Multi Asset Platform in Hong Kong

What is a multi assets trading platform?

Multi-asset trading has been gaining momentum recently as brokerage firms look for opportunities to expand and increase access. In parallel, traders are increasingly using multi-asset trading strategies to speed up trades and increase diversification of the overall portfolio by spreading investments across multiple classes.

Platform, is an online financial intermediary that allows traders to trade on or off the stock markets.

Features of the multi-asset platform

A useful option of the platform has been the ability to track your account and trade through a mobile app. This feature-rich app allows traders to keep their business in their pocket and be aware of what's happening in the market.

A good brokerage platform will teach you how to trade if you are new and have a lot of questions. You will see a lot of training on the platform in the form of video tutorials on various topics, you are sure to find a lot of useful information for yourself.

The online broker provides complete and transparent asset information, with online access to real-time quotes. Some of the features available on the trading platforms include a number of tools which can be used to build an effective strategy. These include market reports and news releases.

The multi asset trading platform allows traders to create and manage an account from anywhere in the world. Traders can make trades from their mobile phones, tablets or laptops. When you open your brokerage account on the platform, you will see how convenient it is. You will be able to track your trading history, analyse your profits and losses and change your strategy if necessary.

With its wide range of investment products and services, the brokerage platform is a one-stop solution for your investment needs.

A trading platform is a web-based program or software that allows you to monitor and manage your trading accounts, execute trades, view stock quotes, select stocks and, finally, invest in the market. With a robust trading platform, you can study historical data and assess future possibilities for different investment options. You will gain more experience in the stock market and have a better understanding of risk management.

Types of asset analysis on the platform

Before you invest in any asset, you need to analyse it. You want to invest money with an understanding of what the asset will be in the near future. Of course, no one can predict what will be 100% in the future, but analysis significantly increases your chances of making a profit. There are 2 main types of analysis.

Fundamental analysis is used to evaluate a particular company or any asset from the key indicators side. If it is a company, you will analyse its profits and losses and look at its development strategy. If it is an option, you will look at what is happening to the market as a whole, studying news in the desired area, etc.

Fundamental market analysis, includes changes in economic, political, social events. The best tool for such analysis is the economic calendar.

The calendar reflects the news that happens in different countries. All the news are divided into three groups according to their importance:

- Weak news, which has little or no impact on market price movements;

- Moderate news, may have a certain impact, causing short-term impulse movements in the market;

- Important news, such news may not only change the course, but even reverse the market movement.

Technical analysis is carried out with the help of graphical drawings or by means of technical indicators. During graphical drawings different lines, graphical figures, support/resistance levels are used.

If a trader uses technical indicators, in this case, he analyzes them, looking for the most opportune moment to open deals, in other words, he finds entry points into the market.

The candlestick analysis is widely used by traders. To use the results of such prediction, it is necessary to study the Japanese candlesticks, candlestick configurations, and patterns. They need to learn and be able to find them on the chart.

The more often a beginner performs the candlestick analysis, the faster he remembers the candlestick patterns, with the help of which this type of market research can be conducted.

Types of platform trading

Today's trading exchanges are an important link in the market economy. They act as intermediaries and regulators, ensuring that various financial instruments are stable. So, a multi assets trading platform can offer you a really wide range of instruments to buy. These include currency pairs, indices, company shares, options, and forex. How to choose the best and most profitable asset? You should try investing in each type of asset to see which one is best for you. It depends on your investment objectives and the length of time you wish to invest. Let's take a look at the most popular trading assets.

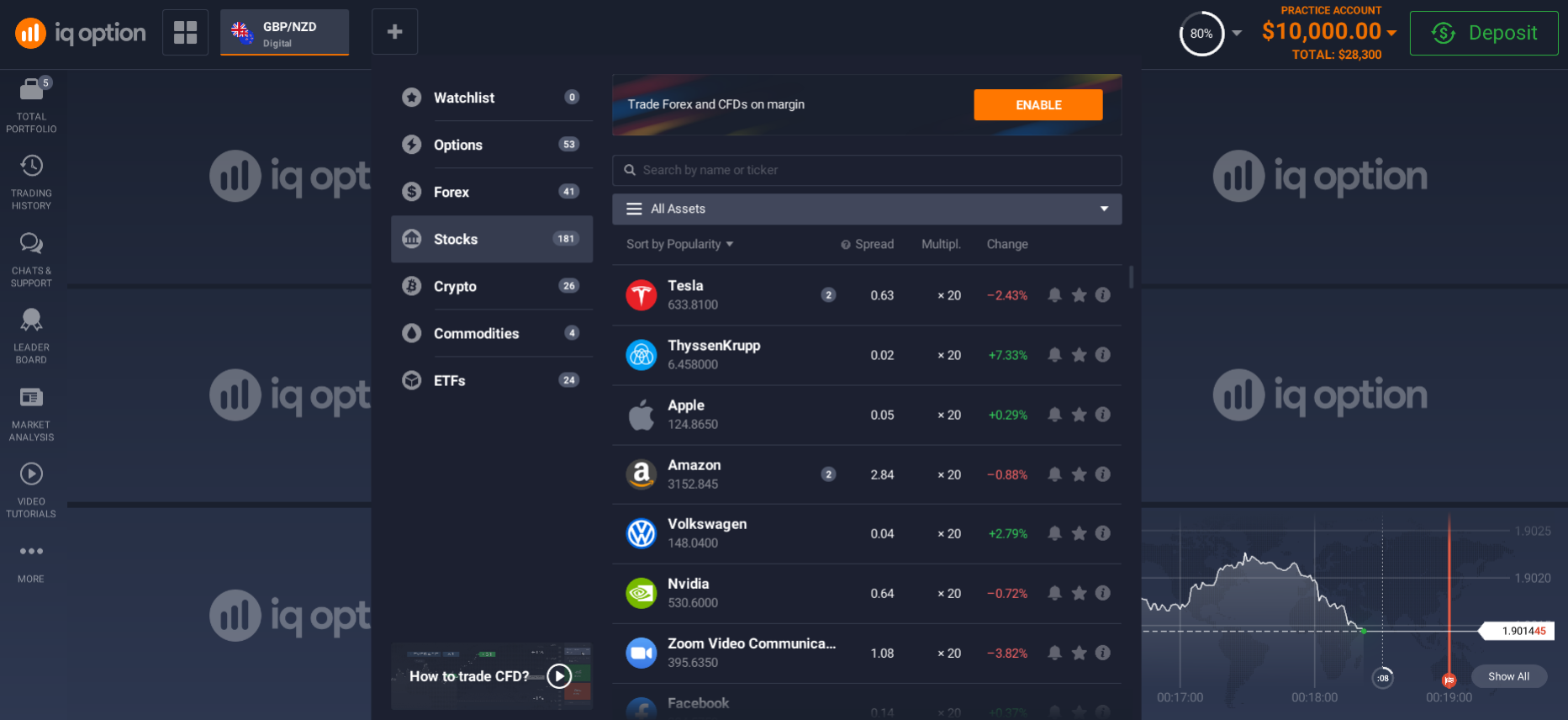

Platform for stock trading

A stock exchange is a security issued by an issuer for the purpose of raising new investors and money for the development of the business.

The approach to stocks and their analysis differs depending on the style of work:

- Long-term investing - you need an understanding of the outlook for the sector in which the company operates and its financial condition. The creditworthiness, expected income, roadmap and cost structure are assessed. An investor invests for a number of years and a careful selection of securities is required.

- Active trading - any stock screener and report release schedule is sufficient to understand which stocks can be profitable. A screensaver is a set of filters, indicators by which a trader follows the price movements of a stock over a period of time, tracking the formation of trading signals.

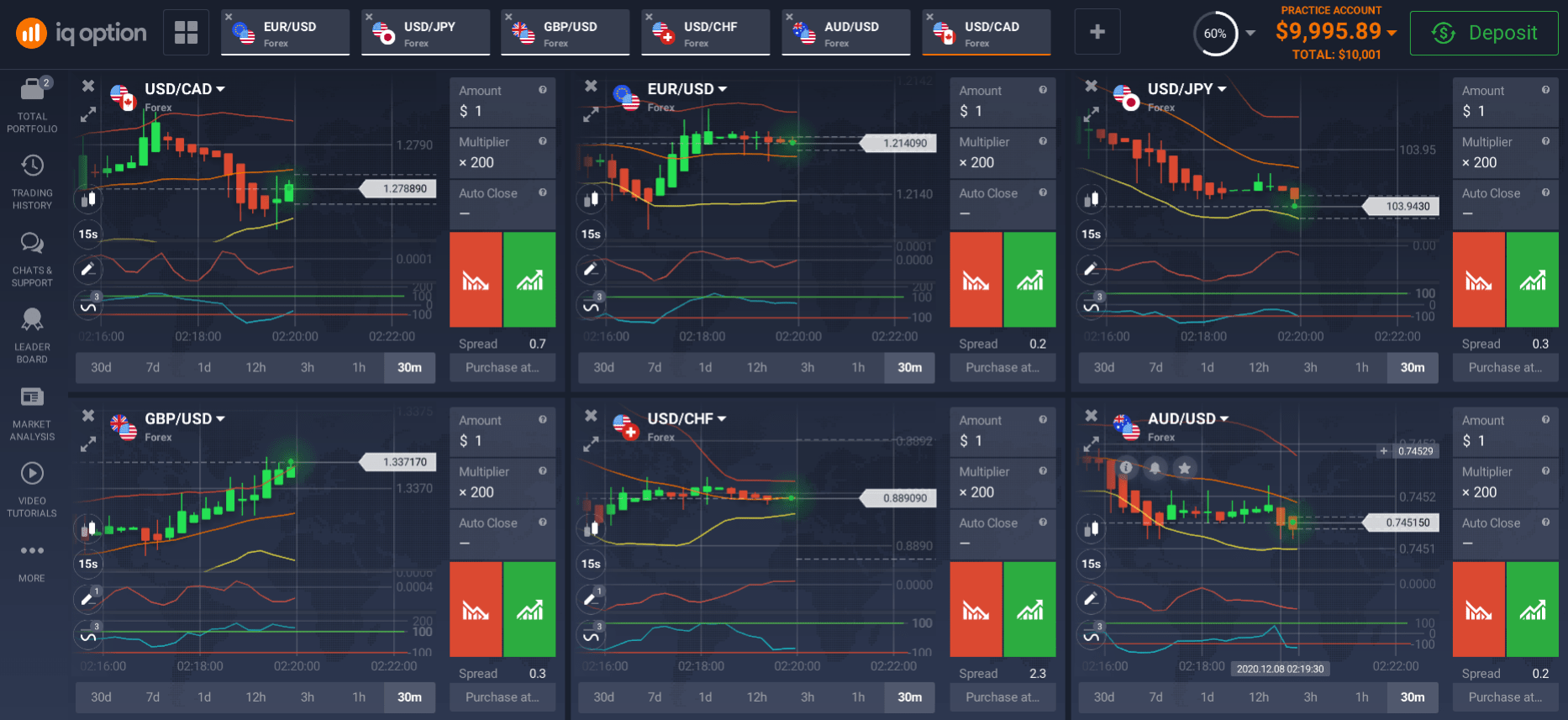

Platform for forex trading

Currency pair is a financial instrument for trading in Forex. By buying one currency pair, you automatically buy another. The first currency is called the base currency, while the second is called the quoted currency.

Depending on its popularity (trading volume) there are:

- Major currency pairs (sometimes called majors);

- Secondary currency pairs (Minors);

- Exotic currency pairs.

To make money on currency pairs, you must, as with many other assets, sell at a higher price than you bought.

Technical analysis will help to understand and predict the behaviour of exchange rates. Also, fundamental analysis is carried out with the help of an economic calendar for forecasting currency behaviour.

Platform for trading options

An option is a contract, which means that not the asset itself is traded, but the right of its pre-emptive sale (Call) or purchase (Put).

By this, you buy a kind of possibility to make a transaction with the asset later at a predetermined price. This will be the purchase price of the option; it's called the strike. Every option has its own expiry time. The time of expiry is called expiration, at which point you either exercise the option or it remains unexercised. This option is not free, to get it, you have to pay what is called the option premium. The premium itself is not a constant amount and depends on the strike price and market price of the underlying asset, which is constantly changing, as does the option premium, respectively.

A binary option is a distinct form of classical option. It is a type of financial derivatives that allows you to trade bets on price changes of various underlying assets, which can be stocks and indices of stock exchanges, Forex currency pairs, commodities and even the weather. Your main objective is to tell whether the price will move up or down from the current price. There are many binary options, but they all revolve around guessing the price.

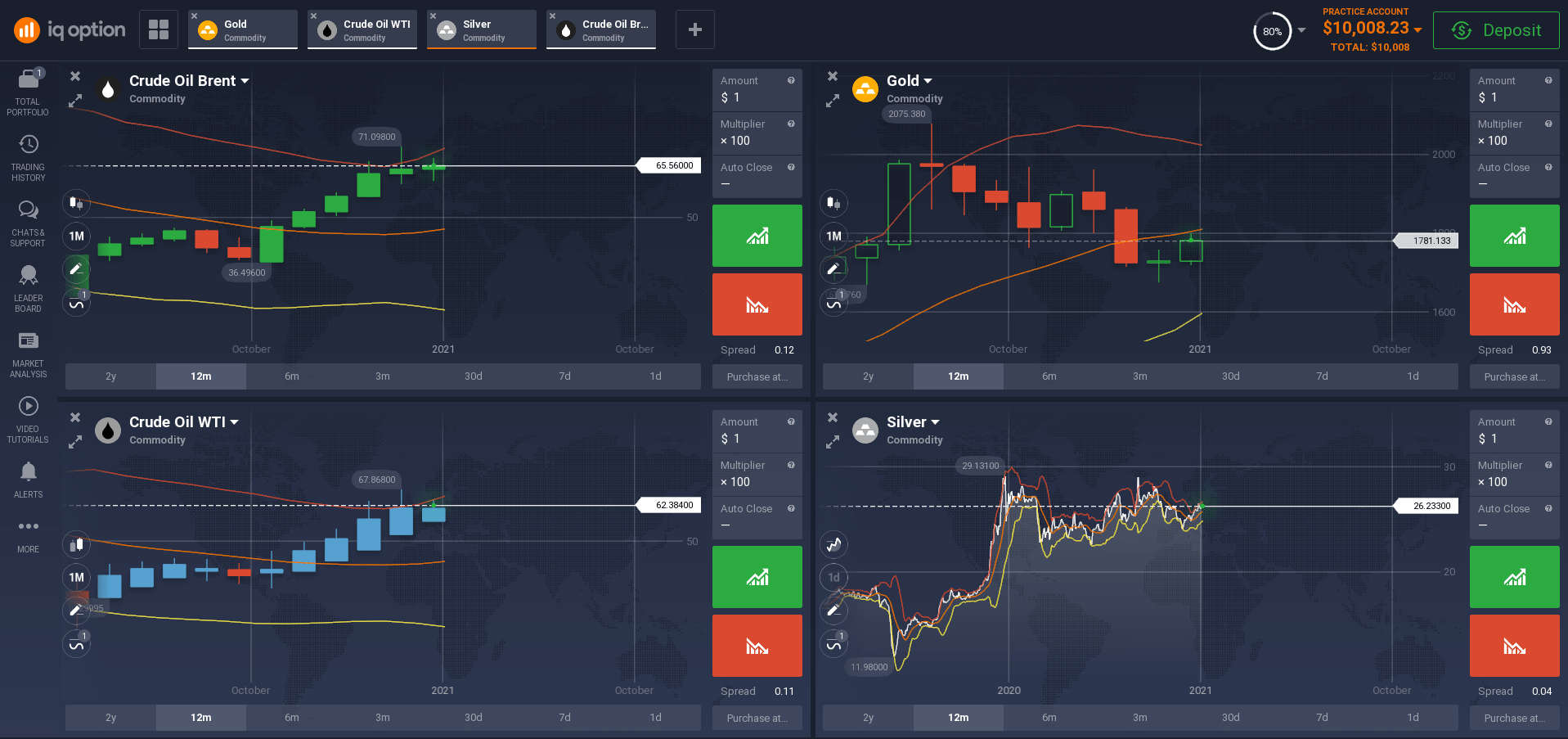

Platform for trading commodities

In commodities trading, there are four main categories which define the commodities market:

- Agricultural commodities: sugar, cotton, coffee beans, etc.

- Energy commodities: petroleum products such as oil and gas.

- Metallic commodities: precious metals such as gold, silver and platinum, as well as copper, steel and others.

- Livestock commodities: cattle and livestock, as well as meat commodities.

With the brokerage platform, you have access to CFDs on the most popular commodities. Essentially, a CFD is a contract between two parties, a trader and a broker. At the end of the contract, participants receive the difference between the opening and closing of the position in terms of money.

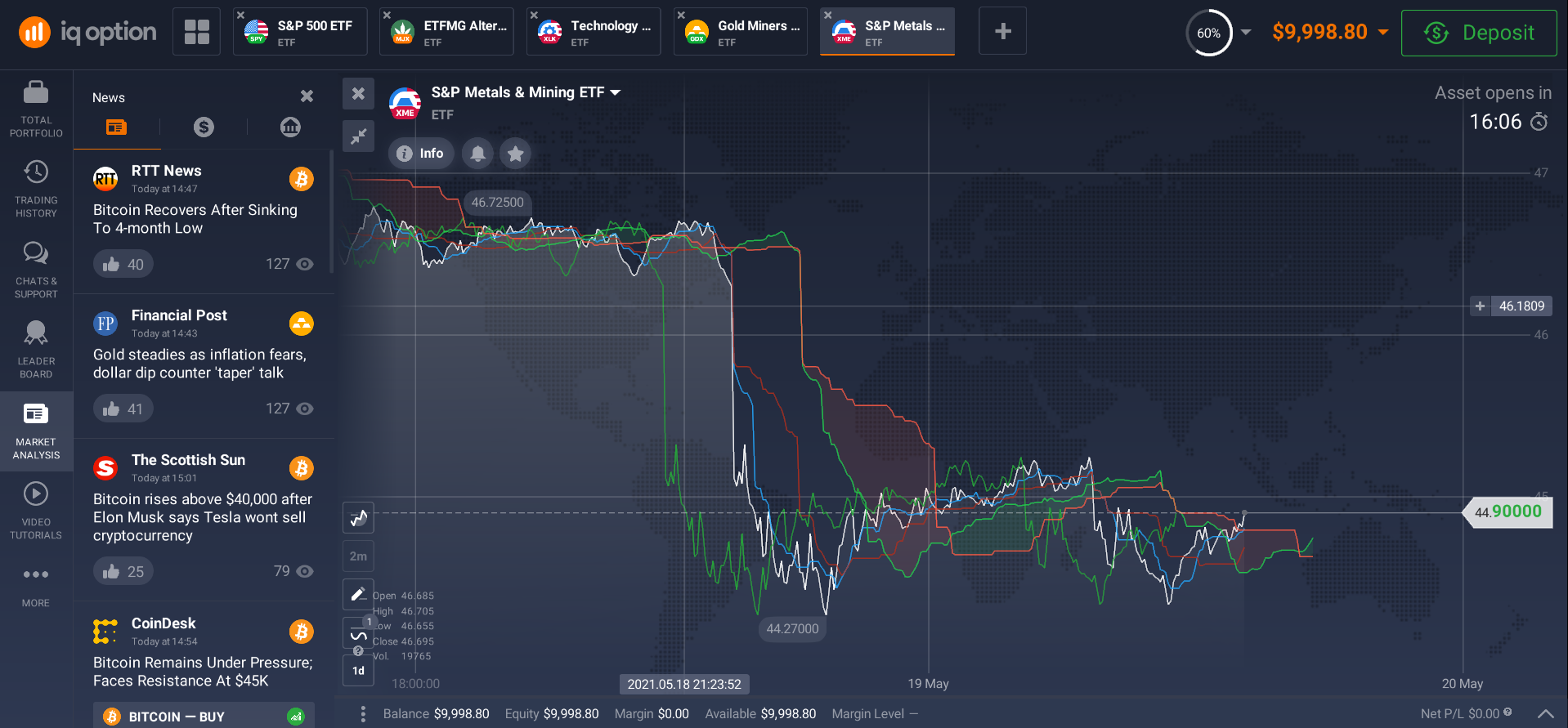

Platform for ETF trading

Each ETF is, conventionally speaking, a ready investment portfolio (fund) that, like a stock, is traded on exchange. An ETF contains a necessary set of securities or other assets, the fund is diversified and balanced, it is constantly protected against price risks, meaning that everything necessary has already been done for you. All you have to do is buy the fund on the exchange, like a stock, and wait for its value to rise. An ETF can be bought and sold at any time, just like any other asset on the exchange.

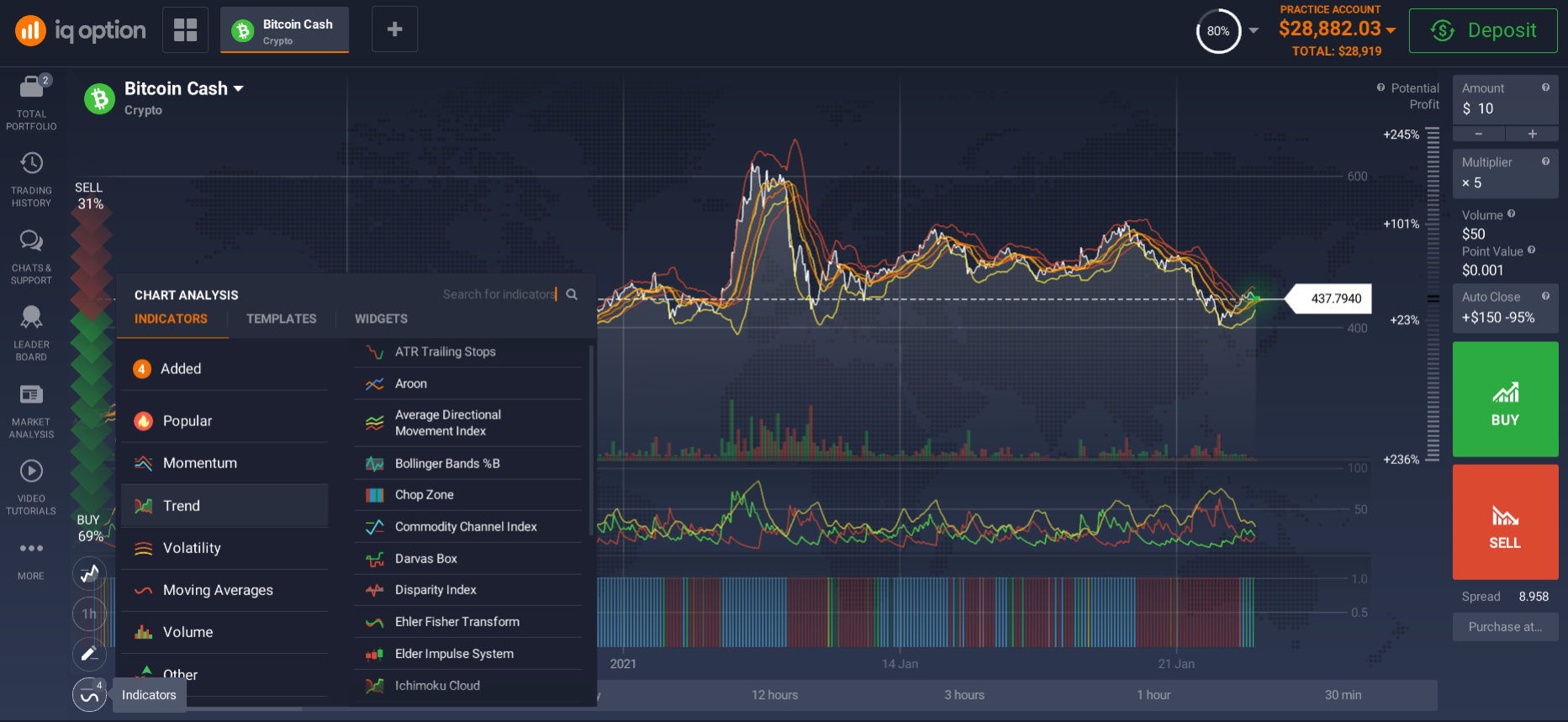

Cryptocurrency trading

Cryptocurrencies can be treated like regular stocks, currencies, i.e. they can easily be exchanged for money and back. Those who are familiar with the principles of stock exchange and Forex trading will have no trouble mastering this area as well. The charts indicate the trend of a currency's value: downward or upward. Cryptocurrency is characterized by volatility. That is why many traders use short trades for this asset.

So, the choice is yours, any asset can be tried out on a demo account, which you can also open on a multi asset trading platform. This will allow you to develop your own successful strategy.

How to start using a multi asset trading platform in Hong Kong?

For investors who are planning to enter multi-asset trading, it is crucial that they understand how to handle the brokerage platform, and how to make the most of its features. It will guide you through the process of selecting an asset, making trades and researching the market as a whole.

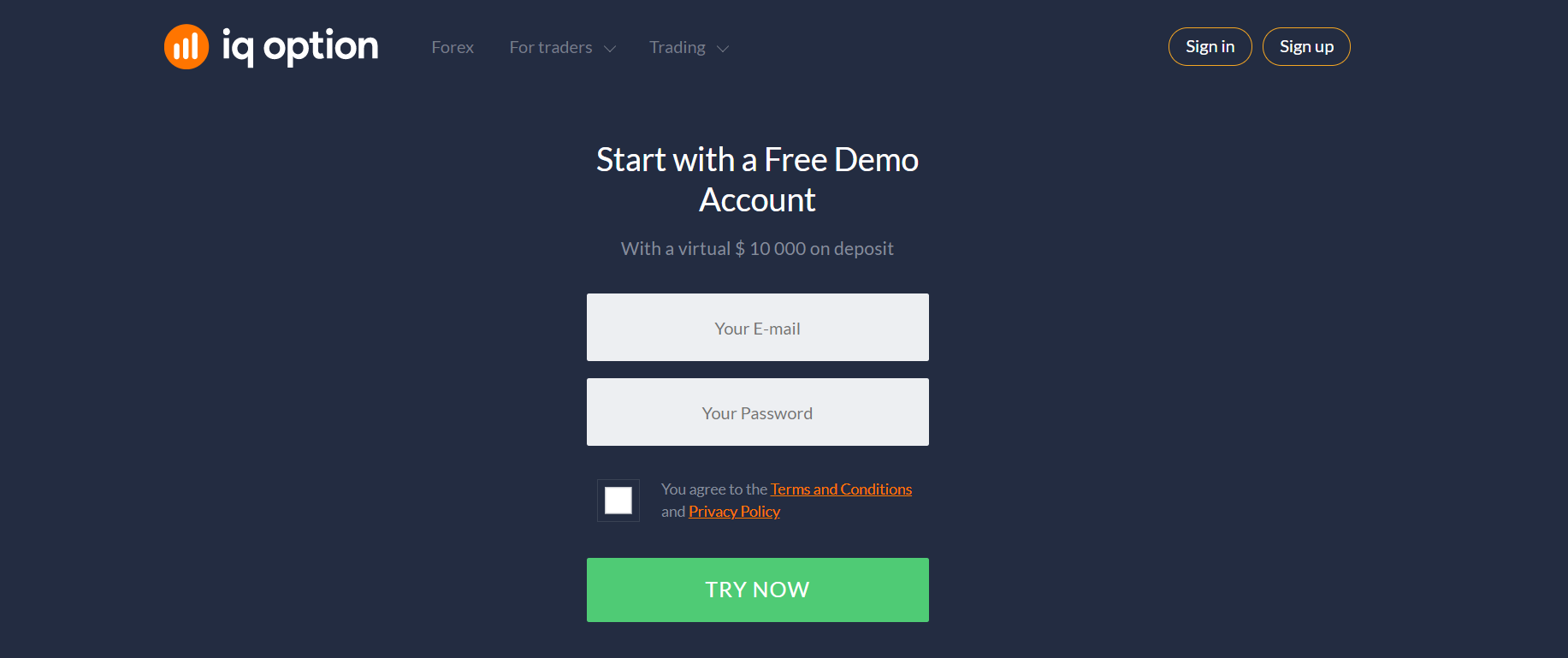

Signing up for a multi asset trading platform in Hong Kong is easy.

Enter your email and wait for further instructions. It is free and will take a few minutes in total, after which the system will prompt you to open a live or demo account.

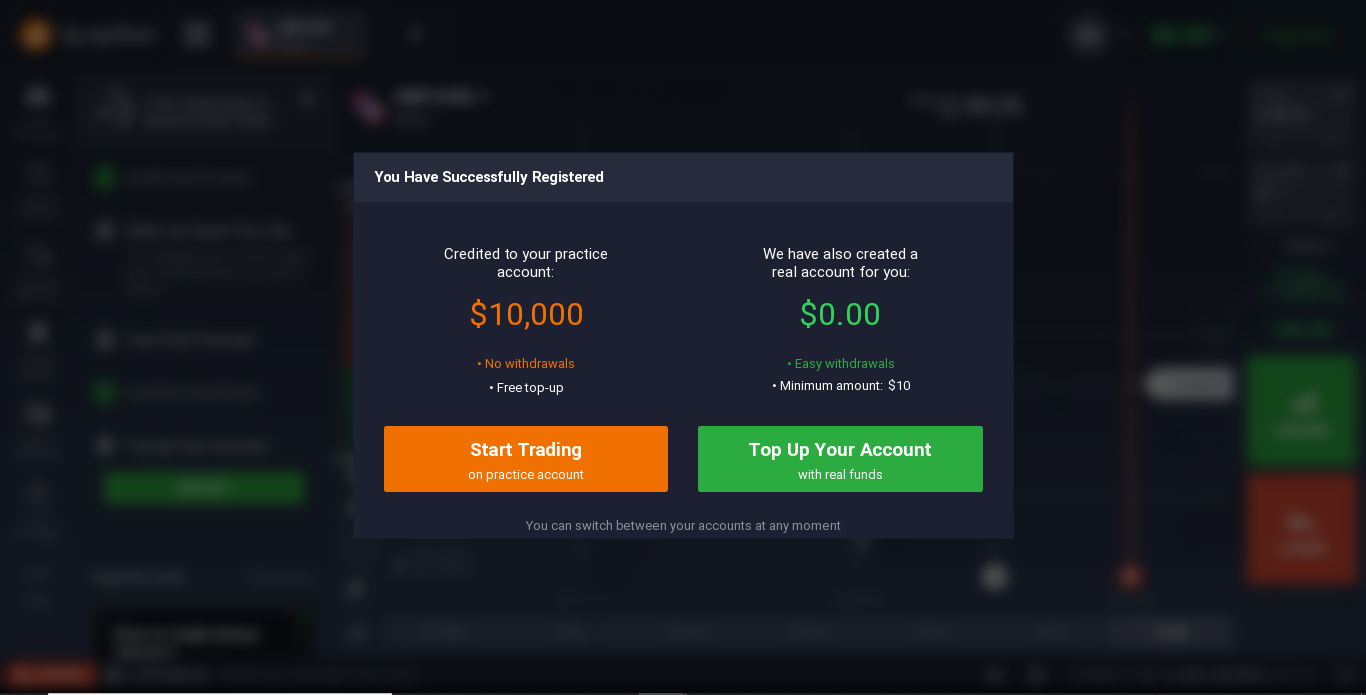

Demo account

Having an opportunity to practice trading on a demo account is a great way for a newcomer to understand the ins and outs of Forex trading. You will be able to trade with virtual money, which will be automatically placed in your account. There are various built-in analysis tools and trading indicators, all of which help the trader to navigate better and trade more efficiently, achieving positive results. This will boost your confidence and open the door for further investments. Once you learn the basics, you'll be ready to step into the real market and start generating profits.

Real account

You can also open a real account with minimal deposit and start trading for real, but be careful and watch out, trading is always risky. Experienced traders advise starting with small amounts, you may not make millions at once, but things will progress, and you will gradually increase your investment portfolio. There is no hurry. Try it and you are sure to succeed!

The advantage of the multi assets trading platform is that it has made the process of making trades easier than ever.

It's fully automated, so traders don't have to spend a lot of time on their transactions. Market fluctuations in the forex market are always present, and the information required for each trade is available 24/7. The software of the trading platforms keeps track of all the market changes and will allow investors to buy and sell assets at the right time. Thus, with a trading platform, an investor can make good profits on a regular basis.

Related pages