How to be VIP at IQ Option

Trading is an exciting and addictive activity that can bring in high income. Trading promises a lifestyle many people dream of, but you will have to work hard to succeed. To succeed, you can take advantage of some services that can help you shorten that arduous journey. In this article, you can learn how to be VIP at IQ Option and what benefits you will gain.

How to become VIP in IQ Option?

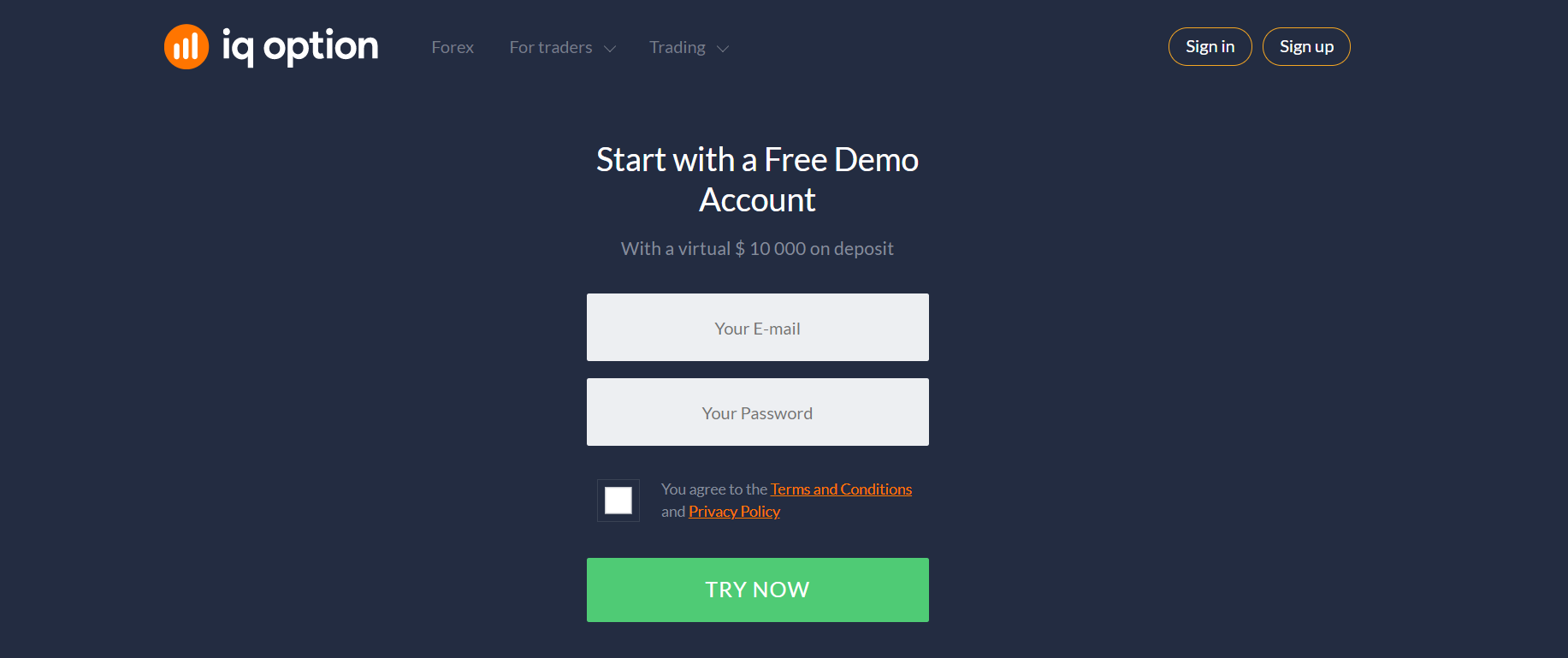

If a trader is wondering how to become VIP in IQ Option, there are simple steps to follow:

- Register on the platform.

- Get a real account.

Since its inception, the IQ Option platform has understood that traders are always looking for exceptional trading conditions. So IQ Option has made every effort to meet their needs.

Registration is a quick and easy process that will not take you long. In the process of creating a personal account, you will need to provide your details to identify yourself as a customer.

The next step is to open a personal account. To do so, you need to make a minimum deposit. However, in order to open an IQ Option VIP account, you need to deposit a certain amount in your personal account. You also need to make a monthly trading turnover of a certain amount.

Some of the IQ Option VIP account criteria may change according to the country. If you want to clarify the current conditions for your country, it is recommended to contact customer support via live chat or by sending an email.

VIP account benefits

Now let's look at the benefits you get if you become a VIP in IQ Option.

- Free Tournaments at IQ Option.

IQ Option offers its traders more than just a platform where they can trade and check charts and quotes. In addition to this, they get an excellent competitive and learning experience beyond regular trading.

The advantage for the VIP account holder is the permit to all the tournaments suggested in the IQ Option platform. Furthermore, you can participate in unique tournaments restricted to VIP account holders.

The Tournament is a competition for traders in which anyone can participate. You may only trade any asset in the tournaments and invest any free funds.

The winner is the trader who has more money in the tournament account.

- Personal account manager for VIP accounts.

With a VIP account, you get a personal manager. Your manager will always be there to support you with any questions you may have. That permits you to concentrate on trading and obtain help from a specialist.

- Increased percentage in binary options.

The raised profitability makes it more leisurely to speed up the growth of your account. So even if you have loss-making trades, you'll find it more comfortable to recoup your losses with a few profitable trades than a standard account holder.

The higher profitability of successful trades is one of the meaningful benefits of VIP account holders over other traders.

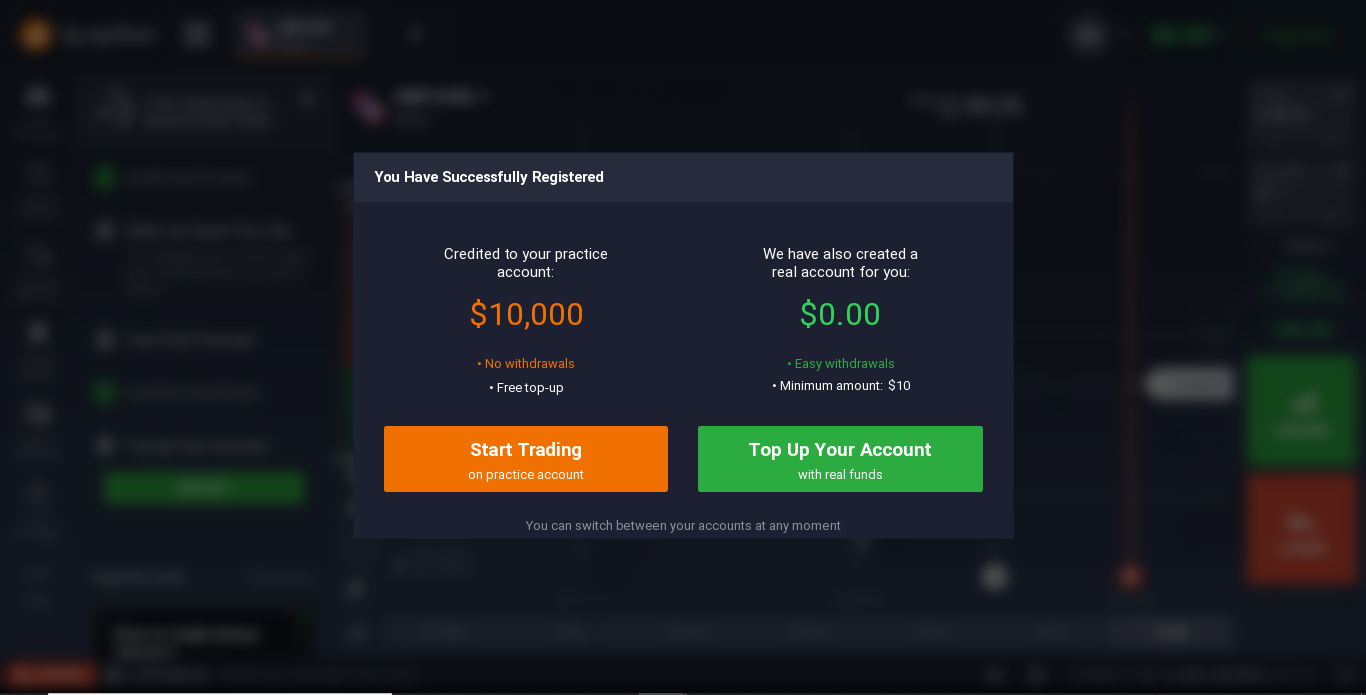

Demo account - trading with virtual money

Demo is a great opportunity for traders provided by the IQ Option electronic platform. Now you can easily get a brokerage account with an amount of 10,000 virtual dollars.

A demo account is test software used by a broker to educate their clients before working with real money. A demo account consists of a terminal program and a virtual deposit. During the learning phase, a client can become accustomed to the market, transacting currency purchases and sales without the risk of losing money.

Opening a demo account is considered to be the best way to get started in the forex market. It allows you to evaluate your knowledge, test your trading strategy and practice your technique. The only drawback of such practice is the psychological factor. Many traders panic even in case of small drawdowns and hence retreat from their proven strategies, which results in losing all the invested funds.

About IQ Option

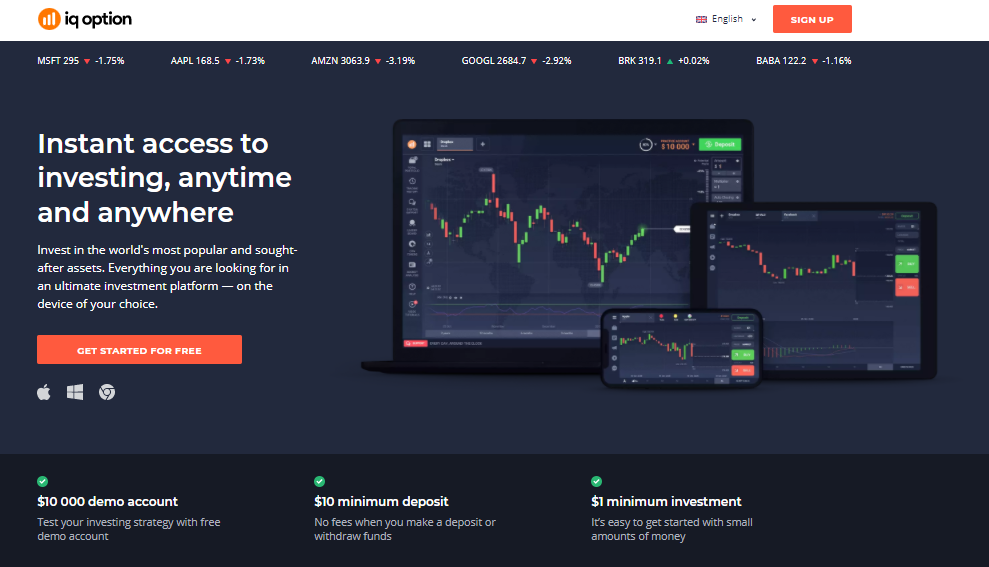

The IQ Option is a platform that allows you to make instant investments anytime, anywhere. All you need is a mobile device or computer and internet access. The minimum deal size available on this platform is $1.

That makes it easy to start trading, even with a small amount.

On the IQ Option you may trade CFDs on:

- Currency pairs.

- Shares.

- Commodities.

- Cryptocurrencies.

- ETFs.

A CFD is an agreement between the seller and the buyer to transfer the difference between the current value of an asset (at contract inception) and its future value (at contract closing).

How do I get started in CFD trading?

1. Improve your knowledge.

Knowledge will always be your greatest asset, so you should try to learn as much as possible about CFDs and how to trade them. That includes understanding the basic trading terms and concepts and the principles and rules for using all the features of the online platform. You can find a wealth of video tutorials on IQ Option.

2. Develop a trading strategy.

CFDs can offer you access to numerous asset classes from a single trading platform. However, several factors need to be considered when creating your trading plan, including:

- The asset class you want to trade.

- Trading capital.

- Time commitment.

- Risk appetite.

- Trading experience.

Having a sound trading plan and following it rigorously is critical to maintaining discipline and implementing effective risk management strategies.

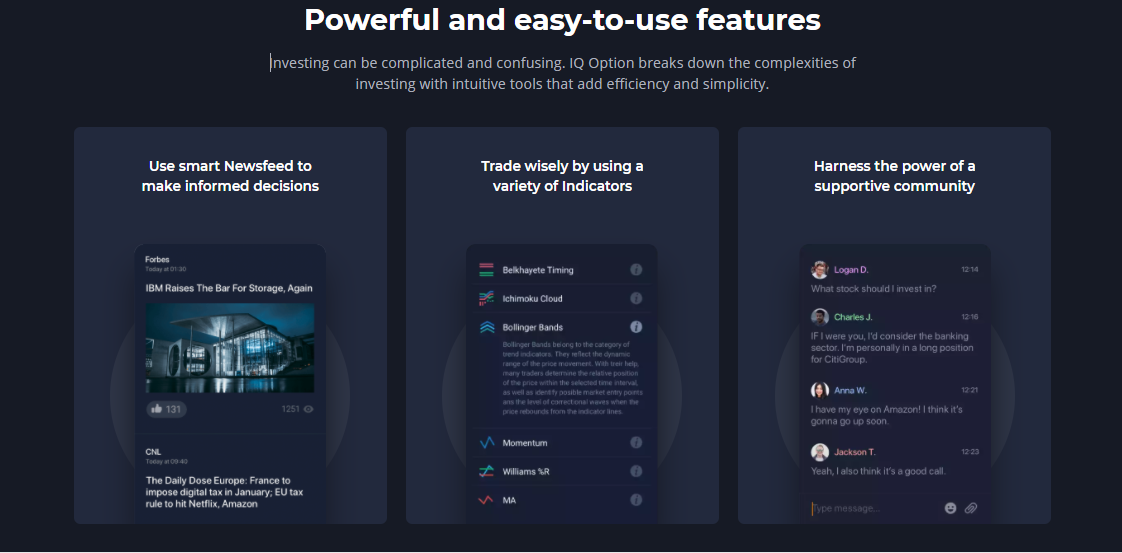

3. Fundamental Analysis.

Through market analysis, traders can identify volatile markets and potential trading opportunities. There are two methods of market analysis: Fundamental Analysis and Technical Analysis. Fundamental analysis considers geopolitical events, publication of economic data and breaking news that can affect world financial markets.

The IQ Option platform has a news feed that is continuously updated. An economic calendar is also available on the platform.

The economic calendar shows the macroeconomic indicators for different regions and when they are scheduled to be published. In addition, data is provided with past values, expected and current values.

4. Technical analysis.

Technical analysis, in turn, makes use of historical market data to identify trends and make trading decisions. You can learn to make informed decisions about potential price trends and future price behaviour patterns by using technical indicators.

The IQ Option trading platform offers traders pre-set indicators and charting tools to help with comprehensive market analysis.

5. Risk management.

Risk management is essential for every trade, regardless of market conditions or position size. Below are some of the tools you can use to limit potential losses:

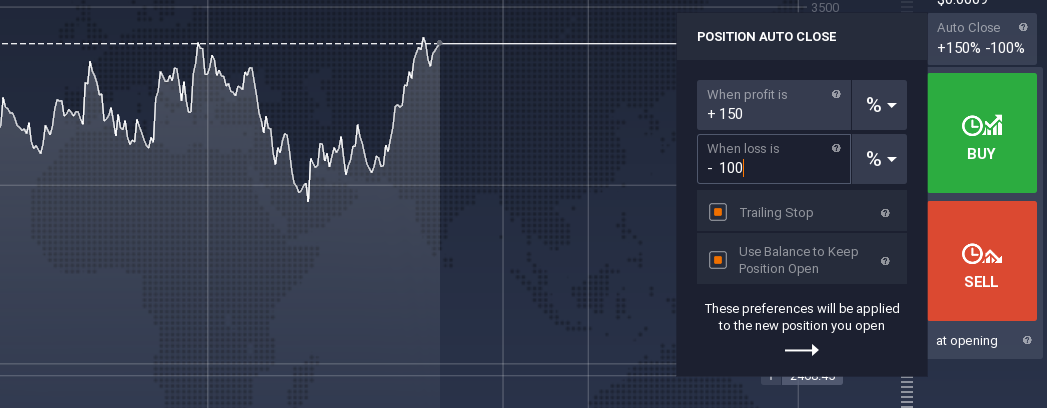

- Stop Loss is a way of limiting losses when you manage an open trading position or a portfolio of positions. A stop loss is an order to close a position in the event of an adverse price movement.

A trader sets a stop loss to limit his own losses and to trade within his own money management rules.

- Take Profit is an order (request) that a trader sends to a broker together with the conclusion of a deal on an instrument. This order prescribes the return transaction (sell the asset if it was bought, but if it was sold) when the profit level reaches the specified value. Setting such an order allows the trader/investor to set a target for a single transaction and lock in a profit when the price moves in the selected direction.

Advantages of trading CFDs

- One of the greatest benefits of trading CFDs is trading in falling markets.

One of the unique features of CFD trading is that these contracts allow you to take both 'long' and 'short' positions. In typical financial markets, you may only go "long" and only profit when the price increases. Conversely, you can go "short" and profit from a falling price with CFDs. This provides traders with additional trading opportunities.

- Leverage.

Leverage offers a cost-effective way to invest, which means you only have to deposit a fraction of the total cost of trade (margin) to open a position. The margin required varies depending on the instrument, liquidity and other factors.

- An effective hedging instrument.

An essential advantage of trading CFDs is their use as a hedging instrument. CFDs can be used to hedge your portfolio against short-term market volatility within an existing position. Hedging is a strategy used by CFD traders instead of selling the assets of other instruments that may incur a tax liability.

- No fixed expiry date.

Unlike other derivatives such as options and futures, CFDs do not have an expiration date. You can keep a CFD trade open for as long or as little as you like.

Bottom line

Trading is a dynamic system of constantly changing trends. On the one hand, many external factors determine the value of securities.

For example, the shares of a major commodity company may react to political decisions, economic sanctions, natural disasters, even rumors of a change in management. But, on the other hand, market participants - traders - influence it just as much.

To make a profit, a trader needs to make a prediction, and that prediction must be correct.

This article has introduced you to various important aspects of trading and how to be VIP at IQ Option. Try always to follow the news. Your hard work will pay off. Believe in your abilities, and you'll succeed!

Related pages