Buy Nike shares in Hong Kong

The dilemma of investing is now much more relevant than it used to be. Whereas investing used to be the prerogative of only big investors, today, thanks to modern internet technology, anyone with internet access and a minimum amount for an initial investment can try their hand at the stock market. Whether you live in the centre of a major city, which is a recognised financial centre, or even in the most remote area of a small state, if you want to learn the basics of the science of trading: the chances are exactly the same on an internet exchange.

Nike is an American manufacturer of sports shoes, clothing and equipment and has been a market leader for many decades. Around 95% of basketball shoes in the USA are owned by Nike. It employs around 70,000 people. Nike is valued at $27.5bn - more expensive than Louis Vuitton.

Founded in the United States in 1964, Nike was then still called Blue Ribbon Sports (RBS). They were athletes, and decided to design a comfortable pair of shoes for professional running themselves. The firm's first deal was to buy 300 pairs of trainers from the little-known brand Onitsuka Tiger (now ASICS) for resale in the United States. The first batch was quickly sold out.

In 1964, the fledgling company sold 1,300 pairs of Japanese trainers. A few years later the firm started ordering shoes of its own design to be made-to-order. Bauermann's success came in 1968 with the launch of the Cortez brand which sold well.

The first pair of Nike trainers appeared in 1971 - they were trainers with a waffle sole. Remarkably, the sole was obtained using a conventional waffle iron. Bauermann, aiming to improve the grip of the sole, used his wife's waffle iron to create a fluted trainer sole. In 1974, the know-how was patented and the world-famous waffle iron is still preserved in the company museum.

In 1971 the business brought the founders $1 million. In 1977 the figure rose to $25 million. In 2016 the company made $3 billion.

In 1978, the company's name was changed to Nike, Inc. The name comes from the Greek goddess of victory, Nike.

Today Nike, Inc. has factories in 55 countries, most of them in Asia. The shops are located almost on all continents. Production is almost entirely in the hands of contractors. The company itself is engaged in design development and is the owner of outlets and shopping centres NikeTown.

Apart from its own brand, Nike has a number of other brands in its arsenal, the most famous of which are Air Jordan, Air Force 1 and others. Since 2017, Nike has owned two key apparel manufacturing subsidiaries, Converse Inc. and Hurley International. In 2019, Forbes magazine named Nike the most expensive sports brand in the world.

For investors, Nike shares are of particular interest. Today, thanks to online trading, anyone can start earning from NKE securities.

Let's take a closer look at how to invest in Nike stock in Hong Kong.

How to invest in Nike shares in Hong Kong?

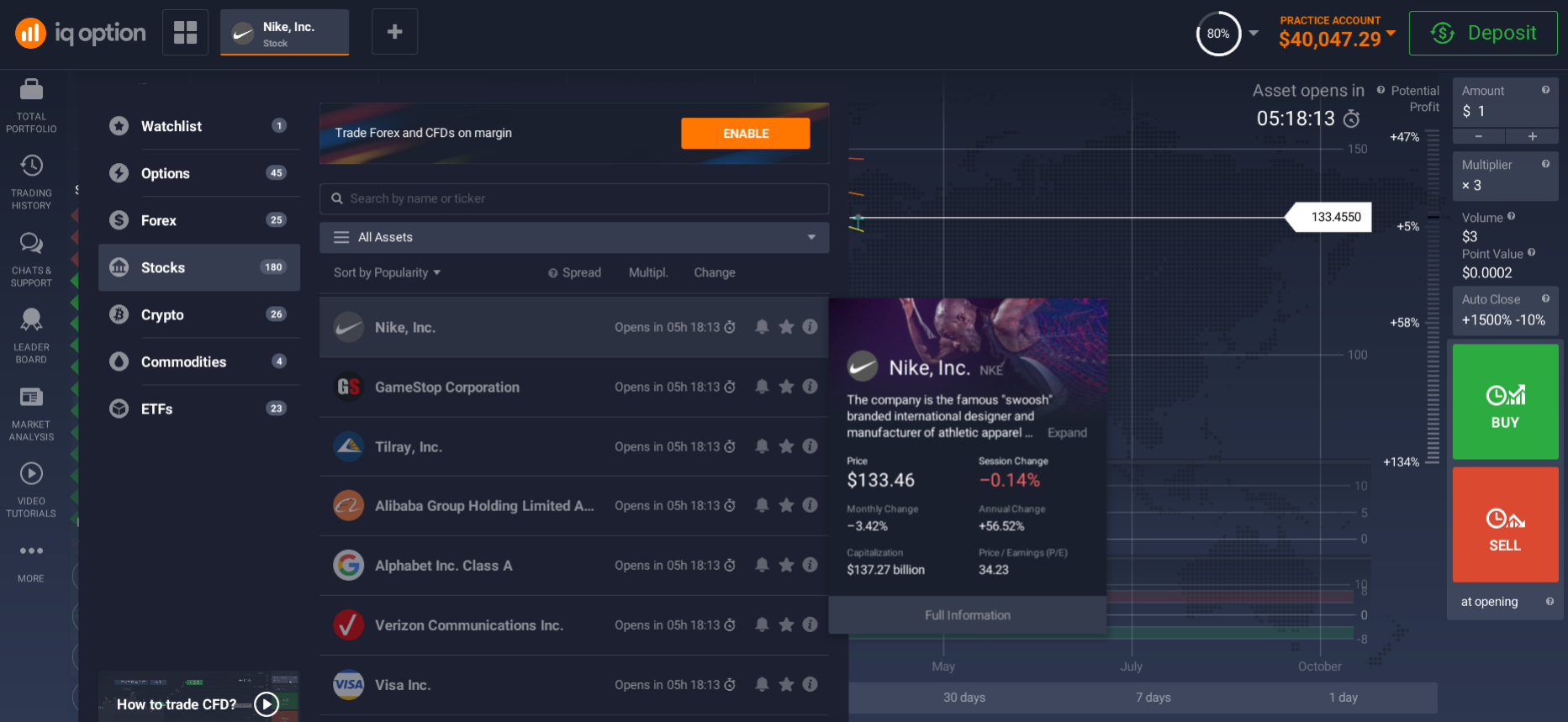

Nike shares are actively traded on the New York Stock Exchange (NYSE), where they can be found under the ticker symbol NKE. Today, the exchange is considered the main trading venue for the issuer's securities.

Dividend payments on Nike stock are made quarterly (4 times a year) at a yield of about one percent. Over the past 10 years, Nike's dividend yield has been shown to be in the range of 1-1.7% of the share price.

CFDs are a good alternative to dividend investments.

A CFD is a financial instrument which allows the dealer and the buyer to redeem the underlying asset without payment, paying each other the difference between the value stated in the contract and the true value. You can make money on both the downside and the upside of the market. The most important task of the investor in this case is to forecast the changes in the value of the underlying asset. That is, depending on the analysis tools offered to him he must guess at what level the value will be in some time.

CFD (Contract for Difference) stocks allow you to use leverage, so you can get a good return on your investment despite your small capital. But it should be noted that trading with leveraged capital involves a higher degree of risk and is unacceptable to many investors. CFDs are complex financial instruments and investing in them carries a high risk of quickly losing money due to leverage. 78% of non-professional clients lose money buying in these commodities. You should consider whether you understand how CFDs work and whether you can afford to risk losing your money.

Nike shares are included in the calculation of stock indices such as the Dow Jones, S&P 500, S&P 100 and many other lesser-known indices. The presence of the company's shares in stock indices helps ensure demand for the stock by a large number of investment funds operating in the US stock market.

Find information on brokers dealing in Nike stock in Hong Kong.

When choosing a broker, make sure it meets the following requirements:

- Having a professional website with all the necessary information;

- Availability of feedback;

- Availability of trading requirements with a wide range of trading instruments;

- The availability of technical indicators to assess stock price movements;

- Speed of responding to enquiries;

- Low service fees;

- Availability of suitable deposit and withdrawal procedures.

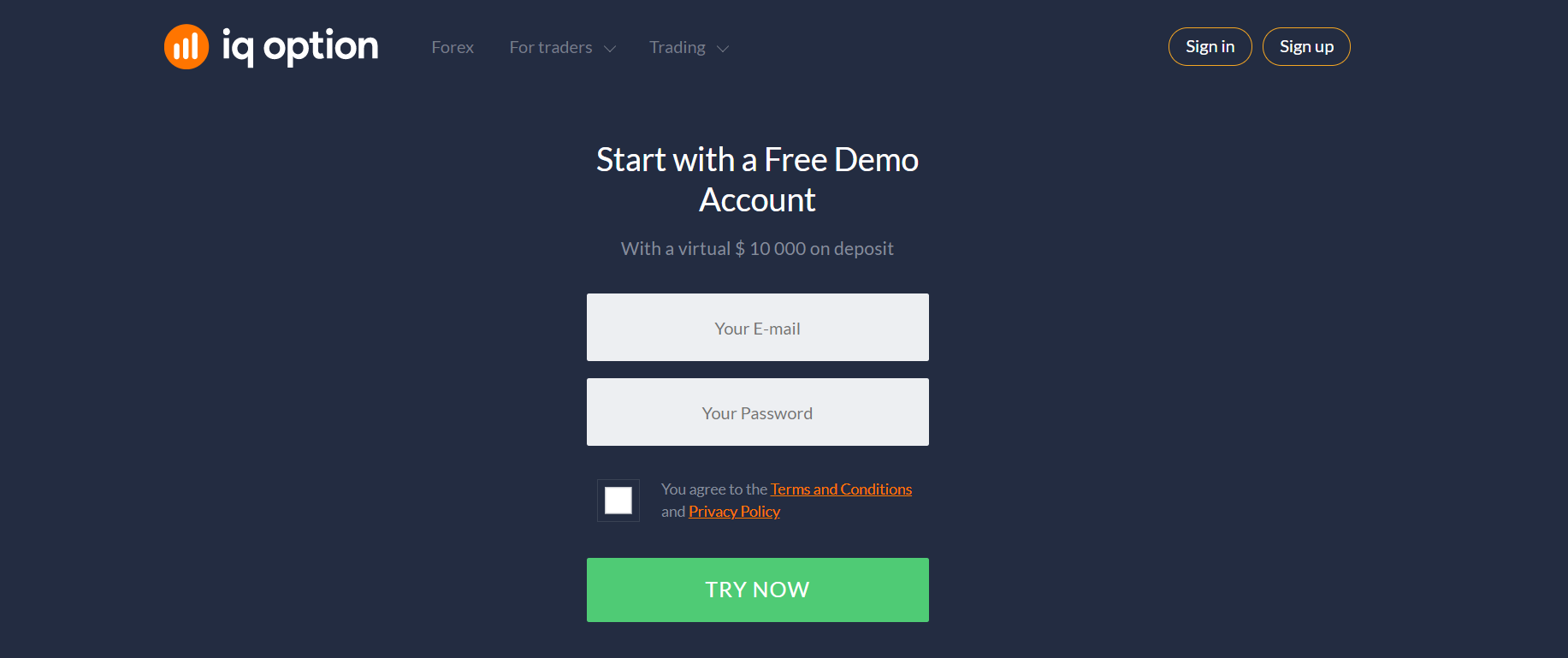

Once you have decided on a broker, register on their online trading platform and start trading.

How to buy Nike shares in Hong Kong?

To start working with shares online, you need to register with the investment system. It is a really simple and quick process which is no different from registering on any other website. The system will ask you to verify your email through an automatic link in your correspondence.

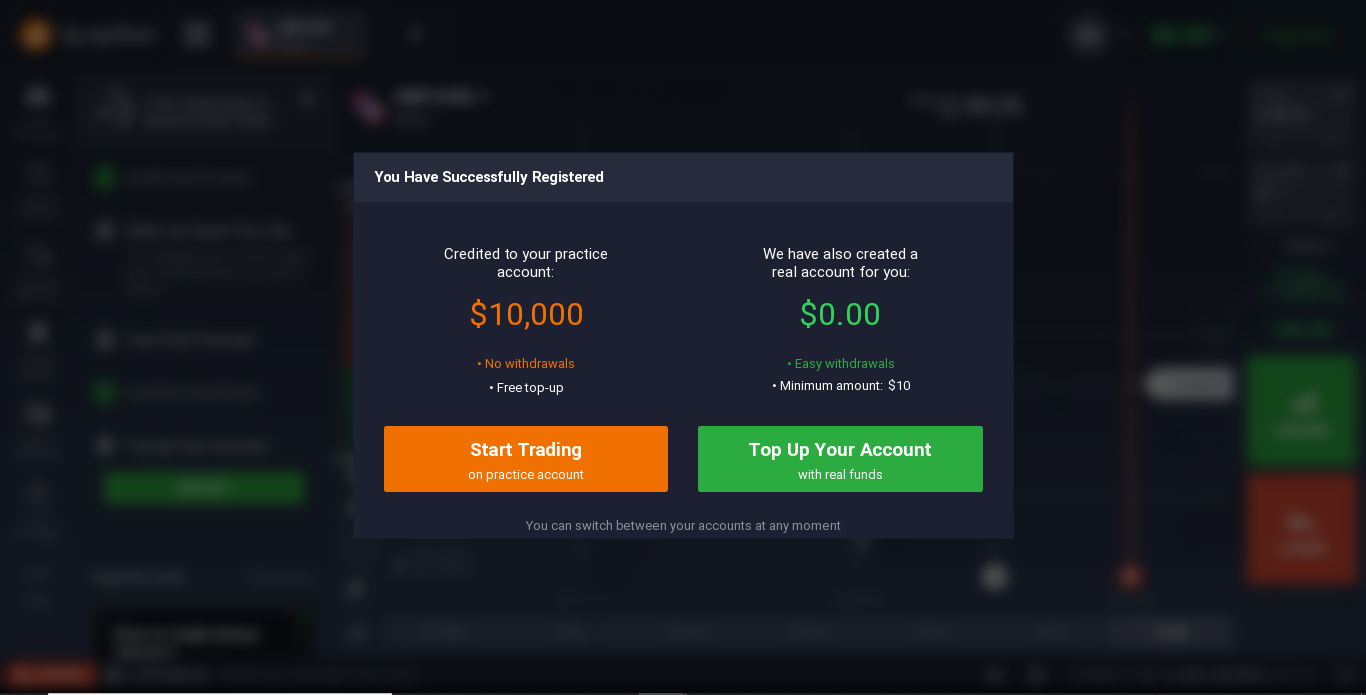

A free demo account will be available to you shortly. A demo account is a test copy of a real account, to which a certain amount of fictitious viral money is automatically credited for test operations for training purposes.You can use it to carry out the same operations as in the case of a real account. Only in the case of a demo account you do not spend real money, but you exchange it for fake money. This practice will help you determine which mistakes you make and which methods are better to use and which are not. You will not have to risk any real money. You will not be able to withdraw money from your demo account.

To start trading for real, you must fund your real account. Generally, trading platforms for regular traders set low deposit amounts, rarely exceeding $10. High-end trading platforms, designed for large investors, may set a much higher first deposit amount.

Depositing an account is simple. To do this, click "Deposit" and choose one of the replenishment options offered by the system: by bank card or via one of the online electronic payment systems. Funds are credited instantly. You can withdraw money from your account in the same way as you did when you deposited it.

Is it reasonable to invest in Nike shares in Hong Kong?

It should not be forgotten that, despite the apparent simplicity and accessibility of online investing, trading is a science that requires at least a fundamental understanding of how the exchange works, an understanding of specific procedures and processes, and also requires constant training and in-depth knowledge.

The online trading platform includes a learning segment, where you will find a wealth of useful information, as well as video tutorials to help you understand the basics of trading right away. In addition, use external sources to get information.

Keep in mind that stock price movements are affected by a number of external factors, such as national and global political processes, national financial laws and macroeconomic market procedures, as well as phenomena such as natural and man-made disasters.

Monitor the actions of the company in which you invest. Follow the management decisions of the company's management and analyse whether the product or service provided by the firm will be in demand by customers in the long term.

If you persistently study these procedures, follow market trends and the behaviour of specific businesses, you can eventually learn to analyse and predict the possible increase or decrease in the value of your organisation's assets. This will allow you to successfully make money in the investment market and grow as an investor.

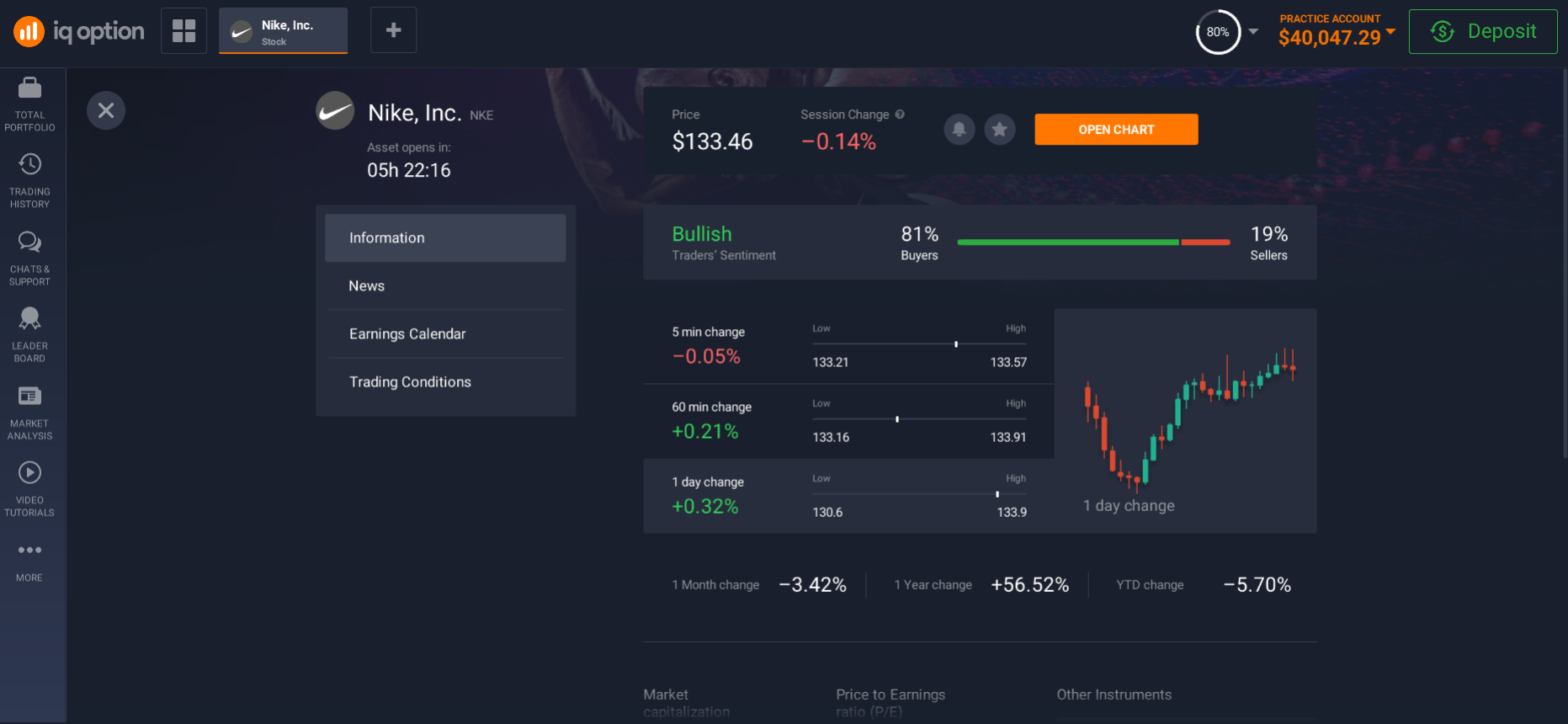

The share price of Nike, Inc. at the time of writing is $133.42, up 56.52% from the same period last year.

Analysts' overall assessment is positive, with annual earnings per share growth potential of at least 34% for Nike over the next five years.

Over the past five years, Nike's stock has risen nearly 200%.

According to one estimate, the global sportswear market was worth $167bn in 2018 and is expected to reach $248bn by 2026.

The company promises further market expansion and prosperity. Investing in Nike in Hong Kong is a great idea that is now available to everyone. As the company's slogan says, just do it!

Related pages

Buy Nvidia shares in Hong Kong