Day trading platform in Hong Kong

Depending on the length of time, a distinction is made between short-term, medium-term and long-term trading.

Short-term trading includes day trading, or, as it is often called, day trading.

Day trading is a trading strategy, where you make short-term trades over the course of a single day with the aim of making a profit. This means that day traders generally open positions during the day and close their positions each evening, leaving no positions open overnight.

This trading strategy is popular before scheduled financial announcements, such as when companies present their earnings and quarterly reports.

The term 'day trading' covers short-term trading in securities - often within seconds, minutes or, at most, a few hours. Day trading is thus quite different from conventional stock and bond trading. The time horizon is usually weeks, months or years.

To engage in day trading, we need certain knowledge, skills and of course a quality online trading platform that provides all the necessary tools to conduct this type of trading.

This review focuses on the topic of day trading and what is a day trading platform in Hong Kong.

Day trading

Day trading involves different time frames. At one extreme, traders position themselves when the stock market opens, hold the stock all day and sell it before the market closes. The other extreme is computerised high-frequency trading, which results in milliseconds or microseconds from the time to buy to the time to sell. There are many variations between these extremes.

High-frequency trading is entirely controlled by computers, which constantly look for price differences in different markets or certain patterns in the market. The trades can be as short as microseconds or milliseconds. Profits are small, which is counterbalanced by extremely high trades.

An example of high-frequency trading is when computer programmes look for differences in the prices of shares that are traded simultaneously on several different exchanges. Any differences involve quick purchases and immediate orders to sell at slightly higher prices. Today, this form of trading is in the minority.

This type of trading is often criticised and cited as one of the factors leading to stock market crashes.

This phenomenon has both positive and negative aspects. On the positive side, it increases liquidity in the exchange and reduces commissions and spreads. On the negative side, it creates a market with very large and rapid price movements.

As defined above, day trading is when you focus on short-term trading and short-term positions, which are closed before the market closes.

Another option for day trading is to trade throughout the day.

This form of trading is used by day traders speculating on stocks that fluctuate widely. An equilibrium stock moves up and down like waves in the ocean. If a stock is in a trough, a trader buys at the open and sells before the market closes. All stocks fluctuate periodically, but the frequency of fluctuation varies greatly.

There are 2 main intraday trading strategies: scalping and intraday news trading.

News trading

Trading the news involves speculating on future news. For each news item there is an expected figure, with which the market is compared. If the news is better than the expected figure, it is positive, even if the expected figure itself is bad.

Speculation exists before and after the news is released. If expectations are high, the price can start to rise even before the news is released. After the news is released, there is often a "rally" if there is a big difference between expectations and the result. It is also common for price to move in one direction first and then reverse. A very tricky situation occurs when several news are released at the same time, especially when some news is positive and some is negative. A trader must keep a close eye on all financial and economic news, which can cause a trend to move, especially positive ones. A calendar of significant events on the stock market and a table of the influence of these events on the exchange rates will help traders in this.

Scalping

Scalping is a trading strategy aimed at making profit from insignificant changes in stock prices. Traders who implement this strategy make anywhere from 10 to several hundred trades in a single day, believing that small stock price movements are easier to catch than large ones; traders who implement this strategy are known as scalpers. Many small profits can easily turn into big gains if a strict exit strategy is used to prevent large losses.

Day trading requires quick decisions and you have to calculate small profits over and over again. A common investment strategy is to profit from long-term price fluctuations, while day trading is considered the opposite.

Day trader

A day trader is a trader who completes his trade on the same day, without carrying it over to the next day.

In case of day trading, it is not enough to learn the theoretical aspects. As this type of trading requires high concentration, constant involvement in the process, it is considered to be rather stressful. That's why the psychological side is important. In day trading it's important to be able to concentrate and keep track of five or fifteen minute stacks. Skills like stress tolerance, the ability to make quick decisions and self-discipline are important here. You need to be collected, concentrated, highly stress tolerant, able to work at an extremely fast pace, and unresponsive to short-term setbacks.

It is very important to accept losses as a natural part of trading. Learning from losses means developing a trading strategy. It is easy to make mistakes, and if you do not pay attention to risk management and are inconsistent in your decisions, losses will escalate.

It is completely wrong to start day trading with the goal of making a big score. The positive returns of successful day traders are made up of lots of small wins and lots of losses, but the losses are smaller compared to the wins. The money you don't lose is just as valuable as the money you make. So you have to ensure that your losses are small and controlled.

A day trader, more than anyone else, should be well versed in technical and fundamental analysis.

What is a day trading platform?

All trading will be done through an online trading platform. Therefore, it is important to choose an appropriate broker - your financial intermediary in the investment market.

You should only choose a licensed broker that provides access to a platform that provides all the necessary tools for day trading.

Due to the strong competition on the Internet, trading platforms are professionally programmed and offer many tools to assist you.

Choose a platform that gives you the ability to trade a variety of financial markets. Most of them you can use for day trading stocks, day trading forex, day trading futures and CFD trading.

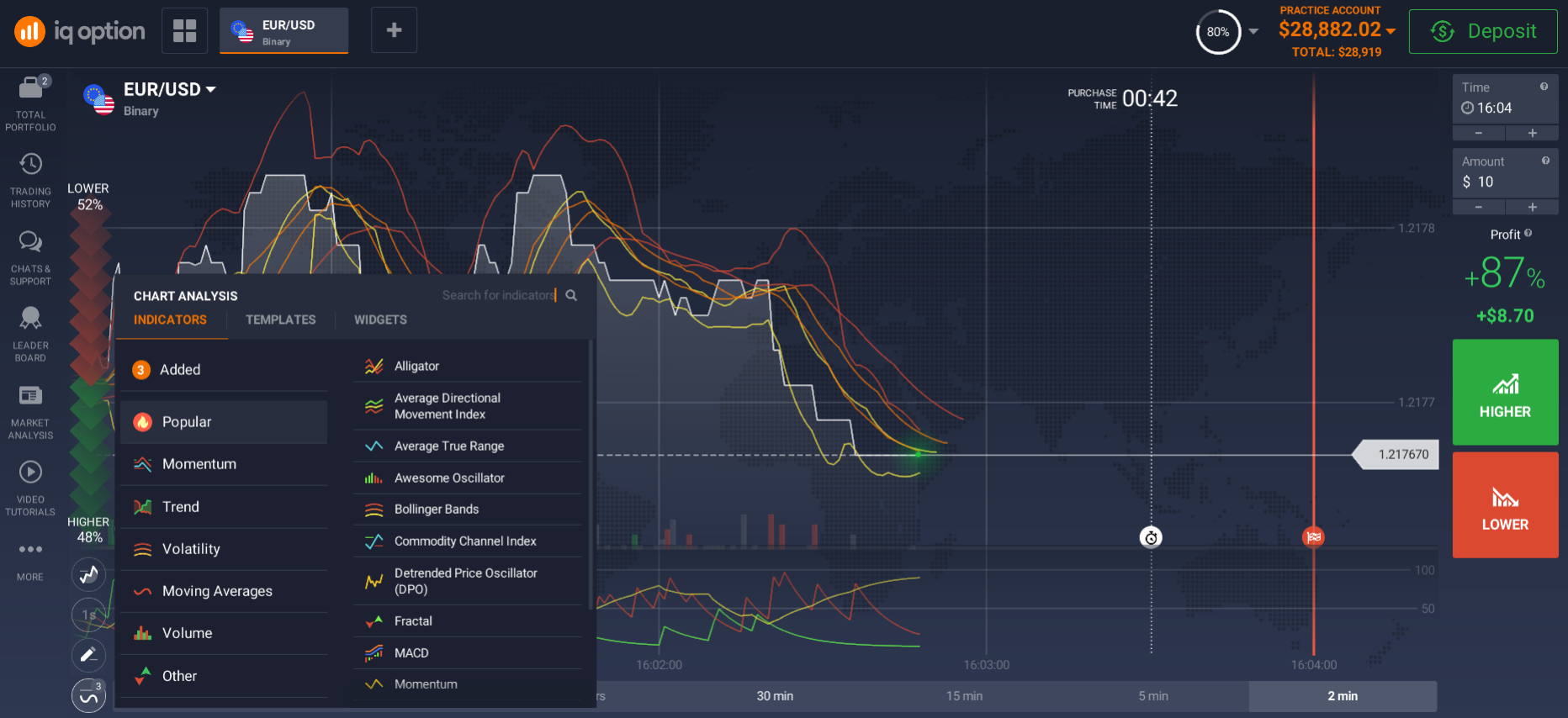

The platform must have indicators for technical analysis.

Indicators for technical analysis

Technical analysis differs from "fundamental analysis", which is generally associated with longer-term stock trading. If you invest on the basis of 'fundamental analysis', you buy a stock because you have expectations about the future. You may have read the company's reports and discovered that the company is doing a healthy business. Once you have bought the stock, you are prepared to wait weeks, months or years for the price to rise. A day trader doesn't work like that.

In other words, if you want to be a successful intraday trader, you need to be well versed in technical analysis. You need to be familiar with how complex indicators work.

On the platform, which we have chosen as the best platform for intraday trading in Hong Kong, you will see many indicators for technical analysis. It is important to familiarise yourself with how each and every one of them works. You do this by testing out different indicators which show you the price movement in new ways, but most importantly, you practice over and over again. The more course charts you review, the easier it will be for you to see the patterns and the more likely you are to succeed one day.

Day trading and CFDs

You now have the opportunity to choose trading platforms designed specifically for day trading. On some of these platforms you do not trade the physical stock of the company in question, but rather enter into an online broker which reflects the price of the asset you are trading.

CFDs also allow you to trade at lightning speed, and to 'buy' and 'sell' in the market simultaneously. As a day trader, you do not have to worry about whether the market will go up or down if you want to win. If you open short positions, you can make money even if the markets go down. It may seem complicated, but modern online brokers are user-friendly. All you have to do is click 'buy' or 'sell' to open a position. This means that trading CFDs is more or less like regular stock trading, and the trading platform organises all the 'paperwork' involved in trading CFDs.

However, we recommend that you familiarise yourself with the way CFDs work. The risk involved in such trading is higher than investing in ordinary equity securities.

Use of Stop orders

Day trading is very dynamic. Some trades, as we mentioned above, may last only a few minutes or even seconds. Just imagine if during this time you need to take an urgent trip or there is a technical problem with your connection to the internet. So traders use automatic stop orders, such as stop loss or take profit, to protect themselves against such misfortunes.

A stop loss is a predetermined level at which the trader wants to sell his security. As the name implies, it is used to reduce losses. You set your stop loss at a certain level because you have calculated in advance that this is a good price to sell your security. This is an effective way to reduce your losses. There is no guarantee that your broker will be able to sell or buy at this exact price, but it is usually better than nothing.

Take Profit is a type of pending order to the broker to close a trade when the price reaches a certain level - a profit. If the price reaches the Take Profit level, the trade will close automatically and fix the profit made.

Take Profit and Stop Loss help to insure a trader's market position in any situation. Regardless of volatility or connection to the broker's server, your positions will close at levels you set.

Other advantages of the day trading platform

Modern online trading platforms allow you to follow even the slightest changes in the market by displaying asset price movements on graphical images of the quotes. Charts can be set up to your convenience by opening one or more windows at the same time to compare different time periods. For example, you may choose a time frame of 15 minutes in one window, half an hour in the next window, and an hour in the next window. You can open up to 9 windows simultaneously.

In addition, you can customize the chart settings to your liking, not only in terms of time span, but also in terms of design - you can choose between bars and candlestick charts, and change the chart colour scheme to something you feel most comfortable with.

Another plus is the availability of a mobile version of the platform. You can follow the market wherever you are with just your mobile phone. The mobile version offers all the same features as the web version.

The platform provides complete and comprehensive information on all market movements - the smallest chart deviations are immediately visible to you.

How do I start day trading on the platform?

To start day trading in Hong Kong, you will need to :

- Choose a broker;

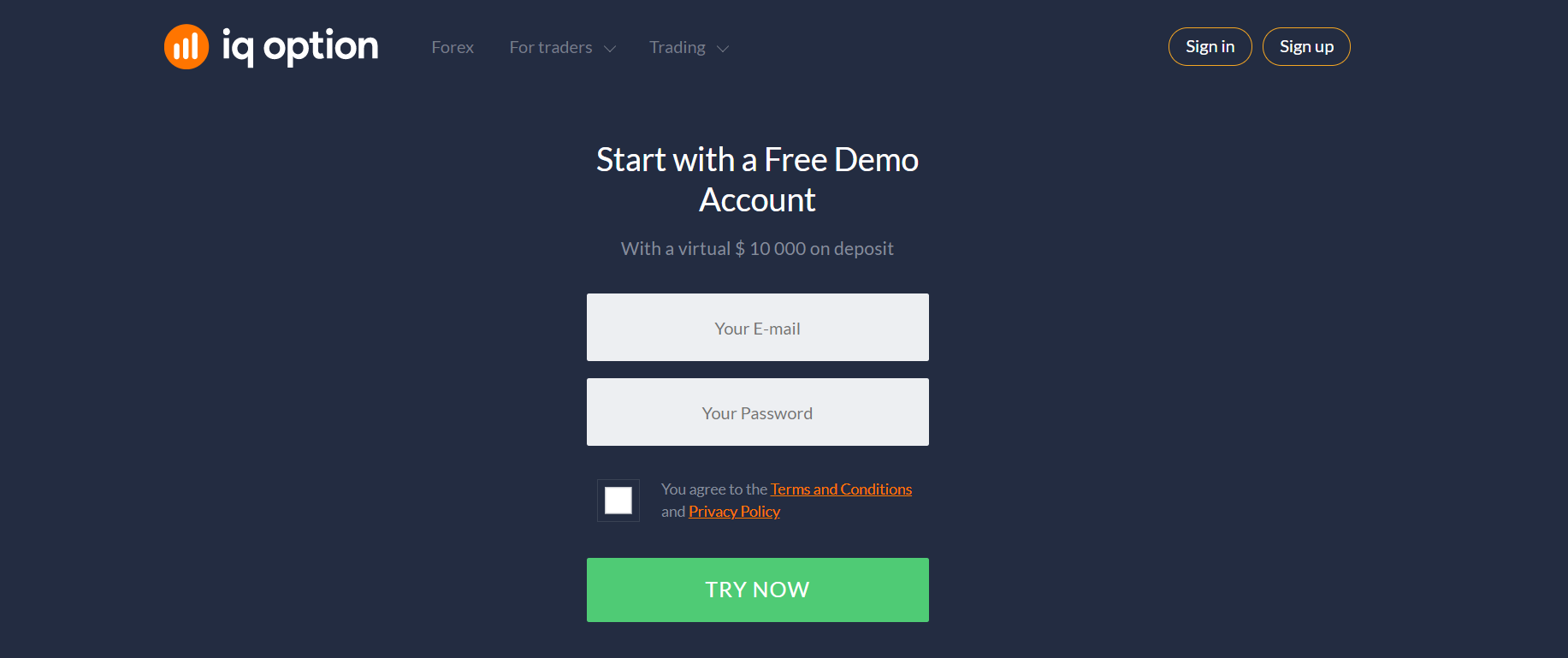

- Register on an online trading platform;

- Open an account.

What points you need to consider when choosing a broker, we have already mentioned earlier. Registering on an online trading platform is the easiest process which does not take much time and you do all the registration activities online, without visiting the offices of the brokerage companies. Simply visit the broker's website, activate the "register" option, enter your name and email address into the registration form. After the standard registration confirmation procedure via the specified email, your account is ready to use.

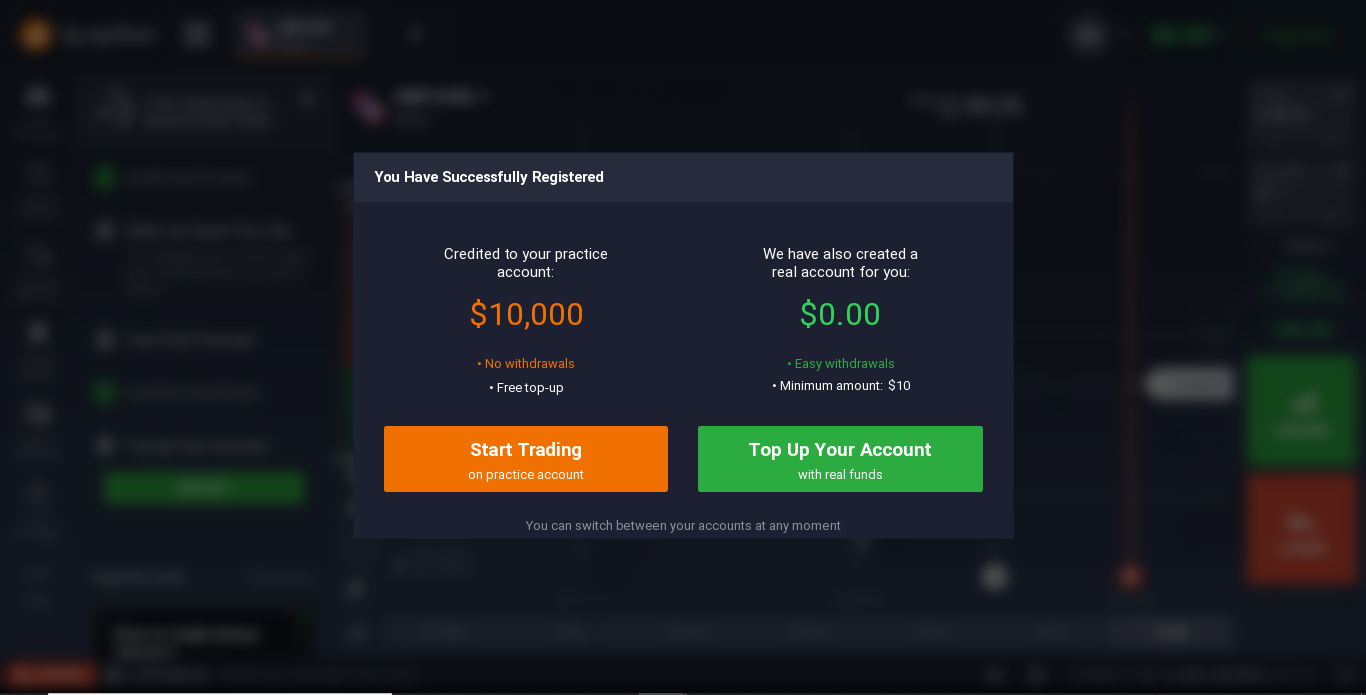

There is an option to use a demo account on the platform for training operations. Take advantage of this opportunity. It's good practice, without the risk of losing money. Just click the "activate demo account" button and your virtual account will be credited with $10000. This is dummy money - spend it on test operations to try out your trading skills before risking any real money.

A real account is activated on your first deposit of $10 or more. Click the 'make a deposit' button, select a deposit option and trade.

Pros and Cons of Day Trading

Intraday trading involves high-paced work, and is often stressful, so it requires great self-control and endurance. The aim is to choose the right moment to trade, like many other strategies.

Like any other strategy, intraday trading has its pros and cons. The ability to bypass the disadvantages and multiply the advantages of the strategy is what distinguishes a professional trader. The disadvantages are as follows:

- The more trades you have to make in a day, the more effort it takes to work. And you can get a decent profit only if you make a large number of deals.

- Day trading requires constant concentration, a trader must "keep the hand on the pulse" of the market, react to the slightest changes, and there is not much time to analyze the situation and the trader in this situation.

- A large number of deals often results in high commissions.

Most of the inconveniences are caused solely by the dynamics of work and nervous tension which often disturbs the trader. For those who are able to work in such a mode, the tactic has a number of advantages:

- Risk control.

- No "gaps" (significant gap between prices).

- An undoubted advantage of short-term trading is that profits appear much more frequently, although not always in large volume.

- Intraday trading allows you to quickly see the results of your activity.

- Short-term deals usually involve smaller amounts, which means that in case of failure the trader's losses will not be so great.

Related pages