How to start investing in Hong Kong stock market

To put some context and make a little history before learning how to invest in the stock market, we tell you that the Hong Kong Stock Exchange started in 1891. A group of businessmen decided to form this entity to formalize a stock market and thus carry out investment operations, trade, earn and develop a new financial environment in the country.

How to start investing in Hong Kong stock market

Investments are made through a Stock Exchange, but what is a Stock Exchange? This is the name given to the companies that invest in the stock market. They can be funds collected from clients interested in investing or own funds, if that is the corporate purpose of the stock exchange.

What are Stock Exchanges and how do they work

The stock exchanges have stockbrokers who must have complied with all the requirements and regulations stipulated by both the Hong Kong Government and the regulatory body, as well as the Superintendence of Securities. Thus, they will be authorized to operate and carry out investment finance and securities brokerage operations. Either on their own account or on behalf of third parties.

The Superintendence of Securities is the entity in charge of ensuring the transparency and correct operation of the stock market. It is also the body that centralizes the contribution of central information regarding all the players in the securities market. On the other hand, there is the National Securities Council, which has the following attributions:

- To hear requests for appeals by stock market participants to the decisions of the Superintendence of Securities and the stock exchanges.

- Carry out a function of observance and control over the behavior of the Superintendence of Securities, and be aware of the reports made monthly by the superintendent in reference to the main activities and be able to establish guidelines in cases that merit it.

- To approve the rates set on quotas and rights that the Superintendence of Securities establishes for supervision, registration rights, and any other service that the Superintendence, through its members, offers to guarantee the good functioning of the institutions.

As we can see, there are several bodies that provide supervision and control, with a final purpose, which is to ensure transparency in the development of the operations of the Hong Kong Stock Exchange.

How it works

The stock market positions function like any other company and have a management government that is responsible for setting the objectives and defining the correct performance of the company. In addition, it ensures correct compliance with current legislation and applicable regulations.

Types of trading posts

There are different stock exchange positions according to the type of investment operations they perform. Because of this, it is very important for novice investors to be able to review the financial statements of the stock market stalls, to verify that they are functioning correctly and looking after the interests of the investors.

In addition to the stock market stalls, there are many options on the web to start trading, not only in the Hong Kong stock market, but in the global financial world.

IQ Option Hong Kong

Knowing where to invest in the stock market is something many beginners look for and IQ Option can help with different methods. IQ Option is a website dedicated exclusively to offering everything necessary to turn interested parties into professional investors.

On the IQ Option website you can find up-to-date quotes from major companies worldwide. It has shares of companies recommended as interesting proposals to evaluate a purchase, quotes of different currencies from all over the world, raw materials or commodities, such as gold, silver or oil, which are usually safe haven values throughout the stock market history. Basically, IQ Option is an online trading platform designed to provide easy access to all the necessary information and to create an investment plan.

How to invest in the stock market

The first thing you must have is a minimum of RD$1,000.00 or US$ 30.00 to start investing and that can be profitable.

- Meet with a brokerage house that is authorized by the Superintendent of Securities and registered with the Hong Kong Stock Exchange.

- Complete the "Brokerage Account Opening" and "Know Your Customer" forms.

- Establish your investment strategy together with your stock market position, according to the investor profile that best suits your characteristics.

- You must define your profit expectations.

- You must authorise your broker to trade on your behalf, buying and selling the securities you already hold, or those you wish to obtain.

- Because you will be trading through a stock exchange, you can be sure that all the trades you make will be registered with the Stock Exchange, and therefore enjoy total transparency.

- You will be able to access your brokerage account electronically and check all the investment movements you have made at any time.

Learning and trading through IQ Option

All the trading, consultation, knowledge you will need to invest in the stock market, how to get started, when to trade, tools, trends, and everything else you need can be found at IQ Option. Using IQ Option Hong Kong's trading platform is simple and very profitable.

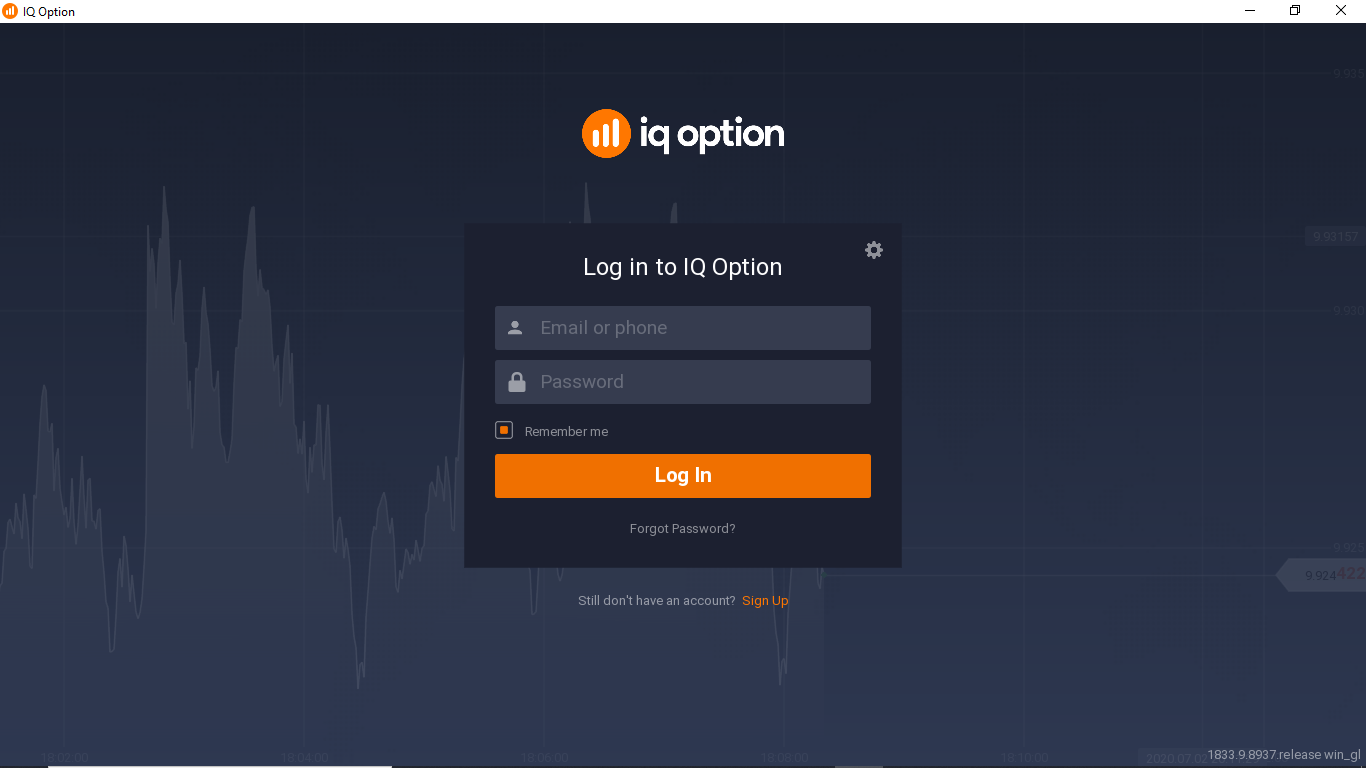

Registration on the IQ Option platform

Once you have created your username and password, you will be able to access the information to know what to invest in the stock market. Among the options you will find currency market (FOREX), crypto-currencies, shares. Actually learning how to invest in the stock market is very simple if you follow the steps to the letter. On the other hand, IQ Option is not just an advertisement, it's a reliable platform, and it's very easy to test. This trading platform has been recognized several times for its services and products, such as the Forex Award it received in 2014 for being the Best Trading Platform.

Why choose an award-winning and recognized platform like IQ Option

The answer is easy. An experienced trader will quickly know that at IQ Option he can find what he is looking for. All the instruments are available, the tools for not losing profits and taking advantage of opportunities were developed especially for its users, and all the functions are clearly visible and practical in use. On the other side, beginners have everything in one place, from resources to learn how to invest from scratch, to tips on how to invest well and trade with good results.

Options on the Hong Kong Stock Exchange

To begin with, you should know that companies that offer their securities through the market are called issuers. Their purpose is to raise money from the public's savings to obtain resources to carry out their operations. There are companies from different sectors in which you can invest.

What concepts apply to the operation of the Stock Exchange?

- Interest Rate - The return that a security offers on the investment made. The interest rate is calculated annually, although the payment of the yield can be agreed on a monthly basis. quarterly or half-yearly.

- Expiration Date - This is the period of time that a title has been on the market. In Hong Kong, securities are valid from 1 year to 30 years.

- Risk Rating - An independent company called Rating Agency is responsible for assessing the ability of companies to meet their commitments and obligations in the short, medium and long term. Risk ratings range from AAA being the best, to D being the worst. It is understood that if the company has a rating where the risk of default is higher, i.e. a lower rating, investors will claim a higher return on the money invested.

- Minimum Investment Amount - Determines which investment can be accessed.

What instruments are traded on the stock exchange?

- Promissory notes

- Preferred Stock

- Financial Certificates

- Certificates of Participation

- Central Bank

- Agro-industrial bonds

- Commercial Paper

As we can see, the Hong Kong Stock Exchange offers access to investments in small, medium and large companies in different sectors with very good returns. There are different methods to invest, but it is always very important to follow a series of advices before starting to invest in the stock market.

Useful tips for trading

You must have full confidence in the stock exchange position you have chosen to trade. This is obvious, if you are going to entrust your savings to a professional, you must ensure that he or she complies with all the regulations in force and is registered to carry out the investment operations they have agreed to. A stockbroker must listen to his client to interpret his expectations and try to implement a strategy in line with them.

You can consult the stock exchange's financial statements to see how they have performed.

Meeting with your brokerage firm before investing is essential to be able to draw up a strategy in accordance with your investor profile. If you are an investor who prefers to safeguard your assets even if this means a much lower return, then your profile will be that of a passive investor and you will have a low level of tolerance for risk. On the other hand, if you are looking to obtain the highest possible return, your risk tolerance level will be high and your profile will be that of an active investor.

Determining your risk tolerance level in conjunction with your stock market position will make your investment plan very clear and there will be no surprises.

Thanks to having clearly determined your investor profile, IQ Option Hong Kong provides you with financial tools that adapt to you, you have a whole range of investments in one place, personalised for you, according to your investment style.

Another important aspect to determine is why you are going to become an investor in the Hong Kong Stock Exchange. In other words, are you looking to earn an income that will become your retirement pension, are you going to pay for your children's education, want to buy property, or simply want to increase your wealth? Obviously, depending on the answer, your investor profile may vary.

Your emotions should not influence your investments. According to financial gurus, keeping your emotional and psychological side in check is more important than the investment plan and methodology you will use.

Diversify your investments. You should never have all your money invested in one asset.

Placing your money in stocks with different or even opposite risks will ensure that market fluctuations will not affect you significantly. You may register losses in some assets, but they will surely be compensated with gains in others. Obviously, your stock market position will be very important when building your investment portfolio, taking into account this aspect of investment diversification.

As we have seen, to start investing on the Hong Kong Stock Exchange you don't have to be a millionaire or belong to large financial corporations. You simply need to have a minimum capital of around US$ 30.00. Thanks to the existing regulations, you will always have the advice of experts in the sector with credentials endorsed by the regulatory bodies and entities that are responsible for ensuring compliance with the rules and that practices are carried out in accordance with the law, thus protecting the interests of all parties.

Due to the requirements of transparency and the periodic publication of reports and financial statements of all the parties involved, you will always have the necessary information before making such an important decision as whether to place your money on the purchase of a title, or to sell it and recover your investment because you believe it is the best time to do so.

Hong Kong : A good time to invest

The Hong Kong Stock Exchange is in a permanent process of internal expansion, offering fixed income or variable income investment funds, with advantageous conditions for investors, although as we know, globalisation can always bring some fright, so it is fundamental that we follow the steps to protect the investment and avoid shocks. In addition, they have recently incorporated the electronic market, which allows for remote trading and expands the possibilities of trading securities.

The Hong Kong Stock Exchange and Securities Markets offers novice investors great opportunities to make a profit through transactions that have extensive regulatory control.

By understanding all this, and following the advice of professionals and experts who are willing to advise you, such as IQ Option who guide you in how to invest in the stock market, you can be sure that the risks you are going to take will be the ones you decide you are willing to face.

Related pages