What is Forex trading strategy?

A good strategy for buying and selling currencies to carry out exchange operations, also known as Forex Trading, will allow you to obtain greater returns and limit the risks, minimising possible losses.

What is Forex trading strategy?

The first thing you should do is learn exactly what you mean when you talk about Forex Trading. The literal translation would be Foreign Currency Trading.

In the world there are many currencies, foreign currencies or monetary units, and all of them have a quote. This quote will be determined by its value in reference to another currency, for example the dollar or the euro. Forex Trading is the buying and selling of foreign currency, depending on its price at the time of the transaction.

The value of a currency unit is determined by many factors, which are very varied. A currency can have a lot of volatility due to weaknesses in its country, because it has a fragile economy, or on the contrary, it can be a strong power with a solidity that makes the value of its currency very stable, but allows a safe profitability, although small.

In addition, before starting to trade Forex, it is necessary to internalize many technical aspects, which will help you to support the operations that you carry out, since you should never forget that you are going to invest real money in a market that works in a certain way, and you should understand the different concepts that you will have to apply to form your trading strategy.

Currency pairs

The denomination "currency pairs" refers to the relative quotation of a currency unit in relation to the unit of another currency on the exchange market.

For example:

- Dollar- Euro

- Dollar-Yen

- Euro- Dollar

- Euro- Pound Sterling

- Dollar- Canadian Dollar

There is the concept of cross-courses, which could be the case of an investor who is in Hong Kong, and through an investment platform performs Forex trading operations, for example, with the Dollar-Sterling Pound quotations. That is, he is trading with cross rates of which none is the unit of currency of the investor's country.

This concept is the cornerstone of the Forex Trading market, since the variation in the values of the different currency unit quotations is the spread on which foreign currency trading operations take place in the foreign exchange market.

It is very important to have reports and analysis that help you form an investment criterion and allow you to develop a solid strategy.

Under this premise, there are many online investment platforms where a trader takes advantage that offer advice for beginners and professionals, but the reality is that most provide very little real data.

Types of exchange rate analysis

A key analysis criterion can be established for foreign exchange operations, which will be extremely important in determining the investment strategy. There are many types of analysis, and each will establish a part of the investment process.

The purpose of the different types of analysis is to help you establish an investment strategy, determine which quotes fit your investor profile and implement financial management to deposit, buy, sell and trade with confidence.

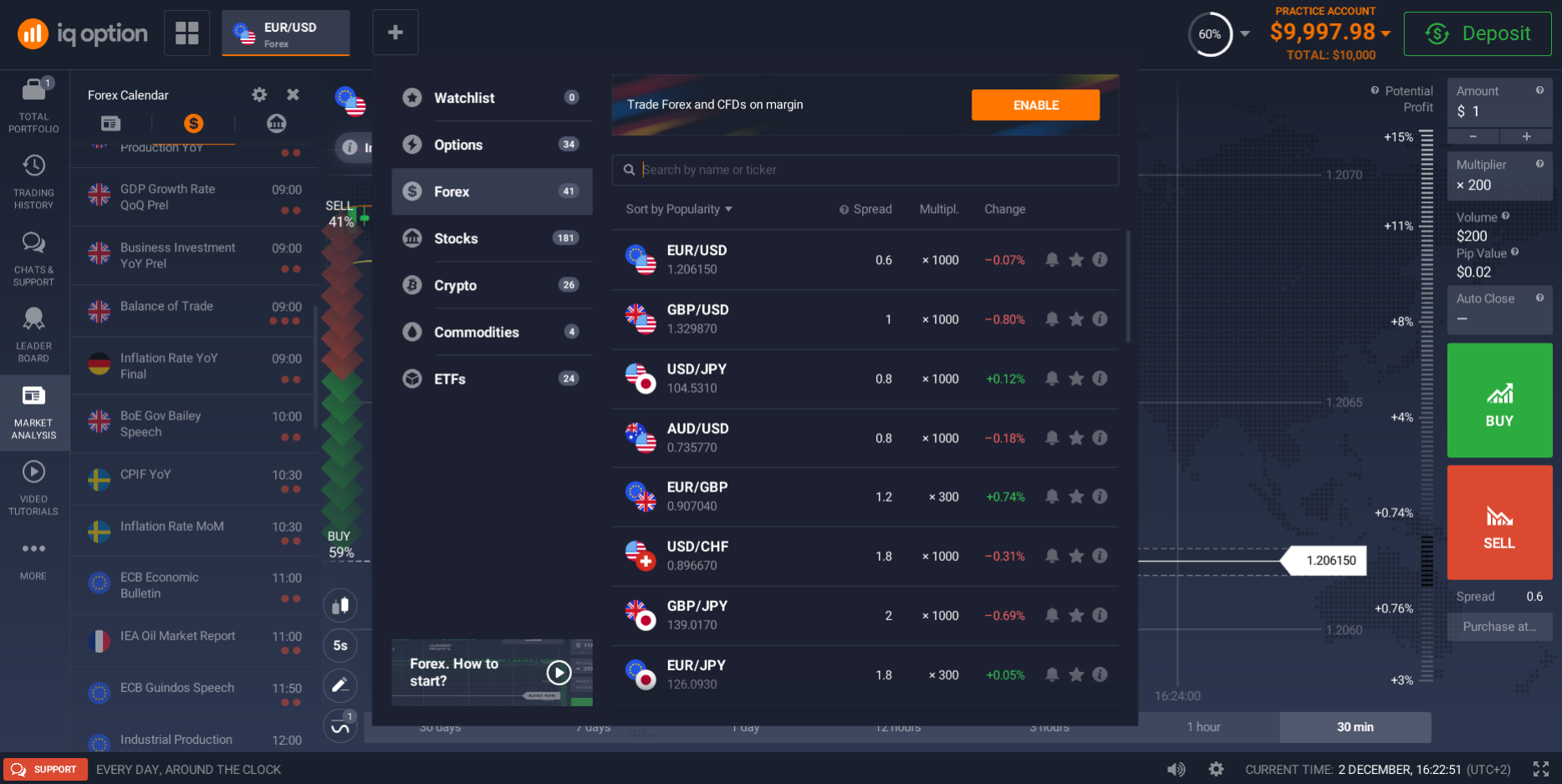

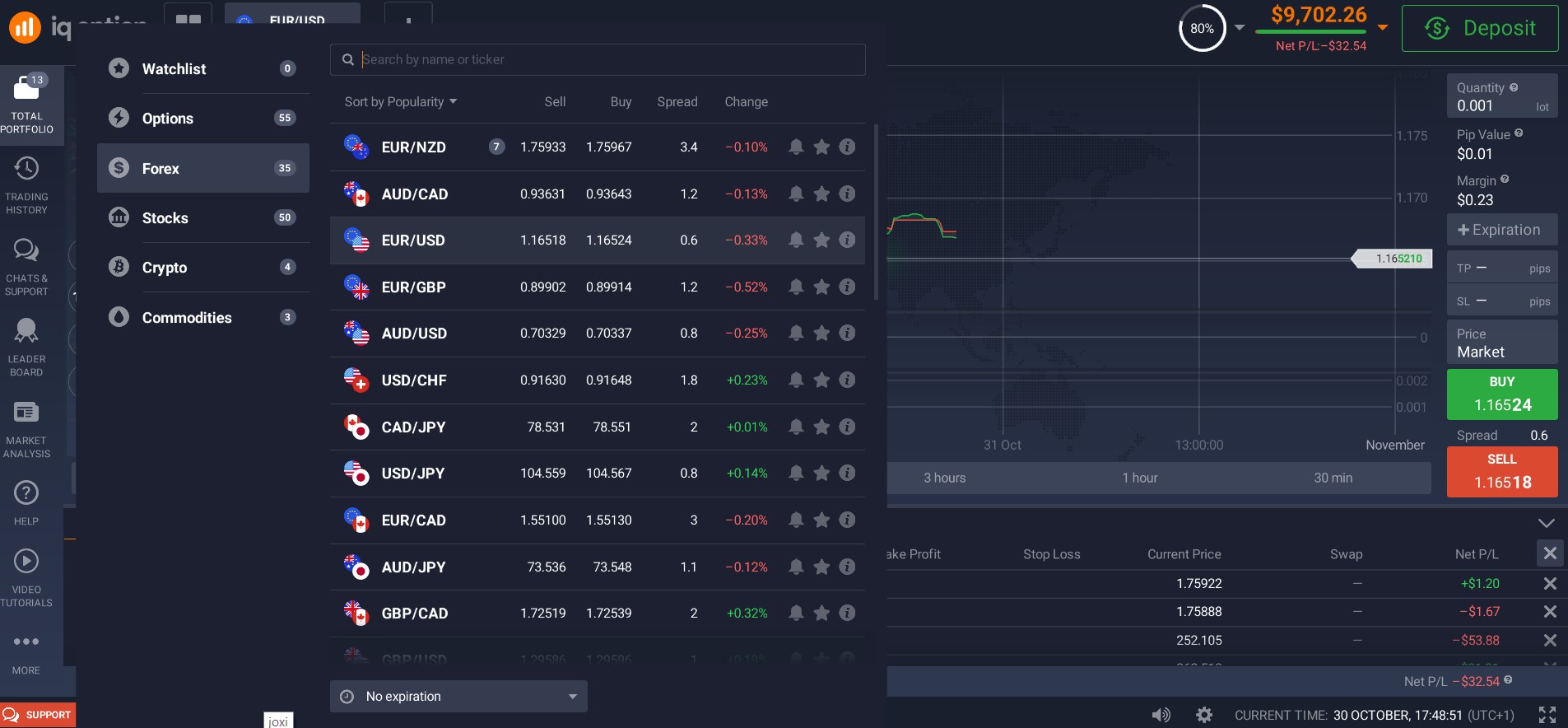

Thanks to investment platforms such as IQ Option, once you have formed your investor profile, it will be determined what type of Forex Trading you can do because all this information is properly developed.

You will be able to determine maximum and minimum values, loss limit, buy limit, buy losses, alarms for buy and sell suggestions, when to stop the loss of sell orders, sell stop, buy stop, exercise price, spot price, and many more configuration points. Of course you can select which values you want to track and for how long. All of this will be part of the investment strategy that IQ Option is helping to build.

List of the main Forex technical indicators

The reality is that there are thousands of technical indicators for Forex trading strategy, because these depend on the criteria that each investor wants to apply to set up his chart. But a list can be made of the most common technical indicators that can be found in almost any chart.

- Moving Average (МА) - This is an indicator that serves to determine a price trend. In this way you can set a value that is your reference point for buying or selling.

- Exponential Moving Average (ЕМА) - This is another criterion that serves to weight the price changes of a currency over a period of time, assigning different specific weights to the daily quotes, decreasing their importance in the final average as they get older.

- Stochastic Oscillator - This is a statistical analysis tool that establishes a position criterion within a given period of time, establishing price highs and lows, which will mark the buying and selling values.

- Moving Average Convergence Divergence (MACD) - Here you have a dedicated indicator to measure the relationship of the Exponential Moving Average (ЕМА), to determine an investment pattern.

- Bollinger Bands - This is a type of indicator that involves a graph with curves, helping to facilitate trend analysis.

- Relative Strength Index (RSI) - One of the most widely used and easily interpreted indicators. It consists of analyzing the closing price of a given currency over a period of time, in order to establish a trend.

- Fibonacci retracement - Using the famous sequence, it allows to determine support or resistance positions, in which a quote will find its place. This serves to confirm a trend.

- Ichimoku Cloud - This is a method of technical analysis that combines different indicators in a single graph, determining potential points of support and resistance that will serve to establish a future trend, analyzing past quotes and forecasting possible future values. In this way, it is believed that the optimal value for investing can be achieved.

- Average Directional Index - This analysis tool exposes the directions and impulses that trends are following. It actually measures the volatility of the assets. The concept of volatility is expressed in the profit margins that a security can offer, as well as exposing the risks of those price movements.

Basic Forex Trading Strategies

Forex trading strategies can be established that will put you on the right track in the investment process. At this point, it is important to remember that establishing a Forex trading strategy or system is a process that can take some time, so it is very important to respect it. We must not forget that we are talking about investing real money in a real market, and we must be as sure as possible of the steps that have to be followed.

- Determine the trends and price ranges of the different markets. By using charts, proceed to capture the behavior of the different markets over long periods of time. In this way, you can determine the trends in prices. The size of the time gap analysed will help to increase certainty and decrease chance.

- Follow the trend. Once the trend has been determined, you should reverse it by following the trend. At this point, the question is whether you will do so in the short, medium or long term. Obviously, if the trend is upward, you will have to wait for some regression to ensure a good entry price.

- Find the support and resistance levels. The support level marks the minimum price and the resistance level the maximum price. The idea is to buy near the support value and sell at the resistance price. When the price pierces the support level, this new value becomes the resistance price, and when the price exceeds the resistance value, it becomes the new support price. In this way, positions are consolidated.

- Be aware of Moving Averages, as these usually expose buy and sell indicators. Use different moving averages that are made up of different time measurements, i.e. one shorter and one longer, e.g. 10 and 20 days. The moment they cross during an uptrend, one can say that it is an excellent time to invest.

- The indicator of convergence of divergence is a concept that should be carefully considered, because it will expose the crossings of different moving averages, exposed on an oscillator.

Create a currency trading strategy

When it comes to buying and selling currencies or Forex Trading, the most important thing is to establish an investment strategy, as this will determine the success or failure of the investment process.

There are many strategies of forex traiding:

- Scalping - This investment strategy is high risk and very complex because it requires an investor to make as many trades as possible in a very short period of time, up to a maximum of 14 minutes. It is a complex buying and selling procedure, with very high profit margins, but with very high volatility. This strategy is for investors who are not afraid of risk and can dedicate a lot of time to trading.

- Positional Trading - Here we are in the presence of a type of strategy totally opposite to Scalping, since it is a very long term investment process, with positions that can last for years. It can yield large profits, but requires investors to be able to leave their investments in place for long periods of time.

- Trading NFP - This is a report of non-agricultural payrolls, i.e. those workers who are paid and do not work in the agricultural sector. This report is very important and is issued once a month; depending on its content, it strongly influences the price of the dollar and will affect the pairs that are compared with the US currency.

- Swaps and Carry - This is a process whereby fixed fees are charged for holding positions for more than one day. These are very risky procedures that can bring either large profits or large losses.

- Counter Trend Trading - This is a strategy for experienced traders or those who have a lot of confidence in their knowledge and themselves. It is about investing against the trend that brings the price, establishing different maximums and minimums. Although in this type of strategy it will be important that those prices are kept under control of the risk.

Below you will find the answers to the most frequently asked questions for those who want to start on this investment path and which will serve as a guide to know how, where and when to trade.

FAQ

How difficult is Forex?

Not difficult at all. Thanks to having a trading platform like IQ Option where you can find all the tools you need, as well as the advice of professionals who are available to guide you during the process of establishing the strategy, all this together makes Forex Trading a simple process.

How can I succeed in Forex?

To succeed in Forex the main thing is to establish an investment strategy, based on all the tools at your disposal, using the different technical indicators, you can build a strategy that fits your investor profile, and thus feel comfortable with your Forex Trading portfolio. From this point on, you will only have to monitor the performance of your investments, and you will have the peace of mind that there will be no movement without technical support.

What is a Forex Trading Strategy?

A Forex trading strategy is the procedure that will lead you to success with your investment. The establishment of the trading strategy is the first step, indispensable if you want to make money. Without a doubt, it is the locomotive of success in the purchase and sale of currencies. There are numerous strategies and they are adapted to the different investor profiles that exist.

How do you create a Forex strategy?

To create a strategy in Forex it is necessary to establish certain criteria that will be the bases on which the investment portfolio will be built. It is very important to determine if you are a bold or conservative trader, if you may need the money in the short term, or if on the contrary you are not going to touch it for a long period of time, as well as some other aspects that must be taken into account. All of these points will cause you to opt for one type of strategy or another.

How can I make a strategy?

The process of making a strategy could be called a process of acquiring knowledge and awareness of strengths and weaknesses as a trader. Audacity can be a strength, if you decide on a scalping strategy, patience will be another strength if you apply a positional trading strategy, in which you will have to maintain your bet for a long period of time. And weaknesses must be addressed and compensated for with knowledge to obtain responses and solutions to situations of volatility and risk.

What is the best time frame for trading Forex?

The timing or time frame varies greatly. It can range from one minute to years, passing through hours, days and months. Therefore, it will depend on the type of investment strategy you are going to apply. The evaluation of the temporality will be decisive within the investment strategy that you have configured, since the greater the temporality, the lower the risk of price volatility, and conversely, a shorter time frame can have repercussions on a price that undergoes important variations. Moreover, if you take into account moving averages, you can use them to determine when favourable situations for buying or selling currencies may occur.

When can you trade Forex?

One of the advantages of trading on Forex is that it is currency trading, which means that at any time there is a market operating somewhere in the world. This means that you can trade Forex 24 hours a day every day, because there are electronic markets that work every day. The only limitation to trading will be what currencies you have invested in, and therefore that will be your guide to time.

What Forex indicators are the most profitable?

The profitability of the indicators will depend on what parameters you set for the charts, but the most commonly used indicators are Moving Average(МА), Exponential Moving Average (ЕМА), Fibonacci Retracements, Ichimoku Cloud and all those you will find reading this article.

What kind of operations are the most profitable?

The type of profitability of the operations will be determined by your investor profile. It may be that a high return is obtained with an intraday Forex trading purchase and sale, but it may be that making a foreign currency purchase and maintaining the trading position in the long term results in a significant profit. Therefore, it is not a certainty which type of trade is more profitable than another, because the Forex market is influenced by many factors. But it is important to know every passive and active investment strategy, how to buy and hold, the Swing trading, the intraday trading tactics, and above all the trading time to be successful.

What is the best indicator for scalping?

There are several indicators to use with this trading strategy. For example, Moving Average, Fibonacci, Exponential Moving Average (ЕМА) and Bollinger Bands, although the parameters need to be set in a very short time frame of 1-3 minutes. The reality is that medium and long term indicators work just as well in this short term strategy, the only thing that varies is the charting parameters.

What does scalping mean in Forex?

Scalping is a strategy of buying and selling currencies, in which many trades are made in a very short period of time, at most 14 minutes. It is very risky and requires a high degree of concentration and temporary availability. The watchword is to buy and sell large amounts and make a profit on those trades.

How do you predict trends in Forex?

The way to predict trends in Forex is by using charts that cover as much time as possible, incorporating all the daily quotes that the currency we are studying had. This way, the longer you incorporate the chart, the more faithful the trend will be.

How do you check forex trends?

Verifying trends in Forex is possible by establishing price curves based on the charts of past quotes, which determine a pattern of behavior for the future, the same can be configured taking into account the pair of currencies you want to verify, evaluating their price every fifteen minutes.

Which chart is best for trading?

Generally, Chinese candlestick charts are very useful for marking positions, so they are highly appreciated for tracking currency prices and their behaviour throughout sessions.

What is the time frame?

The time frame is the time frame within which the foreign exchange transactions are carried out in a market session, they are short term or they can be in medium or long term. The time frame helps to evaluate the behavior in a period of time of a quotation, and the wider the frame, the more precise the evaluation will be.

What is a trading period?

A time frame is the unit of measure used in trading to evaluate the behaviour of a currency, i.e. this unit can vary from minutes to days, weeks, months or even years. When determining the period of time that will serve as a measure, each of the periods will be an indicator of the evolution of the price.

What is a Pip in forex?

The term PiP, or point in percent, is the smallest unit of measurement used to express the change in the exchange rate of a currency pair. It is equivalent to a 0.01% change.

Can I trade forex with $10?

Only IQ Option allows you to invest such a small amount. Whichever option you choose to start with, in any financial market, you can start with this unmatched amount of money. Nowhere else will you find such a low floor to start making money.

Conclusion

The Forex market and trading with major currency pairs on a trading platform can be challenging. As a trader you have to be aware of a price chart, price movements, technical indicators, the bear market, the bull market, in short, an overall active trading strategy in order to achieve a successful trading position.

In short, a trading plan is indispensable for short term trading. But to achieve this and avoid financial risk, a novice trader must learn the technical analysis already established in the market from the beginning and in detail.

Related pages

Characteristics of the currency pair USDJPY