Basic сryptocurrency trading strategies

Knowing the strategy for trading crypto-currencies, which is essential in this activity, especially for thousands of Hong Kongers who enter digital finance every day. Hong Kong is the 2nd country in the region with the greatest number of users, while its capital is among the 10 cities that trade most in the cryptocurrency market. Many experts consider that "a new financial system has emerged and is 100% digital". Users are not only using them as a store of value, they are also marketing and investing through the available alternatives.

A trading strategy is needed to achieve profits and keep them in such a dynamic environment, in that sense, we show you an introduction to the learning of this exciting activity.

What is crypto money trading?

It is a form of online investing that allows you to receive profits (gains) on changes in value (price), in other words, traders study those price movements (up or down) in the crypto-currencies and fix an idea of what the variation would be. If this forecast (buy or sell) is correct within a specific period of time, then a profit is made which is proportional to the investment made (trading volume).

Digital commerce is a sector where fluctuations are constant (frequency of price change in a given time), this scenario offers opportunities and new options for profitability (in the short term) despite the high risk present in the activity.

On the other hand, expertise is a determining factor in achieving success. Trading requires vast knowledge related to: the technology involved, how these digital assets work as well as the analysis of operations (studying the elements that can intervene in the changes in the chart price) as well as knowing the trading platform where the activity takes place. In fact, the experience will allow you to better manage your money and protect your funds.

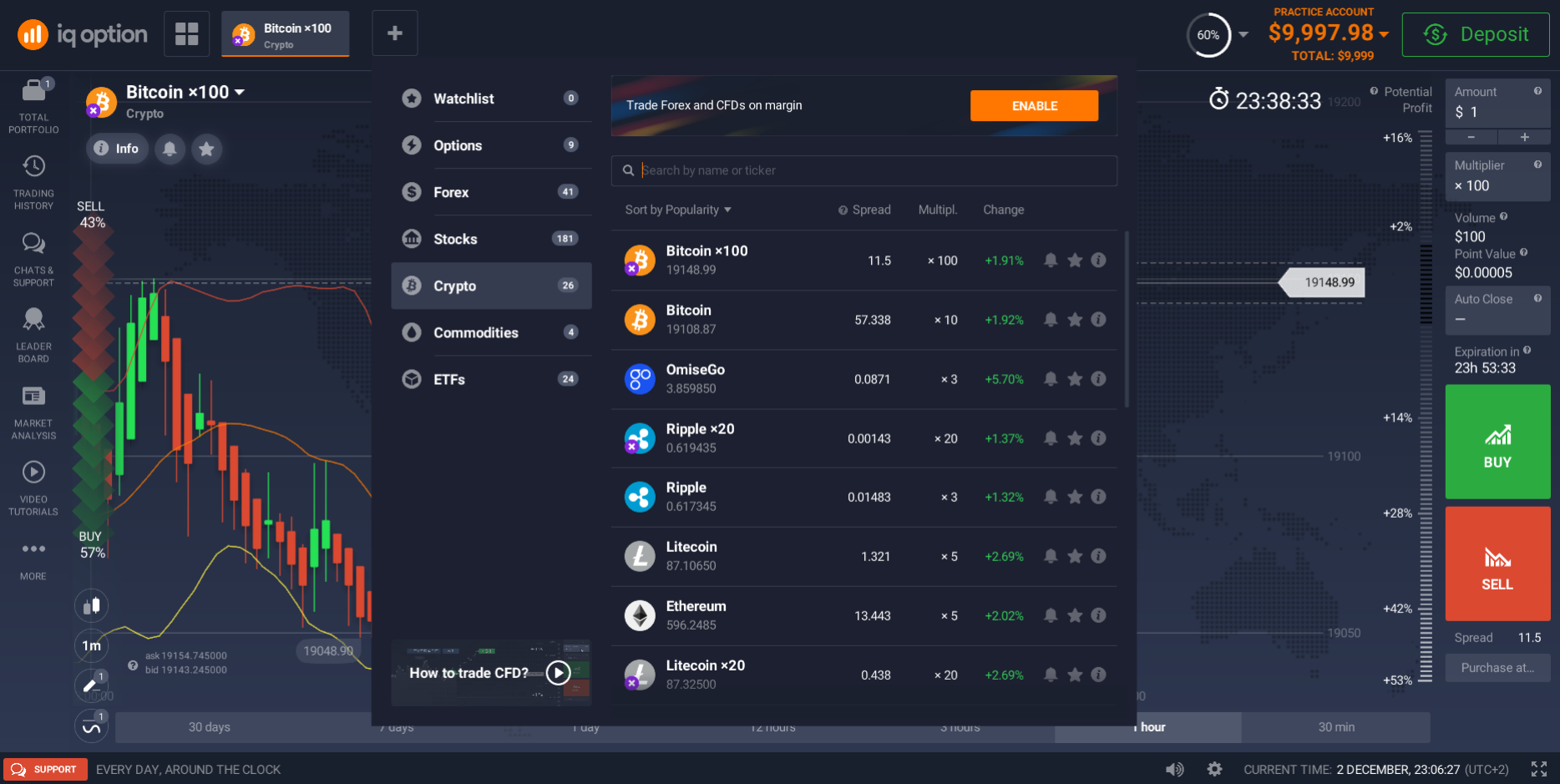

Notable cryptocurrencies

Contrary to the amount of assets that can be traded, there is a list of those that are most selected for their performance and level of trading (for buying and selling or as an investment instrument).

It is reiterated that training in this activity is essential to achieve satisfactory results. Learn about the 10 notable cryptocurrencies as part of your learning:

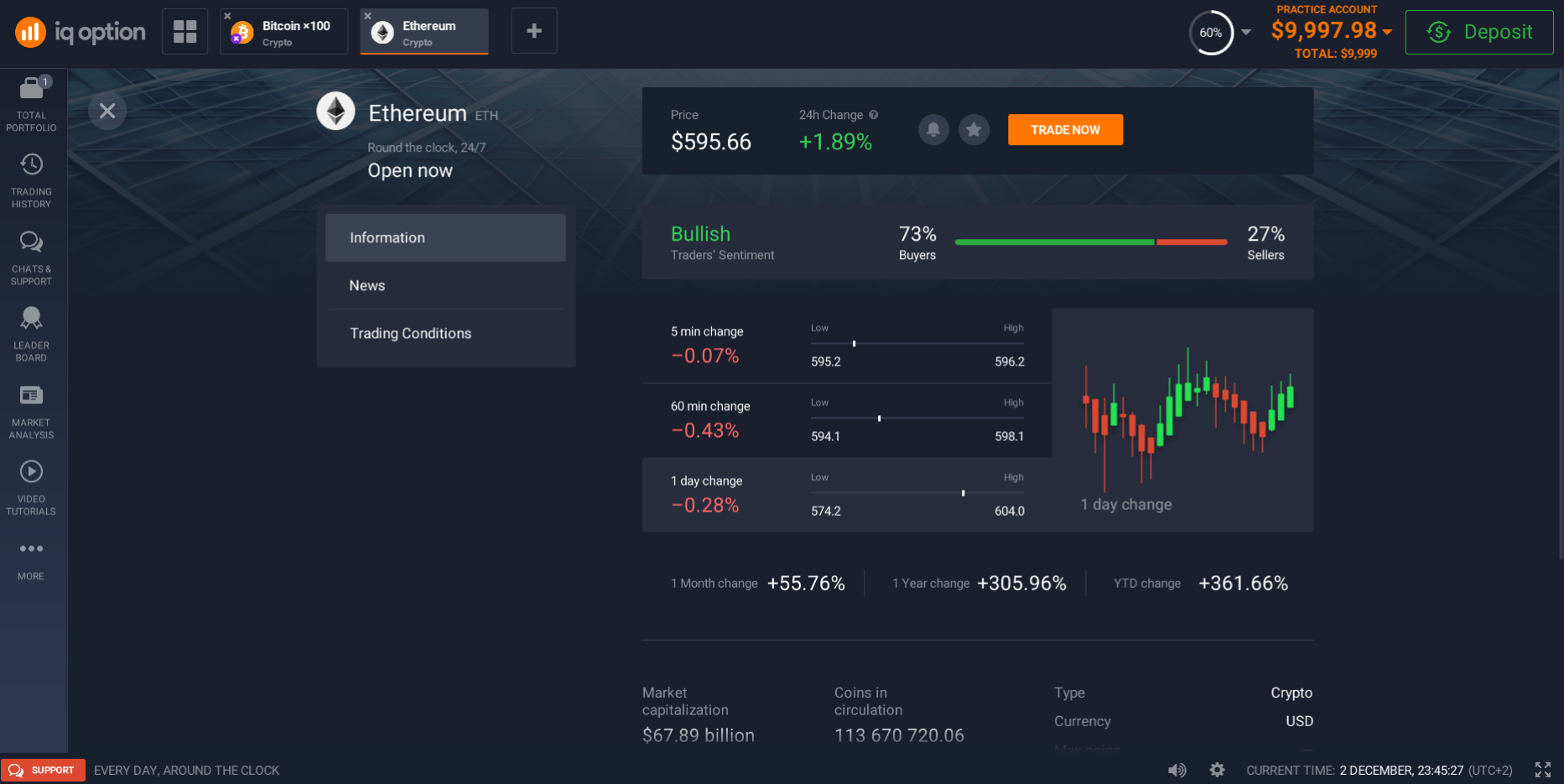

- Ether: undoubtedly the most commercialised after Bitcoin, it is operated through the decentralised Ethereum. There are indicators that show it as the most correlated cryptocurrency (it experienced the best average coefficient at the end of 2019). Currently its quotation has been promoted by the decentralized finance (DeFi), as well as the ETH 2.0 (it has important improvements).

- Litecoin: this coin has a design that is adapted to trade between people (P2P). It has technological development made in free software (based on blockchain), and also facilitates a large number of operations, although its reference is the BitCoin, it offers some particularities in its operation.

- Ripple: also known by its acronym XRP, it was launched more than 8 years ago and is recognised as one of the most traded crypts. It is generally used by banks and companies through exchanges at a lower cost (with excellent reviews for the speed of transactions compared to its competition).

- Bitcoin: is the digital currency with the highest volume of trading worldwide, in fact, it is used for various financial purposes (despite not being recognized as a legal currency): it works as a method of payment, exchange and even represents a "refuge" for millions of people (compared to instruments such as gold).

- Bitcoin Cash: it has a technological development resulting from Bitcoin, and it operates with some particularities in the decentralized network (blockchain) such as: the size of the block. Furthermore, it has been very useful as a means of payment, as well as in trade between people (exchange) and investment through online options.

- Stellar: it was developed in a "decentralised environment'' just like its competitors, it also offers its own cryptocurrency called Lumens (or by its acronym XML). It uses block-chain technology, which guarantees reliability and speeds up operations between companies, financial institutions and individuals.

- Cardano: has been designed under a scientific concept and with 3rd generation technological development. It uses its own cryptocurrency (known as ADA) and the famous "Ouroboros" algorithm. Although its launch is recent, it was positioned in the "top-ten" of this sector.

- IOTA: was established with a particular concept, by means of distributed accounting records (also known as Tangle). It allows "micro-transactions" to be carried out between IoT devices (they are communicated via the cloud, the "Internet of things"). Therefore, cheaper, faster and non-mining operations can be performed with IOTA.

- NEO: is the most developed Asian platform in blockchain technology, it can also be operated with its own digital currency and it also allows integration. NEO overcame the problems of scalability and security to facilitate operations.

- Monero: since its launch (2014) it has been known as XMR, it also uses free software on its platform and is recognised for guaranteeing high levels of security (marketing is protected by cryptography).

Analysis types for cryptocurrency trading

During the learning process, new users must gain basic knowledge and experience before investing real money. In this respect, it is important to be aware of the various elements that may be involved in the quotation. The study of these elements allows to organize a trading strategy, therefore, you will be able to make a forecast on the changes of tendency increasing the possibilities of success.

- Technical analysis: it is based on the study of information related to previous operations, which serves as a reference for the forecast of future changes. These data are represented graphically, therefore, tools known as "technical indicators" are used. These indicators allow (by means of mathematical calculations) the study of variations. In fact, some studies measure the volume of transactions and the direction they have taken in terms of prices, when compared with recent data (exercise prices) can provide an important signal.

- Fundamental analysis: this is a comprehensive study (historical and current) of the cryptocurrency to be traded. In other words, the operator analyses the different quantitative and qualitative aspects to determine possible variations in its value.

Main technical indicator list

- Moving average (MA): provides information on the average value over a given period of time. The result varies according to the changes in the price, so it is very useful to know the possible trend.

- Exponential Moving Average (EMA): although it makes a more complex calculation, it also provides relevant information. The EMA assigns a higher "weighting" to each new price and decreases exponentially as it moves backwards in time.

- Stochastic Oscillator: facilitates the prediction about the direction of the variation (either in a bear market or in a bull market), it also allows to recognize several important parameters (overbought, oversold and divergences). In addition, the user can compare the closing amount with the price fluctuation over a given period of time.

- Moving Average Convergence Divergence (MACD): this is a very practical and reliable indicator (highly valued by the operator community), allowing "tracking changes" between 2 moving averages of an asset's value. In addition, it can be used with various instruments such as CFDs and stocks.

- Bollinger Bands: belonging to the list of the most used indicators, Bollinger Bands allows to identify the usual price range for an asset. It also facilitates the study of fluctuations over time, as the band widens, volatility increases.

- Relative Strength Index (RSI): this is a commonly used indicator used to measure the speed with which a value rises or falls (also known as "price strength") by checking it over a specific time period. It is widely used because it enables accurate forecasts to be made about such changes.

- Fibonacci lines: ideal for the study of changes, it allows to determine a point of retreat when there is a sudden variation of the value (up or down). Traders use this indicator for positions with estimated reversals (with a low risk plan).

- Ichimoku Cloud: This is a complex indicator, but very useful to complement the information shown by Japanese candles (it consists of 5 graphic lines). It also facilitates the study of "momentum" and possible inclinations in value changes.

- Standard deviation: also used to forecast the value of the asset and its possible changes. The standard deviation calculates the deviations of the quoted amount from the moving average.

- Average directional index: this technical indicator (ADX) facilitates the study of changes in the value of the asset. The user can also measure the levels (or frequency) of such changes, and is therefore highly valued by operators.

Basic trading strategies for cryptocurrencies

The crypto currency trading strategy offers a secure option for your capital, as well as allowing the opportunity to make a profit. Learn about the common active trading strategies below:

- Day Trading (Intraday Trading): is one of the active strategies used par excellence in this activity, it consists of trying to obtain returns on the fluctuations when entering and leaving positions on the same day. In addition, additional fees for trading overnight are avoided (you will need to know the trading times).

- Trading positions: this is a strategic plan considered to be long term (more than 1 day), in which a study is used of the details and different characteristics of the asset. Although intraday movements are not taken into account, it represents a lower risk with fewer open positions. You can also use the following orders: sell limit and buy limit, they will help you with the execution according to a set value (according to the study carried out).

- Swing Trading: is used for terms of up to 1 month, however it offers the possibility of obtaining returns on the variations of the digital asset during the advance of the slope (up or down). It is very common that some additional signals are adopted to improve the study. Although stop loss is used, you can also use orders such as: sell stop and buy stop which will only be carried out when the asset reaches a certain price.

- Scalping: is known as a plan that is executed in seconds (short term trading), therefore the trader maintains a constant activity (entering and exiting during business hours) and makes profits for a low amount. It is considered very favourable when used with assets that suffer high fluctuation in value (such as crypto-currencies). To improve the effectiveness of this plan, you can use the different types of orders available, such as: sell order and buy order, depending on the market situation.

There is also the passive investment strategy (long term trading) where a high level of activity is not required:

- Buy and insure: aims to buy the asset, but is maintained over a long period (regardless of fluctuations). It is a trading plan based on fundamental analysis.

Creation of a trading strategy for cryptocurrencies

An effective business plan must include technical aspects that allow for increased success during the trading day, as well as the use of options that secure capital. The sector is characterised by a high level of inconsistency, in that sense the design of the plan will have to be balanced (increase opportunities and keep a large part of the funds safe).

FAQ:

How do you create a cryptocurrency trading strategy?

Each person establishes different objectives, therefore, it is recommended that you personalise and adapt the plan according to your criteria. To achieve this, you should document the types of studies to create a strategic plan (experienced traders can use a combination of the available indicators).

Once you assimilate the information, you can put it into practice on a demo account (it is completely free), it allows you to gain experience through fictitious trades (through hits and misses). Although there is no "perfect plan" where you get 100% return, you can get enough experience to improve trading performance.

What is the best strategy for encryption trading?

You must meet expectations, get an acceptable hit rate while keeping the funds secure. Furthermore, the study of each digital currency is different because they have particular functions and characteristics. At this point, experience has a "starring role" and will allow you to be more determined when making decisions, as well as the type of active strategy according to variations in the spot price during the day.

What percentage of the deposit can I risk?

Caution is vital in this activity, so you can risk up to 1% of your total capital. In other words, for every $1,000 you have to deposit you can invest up to $10, securing the bulk of the funds (in the event of a loss, you risk only a portion). You can also use security options that allow you to protect your money, known as: stop loss, you can set a limit depending on the fluctuations that occur.

What size lot should I trade?

It is recommended (during the training stage) that novice traders trade with "microlots" (0.01 Lot). Dividends and losses correspond to the size (or volume) of the position, however, if you use leverage you should exercise caution as this increases the result in both cases. Once you are more experienced you can increase the size of your trades but always with organised tactics and good financial risk management.

How do you determine the objective of the measurement (potential profit)?

It is a basic aspect considered by all operators, the risk/profit ratio allows the development of a safer day for your capital. This ratio is based on the following calculation: divide the amount you are willing to lose by the amount of profit considered when closing the position. The recommended ratio should not be less than 1:1, however, you can also use tools such as: take profit, which helps you to obtain the profit if changes occur in the expected direction.

Related pages