Best options trading platform in Hong Kong

If you are new to options trading platforms, then you probably want to start with some fundamental principles. So what is an option? Once an investor buys options, he or she declares to buy a specific number or group of shares at a specific price on or before a specific date. The buyer is then considered to “cash out” the option if the target value or the value of the option is met on or before the expiration date.

But that doesn't mean options trading is easy. Indeed, options trading can be very dangerous when the industry is unstable, especially if you don't understand technical analysis. For example, the prices of the option (the contract you buy) will be the price you pay to buy the right to buy the underlying security. You can purchase as a call or put option.

For the opportunity to use a "pending" trade, you must pay a certain amount, called the option premium, which becomes the price of the contract. The time at which the transaction is postponed is called expiration.

There are 2 types of option contracts: call and put. A call is a right to buy, and a put is a right to sell.

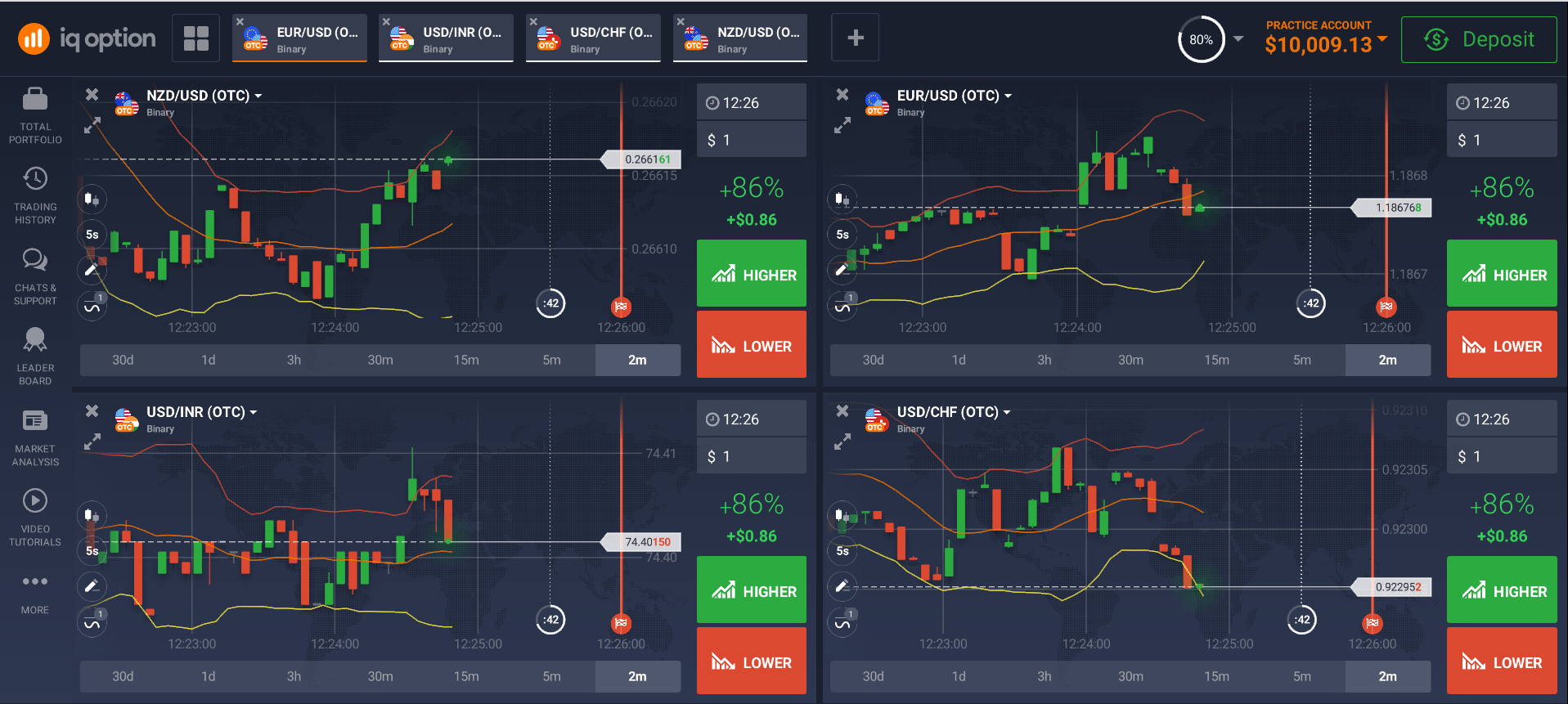

So what are options trading charts? These are essentially visual descriptions of the value of the underlying asset at any given time. Our options trading platform displays these charts, which provide you with the information you want in order to make informed decisions about whether to buy or sell your alternatives.

In total, it is customary to distinguish three types of graphs:

- Linear. A line chart is a broken line that shows price movement over a long period of time. The horizontal scale corresponds to time and the vertical scale to price marks. It is simple and concise and helps to assess the overall market trend. However, data on local extremes or price gaps, alas, cannot be obtained with its help.

- Candlesticks. The Japanese candlestick chart is considered the most popular and most comfortable for studying market phenomena. Outwardly, they look like bars (columns of a histogram), and each element indicates a price change relative to a certain time interval. The lower part of the candlestick represents the open level, and the upper part represents the close level. Such candles are usually called bullish when the market is dominated by buyers. If the opposite happens, then they will be called bearish, therefore, the sellers' forces dominate the market. Each candle has a shadow, or a tail. It indicates the price extremes (minimum or maximum) of a trading asset.

- In the form of bars. This is not the most popular, yet useful and functional chart. On such a histogram, options are arranged in a strict sequence from right to left, thus, you can determine the trend. Each next bar must be higher or lower relative to the previous one, and can also be equal if the market is calm. By the bars, you can understand how the price has changed during the entire specified time.

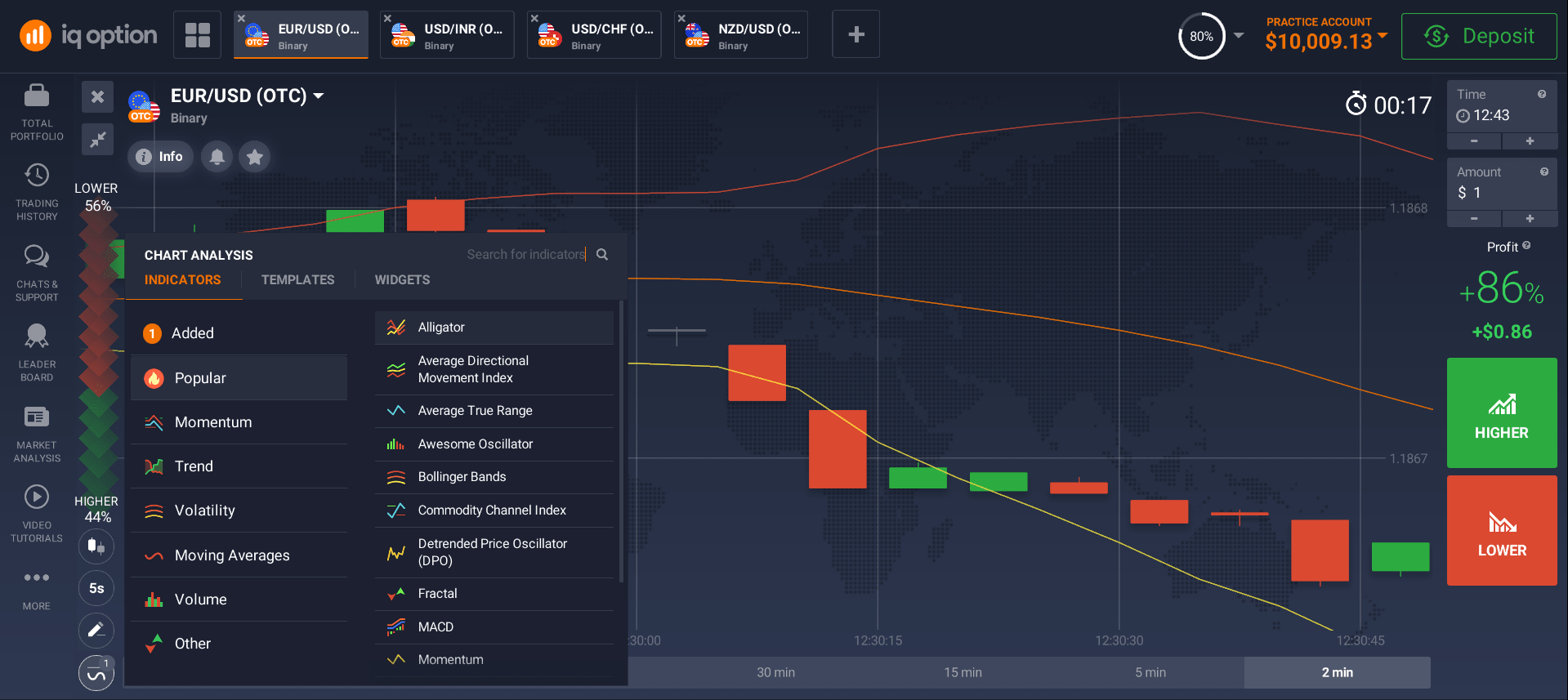

Technical analysis indicators are algorithms that allow you to obtain data on future prices using data on quotes for a certain period of time.

In addition to charts, it is advisable to use indicators. The most effective are "Moving Averages", "MACD", "RSI", "OBV".

Options trading can be very difficult. There are different strategies "Straddle", "Sold Butterfly", "Strangle", etc. Each of which has its own set of rules and benefits. This is why you need the best options trading platform that has been designed specifically for this challenging and one-of-a-kind area. Plus, you'll want to be able to interact with it from your computer, not just with a pen or paper. Our site is developed by professionals, and we already have more than 1.5 million users! Rate our convenience and you!

The options trading platform is excellent as it makes it much easier for you to trade online. You no longer have to sit at your computer and wonder what you are doing when the options market is closed. Using the trading platform, you can exchange them at any time of the day or night.

Online platforms are a great way for anyone to learn about options trading. Plus, it's a fantastic way to get started with options trading. Although they make the process of trading options a lot easier, you still need to know how to do them correctly. In addition, you must understand when to stop trading. With us, you can easily follow your charts and know when to buy or sell options based on current market conditions.

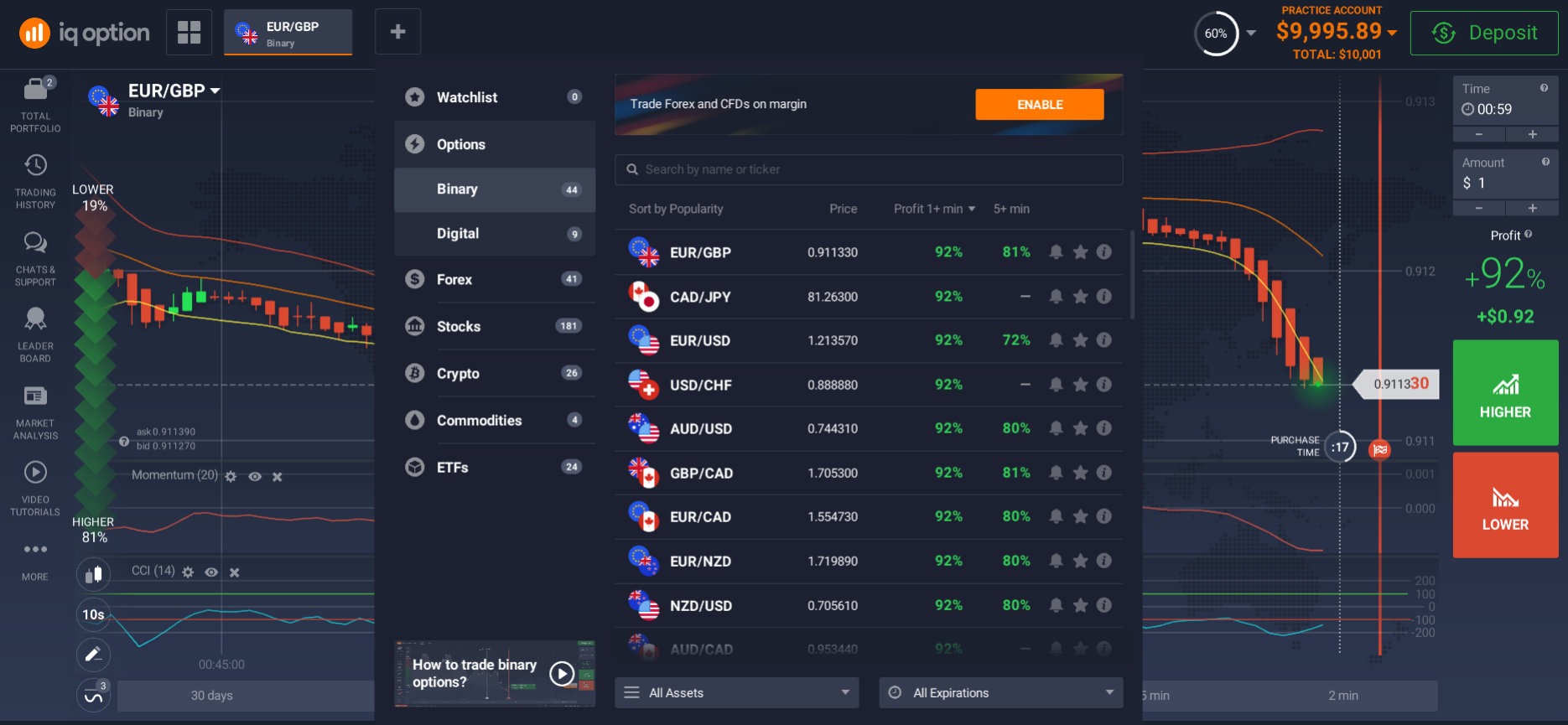

Types of binary options?

If you are in the forex world or are interested in it, then you have most likely heard about this term binary options ... and if you are new to investing in the markets or simply have not yet become familiar with it, let me give you a short description of the main types of binary options.

Binary options are, in a sense, trading futures contracts. This means that there are underlying assets that can be traded. These assets can be currencies, stock indices, or even individual commodities or weather. Similarly, binary options contracts exist. You buy a contract for this asset under some condition. For example, the price of an asset will be higher or lower by the time of expiration. If you guess the direction of price movement, then you are in the money. You get your rate and premium, which is quite a lot in binary options, about 60% -85%. If your forecast does not come true before the expiration date, the trader loses investment. Nothing complicated right? Therefore, such a contract attracts more and more people.

While most traders focus on these two extremes (above - below), it is important not to forget that there are a number of options that can be played, they are traded in the short, medium or long term.

So, we have decided on the first type, it is "Above / Below".

We need to choose the right direction in which the price moves after a certain time. This is the simplest one.

The next type is "Touch". Touching implies trading within a certain range. If the price touches the upper or lower line of the border indicated on the chart, then we make a profit. Another type of "Range". This type of option implies price movement within a certain price band. We can widen the corridor by choosing a longer option period. In this type of option, we do not trade up or down, we have to guess whether the price will stay in the range or go beyond it.

These are just the most popular options, and as you can see, they differ only in some mustache. You can find at least ten varieties, but if you are a beginner, we advise you to start with the simplest and most understandable options.

Most of the trading operations on binary options are carried out by dealers via the Internet. Trading platforms have become a fantastic source of information for many people who would like to know more about this market. Due to its expanded availability, many new binary options brokers have emerged over the past few decades to offer your services. Be careful and choose only trusted sites! Our platform is completely secure and regulated by authorized bodies!

When an investor enters into a contract, he agrees to pay a certain amount of money up front as a premium to the binary options broker, and he agrees to play for a certain period of time, based on which he expects the value of this product to be justified. At the same time, he takes a certain risk. To mitigate some of this risk, many investors set a limit on the amount they are willing to lose in the event of a trade.

How to start trading options in Hong Kong?

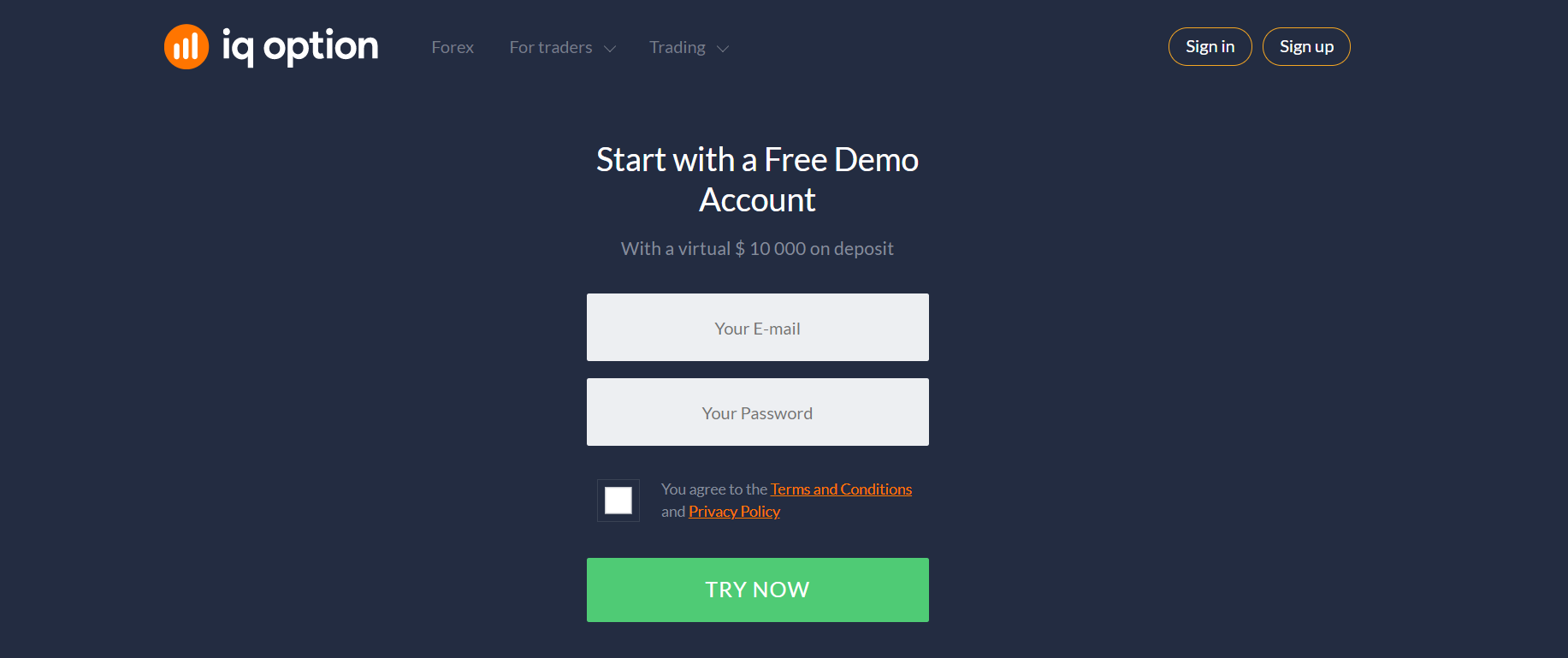

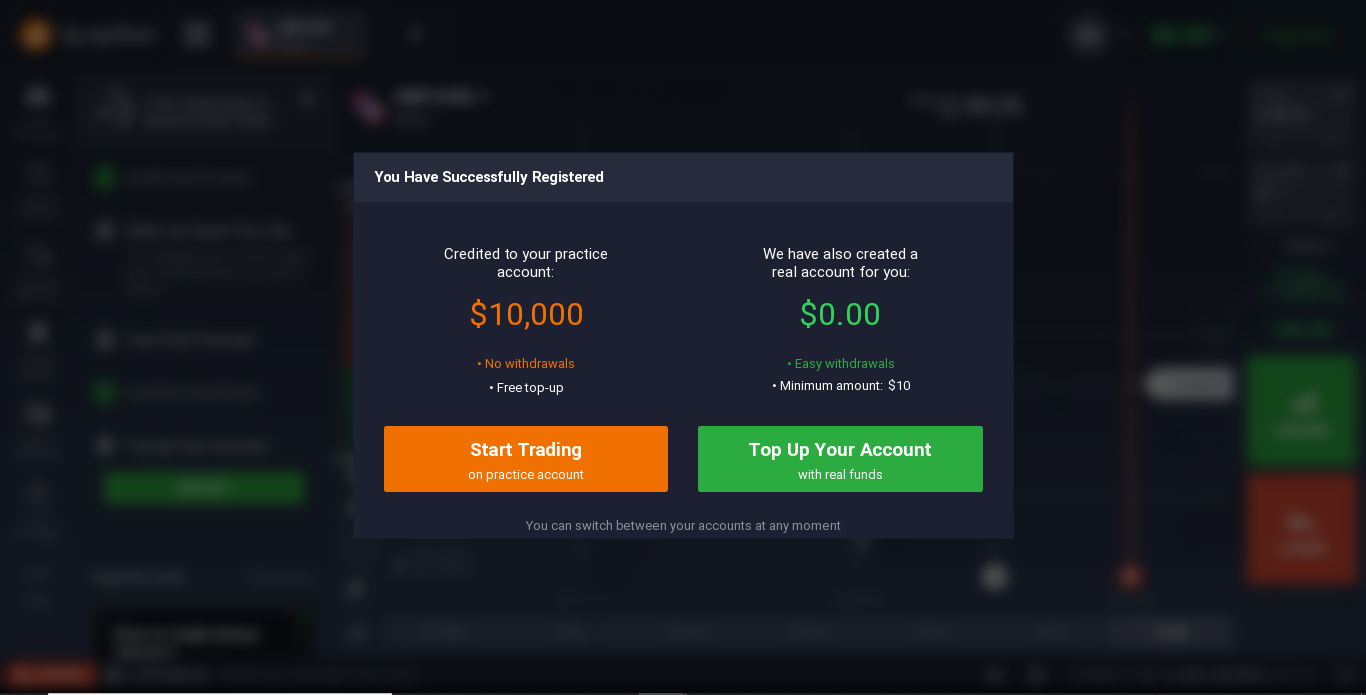

To become a trader of options or any other Forex contracts, you need to open an account to trade options. Once you have found the best options trading platform in Hong Kong, you open a live account, or you can open a demo account to practice what you gradually learn and learn. In addition, after registering with us, you will get access to the section with training, this is a set of various video tutorials on Forex trading that will be an excellent help for you in gaining experience.

Many investors choose to open a live account and learn how to trade options. In this case, prepare $10, it is with this amount that you can open an account and start trading with us. This is much more rational for people who already feel comfortable with market changes and the risk associated with trading options, know the principles of trading and know how to choose the right positions. Once you've opened an account, take a look at the variety of trading options on offer and find the one that best suits your needs.

If you open a demo account to trade options from India, you can gain valuable experience from the experts without investing a fraction of your money. It will not let you make a profit, but it will also keep your budget intact. You are offered $10,000, this is not real money, but virtual, and you will not be able to withdraw profit from it. But it will give you a wonderful experience and understanding of how the system works in general and our platform in particular. You can also understand what strategy you are ready to choose for yourself, see how much time it takes you to work on the exchange.

You may stumble across some interesting articles on how to get started trading options in the Forex market. Likewise, you can read about tips to use when entering the market, how to look at the profitability of your place, and how to place orders. There is no shortage of literature that teaches you the basics of Forex trading.

Trading options can be very insecure and there are dangers associated with trading stocks as well as options. But if you understand the principles of the stock exchange and the various strategies used to manage risk, then you have a fantastic chance to create profitable income.

Related pages