Bitcoin Leverage Trading in Hong Kong

Novice investors often have many questions about the concept of "margin trading". At first glance, it seems complicated to understand terms and ideas, but the main thing is to understand the essence and evaluate risks correctly. What is Bitcoin leverage trading? And how to effectively trade Bitcoins with leverage? Read this article.

What is margin trading?

Margin trading is a transaction that takes place using cash or securities lent to a client by a broker.

Essentially, Bitcoin leverage trading is a transaction that an investor makes on loan: he borrows either money or securities from a Bitcoin leverage trading platform.

Buying instruments with the broker's money is called a long position or a leveraged long position. In this case, the investor borrows money from the broker. Selling the broker's stock is called a short position or short. In this case, the investor borrows securities.

The broker charges a commission for margin trades - a small percentage on the loan you have taken from him. The percentage depends on the risk rates.

For a broker, a loan means the risk that the funds will not be returned, so he only lends money or shares for trades in the most liquid instruments and reserves the possibility to execute a margin call, i.e. to force a client's position to be closed. In this way, the broker can protect both himself and the client: in case of force majeure, it is easier to close a losing position.

What is margin and what types it has?

1. How much money or stock can be borrowed from a broker is indicated by the level of margin - the amount of collateral that the broker locks in the account when the margin position is opened.

Margin is expressed as a percentage of the funds in the account and depends on the number of securities and the loan size.

For example, an investor has $100,000 and wants to buy three Bitcoins. Then he will borrow money from the Bitcoin trading platform with leverage. The broker will use a unique formula to calculate how much money to block in his account so that he does not incur a loss.

Two indicators are displayed in the trading platform or application: Initial margin and minimum margin. As a rule, they are displayed immediately in the currency of the transaction. However, they are counted as a percentage.

2. Initial margin - the amount of money in the broker's account as collateral for the transaction with a specific security. It is different for each asset. For example, if an investor bought crypto-assets with total leverage and the price went down, the level of funds becomes lower than the initial margin. This is because he can't buy more crypto assets. After all, the money is locked up. But he can sell some assets to free up funds for purchases.

3. The minimum margin shows the level at which the broker will ask the investor to fund the account or close the position. This will mean a risk for the broker to take a loss on loan. If the margin level reaches the minimum level and the investor does not respond to the broker's request to exit the trade or fund the account, a "margin call" occurs. Then, employees at the broker close the position themselves. This is possible because investor funds in margin trades are pledged to the broker, and the broker is contractually entitled to dispose of them in case of force majeure.

How to calculate leverage and risks?

Leverage is the amount of credit a broker gives. Leverage shows how many times more money an investor uses than he has.

For example, an investor bought $10,000 worth of cryptocurrency but decided to use the broker's money and makes a trade for $20,000. This is twice the amount of your capital: 20 / 10 = 2. The leverage is 2. If he bought 15,000 shares, his leverage would be 1.5, so 15 / 10 = 1.5.

How to start using margin trading properly?

Bitcoin trading with leverage requires comprehensive stock market knowledge and some trading experience. Therefore, investors need to keep in mind the risks and commissions and avoid the most common mistakes, if they want to start Bitcoin leverage trading in Hong Kong. To do so, you need to stick to a well-thought-out strategy in advance:

1. Decide on an instrument.

The broker allows only liquid instruments from the detailed list for margin transactions.

2. Decide in advance where and when the position will be closed.

Margin trading is a risk, so it is better to calculate it in advance. In addition, it is necessary to determine the time frame of the transaction so as not to lose money on commissions if the price does not move, and also determine how much money the investor is prepared to lose and at what price level he will close the position.

3. Keep an eye on the crypto asset and the margin level.

You should monitor prices so you can react to changes in time. That will allow you to close your position on time. Digital assets differ from stocks and fiat in their level of volatility. Even large coins like BTC or ETH fall or rise by 5-10% in one day. That increases the risks when trading cryptocurrencies with leverage.

It would be best if you did not ignore the news. The cryptocurrency market regularly experiences important events that significantly affect the exchange rate.

How is cryptocurrency margin trading different from spot trading?

The usual way to trade cryptocurrencies is to buy and sell cryptocurrencies on an exchange with your funds. This way, you will purchase coins or tokens and then hold them until the price goes up, both in the short and long term, so that you can sell them at a profit.

The main difference with margin trading is that you are borrowing money from the exchange to increase your purchasing power, with the potential for higher profits and higher risks.

How to minimise risk when Bitcoin trading with leverage?

If you are a margin trader, the accuracy of your calculations is of paramount importance, as any minor inaccuracies will have a more significant impact on each trade's actual profit or loss. In addition, consider all costs charged by your broker, including commission, rollover and other fees.

- Avoid opening trading positions in low liquid assets. If an asset has inferior liquidity, you may not stand a good chance of exiting a trading position at a price you would benefit from if the situation were to change. It is better to trade popular financial instruments and avoid more exotic ones.

- Keep up to date with news and market events. Some news can drastically change the market's direction, and if you are not aware of such an event when you have open leveraged positions, it can have the most adverse effect on your balance sheet. Of course, the best way to prevent such events from having a disproportionate impact on your trades is to provide a stop loss for each trade.

- Avoid opening too many positions at once. Such an approach, along with the use of high leverage, will expose your trading account to considerable risk. Opening too many positions too long will increase your risk profile. It is best to open as many positions as you can easily monitor and manage.

- The best way to avoid low liquidity is to check the difference between the buy and sell price. If this difference is slight, you can be sure that there is sufficient liquidity.

While volatility offers exciting trading opportunities, it also comes with increased risks, and leverage only amplifies their impact. So remember to diversify your trading portfolio and open positions in various assets.

How to Start Trading Bitcoins with Leverage?

Enthusiasts ready to conquer new heights and willing to try margin trading in Hong Kong should choose a trading platform.

Remember to make sure your computer and internet connection works smoothly and has good speed.

It is imperative to choose the right Bitcoin leverage trading platform with high reliability and excellent speed.

Then you need to go through the registration process at your broker's website. Again, this is a mandatory step that will give you access to a wide range of features.

By the way, you can start with the training videos on the platform. After that, you can practise on a demo account and then trade for real money.

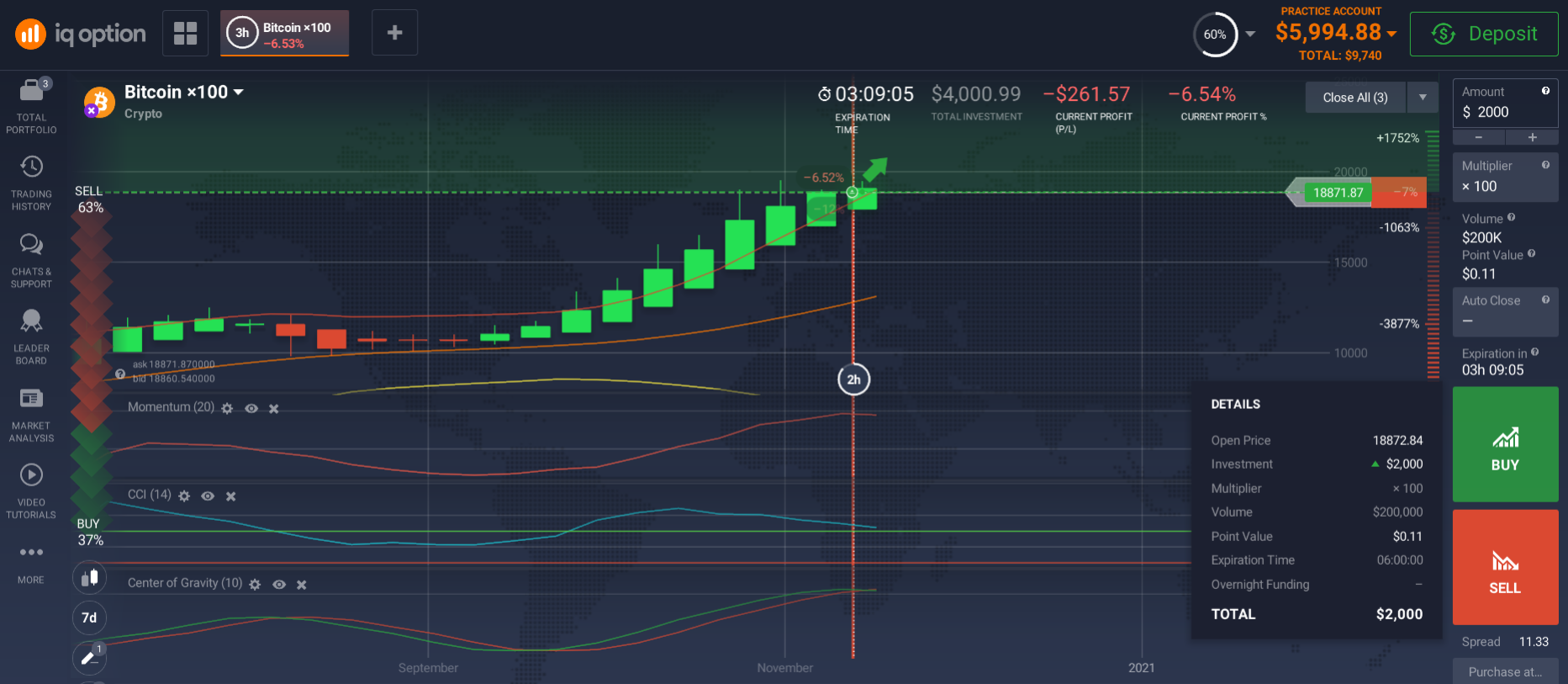

A demo account is a free practice trading account almost identical to a real one, but you trade with virtual money. You make a profit or lose your deposit with virtual money.

Disadvantages of the demo account for beginners.

- Fake money - fake risk, sometimes it can force a trader to break the rules of money management and perform an action that is unacceptable in a real account;

- A demo account does not allow you to make any real money.

In any case, trading on a real account is an entirely different experience and emotion. However, demo accounts are suitable for the short term, so you can quickly learn the basics of Bitcoin trading with leverage or experiment with a new strategy.

A demo account loses all its advantages in the long run - once a trader is already familiar with the market and knows how to trade, there is no reason to stay on a demo account, except for small tests.

Learn, develop your skills, learn your strengths and weaknesses, manage your risks and start earning now. All the best is waiting for you!