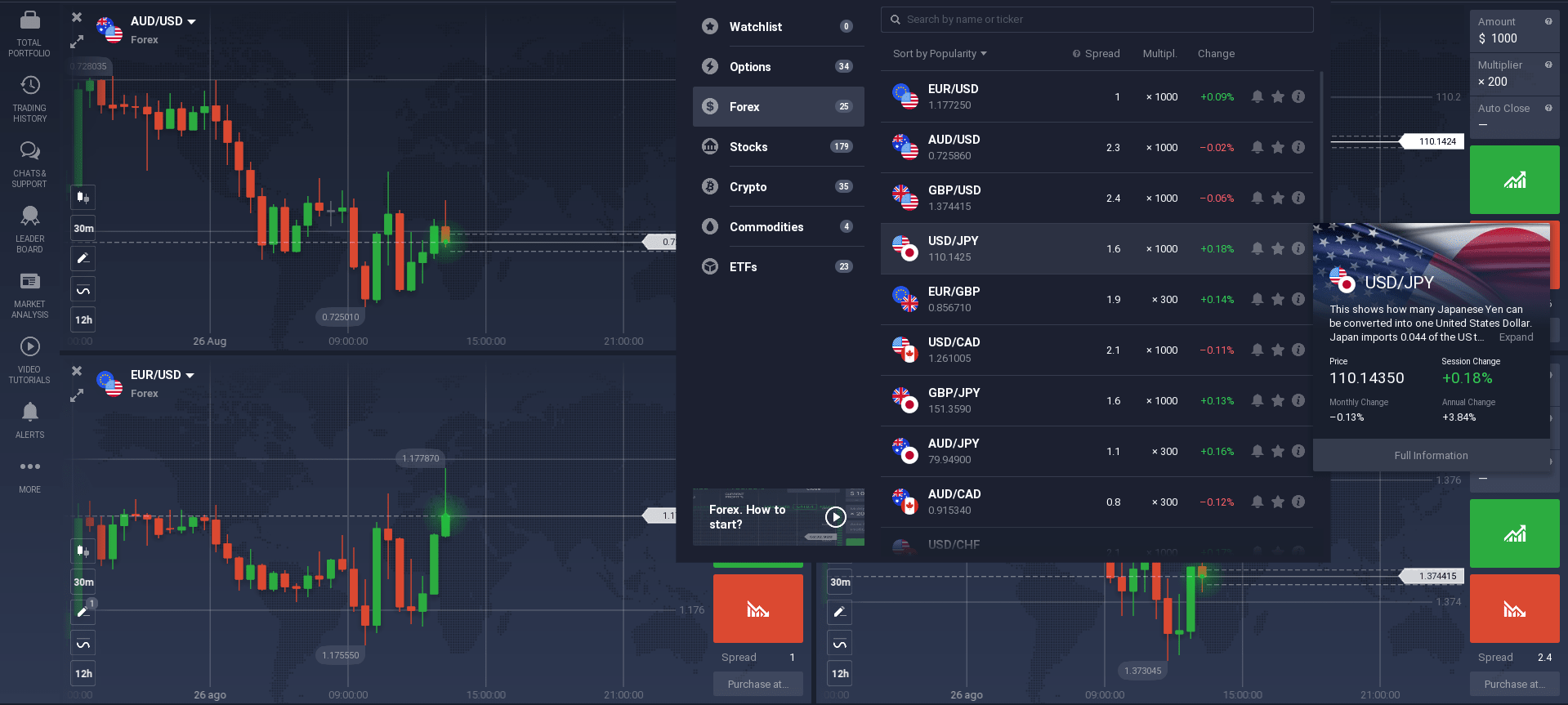

How to start trading USDJPY in Hong Kong

One of the easiest ways to open an account in Hong Kong is to register on a trading platform by contacting an online broker who specializes in foreign exchange trading. A good broker will give you all the advice you need and show you how to open a trading account. It is always preferable to contact an online broker with extensive experience so you can be sure that you will get the best results.

If you are ready to start trading foreign currencies, you should make sure that you use a broker that has your best interests in mind. The trading platform should provide you with valuable advice based on your knowledge of the foreign exchange market. It should clearly present you with the essence of transactions and how they work. You should also be aware of the risks involved and limit your options yourself in order to minimize them.

Before you decide and open an account, you should learn everything you can about the foreign exchange market and the rules associated with it. There are many quality trading platforms with a demo account service that can help you understand the basics of trading. This feature will help you, in learning the charts and teach you how to manage your money. Once you know all this basic information, you will be able to successfully trade foreign exchange on a daily basis.

There is one simple fact that you should understand about the currency markets and that is that there is risk. You cannot fund an account blindly, hoping that you will always be making money. Currency exchange is a business, and you will always face ups and downs. It's very easy to make a huge investment and lose everything. However, you can learn how to minimize your risks and eventually make a profit.

Related pages

Characteristics of the currency pair GBPUSD