Crude oil trading platform in Hong Kong

In the past few years, Hong Kong's largest investment banking and financial institutions have already been investing big bucks in energy and commodity trading platforms to facilitate their clients' trading activities. First and foremost, the platform is an excellent service offered by brokerage dealers. The main reason the platforms are so popular is because they have a very high degree of automation for trading transactions.

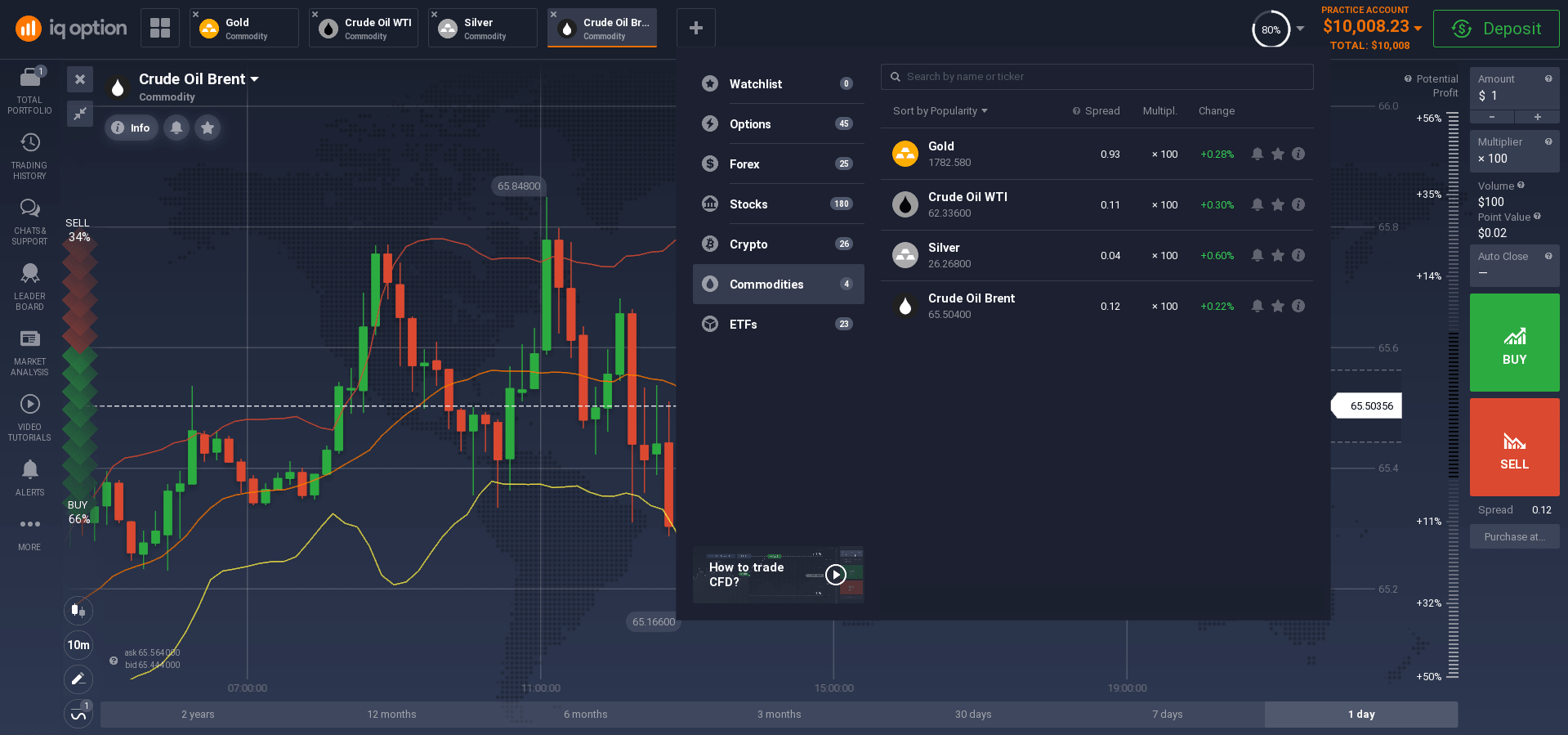

For example, our crude oil trading platform was created by professionals and uses high quality and convenient terminals, thus it is a reliable platform that will surely bring you the profit you desire!

But don't be fooled into believing that brokerage platforms will provide you with all the information you need without any effort on your part. You should study the fundamentals of the market as much as possible, how the oil price is formed, what indicators and charts do you need, etc. With knowledge and a clear strategy, you will be able to take full advantage of the platform.

However, if you still have little experience and knowledge, you can open a demo account with us, it is convenient and allows you to learn to understand various data graphs without spending your money.

Another important aspect to consider when choosing a platform for trading crude oil will be the number of trading indicators. The quantity and quality of these indicators will greatly affect your trading performance. For example, some agents do not provide any indicators at all in the crude oil trading platform. Any strategy should consist of several indicators. The ideal option is the presence of a trend indicator, as well as an oscillator.

As a trader, it is important for you to have a good understanding of the underlying patterns before you can develop a strategy that gives you a potential advantage.

When you combine a couple of these different methods, you really "discover" the power of technical analysis. And although our site has a huge variety of indicators, here are the most popular indicators that are used to trade oil:

1. Moving Average indicator - for determining the trend.

The first indicator is a trending instrument called Moving Average (also called Moving). It will give us an understanding of the current trend in the market. Many trading systems and strategies are based on this indicator.

2. Stochastic indicator - to determine the entry point.

The second indicator is an oscillator called the Stochastic Oscillator, which will tell you where to buy and where to sell oil by crossing signal lines. The essence of the oscillator is to show how far the price has deviated from its average values.

3. Each trading instrument within a specific period has its own volatility amplitude, or power reserve, which is calculated in points. It is called Average True Range, or ATR. Why would a trader know the ATR of oil prices? In order to understand the potential for continuation of the movement and not to enter a trade when the directional movement is already running out.

When choosing Crude Oil to trade, you should also be mindful of the number of trades you will be able to carry out on a daily basis. Also, look for a platform that has instant market views and direct data feeds. This will allow you to find price action over a period of time.

How to make money trading crude oil in Hong Kong?

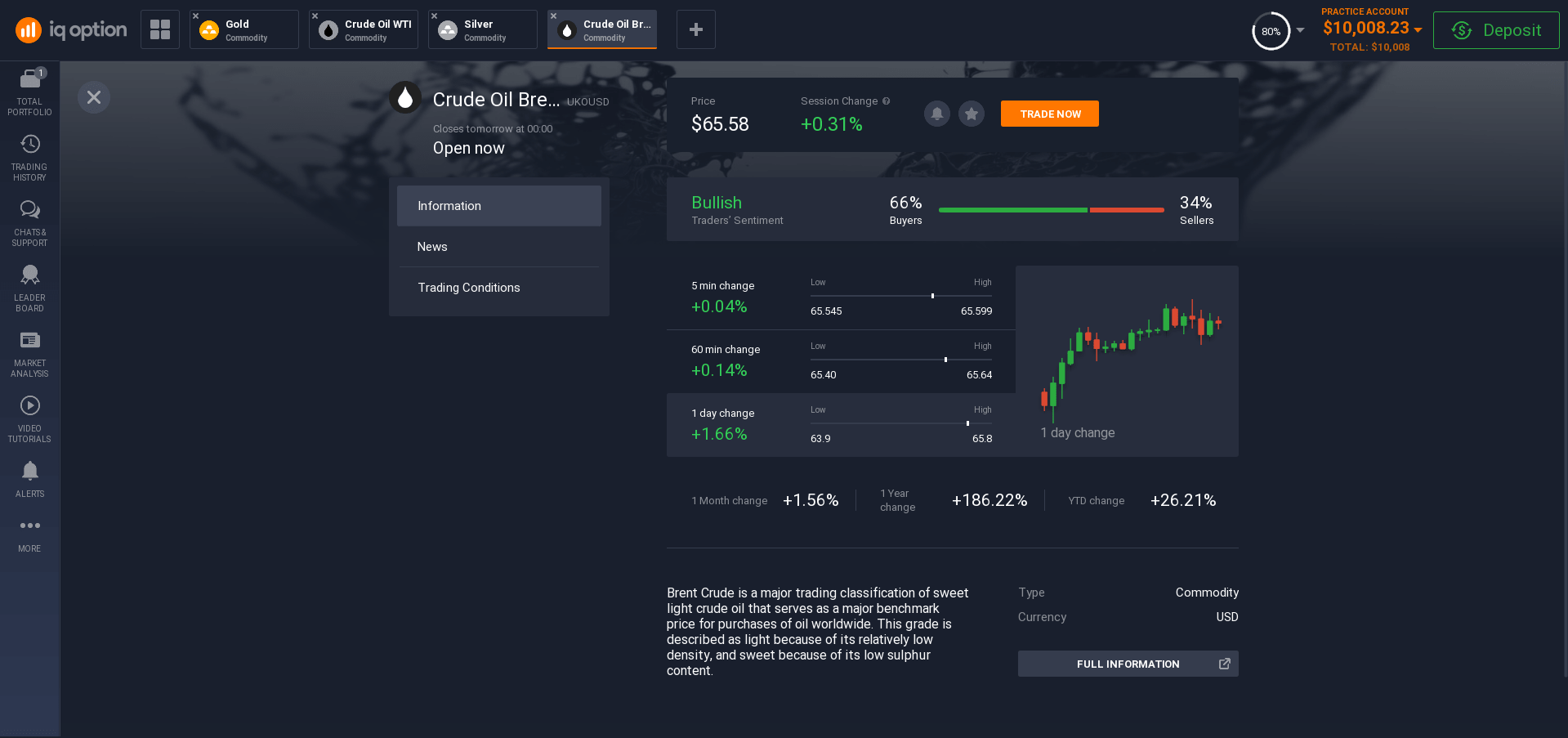

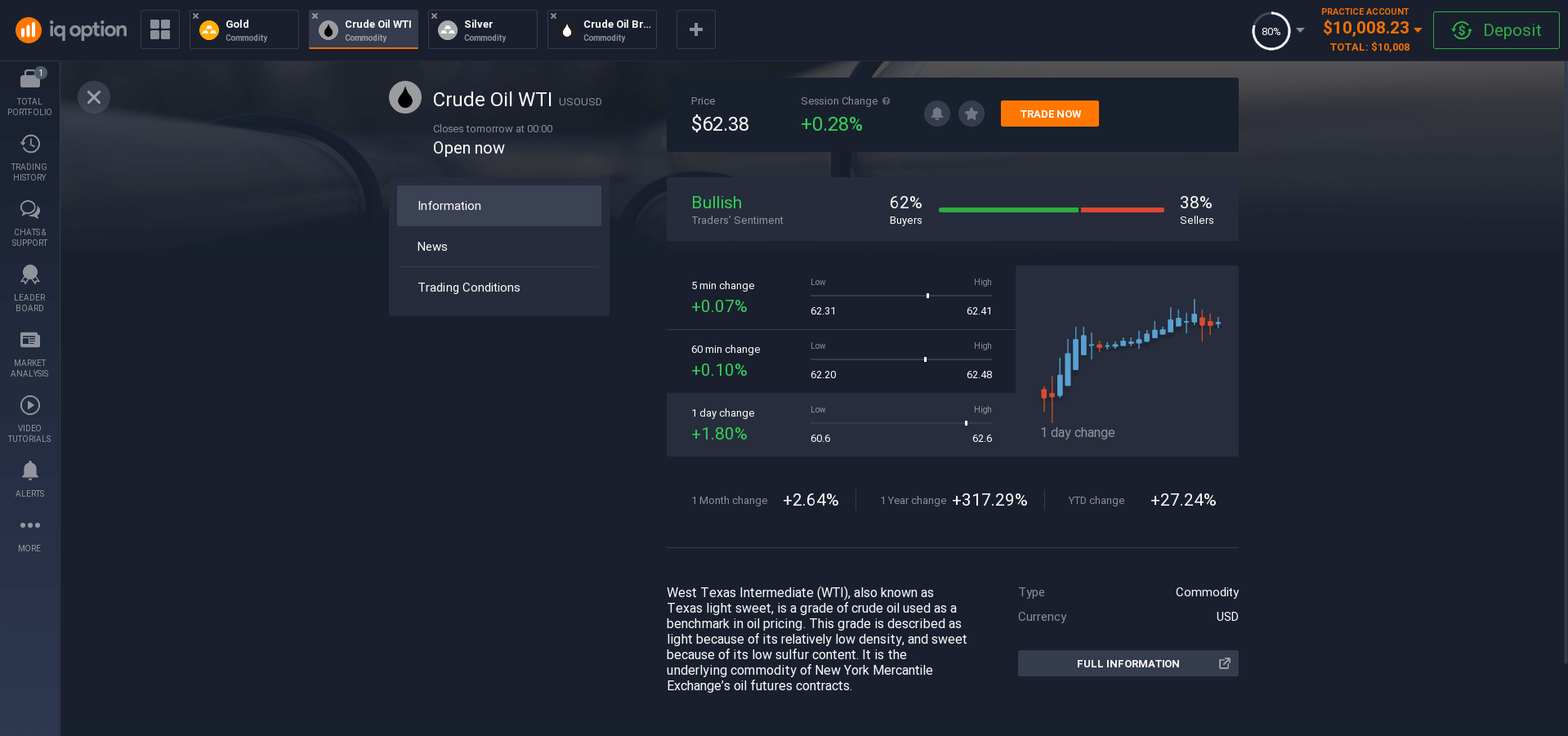

Crude oil contracts are the world's leading energy benchmark. The contract is quite liquid and, moreover, has the qualities of high volatility, which attracts traders and investors. It is likely to generate a substantial return on your investment in the crude oil market if you use the right investment strategy.

Online trading of oil on the exchange is carried out by crude raw materials measured in barrels. For reference, one barrel of oil is 42 gallons, or 158.988 liters.

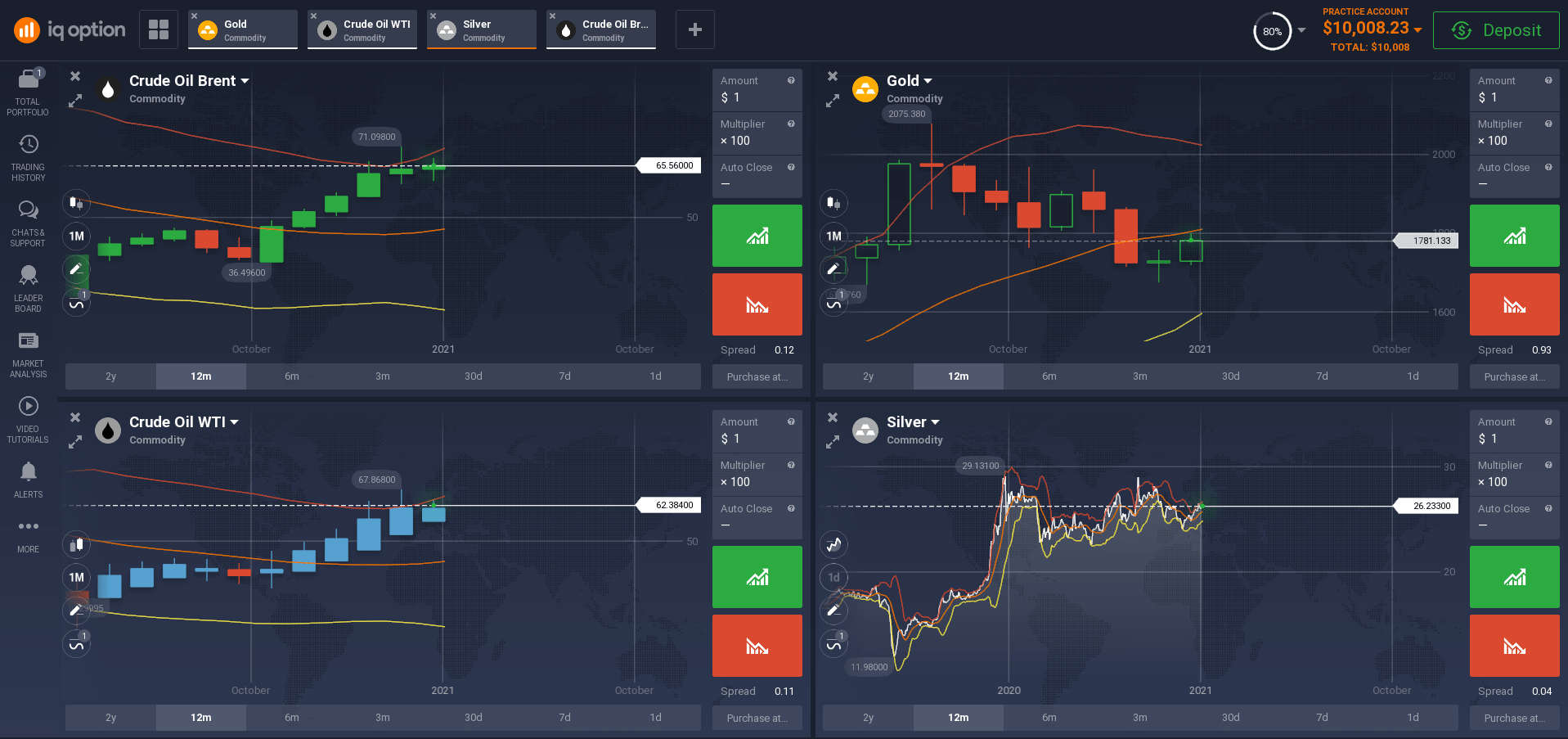

There are 2 types of oil, BRENT and WTI on our platform.The price of oil refers to the amount that must be paid for one barrel of the product. Crude oil is a commodity that has a significant impact on energy costs around the world. In addition, this product additionally affects the American market. There are two types of traders in the oil market: short-term and long-term. Long-term investors buy goods that have a lifespan, that is, decades, and invest them over a long period of time, such as 10 years or longer. These traders seek profitability by holding on to a commodity for several years and thus build up their portfolio with significant long-term returns.

On the other hand, short-term investors usually buy a commodity and sell it for a day or week / month to make a profit. These short-term investors look at future prices using charts to determine their profit prospects. They follow the pattern of the price movement of crude oil futures and thus provide themselves to capitalize on profit opportunities exactly when they arise. Therefore, they will have to regularly contact the market.

These investors look at the factors affecting crude oil prices and buy and sell the product when prices go up or down. These variables include the balance of trade in world energy markets, the state of the world economy, etc.

Short-term investors are also studying the political situation of countries to assess their future forecast for the global energy market.

Many believe that the supply of oil is shrinking. The limited supply of crude oil is mainly due to the growing demand for this product. In addition, the fact that the world's energy markets are dependent on oil exports makes this commodity a highly viable solution to the energy needs of many countries. One way or another, the authorities of different countries encourage the use of this source because of the advantages that it gives to their own societies, market and way of life.

There are many factors that affect the crude oil futures markets such as the balance of trade, the world economy, politics, geology, economics, geography, natural resources, the oil industry, etc. These factors determine the state of the art of their oil industry. They also play an important role in shaping the future of this global crude oil futures exchange. Most of the trade takes place between producers (i.e. refiners and oil producers) and consumers (i.e. oil firms).

To be able to take advantage of the expensive oil market, investors use oil CFDs. Crude oil CFDs are popular with traders who use them as part of their portfolio diversification strategy. Some investors prefer long-term investment plans, while others prefer a more flexible portfolio. Short-term contracts, however, are ideal for those looking to speculate on short-term trends in the oil industry.

How to start crude oil trading in Hong Kong?

The secret to successful trading is to be prepared and have a plan. It can help you set realistic goals, so you can understand exactly what needs to be done to make this happen.

You must learn about the crude oil trading platform in Hong Kong before you start real trading. You will be able to determine which platform is best for you. Furthermore, you also need to understand how to exchange in a computer system. Once you are well versed in the trading platform, you should start making trades on the live platform. This will help you learn more about the market and better understand the process.

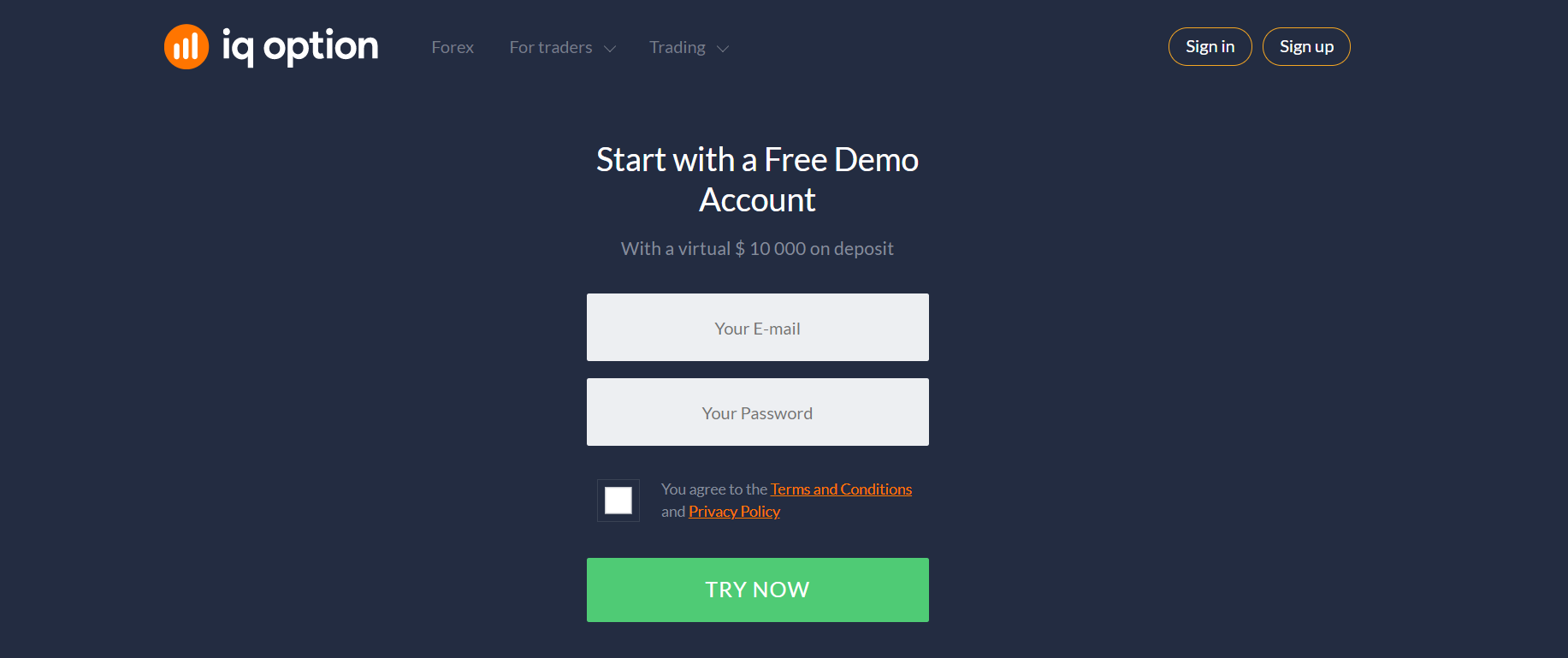

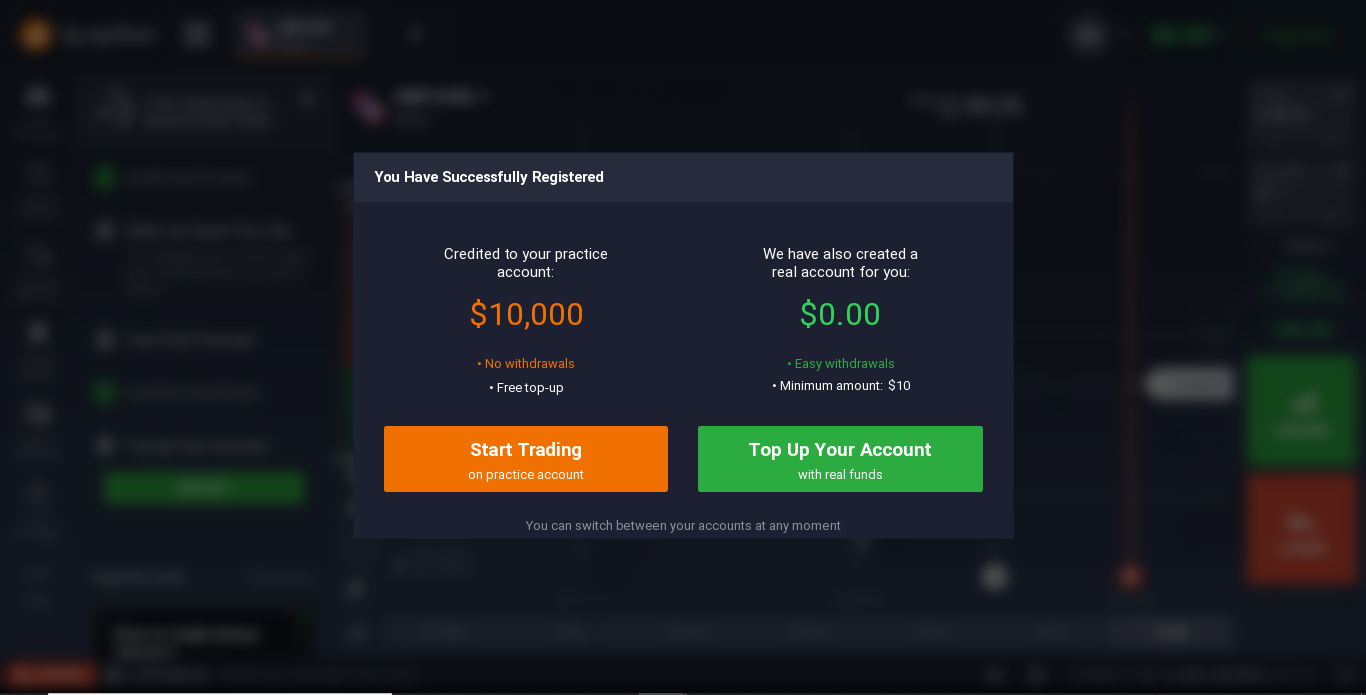

You can start your journey into the world of trading by opening a demo account for trading on our website. It is very important that you do this as it will give you an idea of how best to buy and sell these stocks. Within this account, you will have $10,000, this is a virtual amount. And also the opportunity to receive training and learn how to maximize profits and minimize risks when working with oil.

Once you feel comfortable enough to do this, there will come a time when you can go ahead and open a live trading account, for which you will need a small deposit of $10. The first thing you should do before investing in the crude oil market is to analyze the current trading scenario and choose the best time to enter the market in order to make a profit. It is very important to have a basic knowledge of the market.

You can make money on oil without leaving your home, and oil CFDs help in this.

In general, what are CFDs? This is a derivative, the full name of which sounds like "Contract For Difference". In fact, it is simply an agreement between the buyer and seller of a contract to transfer the price difference to the underlying asset. When buying / selling, there is no delivery of real raw materials, i.e. the buyer and the seller enter into a "paper" agreement that at the time of closing the transaction, mutual settlement will be made, i.e. the party whose forecast turned out to be incorrect will pay the price difference to its counterparty.

The most important thing when you open an account is to be more calm and focused. Don't be impatient if you are not getting results right away. Take your time and if you follow the ideas given in this guide, you will open up a demo account for beginners with achievements.

Related pages

Day trading platform in Hong Kong

What to look out for when choosing the best mobile trading platform?