Buy Polkadot (DOT)

What is Polkadot?

Polkadot is a decentralized cryptocurrency platform for applications with a wide range of technological solutions.

The most important parts of the Polkadot network are Relay Chain, Parachains, Parathreads and Bridges. These components greatly simplify and provide interconnection, interoperability and scalability by combining multiple blockchains into a single network.

Let's take a look at each of the parts:

- Parachains - Parachains are independent blockchains that are secured and run in parallel with the Relay Chain. Parachains provide chain-specific functionality and greatly improve the scalability and usability of blockchains.

- Relay Chain - A relay chain is the backbone of the Polkadot network as the validators on that chain accept blocks from all parachains and thus ensure the security of the entire network. It acts as the main communication node between the parachains (shards) that run on the network.

- Parathreads - Paranorms are technically similar to parachains, however, unlike parachains, they are temporary. Parachains are plentiful and can be rented out almost instantly and for a short time, while parachains are more permanent and limited in number.

- Bridges - Bridges are a special kind of Parachain that connects other underlying blockchains (such as Bitcoin or Ethereum) to the Polkadot ecosystem. Bridges provide true blockchain interoperability by allowing tokens and data to be transferred between Polkadot and external networks.

The Polkadot ecosystem has a token called DOT. It has three main functions:

- Binding and payment. The Polkadot (DOT) cryptocurrency makes it possible to add new parachains or remove inactive ones.

- Control. The owners of the DOT cryptocurrency have full control over the protocol. Holders manage all exclusive events such as updates and protocol fixes.

- Functioning. The system uses game theory and rewards those DOT owners who behave with integrity. The deceivers will lose some of their share. This principle allows the system to remain secure.

How to Invest in Polkadot in Hong Kong?

Cryptocurrency is a unique and radical new generation of money that is created and operated exclusively on the Internet. These currencies are not issued by any authority or controlled by any state.

Interest in digital currencies is fueled from all sides: they talk about crypto in news stories on TV, the exchange rate of coins is vigorously discussed on the network, authoritative magazines and newspapers write about the world economy in conjunction with the cryptocurrency world. The cryptocurrency with the unusual name Polkadot is a serious player in the cryptocurrency market. DOT is not a new coin: it was created in 2017, so you can buy DOT now. Many investors were able to invest their capital in DOT during the time and earn on the positive movement of the virtual coin rate.

Below we will consider the most relevant ways to make money in the crypto world.

Mining

Mining is the production of cryptocurrency using the power of computer equipment.

Traditional money is issued by central banks. There are no central banks in the world of cryptocurrencies. The only way to get crypto is mining, built on computers solving mathematical problems. The essence of mining is that computers located in various places around the world perform calculations and thus generate new blocks of the blockchain. This system is compared to a large book containing everything records of what is happening with the cryptocurrency. It is the platform on which the work of any cryptocurrency is based. Roughly speaking, the work of miners is to select from millions of combinations a single hash (the result of some mathematical transformation of a block) from the previous block - so you can "attach" another block. Many miners are fighting for the reward at the same time. Whoever did it first gets the reward.

Since the system operates on the Nominated Proof of Stake (NPoS) consensus algorithm, DOT mining on computing equipment is impossible. Tokens are earned by users participating in supporting the ecosystem's functionality (validators, nominators and fishermen).

Stacking

The process of deliberately holding cryptocurrencies in an account in order to generate income is staking.

This method of passive earnings frees users from all the costs associated with mining: cooling system, electricity bills, autonomous power supply, etc. Therefore, holders of digital notes began to pay more and more attention to staking. Here we can say that staking is similar to banking. a deposit at a certain percentage. And accordingly, the more funds on the account, the greater the profitability. The essence of such earnings lies in the fact that in blockchains based on PoS, operations for processing transactions and generating new blocks are performed by special trusted nodes-validators. And the more coins stored on the validator's wallet, the more chances he has to get the right to create the next block.

There are different types of staking depending on the terms: fixed, indefinite and DeFi.

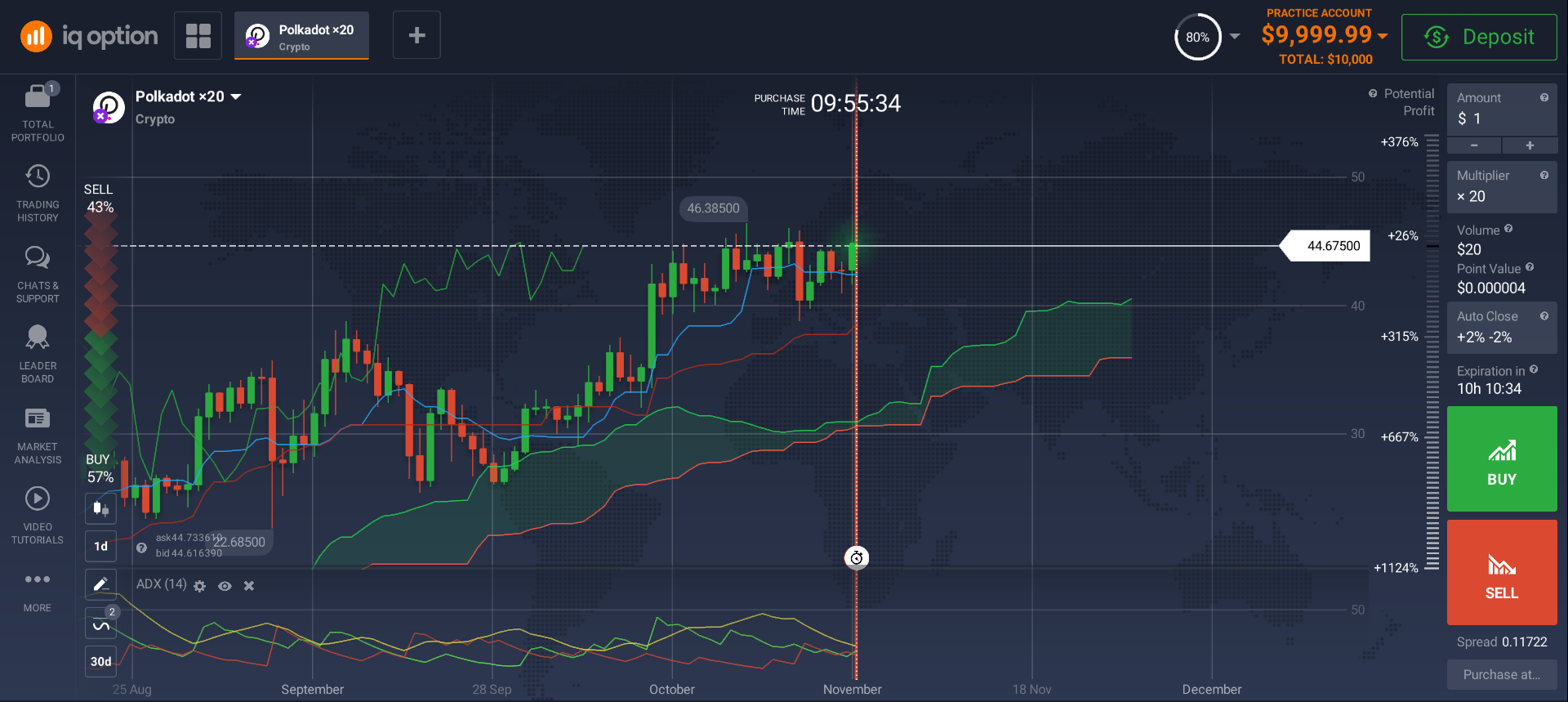

Investing through online platforms

In the 21st century, in order to engage in investments, it is not necessary to leave the house, as in the old days. A lot of services have been created to help novice and experienced investors. These sites and resources periodically update indicators and keep track of important news. Today, due to the increase in the speed of information exchange and the productivity of software, investors can conclude deals from anywhere in the world. The exchange is replaced by a trading terminal window on a personal computer.

When choosing a site, you need to pay attention to the following points:

- Commission information should not raise questions.

- Is it clear that funds are withdrawn.

- The availability of reviews and the duration of the investment platform.

- Traders' preference (the more they preferred one or another exchange, the better, respectively).

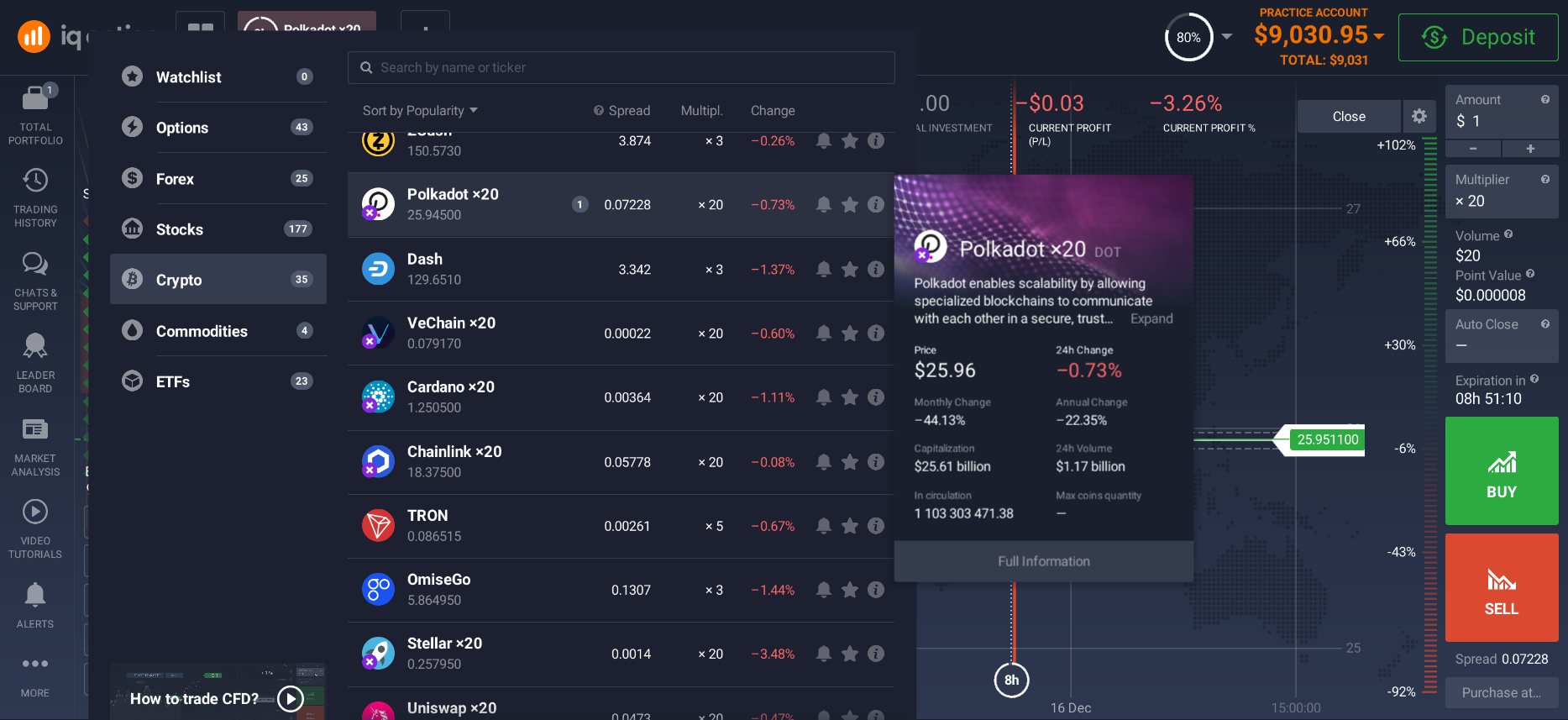

CFD contract and demo account

A CFD contract is a contract between two parties - a buyer and a seller. The essence of the contract is that the positive difference between the opening and closing prices of a certain financial instrument is paid by the seller to the buyer, and the negative difference is paid by the buyer to the seller.

Benefits of CFD trading:

- Low capital - The main advantage of CFDs is the lower requirement for trading capital. In addition, CFD trading allows the use of leverage. By trading with financial leverage, you can significantly increase your initial capital, but such trading involves a lot of risk.

- Convenience. A wide selection of markets for CFD trading allows you to work with currencies, but working with a familiar platform is more pleasant and productive.

- Hedging This property has become actively used in hedging. Due to the fact that CFDs are both buy and sell, these contracts can also be used for hedging. Often, traders use locks and hedges only to protect their deposit in the event of an incorrect market forecast. However, hedging can also be used to make a profit.

A demo account is a trading account where you can trade virtual money for educational purposes.

Many people underestimate trading on a demo account, believing that trading with fake money does not make much sense. However, this is a delusion. Trading on a demo account is an integral part of the success of any trader.

Crypto exchange and crypto wallet

A cryptocurrency exchange is a trading platform that allows you to carry out trading operations online (24/7/365).

Each platform has its own rules and regulations that must be followed with the sole purpose of providing its users with access to cryptocurrencies, as well as additional services. There are two types of cryptocurrency exchanges, Centralized and Decentralized.

A centralized cryptocurrency exchange is a trading platform where a third party, represented by the platform administration, is used to monitor and protect transactions on behalf of the user. The blockchain system itself tracks transactions. This type of cryptocurrency exchange requires their users to provide their personal information before using the tools they provide. These are the so-called KYC and / or AML procedures, they are easy to use and meet the requirements for safe and easy trading.

Decentralized cryptocurrency exchange (often referred to as DEX) - very similar to a centralized platform, but without third party intervention. These exchanges do not rely on any third party. Funds on the exchange are stored in the blockchain by the users themselves. Peer-to-peer (P2P) trading is also allowed by these exchanges. There is no user verification required and the security of assets depends only on the user. In most cases, the interface of a decentralized exchange is more complicated, and deposit and withdrawal of fiat money using bank cards is not available.

When working on a crypto exchange, you will need to have a crypto wallet.

A crypto wallet is a wallet that plays an important role in the crypto world. A crypto wallet not only stores crypto, but also has many private keys that you will need when making transactions and during the process of selling and buying digital assets.

If you want to use a cryptocurrency wallet, you need to encrypt it and then it will be safe; otherwise, you will not be able to use your assets. Passwords and other encryption methods are set right upon opening and purchasing (in the case of a secure) wallet. You can also change your passwords from time to time for security reasons. A wallet is a private matter, managed only by its owner. No one else has the right to manage it as it contains the owner's private funds. There are several types of wallets:

- Hardware;

- Paper;

- Tabletop;

- Web wallets;

- Mobile.

Prospects for Polkadot

The project is developed on the basis of an integrated vision of the network, which implies the return of control to individuals from the Internet monopolies.

Polkadot builds on the revolutionary workings of previous blockchain networks while offering several fundamental benefits.

Polkadot brings the following benefits to blockchain networks:

- Scalability.

- Fine tuning.

- Interaction.

- Self-management.

- Easy upgrade.

Together, these core features open up a world of possibilities for new services that give people back control of their own digital lives. At the moment, buying Polkadot (DOT) in Hong Kong is not difficult, because it is supported by most of the popular cryptocurrency exchanges. The project is rapidly gaining popularity and Many investments in the field of decentralized finance are considered by many. Of course, at the moment, it can only be noted that the Polkadot developers will have to make a lot of effort in order to enter the top three among cryptocurrency projects.

Related pages