Commodities trading platform in Hong Kong

Trading platform capabilities for trade commodities in Hong Kong

Commodity exchanges appeared much earlier than stock exchanges. The primary exchange was the usual market, where some goods were exchanged for others, and a little later, with the advent of money, goods were also sold. As now on the stock exchange, so in ancient times it was the market that determined the current value of goods, if there were few buyers for the goods, its price fell, and vice versa. Now on the commodity exchange, supply and demand determine the value of traded goods, if there are many sellers in the market, the price falls, since everyone wants to sell the goods faster. Along with currency pairs and shares of large companies, binary options traders actively use such an asset as commodities.

A Commodity Exchange is a platform where you can make a deal by buying and selling certain goods. In most cases, the object of sale and purchase in such a market is not a real product, but a futures contract.

Futures is a promissory note that obliges two parties to complete a transaction at a predetermined price.

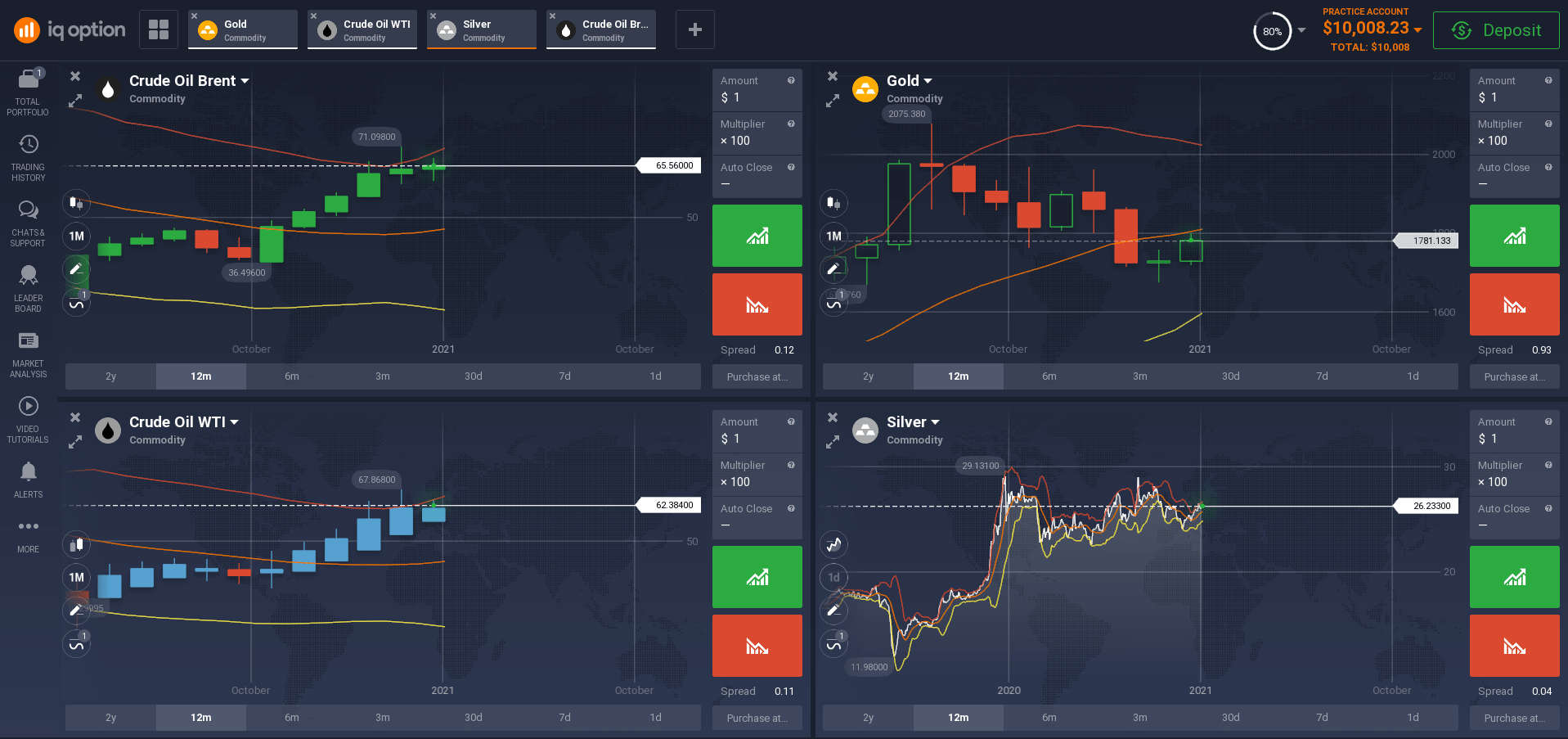

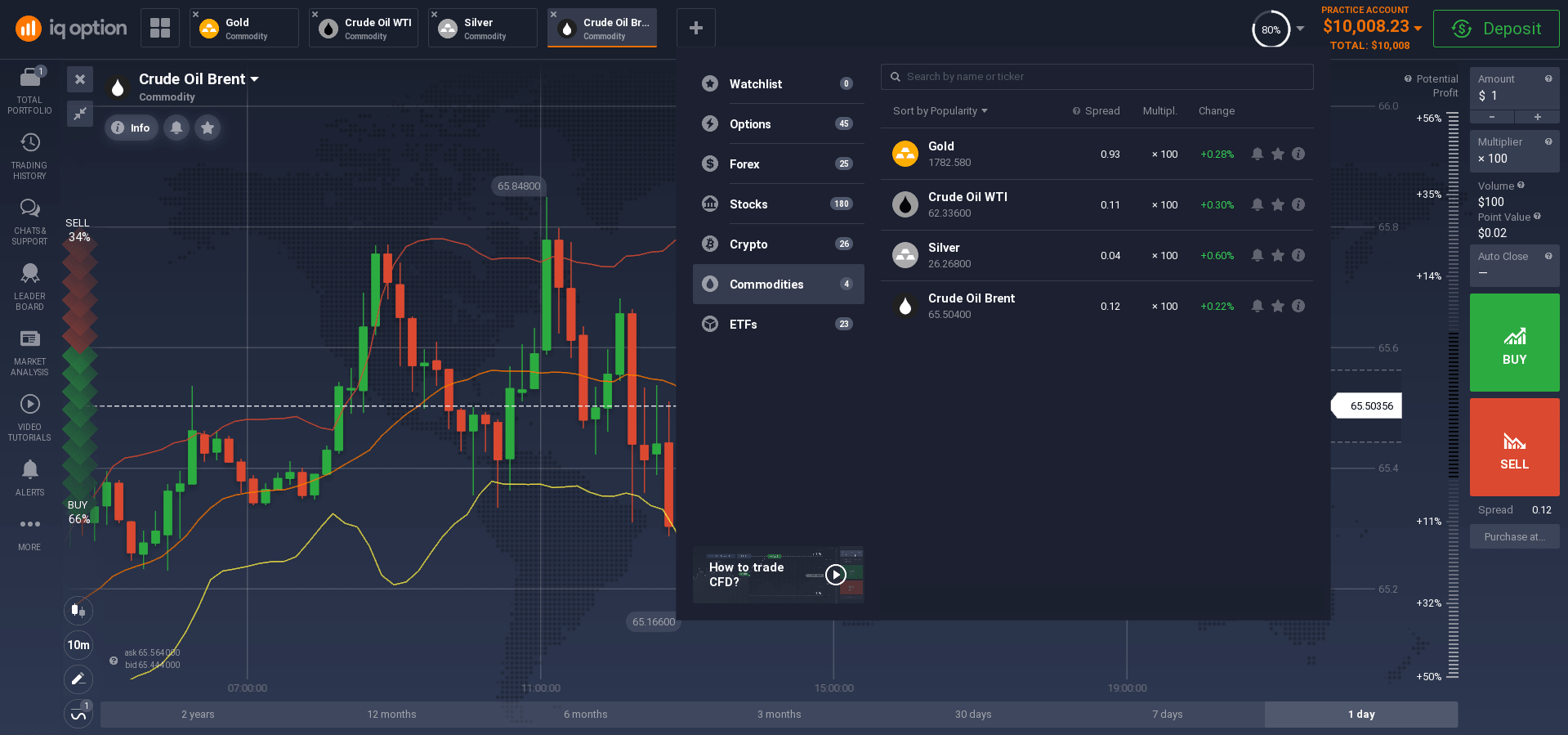

The capabilities of the commodities trading platform in Hong Kong and elsewhere are impressive. They offer handy tools ranging from training to trading account and various indicators. The features it offers include RSI, MACD ADX, moving average, etc.

The trading platform usually includes a number of charting tools such as the following. Bar charting tool, candle charting tool, point and figure charting tool, Japanese candlestick charting tool, RSI charting tool. There are additional kinds of charting tools that may be available, such as a real-time data analysis tool. On our platform, you can customize the parameters to suit your needs, for more convenient use.

The key indicators for trading commodities that are quite popular are the Moving Average Convergence Divergence or MACD. MACD uses moving averages to indicate market leadership. One of the most commonly used tools for this is the RSI, or Relative Strength Indicator. Oscillators are another popular indicator. These indices are able to provide traders with the additional information they need to make the right trading decisions.

Our commodities trading platform is reliable and well established. We offer various guarantees to our own customers. They come, for example, in the form of 24/7 customer service and learning opportunities through video tutorials posted on our website.

The best platforms are those that, like us, offer trading signals as well as market news that are reliable and relevant to your trading requirements. The very best trading platforms assure their clients that they can exchange goods in Hong Kong without any difficulty.

When it comes to making a decision, it is very important to look at the amount of money that you are willing to invest. There are some platforms that offer free trial memberships, for example we have a demo account.

Remember that even the best platforms fail to provide all the functionality you need. You will still need to have knowledge to control the trading process. These are critical aspects of managing a commodity trade. If you are new to trading, then it might be wise to read more information on how best to trade goods online, or talk to an expert who can help you. Remember that learning to trade in commodities can take some time and effort, but it all pays off once you start making money!

Types of commodities

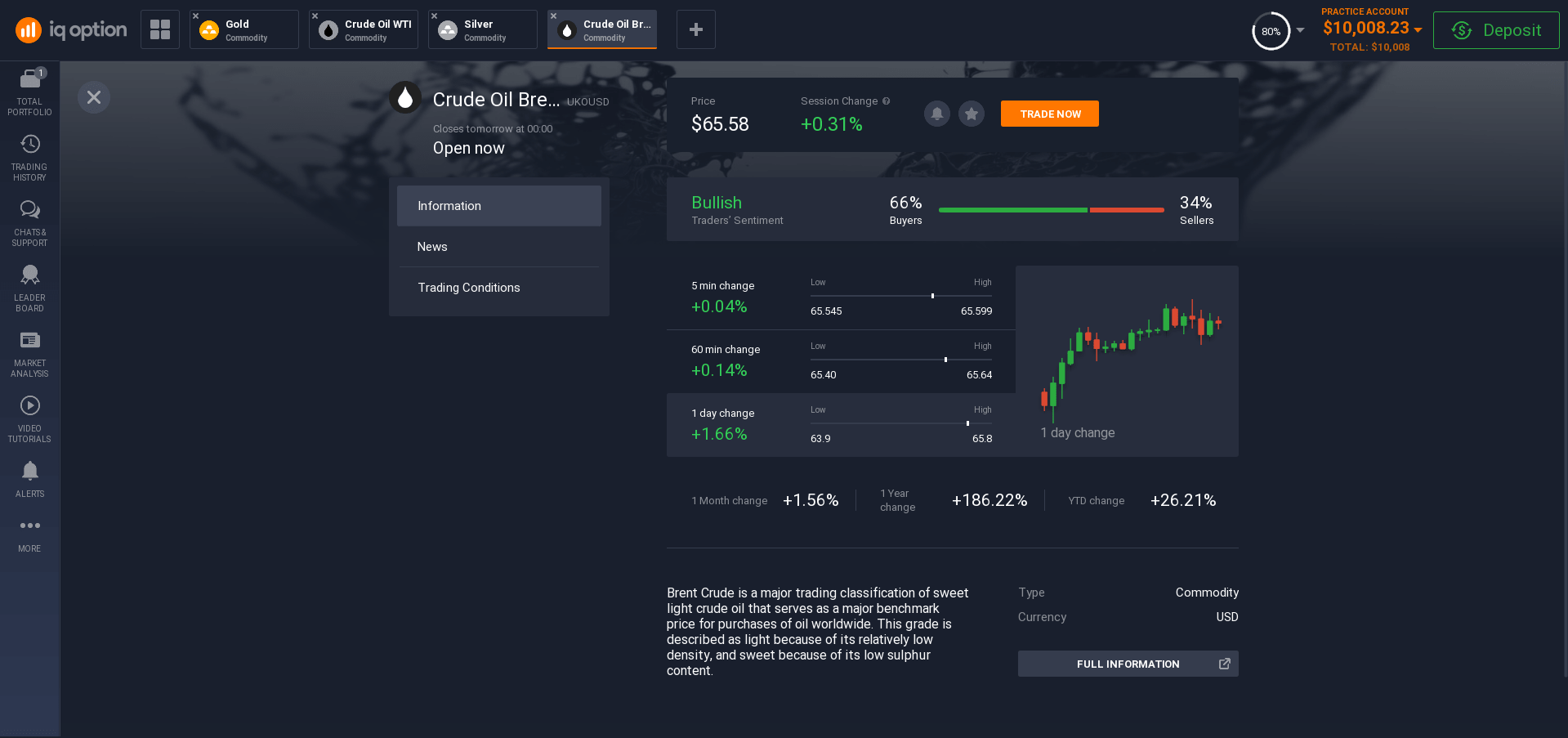

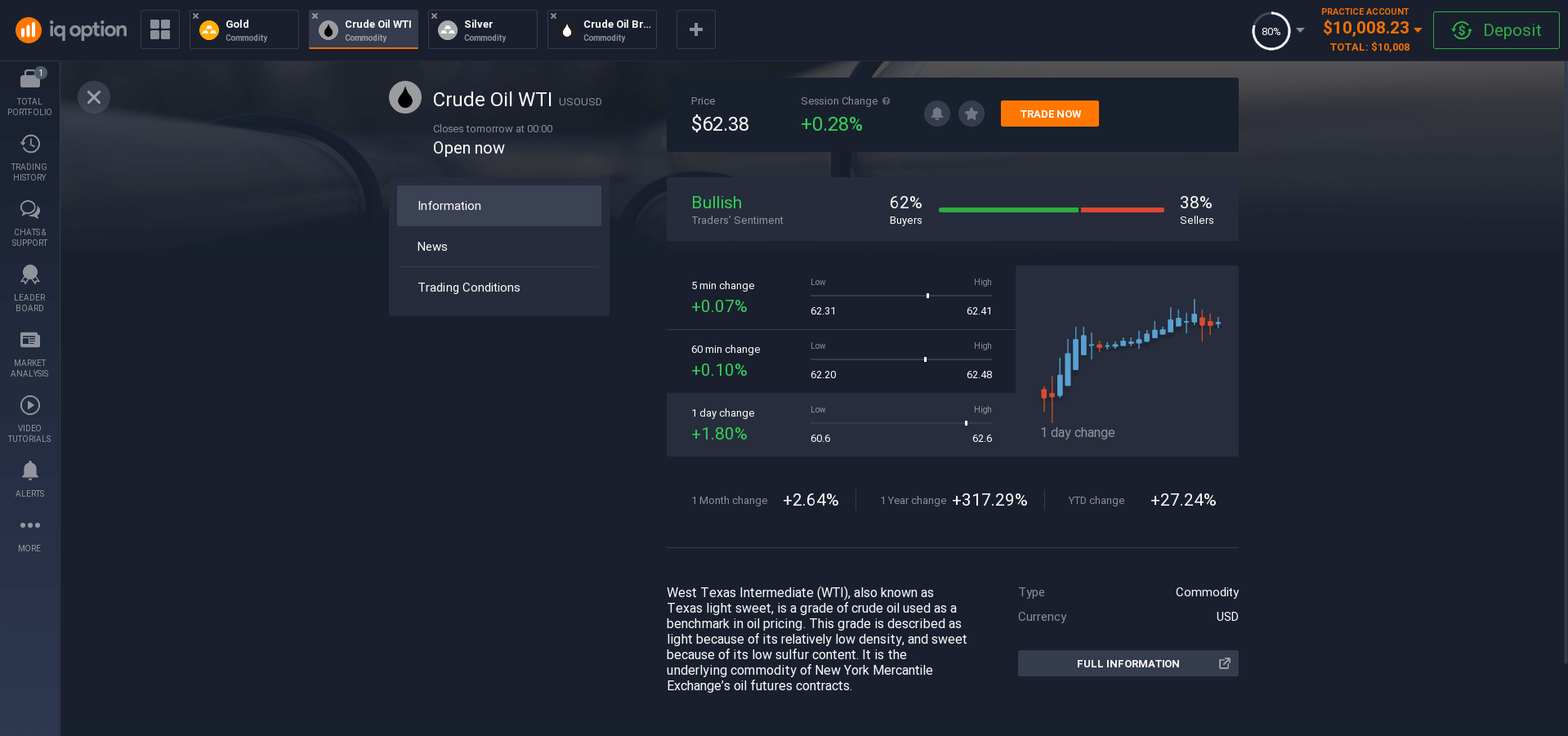

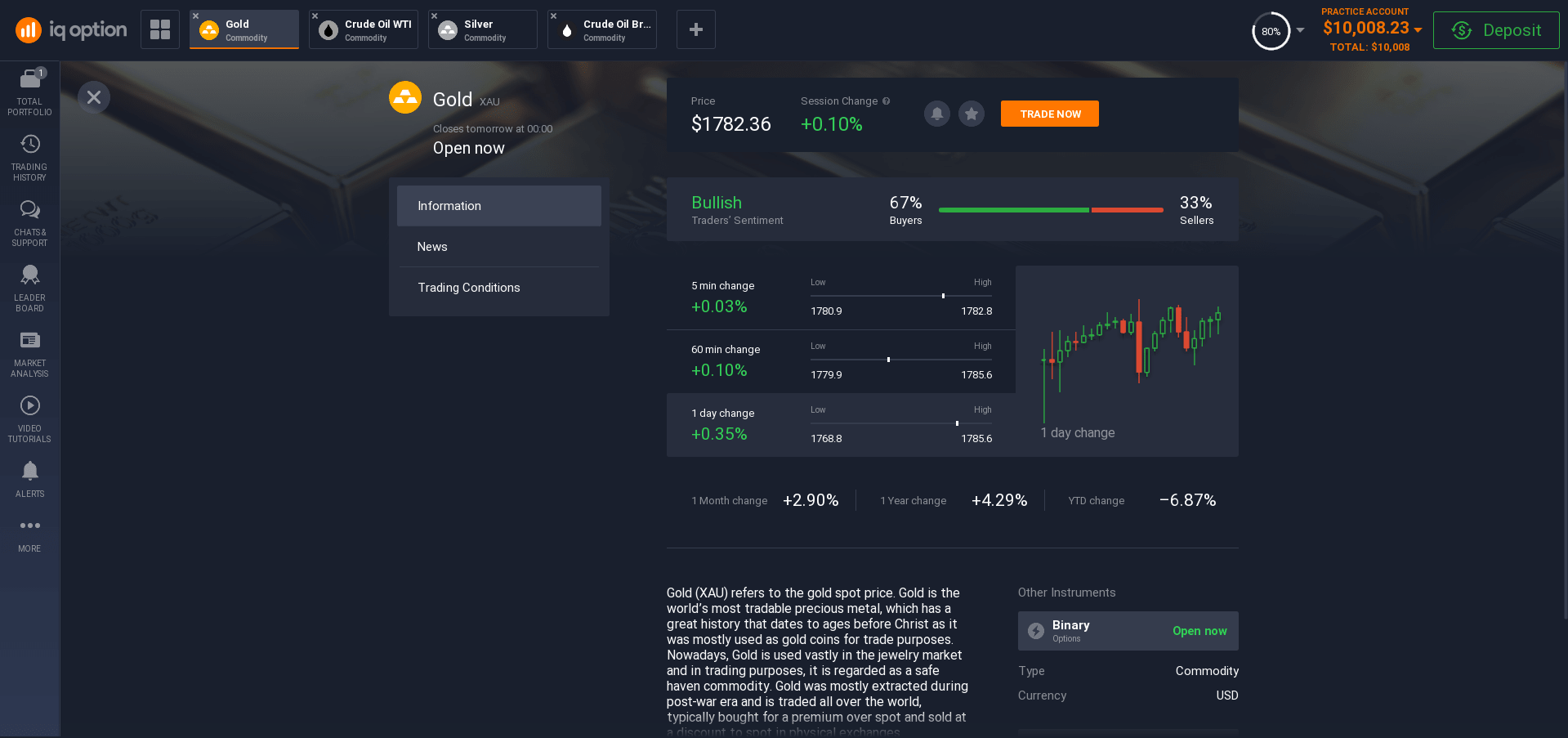

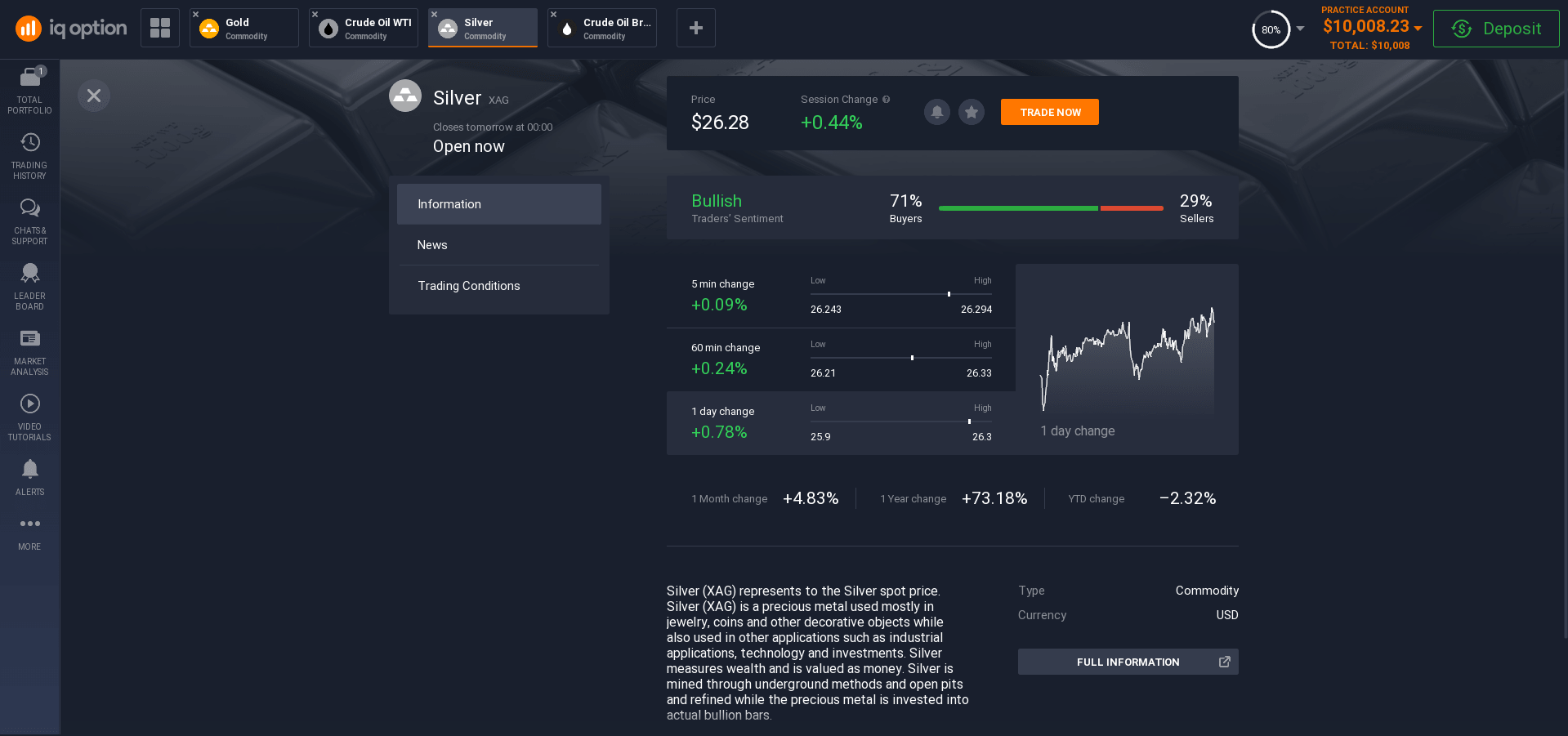

If you do not yet know exactly what a product is, then it is something that is bought and sold in the market. Commodities include food, raw materials, metals, and more. Some types of goods you can purchase include: agricultural products such as corn, wheat, and soybeans; commodities such as iron, coal, gas and other minerals. On our platform you can purchase commodities such as gold, silver and oil in two grades, WTI and Brent.

If you are considering investing in commodities, then the 1 type of investment you might want to think about is futures trading. Futures contracts involve the purchase of a specified quantity of goods on a specified date in the future.

One of the most popular characteristics of futures contracts is price volatility. Volatility implies that the value of a commodity can change from one moment to the next based on several factors. Among the most widely traded commodities that exhibit extreme volatility is gold. Gold usually rises in price along with the US dollar, other commodities and world events. When trading a futures contract, the main contract that you will buy or sell is the gold futures contract.

In addition, investors looking for a long-term investment option can look to gold as a stable market investment. It is not affected by inflation, deflation, or any other global economic factors that affect foreign exchange prices.

When it comes to investing in commodities, one of the most well-known areas of investing right now is gold. As the purchase price of gold steadily rises, more and more investors are choosing to use this market to their advantage.

One of the most typical traits of successful commodity investors is their ability to diversify their resources and stay invested in all areas of the market. Whether you are buying gold bars or just stock in a mining company, you will have to diversify your assets to avoid losing all of your money at the same time.

To determine which type of commodity is right for your portfolio, you need to consider the risks inherent in that particular asset class and compare them with other options. If you are unsure about which products are ideal for your investment portfolio, talk to a financial advisor to help you find more information on how the product market can fit into your overall financial plans. This information can help you determine if the products are right for you and your financial goals.

How to start commodities trading in Hong Kong?

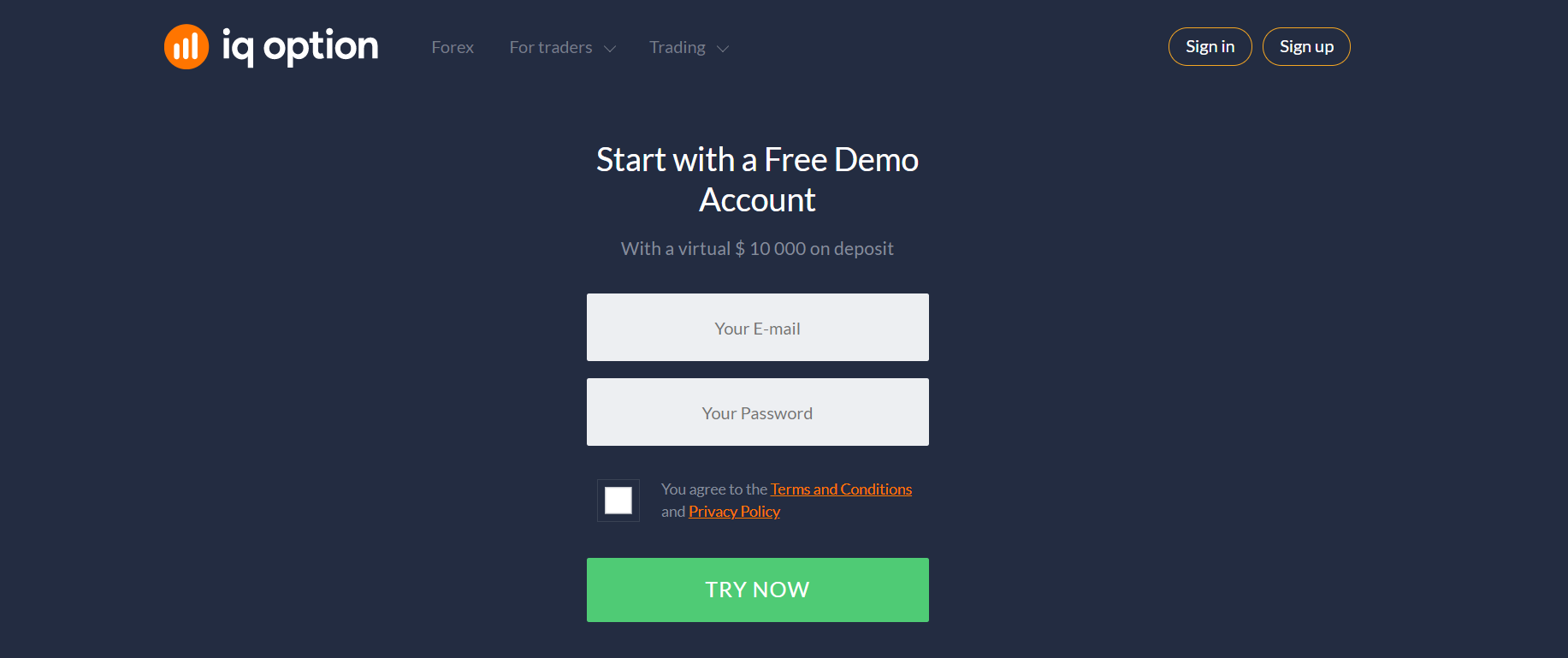

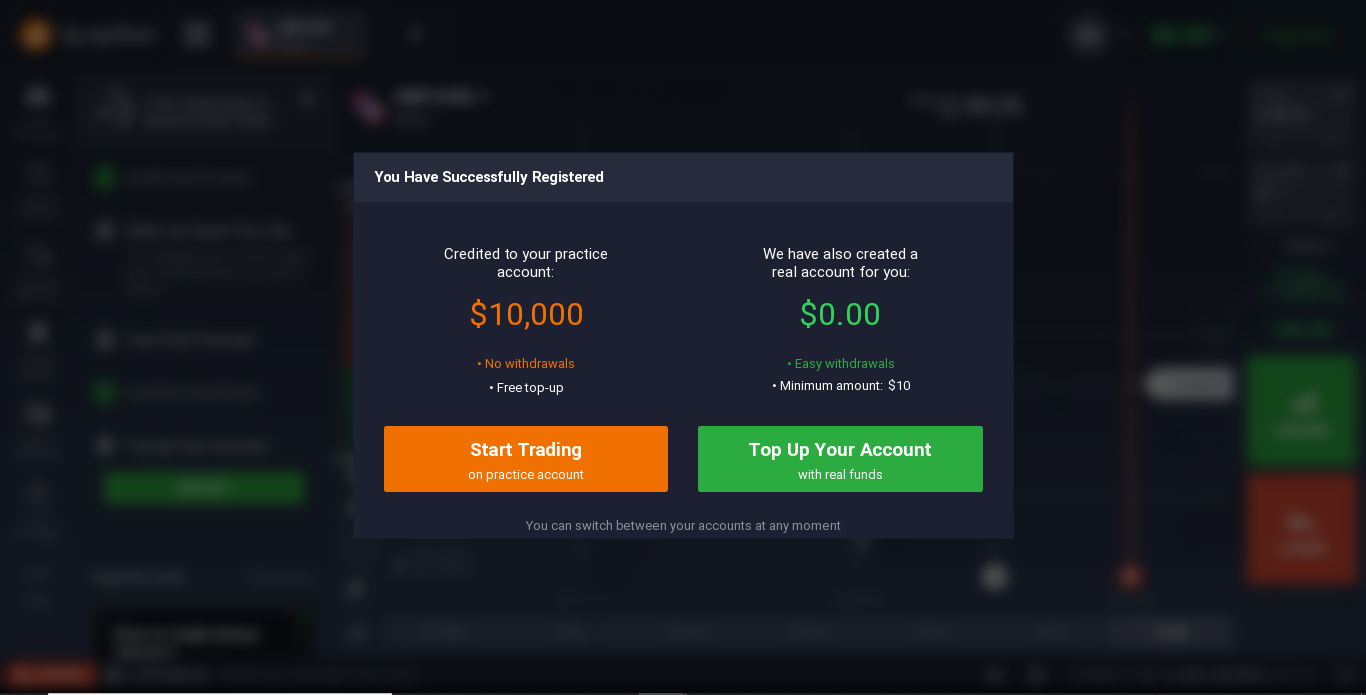

If you want to understand how to start trading commodities in Hong Kong, then the first step is to open a demo account to trade commodities. By opening an account with us, you will receive virtual money in the amount of $10,000. Simulators are used to help traders in the learning process to make the right decisions in trading transactions. You can exchange virtual money in these accounts and learn to identify potential trading opportunities and implement strategies to maximize profits. Then you can apply what you have learned by investing real money in a live environment.

While you are still learning to trade your own money, you can use an open specific account to trade commodities in Hong Kong. This is also called a dummy account and is ideal for beginners. You can use this account until you are confident enough to open a regular account.

It also allows you to learn about the Forex market before you start trading and to make exchange mistakes. If you open a demo account, you can quickly enter and exit trades without making a deposit. This allows you to practice virtual currency trades and see how much profit or loss you would have suffered if you made a real trade. This is especially handy for beginners.

Once you have a trading account, you can easily move to the mainstream Forex market. Opening a real account involves registering with a brokerage company and depositing $10 of money. Such conditions apply on our website. Once your account has been set up, you can easily start trading using your real money accounts.

If you are still learning how to start trading commodities in Hong Kong, you should know that you can use leverage to trade. Leverage is the ability to increase the amount of money you can exchange for every dollar you invest. This increases your chances of winning trades and increases the amount you invest in making trades.

The question you might be asking yourself is: What is a Commodity CFD?

A CFD (or Contract for Difference) allows a trader to speculate on the ups and downs of the market without having to own the product. Essentially, a CFD is a contract between two parties: a trader and a broker. At the end of the contract, the two parties exchange the difference between the price of the goods at the time of signing the contract and the price of the goods at the end. Basically, the trader pays the difference between the open and close prices of the product they are trading.

One of the benefits of investing in raw materials is inflation protection. Inflation is the rate at which prices rise, which means that today's money will have less purchasing power in the future. In the context of commodity trading, this means that buying the same amount of a given product in the future will cost more dollars.

However, by investing directly in commodities, traders can protect themselves from price increases and benefit from selling commodities at a higher price in the future.

While there are no guarantees, there are several things you can do to increase your chances of success when trading commodities. Here are our tips for investing in raw materials:

- Good preparation.

- Analyze the market.

- Manage your risks.

- Diversify your portfolio.

Related pages

How to start commodities trading?