Full swing trading strategy

Swing trading is trading where positions are held for several days or weeks. Swing trading is more versatile than day trading and suits more people because it does not take as much time and does not require instant decision-making speed. Since a trade lasts for several days, it is easier to enter and easier to exit. Swing trading is trading that uses both brain hemispheres most effectively - both intelligence and intuition are important here.

Swing trading and its strategies in Hong Kong

Good swing trading can be compared to surfing. Surfers skip most of the waves. They wait for the big waves to rise to the right height and then choose their moment to enter the wave at a certain point in its formation.

Positive aspects of swing trading strategies:

- The trend movement has a certain cyclicity, and the swing trade represents a certain part of this cycle. The main task of a swing trader is to join the value movement in time and hold a position for a certain length of the trend movement. Swing player is excellent for those speculators who use analytical tactics to trade forex.

- A speculator using swing day trading strategies must learn to trade in any state of the market, both during consolidation and during sharp price fluctuations. By learning to hold a position for a long time and closing trades in a timely manner, you will be able to multiply your capital. Nowadays swing trading is mastered by only a small fraction of traders who managed to achieve great success.

- Swing trading is the best strategy where you can open an optimal number of orders. In this case, the trader does not have to pay numerous commissions to broker companies, as scalpers do. Moreover, swing forex player allows traders to get out of a stagnant market without turning trading into an investment.

- The success of swing trading strategies depends on choosing the right company/broker. The speed of order opening plays a very important role in swing player. A trader who uses this tactic enters the market before the sharp bounce occurs. The profit is fixed at the climax, before the jump is over. In this regard, the trader should choose a broker that reduces the spread at these moments.

Swing trading is trading on fluctuations lasting 2-3 days. Swing trading strategies are suitable for those who do not have time to be in front of the monitor during active player hours and who nevertheless want to profit from sharp price movements in both directions.

To build your own effective swing trading strategy, you must adhere to basic rules:

- Choose to trade only those assets with a medium-term trend on their charts (preferably at the nascent stage), or a clear price channel, the boundaries of which are strong resistance and support levels.

- The strategy should include at least two methods of market analysis, one of which will be the main and the other will be a filtering one. These may be two indicators from different categories (trend and oscillator), or an indicator and levels, or a trend line and a volume indicator. The combinations may be any.

- If the market went in an unexpected direction, you should not wait for the stop-loss to trigger and suffer big losses. Wait for the formation of several candles, and if the situation does not change for the better, then close a knowingly losing position manually.

- Do not open a position 60 minutes before or after a major economic news release. You should also avoid trading at the opening of a player session, unless your strategy is based on such a technique.

- Profit should be taken in stages, gradually moving the position to Breakeven.

- If the market is moving in the direction you want, hold your positions open until you maximize your profit.

- If prices rebound sharply, you should take your profit immediately, because after a powerful spike, a trend can stop or a deep correction can occur.

- Active positions usually are not carried over to the next day. The exceptions are the most profitable orders that accompany the powerful long-term trends.

- No more than 3% of the total deposit per trade can be placed.

- In order to increase the number of trades and profit, you can trade on 2 or 3 currency pairs at once. But do not open too many charts, as it may lead to confusion in the signals and reduced concentration.

- The term "Swing" refers to part of a price level cycle. When using this trade, the trader needs to use cyclical price movements to create profitable orders.

Swing trading strategies in Hong Kong can be used when a flat prevails on the currency chart being used. Traders will need to identify support and resistance levels which function as channel boundaries. As soon as the price level reaches one of the boundaries of the channel, orders should be placed. If the price is near the support level, a trade should be created for buying currency, and if the price is near the resistance line, a trade should be created for selling currency.

The essence of swing trading strategies in Hong Kong is to analyse price level fluctuations and determine as accurately as possible the appropriate moment to open a trade.

In swing players, you can make quick trades and follow the principles of wave theory, which is the basis of many other indicators and strategies. To better understand how swing trading works, you should consider the following features to distinguish it from other types of player.

Distinguishing swing trading in Hong Kong from other tactics:

- Swing trading is a special tactic with many tools and techniques at its disposal, it is not limited to a specific conjunction of indicators or the search for a particular pattern.

- Swing trading can be confused with day trading. The similarity is that these strategies use daily timeframes, but the difference is that swing trading is associated with a swap. Besides, swing trading does not take much time as opposed to action trading.

- There are also some similarities when comparing investments and swing trading. Swing traders focus on price movements, while investors focus only on a long term trend. The difference is also in the timing: investments are more long-term than swing trading.

- Swing trading is often confused with scalping. Just remember that scalping is leading by the low timeframe, while swing trading is led by the medium-term strategy. Also the time you spend in front of the screen is an obvious sign of the difference - in scalping you have to spend a lot of time on the online platform, and in swing trading you do not have to.

You must not forget about swing trading strategies' management techniques, otherwise you can lose: Take Profit and Stop Loss. There are simple rules of thumb to follow:

- Take Profit is ideally 3-4 times the stop loss.

- When buying, the stop loss will be below the lowest point of the chart, take profit at the level of resistance.

- When selling, the stop loss will be set above the price maximum, take profit in the support zone.

- In addition to strict fixed stop signals you can set a floating stop loss, this will allow for greater profits.

- The timeframe for swing trading should be low, usually M5 to H1.

It should be noted that the market is highly volatile in the morning, due to unclosed positions until the night, which is a characteristic feature of the market. And by the afternoon the situation stabilizes, the market becomes less volatile. So go ahead and have a good time trading!

There are certain methods of managing swing trading strategies in Hong Kong: active and passive.

Passive swing trading management techniques

These include all methods of building and maintaining a portfolio, including diversification. Passive portfolio management are techniques suitable for long-term investors who do not want to spend a lot of time and effort studying the market. For the investor, the most important thing is to preserve their capital and, if possible, increase it slightly.

Active swing trading management techniques

Active management is what will help you get more out of your portfolio. Active management is usually reserved for speculators, not pure investors. Active management techniques are designed to squeeze the maximum profit out of a portfolio.

Active management includes:

- Rotating the securities in the portfolio without changing its structure. This means that you will sell higher-priced stocks and buy lower-priced ones by selecting instruments from the same sector;

- Market analysis and choosing the right entry points;

- Choosing specific assets.

In simple terms, active management is all about speculation, but with the structure of your investment portfolio in mind. No matter how ideal your portfolio is, it is good practice to review it regularly. Reviewing your portfolio structure is more of a passive management thing. You should do it at least once every six months. Evaluate the state of the markets and swap "declining" stocks for securities from growing sectors. We wish you successful investments!

How to swing trade equities in Hong Kong?

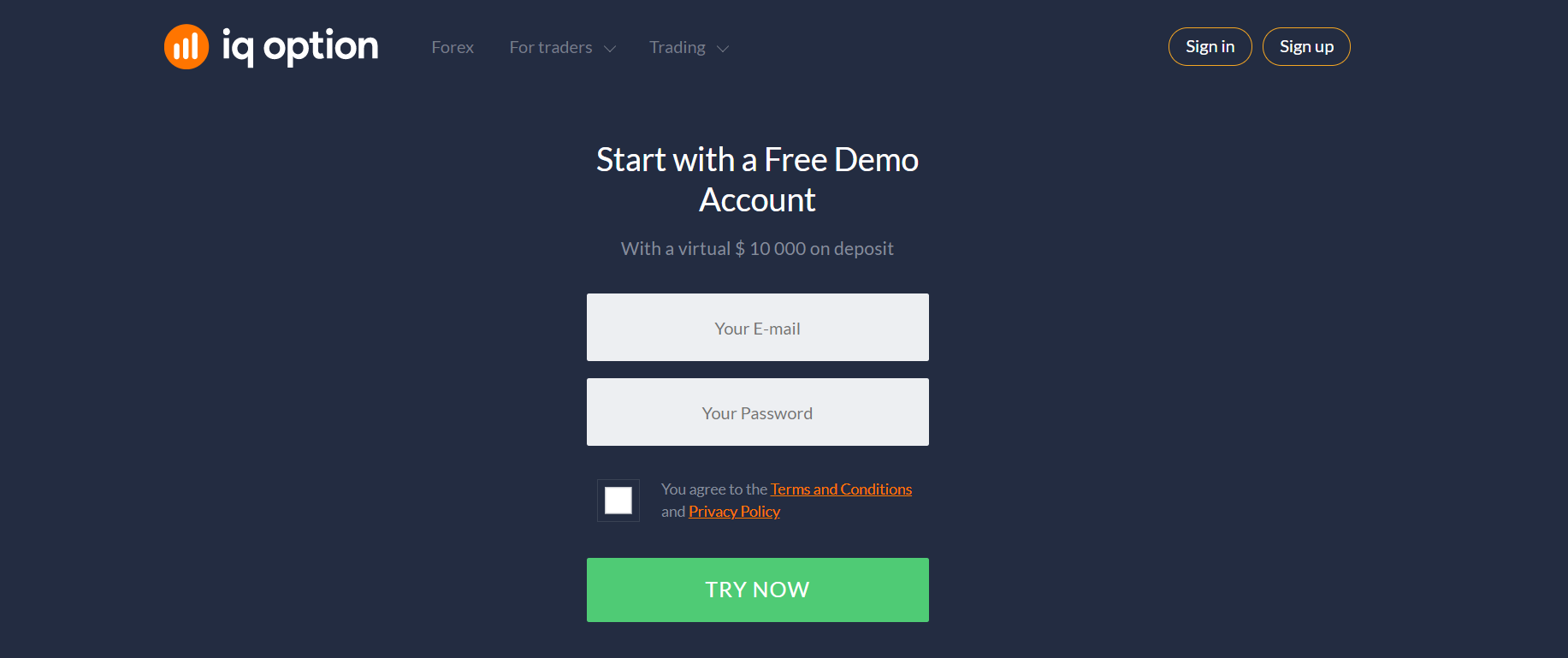

In today's world, online services make swing trading easier by using technology and offering new forms of investment. To start swing trading strategies stocks in Hong Kong, you need to decide on a broker, choose an online trading platform and complete the registration process from the comfort of your own home. It is easy and free! You need to provide your personal details such as name, email address. Then confirm the registration process. After the registration, you can already start playing with swing stocks trading strategies.

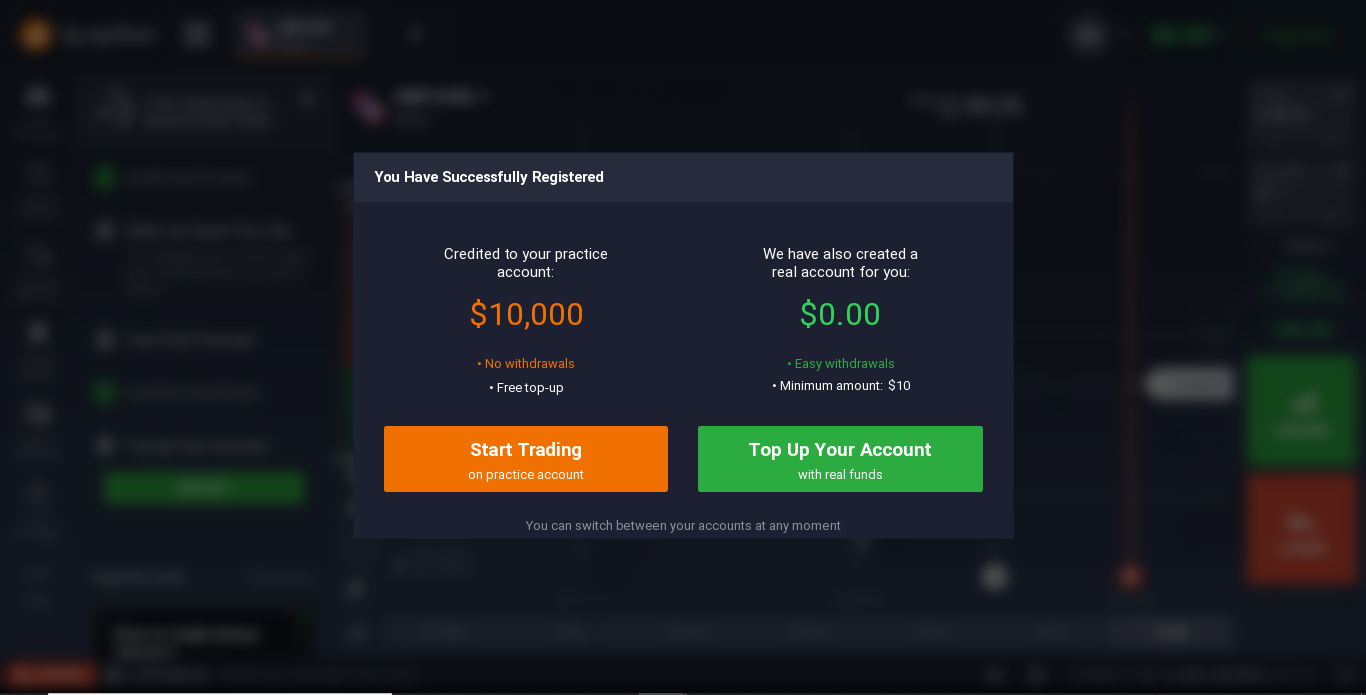

Once you register, you will have access to a free demo account. A demo account is a virtual deposit given to the client by the broker for the player. All operations on it are made only with virtual money, and the quotes and the trading process are identical to those on the real market. You can use it to carry out the same operations as a real account.

Swing trading, the best strategy in Hong Kong, is now available to everyone. Just do it!

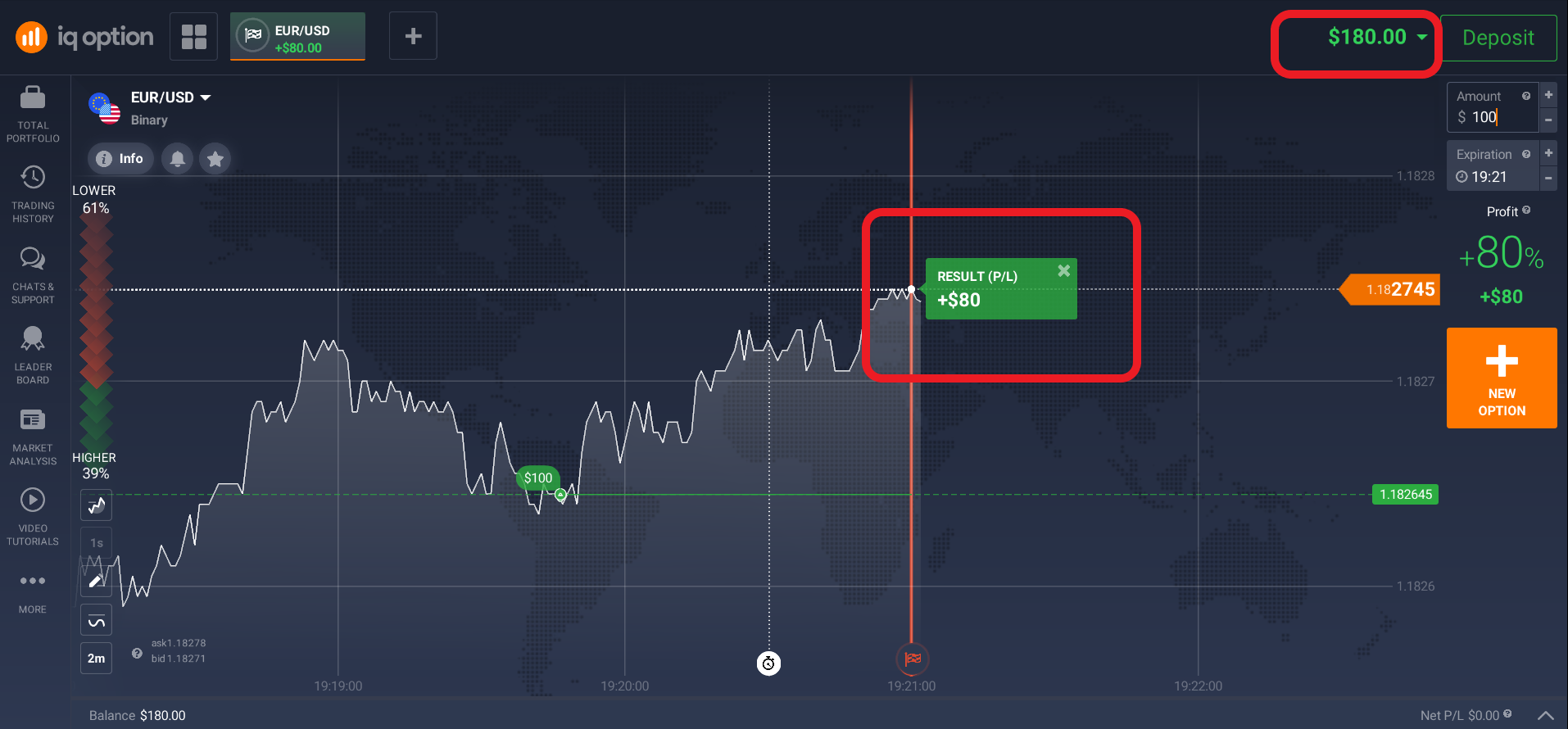

To start player for real, you must fund your real account. Funding your account is easy. To do so, click the "Deposit" button and choose one of the funding options offered by the system: by bank card or via one of the online payment systems. Depending on the chosen method of funding, the money will be available from 5 minutes to 24 hours.

If you have any questions about the trading platform you can ask over the phone or in the chat room of the platform. The trading platform is open 24/7. This means you can log into the trading platform under your account, anywhere, anytime. So, learning how to trade swing trading strategies in Hong Kong, even if you are new to the stock market, is easy! We wish you a successful investment!

Related pages

Martingale strategy for binary options