Investing in markets

Financial markets, as well as conventional markets, are places where goods and products are bought and sold. In financial markets, these buying and selling operations can be carried out both nationally and internationally. The people who trade in the financial market are called traders, and they earn their profits from the variation of the prices of the assets they trade while limiting the risks of each transaction.

Types of financial markets

Financial markets are divided according to the product or financial asset traded. For example, the Forex market trades only foreign currencies, the commodities market only products used to make other assets such as gold, oil and silver, and the cryptomoney market trades established cryptoactives such as Bitcoin and Altcoins with greater circulation and usability.

These markets are classified as follows:

- Capital market.

- Stock market.

- Raw materials market.

- Bond market.

- Money market.

- Derivatives Market.

- Foreign Exchange Market (Forex).

- Cryptomarket.

- Interbank market.

- Spot market.

The fluctuation in asset prices varies according to the market. Similarly, the time at which you will see your earnings reflected varies from market to market. For example, the foreign exchange market pays dividends in the short term, while the stock market reflects profits in the medium to long term.

The capital markets

The capital markets are made up of the market for stocks, shares and bonds, both public and private. Two markets are derived from this at the same time:

Primary market: made up of the issue of new securities by companies and governments.

Secondary market: consists of the purchase and sale of existing bonds and shares, i.e. previously issued.

The capital market is known to represent high-risk investments with perceptible returns at terms of more than 18 months. In addition, it has a different type of liquidity than other complex instruments, since on the one hand, to participate in the primary market it is necessary to wait for the new issue of instruments, while placement in the secondary market can be simple, but not very profitable for investors who venture into these assets.

This type of market is usually the best financial option for people who are used to saving, but with no notion of investment. So they put their money at the disposal of investors and get their profits later.

Capital markets include the traditional market, such as stocks or deposits, and the alternative market, with alternative financial assets such as listed stocks or futures assets.

Real capital market gains are usually made by holding on to instruments, i.e. buying and holding them until they bear fruit or reach maturity.

The stock markets

Also known as "the stock exchange", they comprise a type of capital market and trade any financial instrument that may be negotiable. These instruments are financial contracts that provide their owners with part of the benefits of the asset.

Depending on the types of asset traded, the stock market can be subdivided into:

- Bond market: includes bonds and notes and makes the buyer a creditor of part or all of the issuing company. Investors who buy this type of capital acquire interest earnings and also legal liabilities to the issuing company.

- Variable income market: shares of companies quoted on the stock exchange are traded on this market, which, after making a decision agreed with its board of directors, decides to divide its capital into parts (shares). These shares are sold through a public offering and do not represent major obligations for the shareholders with the company, they simply generate profits or losses according to the valuation of the company.

- Derivatives markets: they can offer a wide variety of financial instruments, such as commodities, shares, interest or bonds. This, despite being a subtype of the capital market, is usually considered a separate market because of the variety of instruments it contains.

Bond markets

The bond market is the market that deals in promissory notes or debt contracts. In this case, a company or government issues a certain amount of bonds with a promise to raise cash quickly so that it can be reinvested.

These bonds have a term of maturity. After this term, the issuer must return to the investor the full amount of its debt plus the agreed-upon amount of interest. This type of asset can be traded through the primary or secondary market depending on the age of the bond.

Governments are the main issuers of bonds, and often use them as long-term payments to finance their countries' development.

Raw materials market

The commodity market is considered to be the oldest of all markets, dating back to the barter trade carried out by ancient civilizations that used the exchange of products for their subsistence.

Commodities, also known as commodities, are products traded in markets that are used as base components of other more elaborate goods or services. For example, potatoes and salt are raw materials used to make a snack bag.

The main difference between commodities and other assets is that they are standardised within the market. In other words, when investing in 1 pound of cocoa, the country of origin is not important, since different units of the same product will have almost the same price and quality.

Raw materials or commodities are classified in:

- Energy products: such as gas, electricity and oil.

- Agricultural products: unprocessed products such as coffee beans, sugar, oranges and cotton.

- Livestock products: livestock in general, meat products and animal products.

- Mineral products: such as platinum, gold and silver.

When investing in commodities, you will find terms such as hard commodities and soft commodities. The former include products that are extracted, such as minerals. While the latter include agricultural and animal products.

Money market

The money market comprises a set of independent but correlated markets that exchange assets in order to repay debts with terms of less than 18 months. This type of exchange represents a low level of financial risk with a high level of liquidity.

This type of market commonly involves central and local banks, making interbank loans and using the national central bank as the issuer of the loan in question as a last resort. It is therefore a type of trading executed solely by banks.

Derivatives market

The derivative market is based on the trading of an asset whose value is directly related to the price of another product. This type of trading functions as a hedge against price changes. By investing in these markets, the trader acquires the derivative at a specific price and benefits from the variation of the price between the time the order is opened and closed.

Unlike other markets, these do not require large amounts of capital to start investing. In addition, the movements of these markets are a little easier to predict, so it is easier for investors to forecast their profits.

The types of derivatives that exist are:

- Swaps: a contract to exchange one product or debt contract for another product and is intended to cushion the level of risk for both investors. In this way, both parties benefit from their securities with each other. That is, one party promises a payment on a certain date to another party in exchange for receiving another payment from that party. This type of financial derivative works on the basis of the payment of interest from the modification of the initial payment scheme.

- Forward: Forward markets consist of an agreement to buy or sell at a predetermined price, but on a set date in the future. With this type of trade, risks in commodities, exchange rates, shares or interest rates are covered.

- Futures contract: this type of insurance contract establishes the delivery of raw materials at a set price. Thus, companies are protected from the risk of an increase in their raw material by means of the insurance markets.

- Options: these are optional agreements between two parties that give one of them the option to buy or sell an asset to another investor, on a set date. They trade shares as their main asset. In this case, the exchange is optional, not a binding contract. Options are used to hedge assets in the event of a possible fall in prices.

Forward market

The forward market or market of term contracts is made from exchanges of the cash agreed before the closing date of the contract. This is a payment in advance before receiving the good in question.

This case is ideal for buyers or traders who wish to ensure the existence of the goods they are buying. When completing this type of deal, the difference in price generated between the day of payment and the day of closing the deal must be paid.

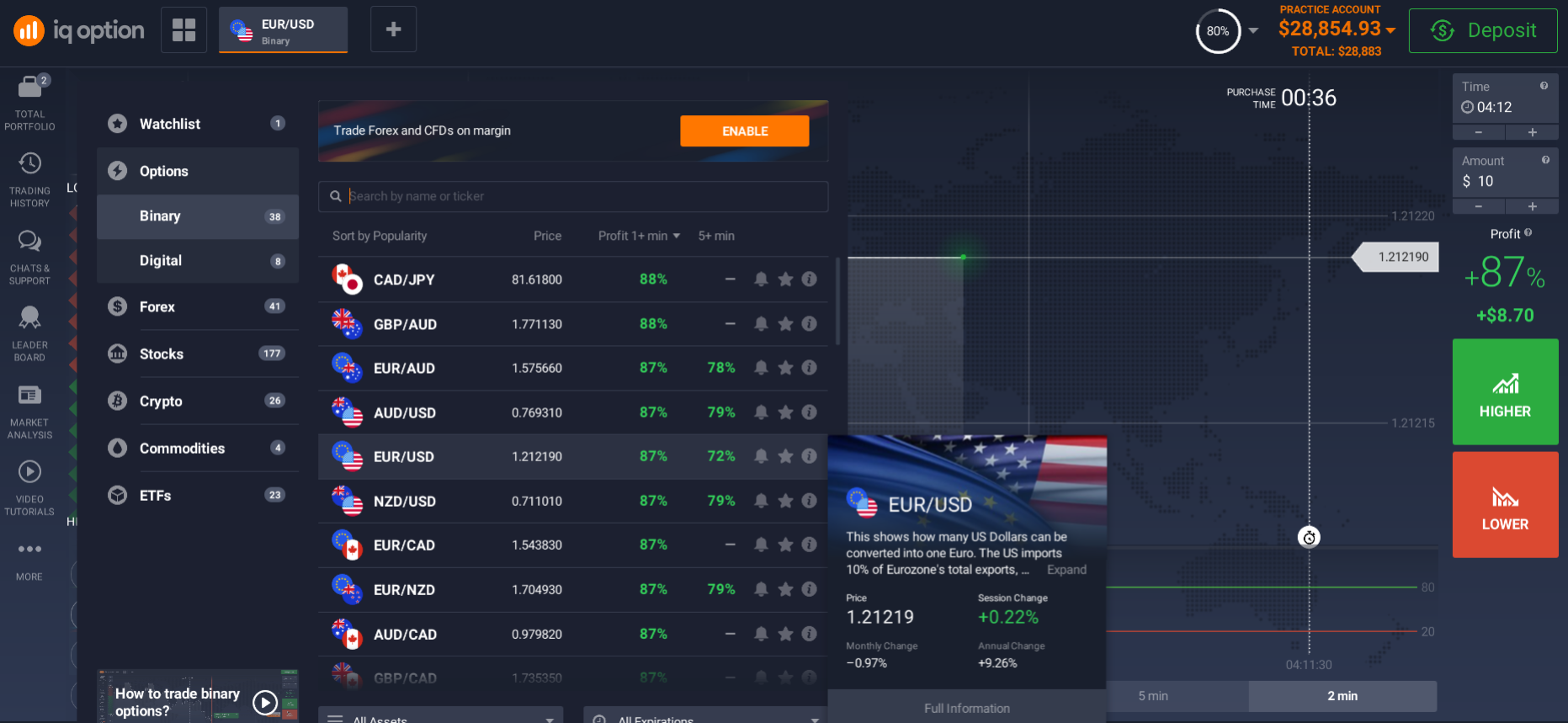

Foreign exchange market

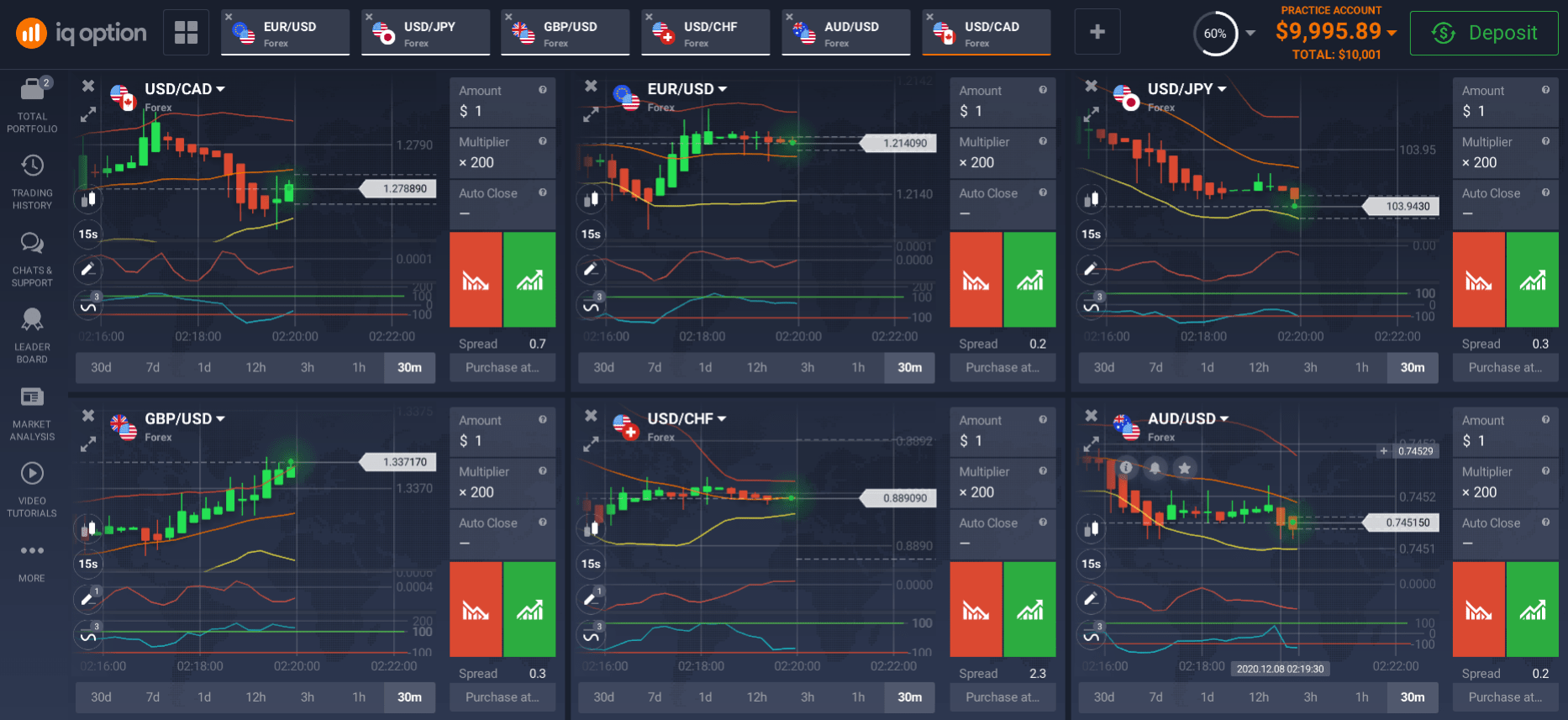

This is the most liquid and price volatile market of all. The foreign exchange market or Forex represents good investment opportunities in the short and medium term. This market trades currencies, which are the currencies used in a country or region. In this market, highly liquid currencies or major currencies such as the Euro, the US dollar and the pound sterling are traded.

In the Forex market transactions are made between currencies, and speculation is made on the strength of one against the other in order to make a profit. In this way, exchange rates are established between currencies that fluctuate constantly depending on different factors that affect the economy that uses them.

This market presents currencies in pairs, so with each movement in a pair, one currency is bought while the other is sold. Currencies like other financial instruments are presented by tickets, that is, you will not find a pair that says "US dollar" but "USD", and instead of looking for the word "euro" you should look for the acronym "EUR".

Thus, currency pairs like EUR/USD, present first the main currency (euro), and then the quoted currency. So in this example the EUR would be the base currency and the USD would be the quote currency, this means that if the price marked is 1.56345, this refers to the amount of USD you must invest to acquire one unit of EUR or the exchange rate of the dollar to the euro.

The foreign exchange market is a decentralised market that facilitates the flow of money in international trade. The functions of this market include: converting the currency of one country into the currency of another and providing a certain level of security against exchange risk by protecting your capital from factors that could devalue it in local currency.

There are two types of foreign exchange markets:

- Spot or cash: consists of immediate transactions in less than two days.

- Forwards: transactions whose effectiveness requires a longer period of time. The exchange takes more than two days to take place.

Types of currencies traded in this market include:

- Bilateral currency: used for settlement processes between governments using bilateral agreements.

- Convertible currency: those that do not have exchange restrictions or controls.

- Non-convertible currencies: those that are not negotiable in the international market.

- Strong currency: those with a certain level of exchange stability, usually from countries with strong economies or power countries.

- Exotic currencies: those that do not have a large international market, that is, they are not in demand globally.

This market, unlike the others, is not organized and does not have established amounts or dates of transactions. In addition, it operates 24 hours a day allowing free transactions at all times.

Cryptocurrency

This is a new market with a high level of volatility. The crypto-currency market works on the basis of blockchain technology and has a financial mining system that allows individuals to create their own currencies in addition to trading this type of currency.

The most widely traded crypto currencies to date are Bitcoin, Ethereum and Ripple, and these are the ones listed for investment in the derivatives market. To buy or sell these currencies or any other Altcoin, it is necessary to get an Exchange platform to acquire the asset.

Spot market

The spot market is based on immediate transactions where both the transaction and the settlement coincide on the execution date. However, transactions where payment and delivery of the asset occur within two days of each other are also considered to be in the spot market.

This is the type of market that covers, for example, retail purchases on the Internet. It therefore implies that there is physical delivery of the asset in question. In other words, you bid for an asset, make payment, and no more than two days later, you get your product.

Interbank market

The interbank market comprises loans between banks with terms of no more than one week. This type of transaction stipulates a certain price and interest rate and represents an increase in liquidity at low risk.

Other entities that participate in this type of trade are savings banks, financial institutions and companies that offer insurance contracts.

From this market, three types of market arise which are:

- Interbank foreign exchange market: it occurs between banks in the country with foreign banks in order to operate with foreign currency.

- Interbank market for transferable deposits: customer deposits in local currency are transferred between banks.

- Futures market: credit derivatives are traded and transferred between banks.

How to invest in the markets?

Financial markets were once accessible to bankers or investors with large amounts of capital located in major cities such as Paris, Berlin or New York. With time and the creation of brokerage companies, access to the markets was extended to investors from different regions and with different amounts of capital.

Thanks to the expansion of the global economy and technological development, any individual can invest directly in the national stock market of their country of residence. But in addition, they can access the web to invest in different assets listed on stock exchanges on the other side of the world.

How to invest in online markets?

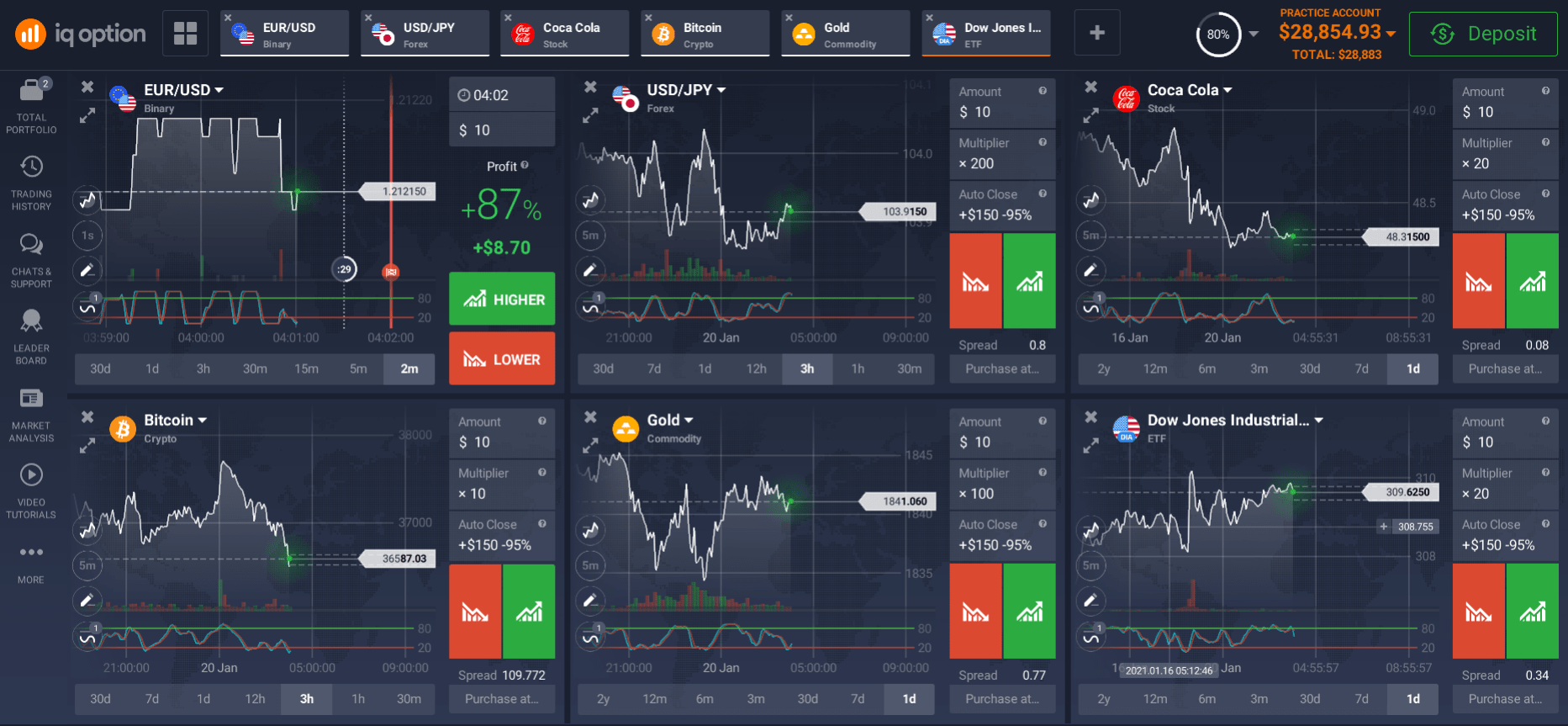

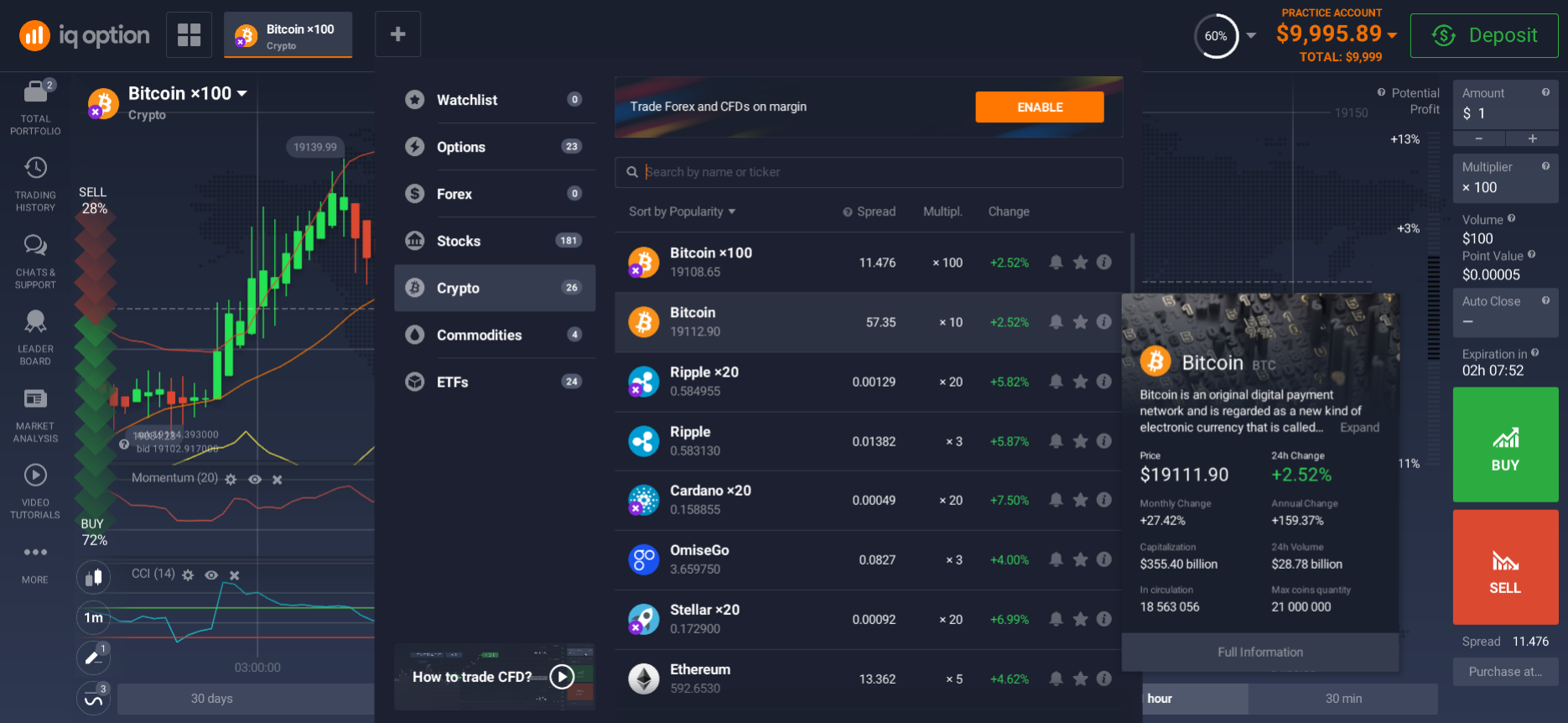

Investing in the online markets is possible thanks to internet brokers or brokerage companies. These allow you to monitor the market's movements, visualize the situation of the assets and access the fundamentals that can alter the price of different instruments.

These platforms offer a range of assets in which you can start investing your money and allow access to a large number of markets and options in one place.

Investment Platform

There are currently a large number of platforms that allow you to invest in the markets and most of them allow you to trade Forex, indices, stocks, CFDs and commodities. When choosing a reputable brokerage platform, we suggest you consider the following aspects:

- The broker must be regulated and have a current license under the supervision of a reputable government entity. Every brokerage company must be registered under the laws of some government, and preferably locate its offices in some stable country and not in tax havens.

- Each broker has its own policies and rules for use, including the minimum deposit amount required to begin trading. It is important to review this aspect and make sure that this amount is in line with your needs and capital.

- In the same way, each platform uses payment and withdrawal methods that vary in effectiveness times and commission amounts. In addition, they depend on the country where both the broker and his users are located. Knowing these means in advance will save you time and money.

- These platforms offer a great variety of financial instruments for trading. Now that you are familiar with the different types of market and the assets that each one offers, you should confirm that the chosen broker offers this market among his investment options before carrying out the registration process.

- Once you have chosen the platform, you can make use of the tools and indicators it offers to perform your technical analysis, observe the product charts, and constantly monitor your investment.

What is an online investment platform?

The investment platforms or "brokers" play the role of intermediary between clients (investors) and the companies that trade the financial assets. These platforms allow their users to employ and manage their capital at their discretion, maintain a constant monitoring of their assets and operations, access to charts, indicators and tools, and the possibility of being part of the market with low amounts of capital and from anywhere in the world.

How to start investing in the markets?

To start investing in the markets, generate good returns from the start and minimize the risks in every move, you must:

- Know the financial situation of the asset you are investing in, now and in the past.

- Familiarize yourself with the position of the asset within your market and among other assets in your industry.

- Study the correlations that may affect the price of the asset you are investing in.

- Allocate a percentage of your capital to the investment of this asset, and diversify your investments intelligently.

- Invest in different assets respecting the correlations that govern them.

- Diversify your investment in assets from different markets in order to guarantee your earnings in different periods of time.

- Register with a trusted broker, which adapts to your needs, make your first deposit and start investing.

- Monitor your investments constantly and actively.

- Frequently update your fundamental and technical analysis of the assets you are investing in.

- Avoid investing as much as possible during fundamentals that may affect your investment.

How to register?

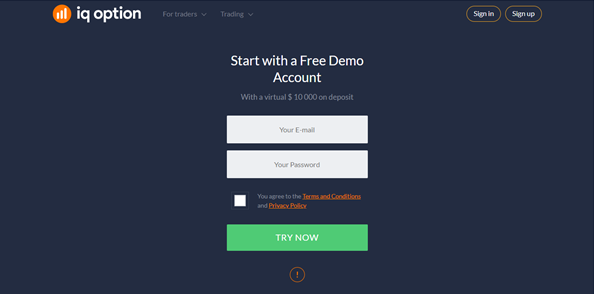

This process is mandatory on the most reliable trading platforms in the market. Some of them require more detailed data for their entry, but all of them coincide in the basic data of the user (name, surname and e-mail). A common registration process usually includes:

- Entering the platform's home page look for the "Register" button, located in the upper right hand corner of the page and click on it.

- Fill in the pop-up form with the required data (name, surname and e-mail address) and create a password for your new account.

- Search the inbox of the email used for registration for a confirmation email in the name of the broker. Click on the link that will send it back to the platform in order to log in.

- Once this process is complete, you can familiarize yourself with all the functions of the platform, access its tools, review the assets it offers, access detailed information, analysis, news and charts for each asset, and begin trading from your demo or real account.

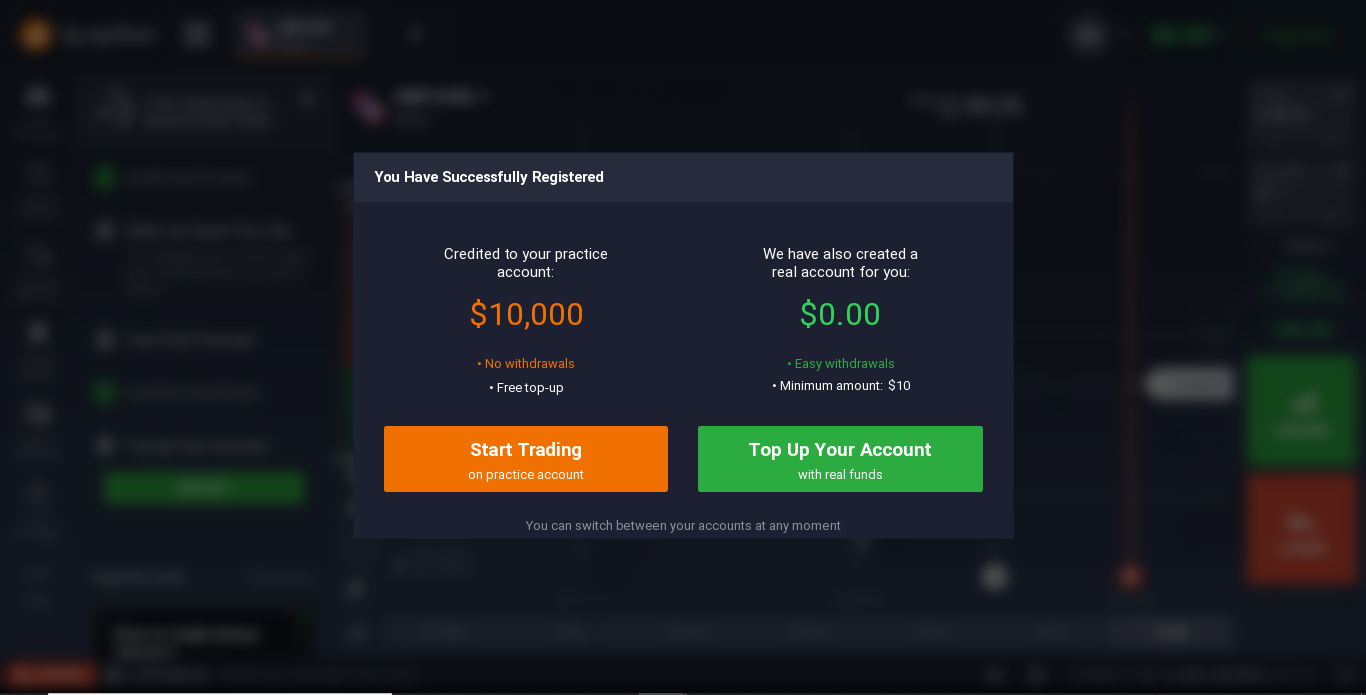

How do I open a demo account?

Once your registration is complete, your demo account is created fully automatically. To access it you just need to log in. With this account you can start trading with fictitious money. The demo account is ideal for trying out new trading strategies while finding the right ones to multiply your capital and become familiar with the platform, while avoiding putting your capital at risk.

How do I open a real account?

Like the demo account, it is created after the registration process with the broker. A real account requires a deposit of real money in order to be used and thus enter the market. With your real account you can generate a good dividend yield, make real transactions and multiply your money with market price movements. However, we recommend the prolonged use of the demo account until you have created a solid and successful trading strategy.

How do I replenish a deposit?

Deposits are required in order to use your real account. To deposit funds into your account, please choose the most convenient payment method for you. The most common means of payment among trading platforms include bank transfers, digital wallets, credit card charges, and occasionally, crypto-currencies.

The accepted means of payment, as well as, the minimum amount of deposits, commissions charged and time of effectiveness of the transactions vary from one platform to another.

Minimum deposit amount

The minimum deposit amount represents the lowest payment amount accepted by brokers to start using your real account. This varies according to the policies of each platform, and as well as the accepted means of payment, it is advisable to know them before proceeding with the registration.

The platforms vary this amount according to their target audience. For example, those aimed at professional traders request amounts of more than five hundred dollars to start, while those aimed at new traders or retail traders request amounts of around twenty dollars to start.

How to withdraw money?

Usually, the withdrawal methods are the same as those used for depositing. However, some platforms require that the money be withdrawn through the same means used to deposit in the first place. That is, if you use a card to make a deposit, the withdrawal must be requested to the same card.

In which markets to invest?

Choosing which of the international markets to invest your capital in depends primarily on the amounts you have available to start with and the time you expect to see results. For example, stock market or index investments generate medium to long term returns with lower levels of risk. This type of investment requires more fundamental studies, attention to meeting dates or publication of results in terms of predictions of the country in which the asset in question operates.

On the other hand, currencies generate an almost immediate return, but with a higher level of risk due to the volatility of this market. In this case, it is more common to study the graphical patterns in the pair, but it is equally important to study the fundamental environments of the quoted currency. In the foreign exchange market, government decisions, social upheavals or natural disasters often have a major influence on the currency price.

How do I invest in the stock market?

To invest in the stock market, it is important to know the assets or types of investments offered. It is important, first of all, to be aware that all investments carry a risk or a possibility of gain. This depends mainly on the study you make of the assets chosen for investment, the monitoring of the investment, the ability to diversify your capital, and the care with which you open and close a trade.

When participating in this market, you can do so by buying or selling a certain asset. When you go in to buy, you are assuming that the price will rise over time, that is, it will go up. When you go in to sell, you expect the price to go down or devalue.

Before you start investing in the stock market, we recommend that you access stock market simulators or register with a broker who has demo accounts to familiarise yourself with market movements, the tools offered by the broker and understand how external factors (such as the rise in other assets) can alter the value of the asset you wish to invest in.

Remember that the stock market allows trading in bonds, options, commodities and other products that it is prudent to know when diversifying your capital.

How do I invest in indices?

Indices are part of the derivatives market, and are based on the average of the most relevant share prices on a given stock exchange. Investing in indices is a good way to participate in the market while keeping an eye on the major stocks.

To participate in this market, transactions are made with contracts for differences in one or another index. These assets generally show the behaviour of certain markets. In other words, instead of trading shares of different companies in a sector, you can simply trade CFDs of the index to which they belong and study the overall performance of that industry.

Intraday investments in this type of asset usually generate good short-term dividends. However, for those looking for medium to long term results, trading Exchange Traded Funds or ETFs on these indices is ideal.

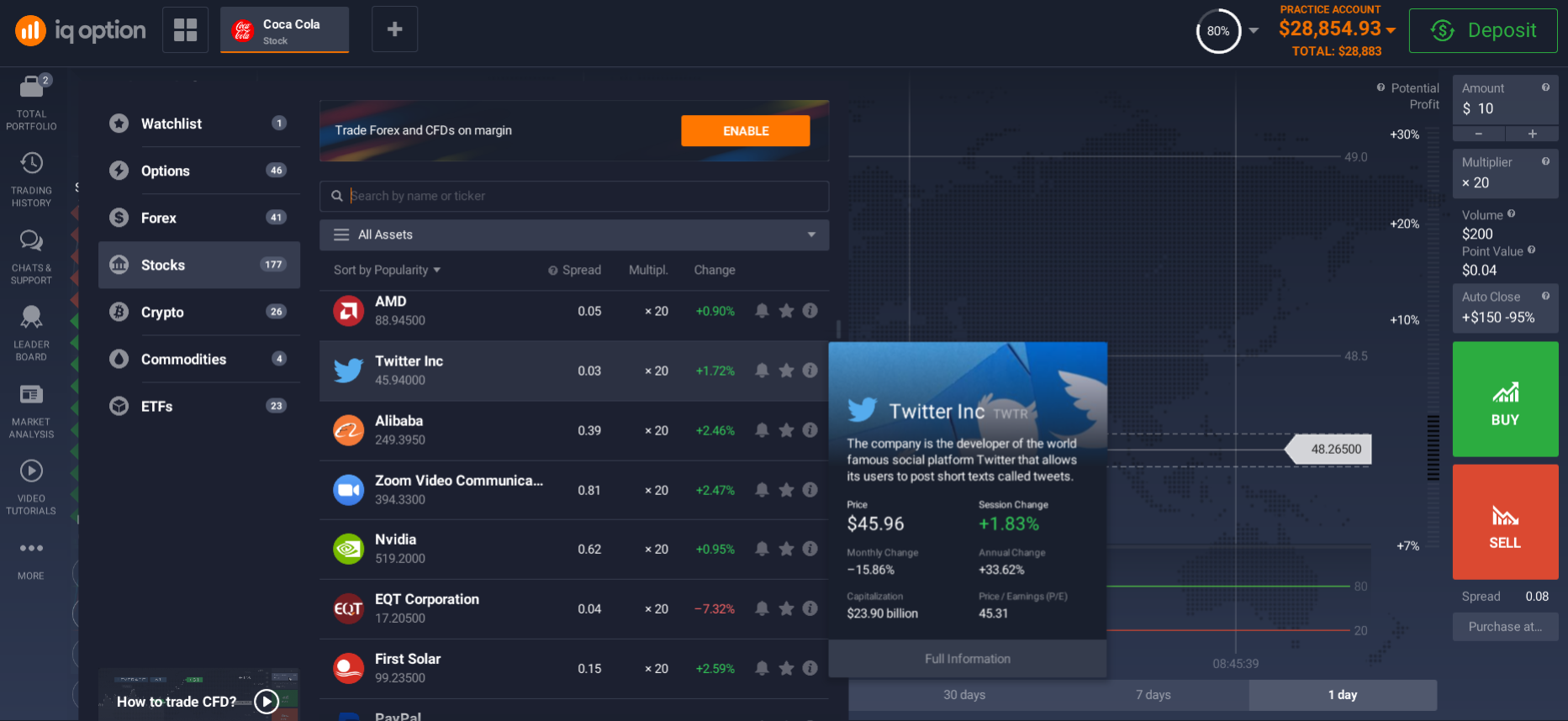

How to Invest in Stocks

Investing in shares is a good way to generate returns over periods longer than a year. To invest in this type of asset, it is important to be well informed about the financial situation of the company, to study the results of all the meetings in the last 5 years, to know its debt statements, to keep informed about the public image of the company and to know if the company in question makes dividend payments and on what date.

Trading stocks is a more complicated process than investing in indices, as each company must be studied independently. However, you can access this asset online or invest in companies listed on your national stock exchange.

How to invest in the foreign exchange market

There are several ways to become part of this market. One is the traditional way and you can access it through different exchange offices in your region or country by acquiring foreign currencies in exchange for your local currency. With this method you will be limited, depending on the country you are in, to trading only for dollars or euros. In other words, trading in exotic currencies, other hard currencies, or other convertible currencies is completely out of your reach.

The other way to participate in the exchange market, is through a broker from the purchase and sale of currencies in pairs, as we will explain next.

How do I invest in currencies?

Once you have established the capital to invest in currencies, you must select a currency pair with which you will not only begin to invest, but learn to recognize the behavior of the pair and the graphical patterns that go with it.

This study must be measured and controlled. Therefore, we recommend that you keep a record of all the movements, patterns or trades you make within the pair. In addition, by supporting this pair in charts of other assets (such as commodities) you will be able to recognise if there is any correlation between the assets, which will indicate later when it is a good time to enter or exit the market.

How to Invest in Dollars

To begin investing in dollars, you must locate a pair that includes the initials "USD", which represents the US dollar. For example, USD/JPY which is the Japanese yen based on the US dollar. In this case, when you enter "buy" you are buying Japanese yen in exchange for US dollar. On the other hand, when you enter "sell" you are buying US dollar while selling yen.

How do I invest in Euros?

To invest in Euros, you must locate a pair that includes the initials "EUR", which represent the Euro. For example, EUR/USD where the US dollar is quoted against the Euro. In this case, when you enter "buy" you are buying US dollars in exchange for Euros. On the other hand, when you enter "sell" you are buying euros while selling dollars.

How to invest in the crypto-currency market?

Commonly, crypto currencies are quoted on the basis of the US dollar. They can be traded through the Exchange, i.e. by buying the actual currency, or through a broker, or by buying a CFD of the currency.

When investing in the cryptomoney market from an Exchange, you can access a wide variety of Altcoins offered in the market, with varying strength, age and warranty. However, when you invest in these assets using a broker, you will have at your disposal contracts that differ from the most widely used international crypt currencies, including Ripple, Bitcoin, Ethereum and Bitcoin Cash.

How do I invest in Bitcoin?

To invest in Bitcoin, you can buy the asset through any exchange that offers this currency and profit from the price change upwards only, or buy and sell Bitcoin CFDs on your trusted broker and profit from both the upwards and downwards price of the asset.

When trading Bitcoin CFDs, you can take advantage of the tools and leverage that brokers offer to multiply your capital.

How to invest in Ethereum?

To invest in Ethereum, you can either buy the asset on any exchange that offers the currency and profit from the upward price movement only, or buy and sell Ethereum CFDs on your trusted broker and profit from both the upward and downward price movement of the asset.

If you invest in Ethereum CFDs, you can take advantage of the tools and leverage offered by brokers to multiply your capital.

How do I trade Ripple?

To trade Ripple, you can buy and sell Ripple CFDs on your trusted broker and profit from both rising and falling asset prices. When trading Ripple CFDs, you can take advantage of the tools and leverage offered by brokers to multiply your capital.

Buying this asset through the Exchange is more complex because its use is usually limited to interbank transactions, so it is difficult for retail investors to get hold of this asset.

How do I invest in the commodities market?

There are 5 ways to invest in commodities or commodities:

- CFDs allow you to speculate on the rise and fall of asset prices. They are purchased through brokers and allow the use of leverage, low or no commissions, equity and open market profits 24 hours a day, Monday to Friday.

- Futures: allows you to speculate on the estimated price that you will acquire the product on a certain date. Thus, if the price rises, the trader can sell the contract at a profit; if it falls, he loses.

- With options: in this almost neither the seller nor the buyer of the contract is obliged to complete the transaction. They simply benefit from the leverage by setting a purchase or sale price for a given date, or earlier. If the price goes up on that date, the buyer gets the benefit. Otherwise, the seller makes the profit.

- ETF: this can be accessed from a broker or through a stock exchange. Some of them contain stocks, while others contain physical products, futures or options on commodities. With this type of investment, you would be purchasing a group of assets from a single fund rather than investing in individual assets each time.

- Commodity shares: based on the acquisition of shares in companies specialising in commodities. In this case, the fundamental factors that alter the price of the company and not just the asset must be considered.

How to Invest in Metals

You can invest in metals by purchasing some of these assets from your trusted broker.

How to Invest in Gold

You can invest in gold by buying and selling CFDs on this asset on your trusted broker and profit from both upward and downward movements in the price of the asset with well thought-out entry and exit strategies.

How Do I Trade Silver?

You can invest in Silver by buying and selling CFDs on this asset on your trusted broker and profit from both upward and downward movements in the price of the asset with well-thought-out entries and exits.

How Do I Trade Oil?

You can invest in Oil by buying and selling Crude Oil CFDs on your trusted broker and profit from both upward and downward movements in the price of the asset with well thought out entries and exits.

How to invest in the derivatives market?

To invest in derivatives you only need a reliable broker, little capital, a good strategy and clear investment objectives. Derivatives are good investment options for individuals looking to multiply their capital at low risk. This type of investment is usually made with a view to medium to long term benefits.

How do you invest in cfds?

CFD investments assume the direction of the price that a certain asset will carry. They do not require more capital, but should be studied to generate good dividends and avoid risky moves. You can trade indices, currencies and commodities in this type of asset without incurring high risk and making profits on both high and low prices.

How to invest in etfs

ETF investments take the direction of the price that a particular asset group will carry. They do not require greater capital, and contain assets from the same industry or sector rather than individual assets. In this type of investment you can trade indices and funds without incurring high risk and obtaining benefits at both high and low prices.

How do I invest in options?

Options are rights to buy and sell an asset or a contract based on the movement of an asset. This market offers the possibility of buying or selling contracts on different types of assets and generates profits based on speculation of price movement.

FAQ:

Why is the study of financial markets important?

To understand the movement of the prices of the assets listed on them, which are the same ones that we acquire in our daily lives and whose movement affects us, although we are not aware of it.

How do you analyse the behaviour of the financial market?

Based on the graphs of different assets we can observe how their price behaves throughout history and how different events influence it.

How do governments influence financial markets?

Depending on the decisions a government makes, products, companies and currencies from that particular country are affected. This includes the social, economic or legal measures put in place by each government.

Who can issue financial assets?

Banks, companies, private or public entities issue these types of assets in order to receive a return from their purchase, sale and demand.

What are the characteristics of financial markets?

- They have a large number of negotiable instruments.

- They allow free and unrestricted entry and exit.

- Their prices are set by the supply and demand for the assets.

- Transparency in sharing information about different assets.

- Large amount of participation and liquidity.

How can you start investing?

By accessing a trusted platform, setting aside capital and studying some assets you can begin to create your investment strategy.

What is involved in investing in the financial market?

Investing in the financial market always involves a level of risk to your capital. We therefore recommend that you study each move carefully.

How do I invest in the financial markets?

By choosing a platform and asset type to begin creating an efficient trading strategy.

What are the different types of financial markets?

- Capital markets.

- Stock markets.

- Bond markets.

- Commodity markets.

- Money markets.

- Derivatives Market.

- Forward Market.

- Foreign exchange market.

- Cryptomarket.

- Spot market.

- Interbank market.

What is the relationship between risk and return in the financial markets?

There will always be a proportional risk between both terms, the greater the risk, the greater the profit, but the greater the possibility of loss.

Why are markets growing?

Markets are growing because of demand and the entry of new market participants.

Why are markets falling?

Markets are falling due to low demand, misinformation or large inflows from large investors.

Related pages